Limited Liability Company With The Ability To Establish Series

Description

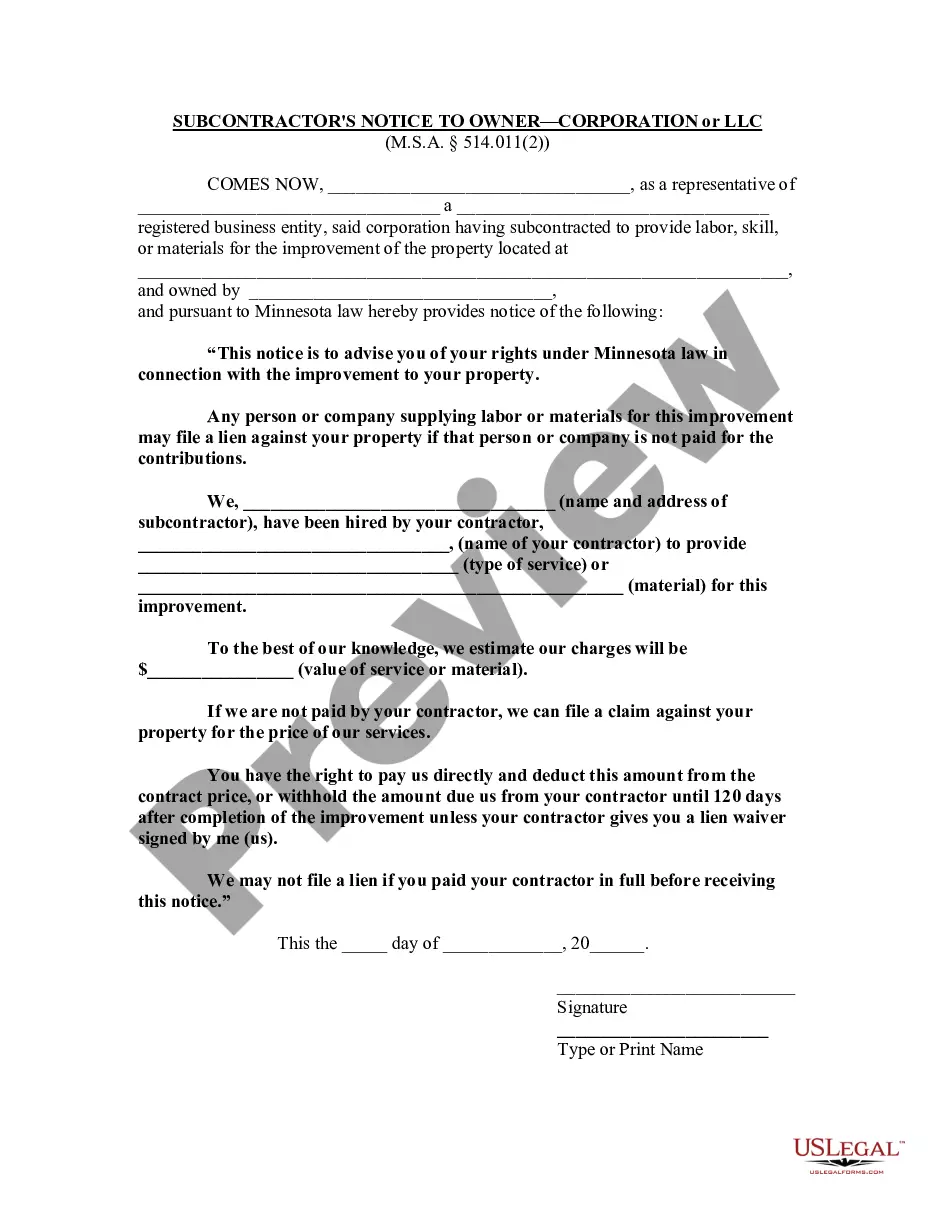

How to fill out Minnesota Contractor's Notice To Owner - Corporation Or LLC?

- Log into your US Legal Forms account. If you are a returning user, make sure your subscription is active. If it's expired, renew it according to your plan.

- Select the appropriate document template. Preview the form and ensure it fits your specific local requirements before proceeding.

- Use the search feature if you need a different template. Locate any inconsistencies and look for alternative forms that meet your criteria.

- Purchase the document. Click on the 'Buy Now' button and choose your preferred subscription plan, creating an account if you're a first-time user.

- Complete your purchase by entering your payment information through credit card or PayPal.

- Download your completed form. Save it to your device and access it anytime through the 'My Forms' section in your profile.

In conclusion, US Legal Forms is your go-to solution for accessing a diverse library of legal documents efficiently. With a comprehensive variety of forms and expert assistance at your disposal, you can ensure that your LLC is set up correctly and operates smoothly.

Start your journey today by visiting US Legal Forms and discover how easy it can be to establish your limited liability company!

Form popularity

FAQ

A series LLC can be a good idea for business owners looking to limit their liability while managing multiple ventures. It offers operational efficiencies and can save on administrative expenses compared to forming separate LLCs for each business. However, it is important to consider your specific business needs and consult with a legal expert before proceeding.

Establishing a series LLC means creating distinct sub-units within a parent LLC that can operate separately while still being part of the overall entity. Each series can have its own assets, liabilities, and members, providing a shield against risks associated with other series. This setup appeals to business owners who want to diversify their operations under one legal framework.

A limited liability company with the ability to establish series is a unique structure that allows a single LLC to create separate divisions, known as series, each with its own assets and liabilities. This structure provides flexibility and can be beneficial for managing different business ventures under one umbrella. It combines the ease of an LLC with the protection of isolation for each series.

Yes, in most cases, each series within a limited liability company with the ability to establish series requires its own Employer Identification Number (EIN). This is essential for tax purposes and to maintain the separation of financial obligations between the series. It is advisable to consult with a tax professional to understand the implications.

To convert your existing limited liability company with the ability to establish series, you generally need to follow specific steps defined by your state law. This usually involves amending your LLC's operating agreement to include provisions for creating series. It's advisable to consult with a legal expert to ensure compliance and to help you navigate the process effectively.

While a Series LLC offers flexibility and asset protection, it also has potential downsides. Certain states do not recognize series LLCs, which could limit your business reach. Additionally, the complexity of managing different series can lead to administrative challenges, especially in maintaining proper records for each series. It's important to weigh these factors and seek guidance, perhaps through platforms like USLegalForms, to make informed decisions about whether a limited liability company with the ability to establish series is right for your business.

Filing taxes for a Series LLC can be straightforward, but it depends on how your series is set up and your overall tax situation. Each series within the limited liability company with the ability to establish series can be treated as a separate entity for tax purposes. You will need to report income and expenses for each series separately on your tax returns, which may complicate record-keeping. Consulting a tax professional who understands Series LLC taxation can help ensure compliance and maximize your tax benefits.

Yes, you can transform your existing LLC into a Series LLC, but the process varies by state. It typically requires a formal amendment to your original LLC's operating agreement and filing appropriate paperwork with your state. This transition allows you to take advantage of the benefits provided by a limited liability company with the ability to establish series while retaining your original LLC's history and assets. To navigate this process smoothly, you might consider using a platform like USLegalForms for the necessary documents.

A Series LLC, or a limited liability company with the ability to establish series, allows you to create separate divisions, or series, under one main LLC structure. This means you can protect assets from liabilities associated with other series. Additionally, it offers flexibility in management and operations, which can simplify your business structure. This setup is particularly useful for businesses that operate multiple ventures, as it reduces administrative costs and maintains liability protection.

A limited liability company that has the ability to establish series is designed to provide flexibility and asset protection within a single entity. This type of LLC allows owners to create separate series for different business activities or investments, effectively compartmentalizing risk. It is an appealing option for entrepreneurs who wish to operate multiple ventures under one legal framework. To get started, check out the resources available on USLegalForms, where you can find comprehensive information and forms tailored to your needs.