2023 Instructions For Form 568 Limited Liability Company Tax Booklet

Description

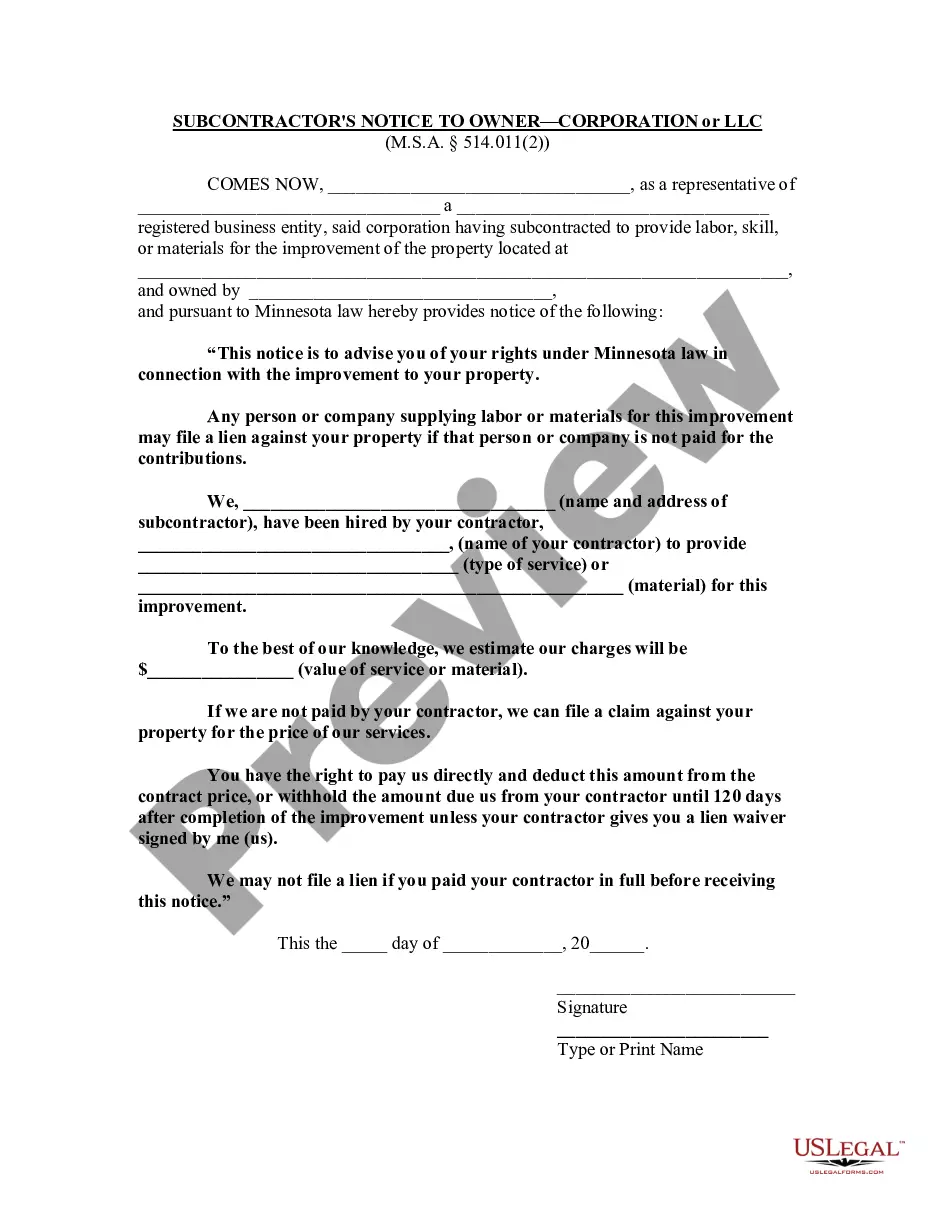

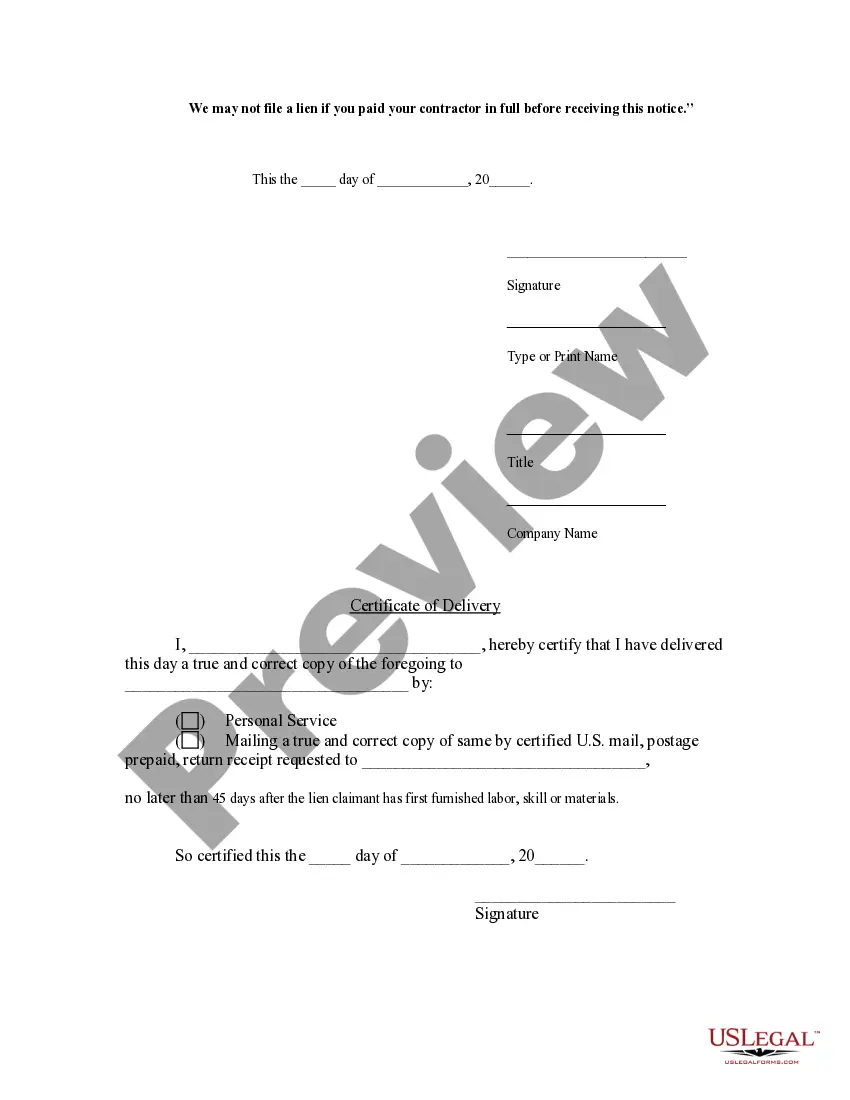

How to fill out Minnesota Subcontractor's Notice To Owner - Corporation Or LLC?

- Begin by logging into your US Legal Forms account if you are a returning user. Ensure your subscription is active to access your documents without issues.

- If you're new, start by checking the preview mode and the form description to confirm you've selected the correct Form 568 for your jurisdiction.

- If necessary, use the Search tab to find an alternative template that better suits your requirements.

- Once confirmed, click on the Buy Now button and select a subscription plan that aligns with your needs. Make sure to register an account for access to the full library.

- Complete your purchase using a credit card or PayPal to finalize your subscription.

- Finally, download the Form 568 to your device. You can also find it later under the My Forms menu in your profile for easy access.

In conclusion, US Legal Forms simplifies the process of obtaining legal documentation while ensuring user satisfaction through its extensive library and expert assistance. Whether you're a returning or new user, following these steps will securely guide you through acquiring the Form 568 you need.

Don't hesitate to take advantage of our services today and ensure your legal forms are handled with precision.

Form popularity

FAQ

While many forms can be e-filed, some forms, often complex ones, cannot be submitted electronically. For instance, certain paper forms and specialized documents might still require traditional submission methods. Following the 2023 instructions for form 568 limited liability company tax booklet will clarify which forms you can and cannot e-file.

Absolutely, you can file form 568 electronically. The 2023 instructions for form 568 limited liability company tax booklet guide you through the e-filing process, ensuring you follow all required steps. This method often speeds up your filing and helps you avoid common errors.

Yes, many tax forms, including those mentioned in the 2023 instructions for form 568 limited liability company tax booklet, can be filled out electronically. Using various online platforms can simplify the process and allow for easy corrections if needed. Always ensure you are using trusted resources for filling out your forms.

Yes, form 568 can be e-filed as part of the California tax process. When you follow the 2023 instructions for form 568 limited liability company tax booklet, you can submit your form electronically, which helps streamline your filing process and ensures timely submission.

You can obtain California state tax forms through several sources. The California Franchise Tax Board website provides direct access to all necessary forms, including those from the 2023 instructions for form 568 limited liability company tax booklet. Additionally, your local library or post office may have printed forms available.

Yes, you can electronically file your California returns. The state offers online options that make submission easy and convenient. By following the 2023 instructions for form 568 limited liability company tax booklet, you will find step-by-step guidance for e-filing your returns efficiently.

The first step in LLC business tax filing is to gather all necessary documents related to your business finances. This includes income statements, expense records, and ownership details. After organizing these records, refer to the 2023 instructions for form 568 limited liability company tax booklet to understand the specific requirements for your LLC type. By following these guidelines, you ensure a smooth filing process and compliance with state tax laws.

Yes, a single member LLC is required to file Form 568 in California. It's vital to review the 2023 instructions for Form 568 limited liability company tax booklet to ensure you include all necessary information. If you're uncertain about the filing process, consider utilizing our resources at uslegalforms for assistance and guidance.

You should send your completed forms and payments to the appropriate address for the California Franchise Tax Board, which is detailed in the 2023 instructions for Form 568 limited liability company tax booklet. Make sure to check for updates or changes to these addresses, as they can vary. Submitting your forms correctly will help your business stay compliant with California state laws.

You can submit a Statement of Information for your LLC online or by mail in California. Check the current requirements in the 2023 instructions for Form 568 limited liability company tax booklet, as they outline key information needed for the filing. Using uslegalforms can ensure your paperwork is valid and submitted correctly, easing the process.