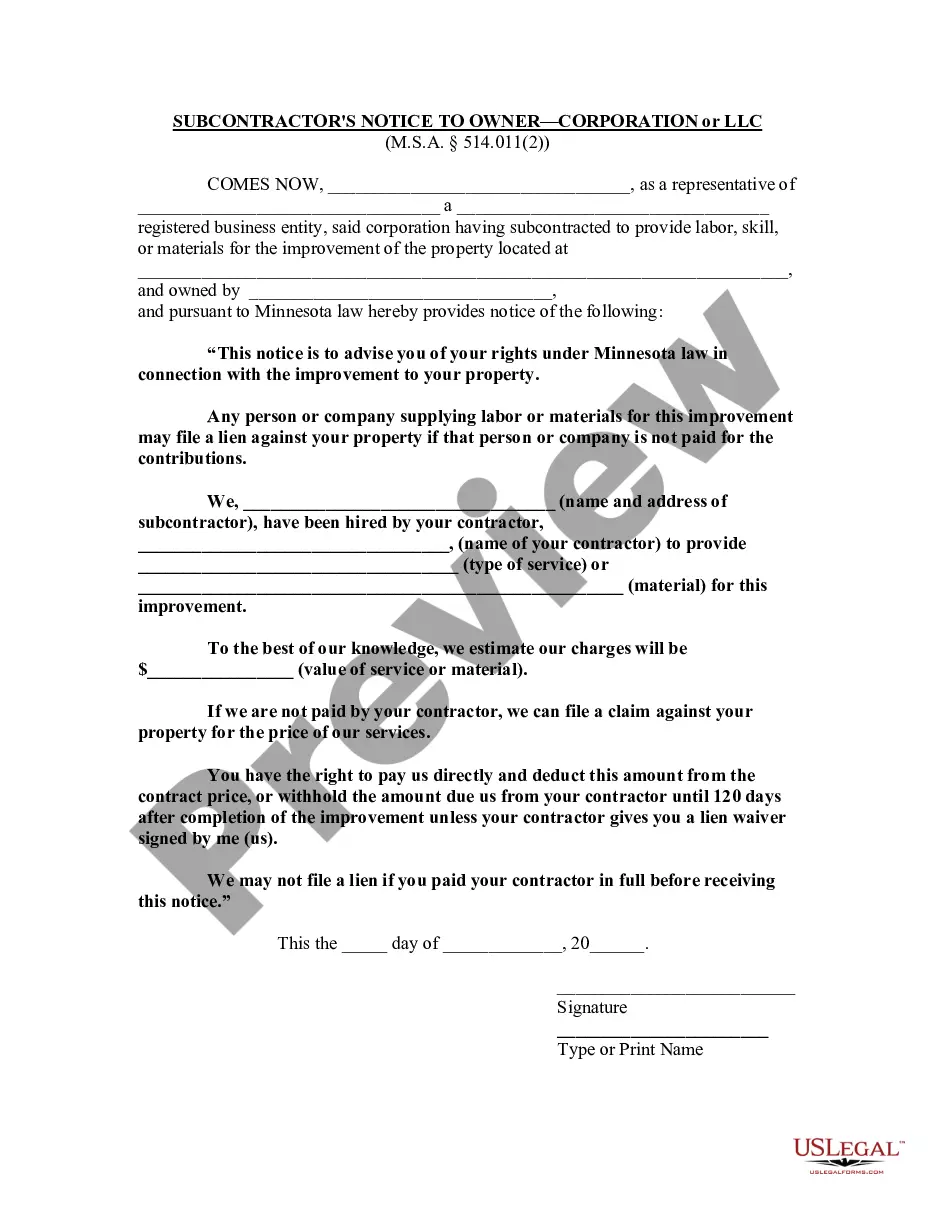

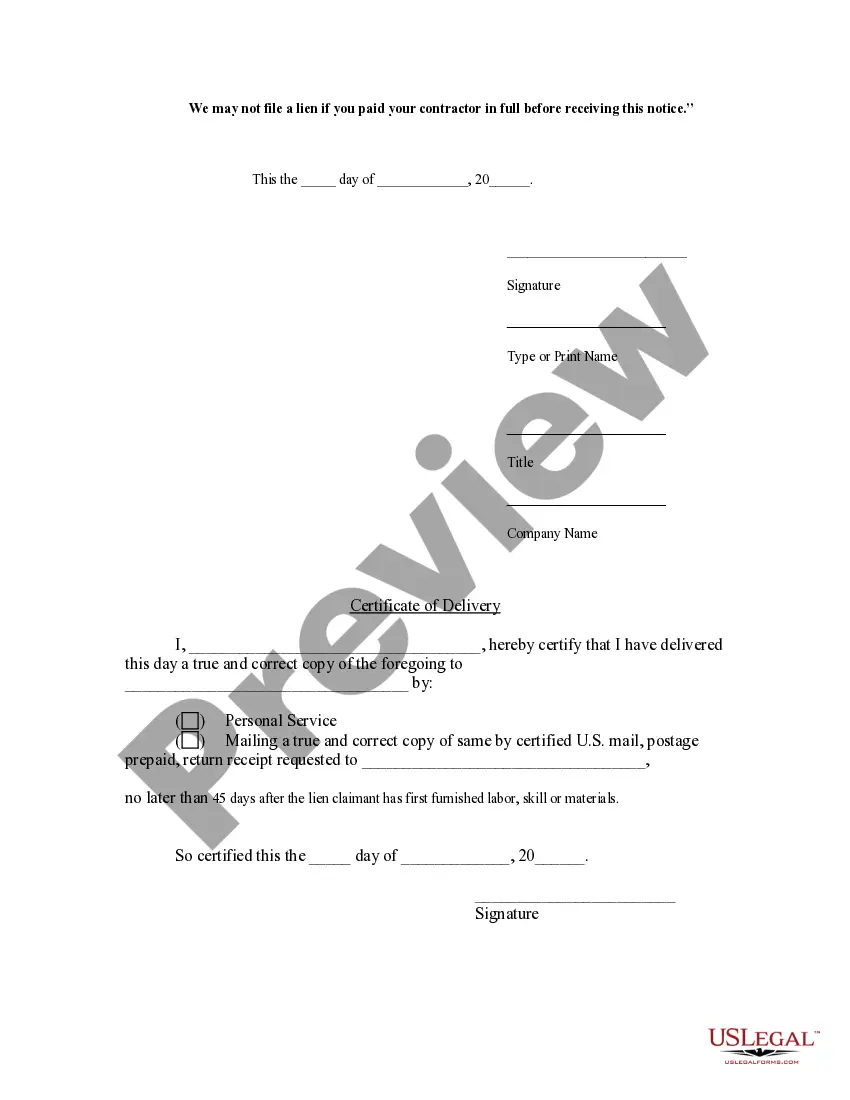

Minnesota statutes require parties who contribute to the improvement of real property without the benefit of a direct oral or written contract with the property owner to provide the owner with this notice. It includes form language required by Minnesota law and serves to let the property owner know exactly what work is being provided and the cost thereof. The corporate or LLC subcontractor must provide this notice to the owner within forty-five (45) days after the lien claimant has first furnished labor, skill, or materials in order to claim a lien against the improved property.

Minnesota Subcontractor's Notice to Owner - Corporation or LLC

Description

How to fill out Minnesota Subcontractor's Notice To Owner - Corporation Or LLC?

Access any template from 85,000 legal documents including Minnesota Subcontractor's Notice to Owner - Corporation or LLC online with US Legal Forms. Each template is created and revised by state-licensed attorneys.

If you already possess a subscription, Log In. When you are on the form’s page, click on the Download button and navigate to My documents to retrieve it.

If you have not yet subscribed, follow the instructions outlined below.

With US Legal Forms, you will always have immediate access to the relevant downloadable template. The platform provides you with documents and categorizes them to simplify your search. Utilize US Legal Forms to acquire your Minnesota Subcontractor's Notice to Owner - Corporation or LLC swiftly and effortlessly.

- Verify the state-specific requirements for the Minnesota Subcontractor's Notice to Owner - Corporation or LLC you intend to use.

- Examine the description and preview the template.

- Once you are convinced the sample meets your needs, click Buy Now.

- Select a subscription plan that fits your budget.

- Establish a personal account.

- Make payment using one of two acceptable methods: by credit card or through PayPal.

- Choose a format to download the file in; two formats are offered (PDF or Word).

- Download the document to the My documents tab.

- As soon as your reusable template is prepared, print it or save it to your device.

Form popularity

FAQ

If a lien is filed against your property (in the form of a lien statement), it must be filed with the county recorder and a copy delivered to you, the property owner, either personally or by certified mail, within 120 days after the last material or labor is furnished for the job.

When a contractor files a mechanics' (construction) lien on your home, the lien makes your home into what's called security for an outstanding debt, which the contractor claims is due and unpaid for services or materials.

The mechanic's lien statement must be filed with the county recorder, with a copy provided to the owner. Importantly, both the filing and the service on the owner must occur within 120 days after the lien claimant's last day of work at the property, or the last day that a material supplier provided materials.

A lien is a claim or legal right against assets that are typically used as collateral to satisfy a debt.A lien serves to guarantee an underlying obligation, such as the repayment of a loan. If the underlying obligation is not satisfied, the creditor may be able to seize the asset that is the subject of the lien.

In Minnesota, all mechanics liens must be filed within 120 days from the claimant's last day providing materials or labor. In Minnesota, mechanics liens expire 1 year from the date of the lien claimant's last furnishing of labor or materials to the project.

If a lien is filed against your property (in the form of a lien statement), it must be filed with the county recorder and a copy delivered to you, the property owner, either personally or by certified mail, within 120 days after the last material or labor is furnished for the job.

Posting a Bond Asselta says to expect to pay 110 percent of the lien amount. Submit the bond to the court. The lien will then transfer to the bond and clear the property's title. Wait for the contractor claimant to foreclose on the lien in the allotted period to dispute the lien in court.

The notice must inform the homeowner of the contractor's right to lien the property, and the right to pay off any subcontractors that haven't been paid by the general contractor.