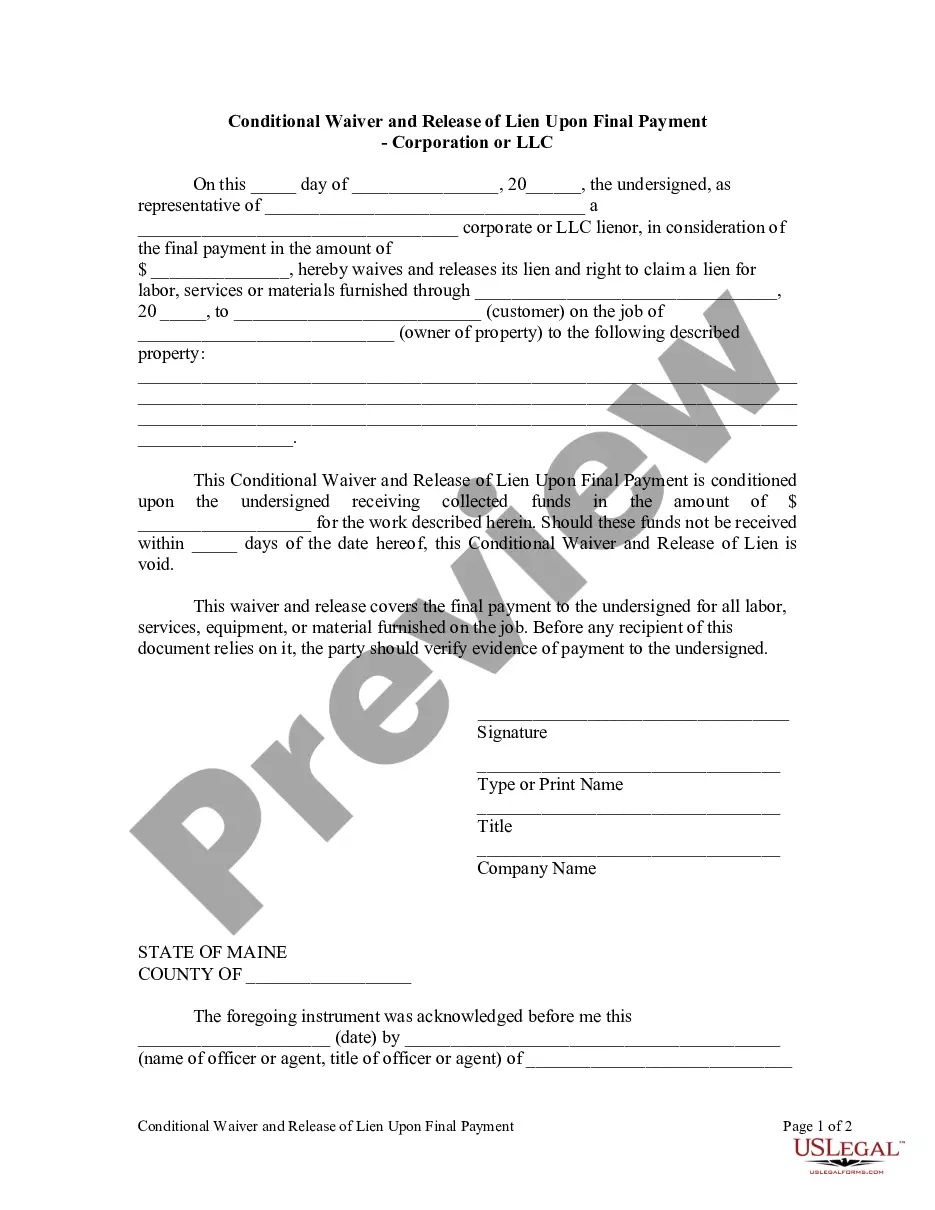

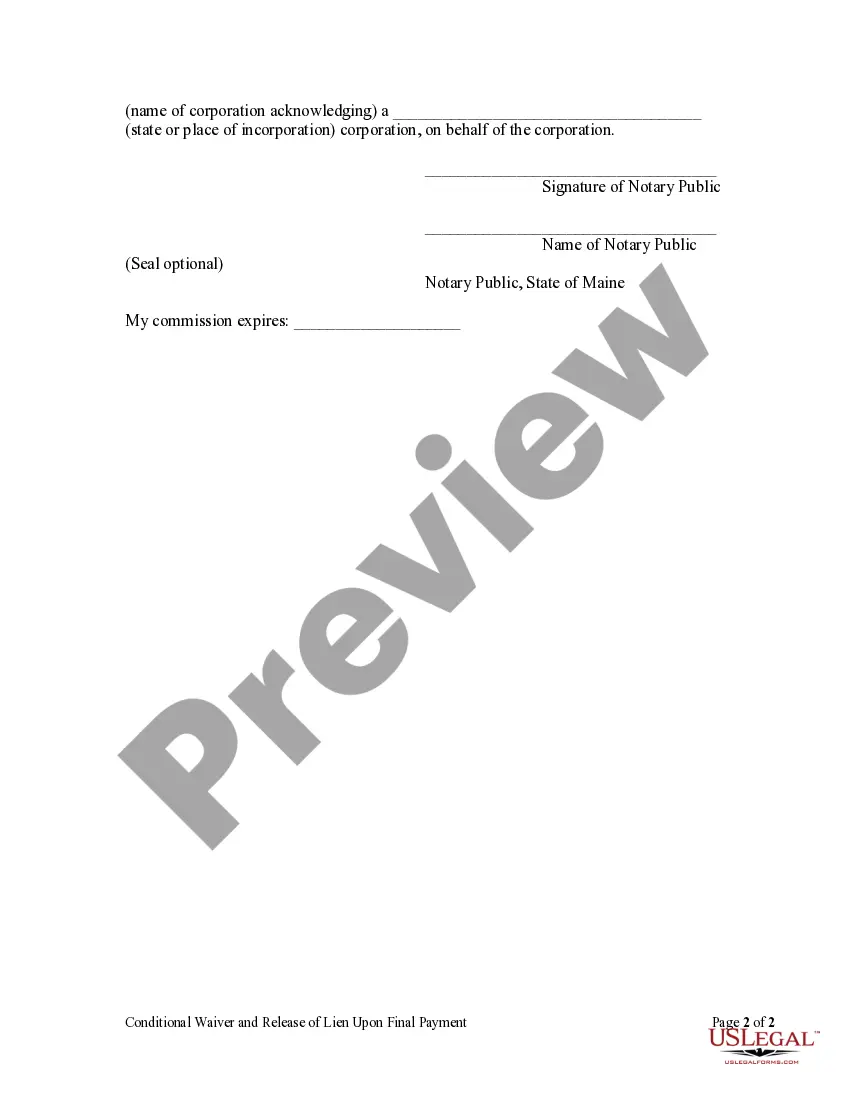

This Conditional Waiver and Release Upon Final Payment form is for use by a corporate or LLC lienor, in consideration of final payment to waive and release its lien and right to claim a lien for labor, services or materials furnished through a certain date to a customer on the job of an owner of property. This Conditional Waiver and Release of Lien Upon Final Payment is conditioned upon the lienor receiving collected funds in a certain amount for the work, and will be considered void if such funds are not received within a certain number of days of the date of this waiver.

Conditional Waiver On Final Payment Form For Llc

Description

Form popularity

FAQ

A waiver of lien is a legal document that relinquishes a contractor's right to file a mechanics lien against a property. This form is crucial in the construction industry, as it assures property owners that they have fulfilled their payment obligations. By signing a waiver of lien, contractors affirm that they will not pursue lien rights for the work performed. Leveraging uslegalforms can simplify the process of managing these waivers and enhance project transparency.

The fundamental difference between conditional and unconditional lien releases lies in their binding nature regarding payment. A conditional lien release takes effect only upon the complete payment, protecting the contractor until funds are secure. On the other hand, an unconditional lien release forfeits all rights immediately, which can pose risks if payment has not yet been made. Choosing the right option is critical, and a conditional waiver on final payment form for LLC serves as a wise choice for added security.

An unconditional release signifies that the contractor releases all lien rights without any conditions related to payment. When a contractor signs this type of release, they cannot file a lien against the property for the specified work, even if they have not yet received payment. It is crucial when there is full confidence that the payment will be made. For those managing such documents, a conditional waiver on final payment form for LLC provides a more cautious approach.

In Florida, a conditional waiver on final payment form for LLC releases lien rights only when the payment is made. This means the contractor will relinquish their right to lien the property, but only once they have confirmed receipt of the final payment. This form offers security to both parties involved, ensuring that the contractor secures payment before relinquishing their rights. Utilizing uslegalforms can streamline this process.

The key difference lies in the completion of payment obligations. A conditional waiver on final payment form for LLC becomes effective once the payment has been made, offering protection for the contractor or subcontractor. In contrast, an unconditional waiver releases all lien rights immediately, regardless of whether payment has been received. Thus, understanding this difference is crucial for effective financial management in construction projects.

In Colorado, lien waivers must include specific language that identifies the parties, clearly state the type of work performed, and specify the payment amount. It's essential to ensure that these waivers comply with state laws for them to be considered valid. Additionally, having the waiver notarized can provide extra protection and ensure compliance. Using USLegalForms can help you craft a compliant lien waiver any time you need it, including for a conditional waiver on final payment form for llc.

Various states require lien waivers to be notarized to enhance their legal enforceability. Typically, states like California and Florida enforce this requirement for certain circumstances. Always check your state's specific laws to ensure compliance. To ensure you follow the correct procedures, refer to the conditional waiver on final payment form for llc on USLegalForms for guidance.

Filling out a lien affidavit involves gathering critical details regarding the debt and property in question. Start by detailing the debtor's information, the amount owed, and the service provided. Ensure you sign and date the affidavit, as it must be notarized in most cases to be legally effective. For assistance, consider using USLegalForms to easily access templates tailored for your needs.

To fill out a waiver of lien, start by clearly identifying the parties involved and providing details of the work performed. Include the property's location and specify the waiver's scope. Remember to state that you are waiving your right to file a lien against the property for the completed work. If you prefer a guided approach, the conditional waiver on final payment form for llc on USLegalForms can help streamline and simplify this task.

A conditional lien waiver means that you agree to waive your right to file a lien on a property, provided that you receive payment. This type of waiver protects both the payer and the payee by ensuring that payment is made before the waiver takes effect. Understanding this concept helps you navigate payment processes more confidently, especially when considering a conditional waiver on a final payment form for llc.