Bill Of Sale For Car With Payment Plan

Description

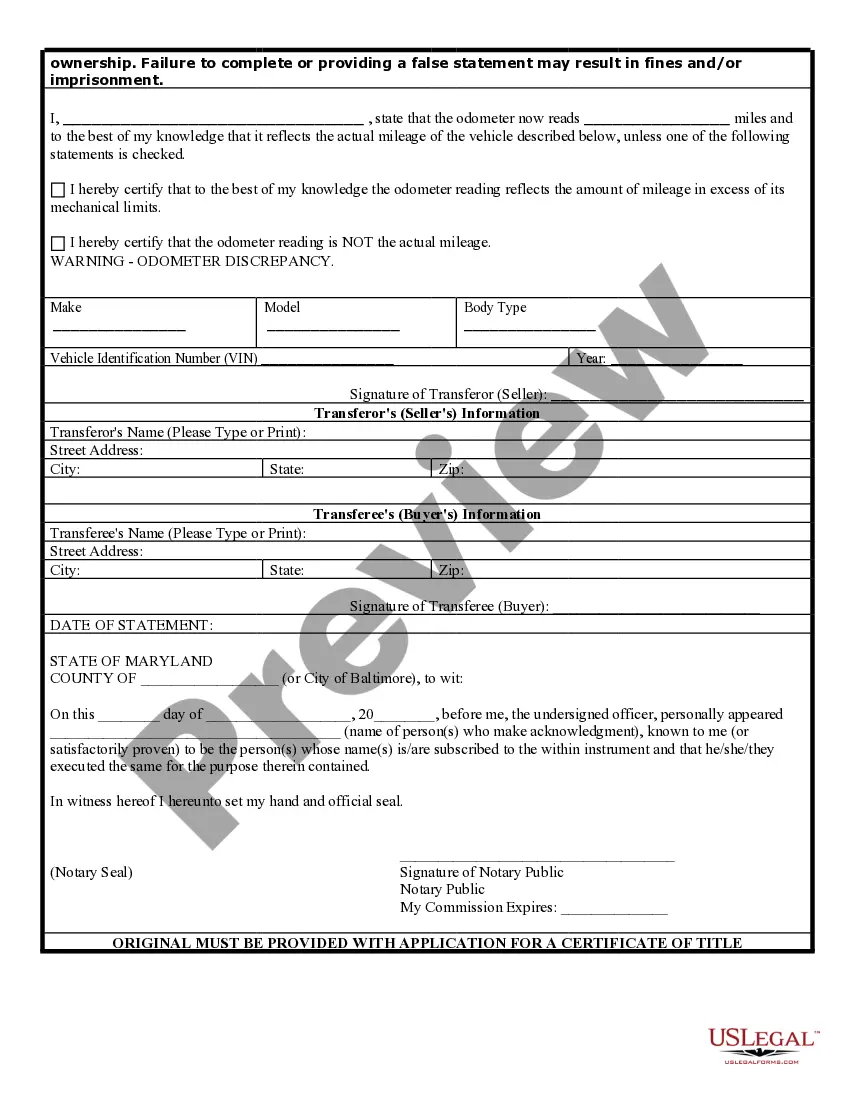

How to fill out Maryland Bill Of Sale For Automobile Or Vehicle Including Odometer Statement And Promissory Note?

- If you are a returning user, log in to your account, confirm your subscription is active, and download the Bill of Sale form that fits your requirements.

- If you’re new to US Legal Forms, start by examining the related forms. Use the Preview mode to ensure you select the document that corresponds to your situation and local regulations.

- Use the search feature if needed to find a different template. Should you spot any discrepancies, it’s essential to locate the precise document before proceeding.

- Purchase the desired form by clicking the Buy Now button and selecting a subscription plan that suits your needs. Account registration is necessary to access the library.

- Complete your transaction by entering your payment details—credit card or PayPal—and confirm your order.

- Download the completed form to your device and access it through your profile in the My Forms section whenever required.

US Legal Forms stands out with its exhaustive collection of over 85,000 customizable forms, making legal document preparation straightforward. Users can also access premium support for expert assistance in ensuring all documents are accurate and legally compliant.

Don't let paperwork stand in your way. Start using US Legal Forms today for a seamless experience in crafting your Bill of Sale for Car with Payment Plan.

Form popularity

FAQ

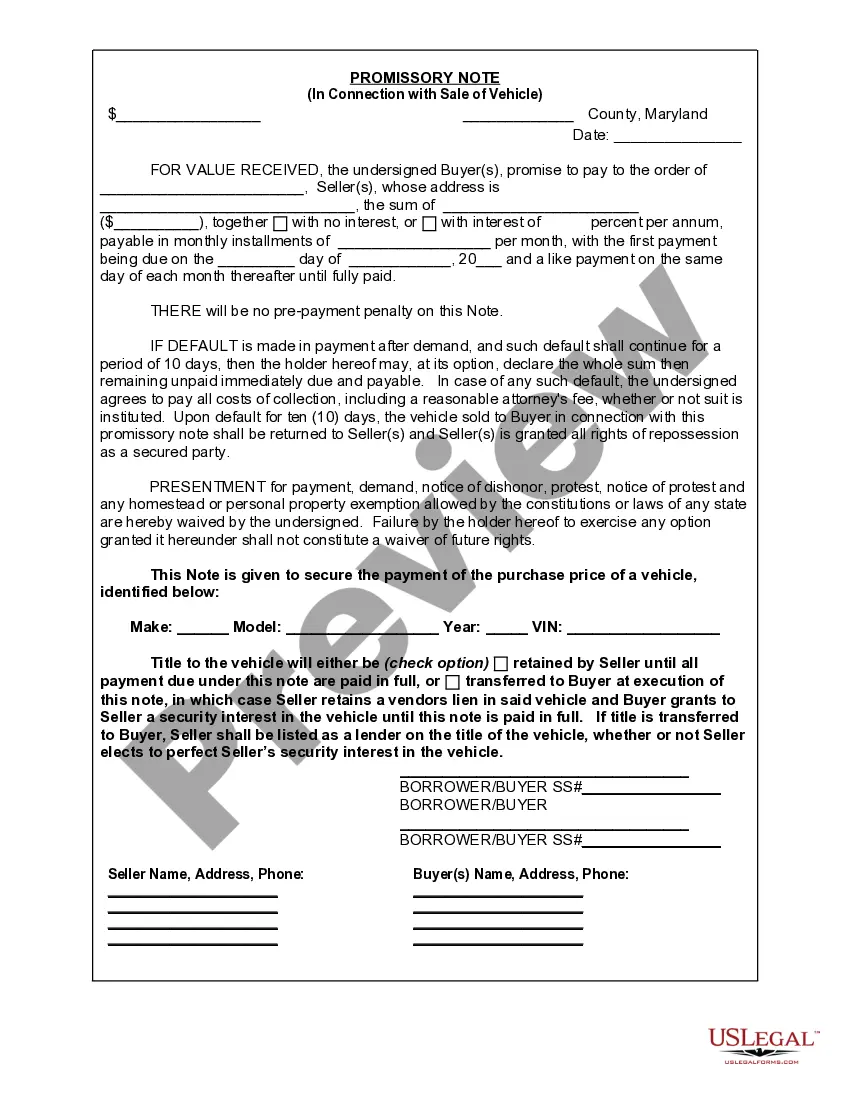

To create a payment agreement between two parties, start by identifying the parties and describing the purpose of the agreement. Include specific details such as the amount owed, payment schedule, and consequences for non-payment. This clarity helps prevent misunderstandings. Leveraging a bill of sale for car with payment plan simplifies this process, offering a structured approach to ensure compliance and accountability.

To write a contract for car payments, start by defining the parties involved, the vehicle details, and the payment terms. Clearly outline the total amount financed, the interest rate, and the payment schedule. Additionally, include clauses about default and late payments. A well-documented bill of sale for car with payment plan reinforces the agreement, ensuring both parties understand their responsibilities.

To draft a payment plan agreement, start by detailing the total amount owed and the payment schedule. Include information on payment method and due dates. Specify the terms for late payments, if any. A well-structured agreement provides clarity and helps avoid misunderstandings, particularly when creating a bill of sale for a car with a payment plan.

A handwritten bill of sale for a car with a payment plan can be legitimate as long as it contains all necessary details. Make sure it includes the vehicle description, seller and buyer information, and payment terms. Both parties should sign it to validate the agreement. Keep in mind that while handwritten bills can be valid, a professionally prepared document may offer additional legal security.