Limited Business

Description

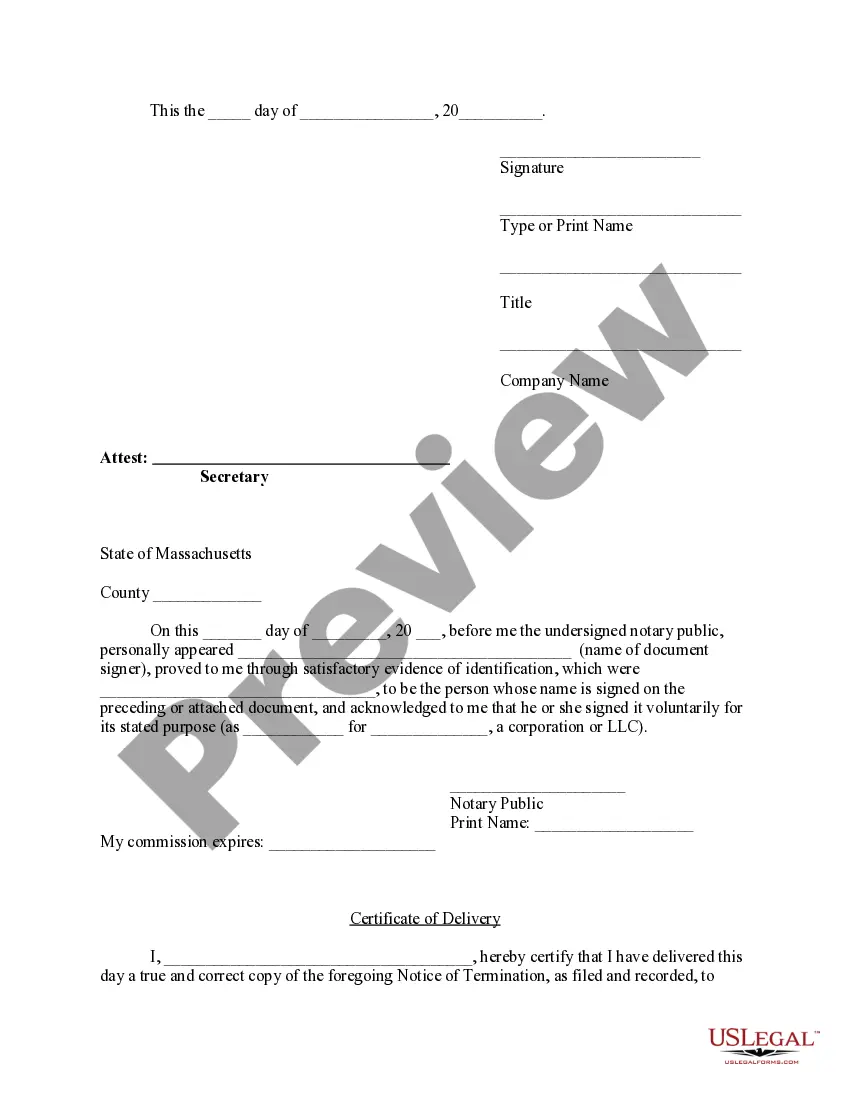

How to fill out Massachusetts Notice Of Termination By Corporation Or LLC?

- Log in to your account if you’ve used the service before. Verify your subscription is active, or renew it if needed.

- Explore the Preview mode and read the form descriptions carefully to ensure it meets your requirements and aligns with local jurisdiction.

- If the selected form doesn’t fit your needs, use the Search feature to find a more suitable template.

- Once you find the right document, click the Buy Now button and select your preferred subscription plan, creating an account if necessary.

- Complete your purchase by entering your payment details via credit card or PayPal.

- Download the completed form to your device and access it anytime through the My Forms section of your account.

Using US Legal Forms not only saves you time but also ensures that your legal documents are accurate and compliant. The platform’s vast library and expert support make it a valuable resource for both individuals and attorneys.

Start simplifying your legal document process today! Visit US Legal Forms and discover the ease of accessing your necessary forms.

Form popularity

FAQ

'Limited' in business often stands for limited liability, indicating that the owner's financial responsibility is confined to their investment. This model is preferred for reducing personal risk and encouraging entrepreneurial ventures. By limiting risk, companies can pursue growth without the fear of losing personal assets. For those looking to form a limited business, USLegalForms offers comprehensive tools to simplify the process.

When a business has 'limited' in its name, it signifies that it operates under a limited liability structure. This status allows shareholders to limit their financial risk to their invested amount, which enhances business growth opportunities. Moreover, it fosters a professional image by ensuring compliance with legal standards. Organizations like USLegalForms provide resources that can guide you through establishing a limited business.

Being a limited company means your business is a separate legal entity from its owners. This separation protects the owners from being personally liable for the company's debts. Limited companies must adhere to specific registration and regulatory requirements, promoting transparency and trust. This structure can be advantageous for small entrepreneurs and large corporations alike.

Businesses use the term 'limited' to indicate their liability status. It shows that they are legally recognized entities that limit personal risk for their owners. This structure can attract investors and partners, as it demonstrates a commitment to responsible business practices. By opting for a limited business designation, entrepreneurs signal their focus on stability and professionalism.

Limited in business refers to a legal structure that restricts the owner's liability. This means that if the business faces debts or legal issues, the owners typically only risk what they invested in the company. Therefore, their personal assets remain protected. Using a limited business structure can provide peace of mind to entrepreneurs embarking on new ventures.

A limited company qualifies based on its registered structure, legal compliance, and liability protection for its owners. This includes having a minimum of one director and adhering to regulations regarding annual submissions and record-keeping. A limited business also must be registered with the state and meet other relevant requirements. To ensure you meet these qualifications, consider consulting the user-friendly templates offered by US Legal Forms.

Using 'Limited' instead of 'LLC' depends on the specific structure of your business. If your business is formed as a limited company, you can use 'Limited' in your name; however, if you have established an LLC, you should use 'LLC' as required by law. It's essential to represent your business accurately for legal and branding purposes. For help with naming conventions and compliance, check out the resources available on US Legal Forms.

You become a limited company by officially registering your business with the appropriate state authority. This registration establishes the limited liability that separates your personal finances from your business obligations. A limited business also must adhere to specific regulations, including filing annual reports and maintaining accurate financial records. If you are unsure how to begin, US Legal Forms provides templates and guidance to help you through the process.

A limited company is a specific type of business structure that limits the liability of its owners, whereas an LLC, or limited liability company, is a versatile option that combines features of corporations and partnerships. Both types offer liability protection, but they differ in formation, taxation, and management structure. Understand your needs before choosing, and explore US Legal Forms for guidance on forming either type of limited business.

You can identify if you are a limited company by checking your business registration documents. Typically, a limited business will include 'Limited' or 'Ltd' in its name. Additionally, you should look for your company registration number, which confirms your status. If you need assistance, consider using the US Legal Forms platform to access the necessary forms and information.