Living Trust Louisiana Without A Will

Description

Form popularity

FAQ

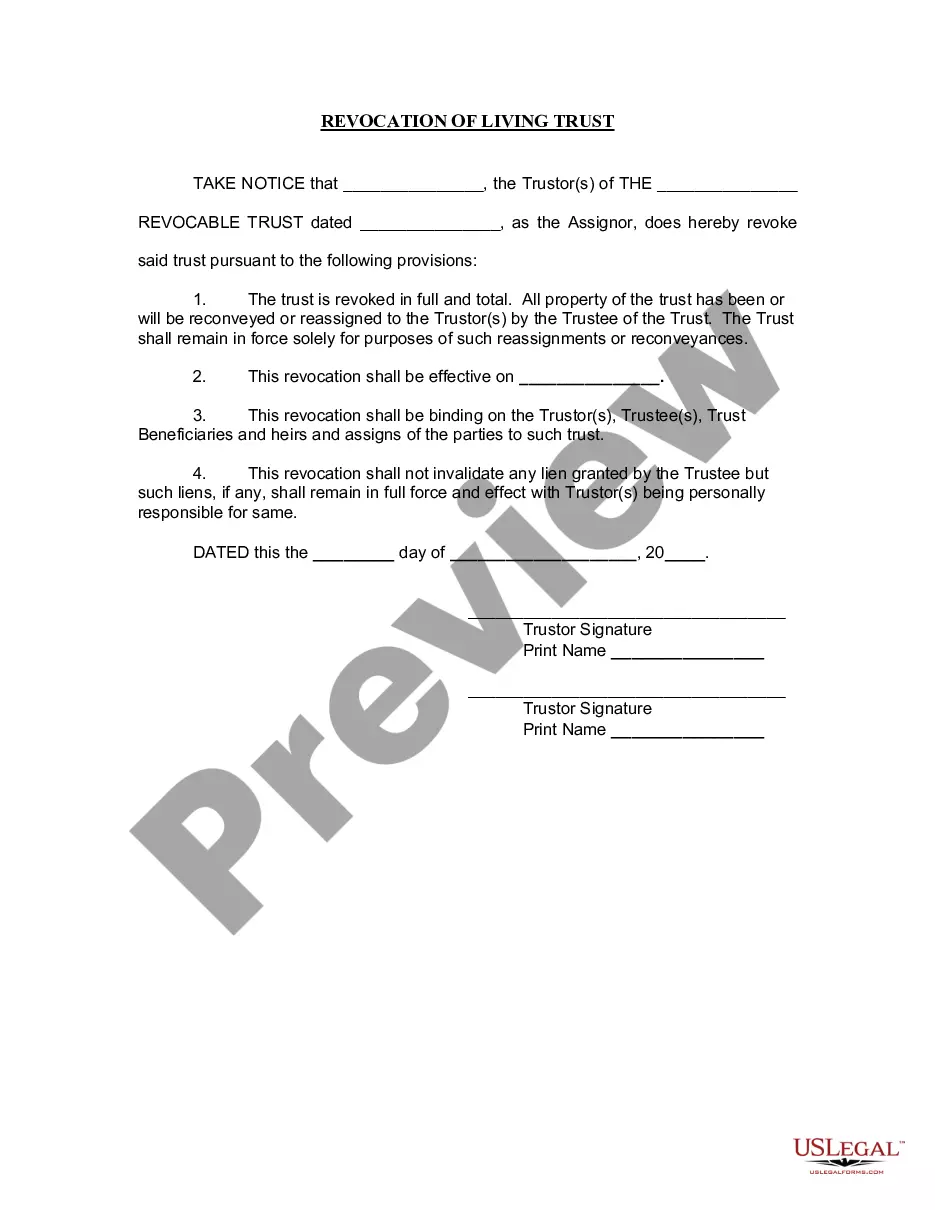

Creating a living trust in Louisiana typically involves drafting a trust document that outlines how assets will be managed and distributed. It is advisable to consult with a legal professional to ensure that the trust meets Louisiana laws. Additionally, platforms like US Legal Forms can provide templates and resources to simplify the process and help you establish a living trust without a will.

Yes, a trust can be created without a will. A living trust in Louisiana allows individuals to manage their assets during their lifetime and specify how these assets should be distributed upon their death. This option can provide more control and flexibility compared to a traditional will, as the trust remains effective without the formalities of a will.

Trust funds can carry certain risks, such as potential mismanagement or conflicts among beneficiaries. Another concern lies in the costs associated with administrating the fund, which can add up over time. By creating a living trust in Louisiana without a will, individuals can lay out clear guidelines, reducing the risks and ensuring the intended distribution of assets.

If your parents want to avoid probate and simplify the transfer of their assets, putting their assets in a trust may be a wise choice. A trust can provide clear instructions and offer privacy regarding asset distribution. Additionally, a living trust in Louisiana without a will can minimize family disputes during an already emotional time.

One of the main downfalls of having a trust is that it can be complex to manage. This often requires ongoing financial oversight and maintenance. Moreover, if not properly funded, the trust may not serve its intended purpose. Therefore, you should consider setting up a living trust in Louisiana without a will to ensure a smoother transition of your assets.

In Louisiana, if there is no will, the state's intestacy laws dictate the distribution of assets. Typically, assets will be divided among the deceased's closest relatives, such as spouses, children, or parents. This can create complications and disputes among family members. Thus, creating a living trust in Louisiana without a will can help avoid these issues.

While a living trust offers many benefits, one downside is the maintenance required during your lifetime. It demands regular updates and oversight to ensure that all your assets are properly placed within the trust. Additionally, some may find the initial setup more complex compared to writing a simple will, but utilizing a platform like USLegalForms can simplify this process for you, making it more manageable.

In terms of direct asset management and flexibility, a trust generally holds more power than a will. A living trust Louisiana without a will allows you to dictate terms while you are alive, and it continues to govern your assets after your death. A will is effective for distribution but does not offer the same level of control or immediate access that a trust provides.

The choice between a will and a trust in Louisiana depends on your specific needs and circumstances. If you desire a straightforward method for asset distribution, a will may suffice; however, if your goal is to avoid probate and maintain privacy, a living trust Louisiana without a will is often the better option. A trust can simplify the process for your family and provide clearer directions for your estate management.

You should consider using a trust when you want to manage your assets efficiently and wish to avoid probate. A living trust Louisiana without a will allows you to maintain control over your assets, even if you become incapacitated, and ensures a smoother transition for your loved ones. If you have minor children, a trust can also provide specific instructions for their care and distribution of assets.