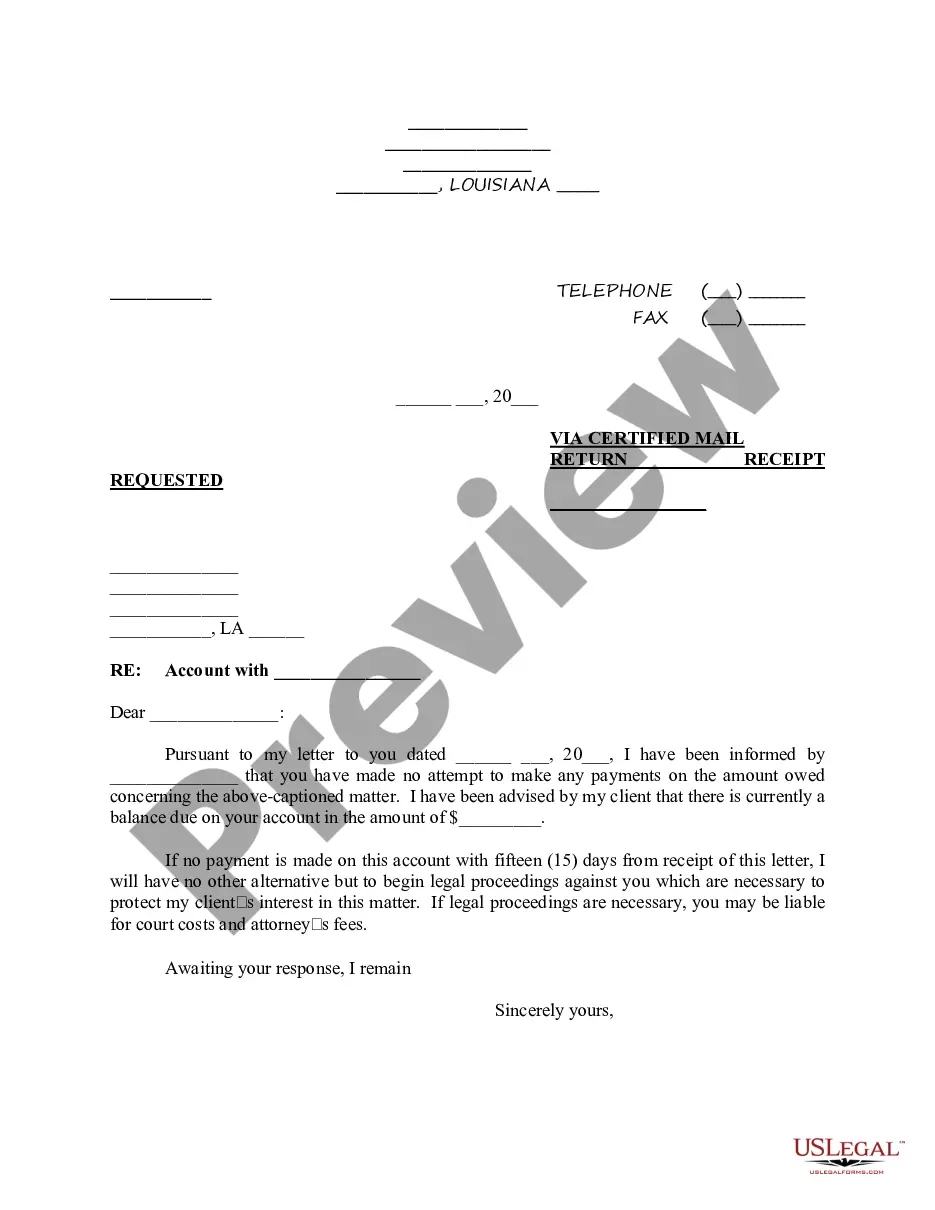

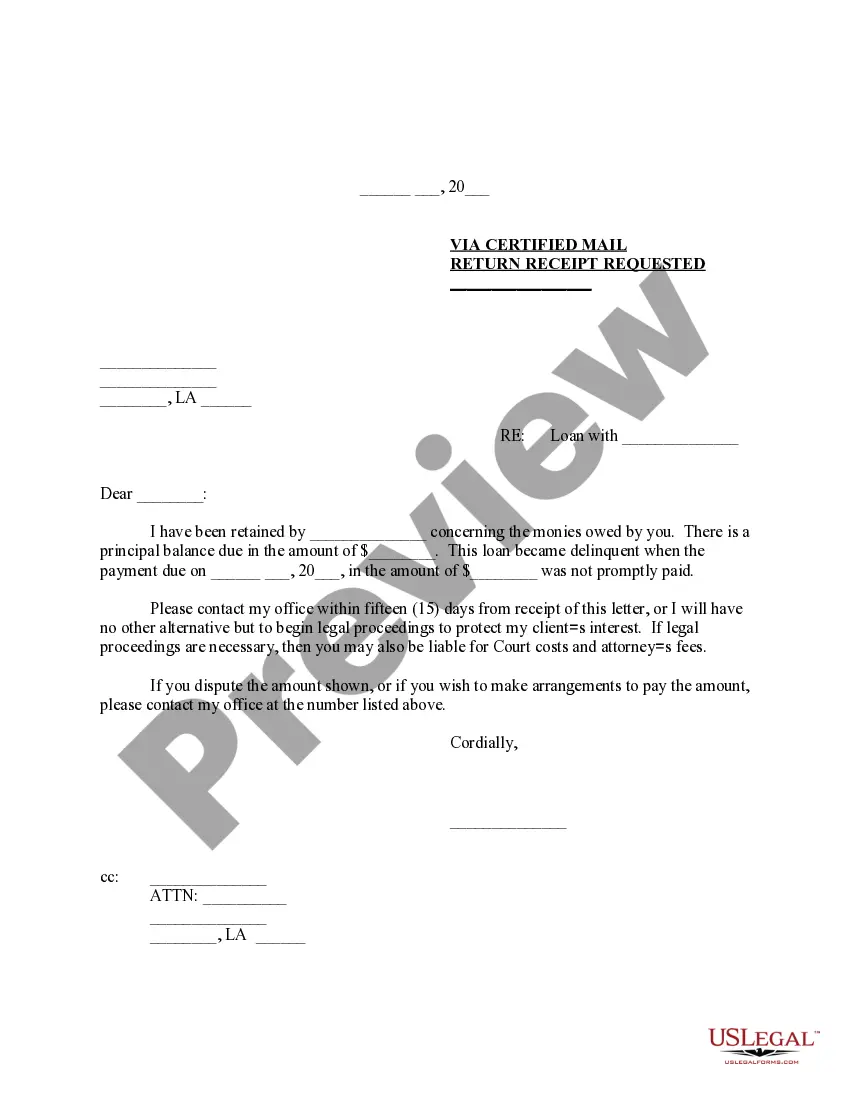

Demand Letter For Payment With Interest

Description

How to fill out Louisiana Demand Letter - Payment Of Account?

What is the most reliable service to obtain the Demand Letter For Payment With Interest and other recent editions of legal paperwork? US Legal Forms is the answer! It's the largest repository of legal documents for any purpose.

Every template is properly composed and confirmed for compliance with federal and state laws and regulations. They are categorized by area and state of usage, making it easy to locate the one you require.

US Legal Forms is an excellent solution for anyone needing to manage legal documentation. Premium users can enjoy even more benefits as they can complete and sign previously saved files electronically at any time using the built-in PDF editing tool. Explore it today!

- Experienced users of the platform simply need to Log In to the system, verify their subscription status, and click the Download button next to the Demand Letter For Payment With Interest to retrieve it.

- Once saved, the template remains accessible for future use in the My documents section of your account.

- If you do not yet possess an account with our library, here are the steps you need to follow to create one.

- Form compliance verification. Prior to obtaining any template, you should confirm if it meets your use case requirements and your state or county regulations. Review the form description and use the Preview if available.

Form popularity

FAQ

Absolutely, you can write your own demand letter for payment with interest. Begin by ensuring that you have all necessary details about the debt, including the total amount owed and any supporting documentation. By being clear and straightforward in your message and covering all legal bases, you can effectively encourage the debtor to respond positively.

To write a demand letter for non-payment, start by identifying the debtor and the specific amount owed, including interest. Clearly outline the reasons for the debt, referencing any contracts or agreements. Lastly, express your expectation for payment within a given timeframe, and inform the debtor of any potential actions you may take if the issue is not resolved.

A demand letter for payment with interest is legal when it contains specific elements. It should include your contact information, the recipient's details, a clear statement of the debt, and any relevant supporting documents. Furthermore, it should indicate the amount owed, the interest applicable, and the deadline for payment to create a sense of urgency.

Yes, you can write a demand letter for payment with interest on your own. Start by gathering all relevant documentation that supports your claim, including contracts, invoices, and correspondence. Use clear and direct language to convey your request for payment and ensure that all important details are included.

You can write a demand letter for payment with interest by first clearly stating the amount owed, including any applicable interest. Next, describe the nature of the debt and any previous attempts to resolve the issue. It is essential to set a deadline for payment and mention the potential consequences if the debt remains unpaid.

In your demand letter for payment with interest, avoid using threatening language or making unrealistic demands. Stay factual and professional, as accusations can damage future negotiations. It's essential to focus on the facts and keep a respectful tone to foster a constructive dialogue.

Yes, a demand letter for payment with interest can backfire if not properly worded. If the letter sounds aggressive or unreasonable, it may provoke the debtor’s anger or defensiveness. This can lead to a breakdown in communication and potential legal complications. Careful wording and tone can prevent this situation.

A demand letter for payment with interest does not guarantee payment, but it is a critical first step. It formally notifies the debtor and establishes your intent to pursue payment. Many recipients take this request seriously, leading to payment. However, be prepared to follow up or consider other actions if necessary.

Writing a strong demand letter for payment with interest involves clarity and precision. Start by clearly stating the amount owed, including the interest details. Provide a deadline for payment and describe the consequences of non-payment. This solid approach makes your demand more compelling.