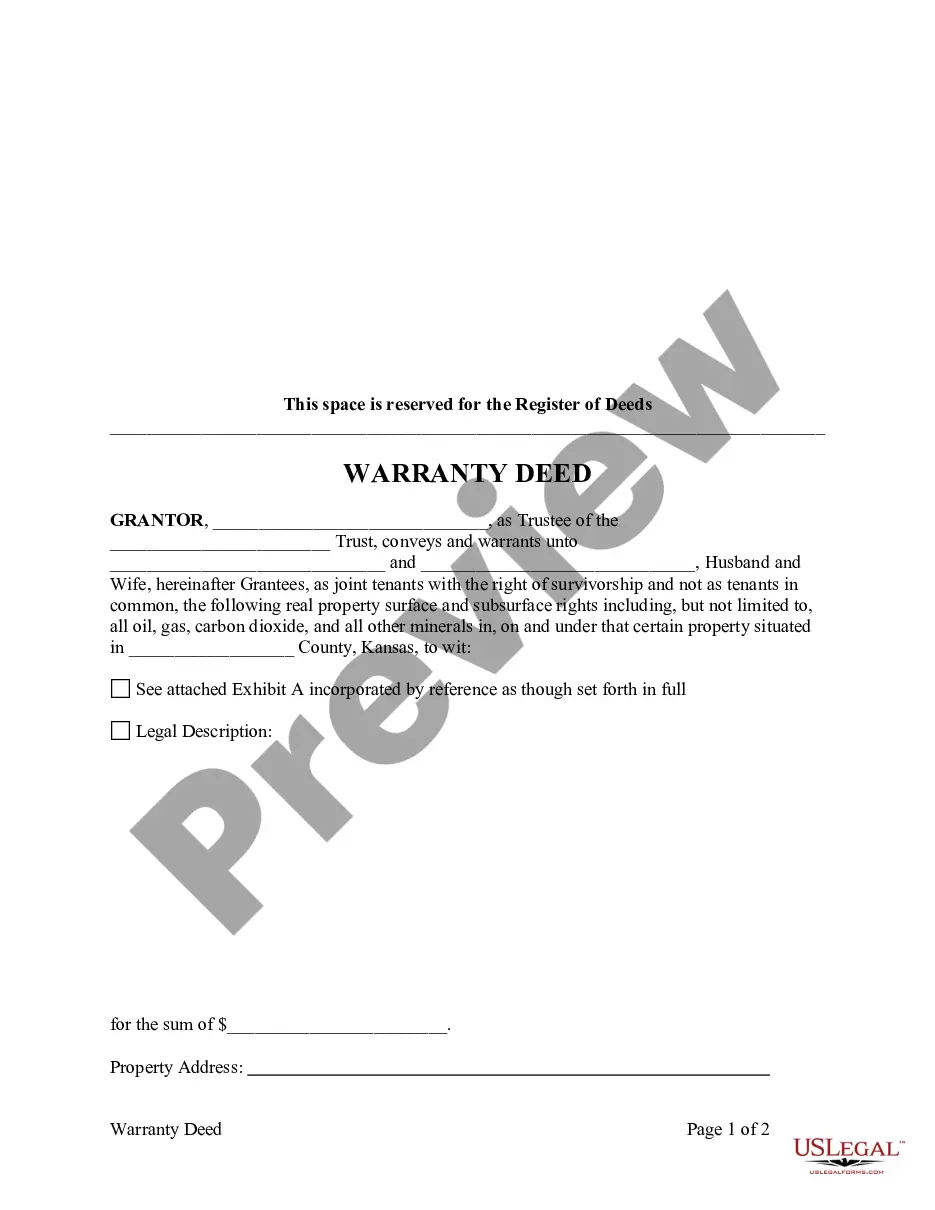

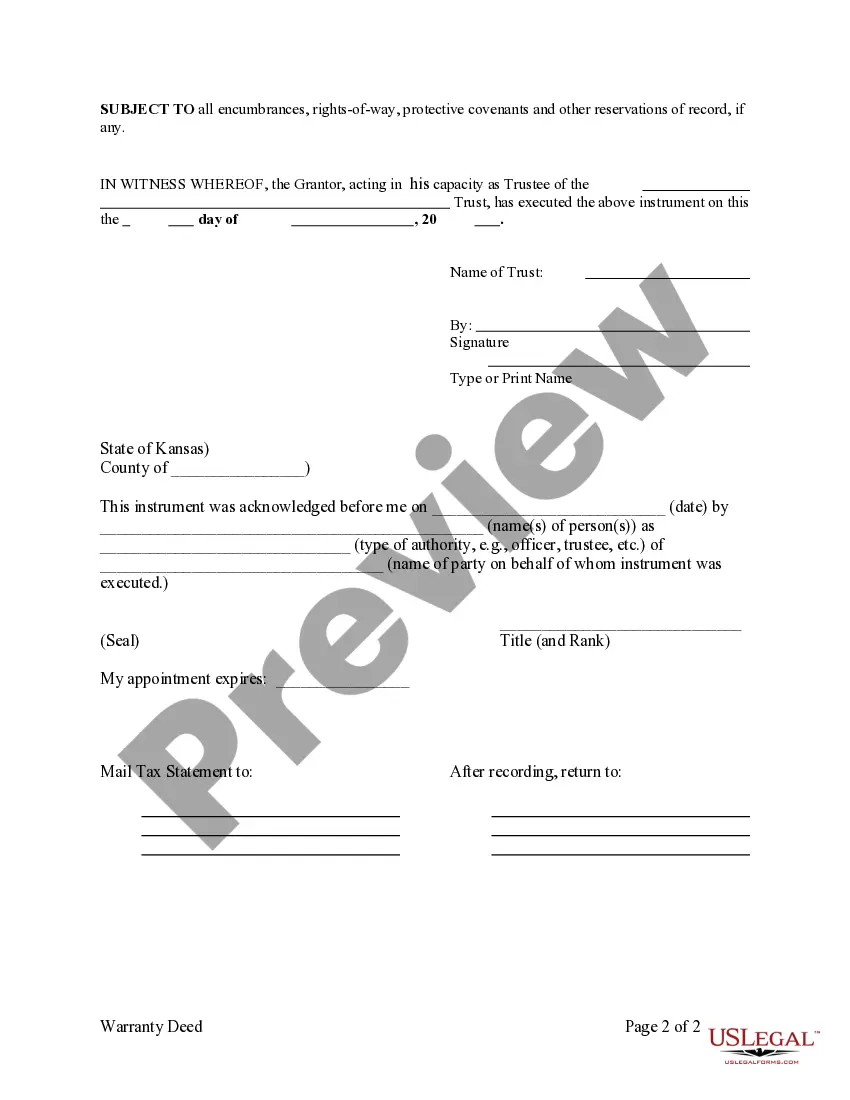

This form is a Warranty Deed where the grantor is a trust and the grantees are husband and wife. Grantor conveys and specially warrants the described property to grantees and specifically includes all oil, gas and minerals, on and under the property. This deed complies with all state statutory laws.

Kansas Husband Wife With A View

Description

How to fill out Kansas Warranty Deed - Trust To Husband And Wife?

- Log in to your existing account if you are a returning user and ensure your subscription is active. If it has expired, simply renew based on your selected payment plan.

- Browse through the Preview mode and skim the form descriptions. Verify that you've selected the appropriate document that aligns with your requirements and adheres to local jurisdiction.

- If you encounter inconsistencies or need a different document, use the Search tab to find another template. Once you find the correct one, proceed to the next step.

- Purchase the document by clicking the 'Buy Now' button and selecting a subscription plan that fits your needs. Remember to register an account to unlock access to the library.

- Finalize your purchase by entering your payment information, either through credit card or your PayPal account.

- Download the legal form to your device for completion. You can access it anytime in the 'My Forms' section of your profile.

With US Legal Forms' vast collection of over 85,000 fillable and editable legal forms, users can confidently create precise and legally sound documents. Plus, premium experts are available to assist you through the process.

Begin your journey to simplify your legal documentation today with US Legal Forms. Don't miss the opportunity to access the best resources designed for your needs!

Form popularity

FAQ

When you file jointly, both spouses are required to report all income and deductions together. In Kansas, even if one spouse has little or no income, it's necessary for both to be included in the tax return. This allows you the advantage of potentially lower tax rates and credits. Managing your tax obligations as a Kansas husband wife with a view effectively ensures compliance while maximizing benefits.

Yes, you can face issues if you file separately when married, especially if you are seeking to take certain tax credits and deductions that require joint filing. In Kansas, while legally allowed to file separately, you'll need to understand potential drawbacks and limitations. Make sure to assess your tax situation thoroughly, as a Kansas husband wife with a view, to ensure you're making the best choice.

Filing as single while married is considered fraudulent and could result in legal penalties. In Kansas, you must choose between married filing jointly or separately. Misrepresenting your filing status can lead to audits or fines, significantly impacting your finances. It's crucial to adhere to the correct filing status as a Kansas husband wife with a view to avoid complications.

For couples who are married but not living together, there are typically two options for filing status: married filing jointly or married filing separately. However, if you are separated, it's essential to note how your filing choice can affect your taxes in Kansas. Your decision could impact how much tax you owe or the refund you receive. Ensure you weigh your options carefully as a Kansas husband wife with a view.

If your spouse filed taxes jointly, you are generally required to file a tax return as well, unless specific criteria allow for exceptions. In Kansas, your filing requirement usually depends on your income and tax liability. If your earnings are below the exemption threshold, you might not need to file. Understanding the implications of filing jointly and your responsibilities as a Kansas husband wife with a view can clarify your obligations.

To qualify for head of household status, you must not live with your spouse for the last six months of the tax year, and you must maintain a home for your dependent child. In Kansas, if you meet these criteria, you can take advantage of this beneficial filing status. Keep in mind, your situation as a Kansas husband wife with a view can influence your overall tax strategy. It's best to consult with a tax professional for personalized advice.

Married couples in Kansas may choose to file separately if it benefits their tax situation. For example, if one spouse has significant medical expenses or miscellaneous deductions, filing separately may offer financial advantages. Additionally, if one spouse has tax liabilities, filing separately can protect the other from potential financial issues. Evaluating your specific scenario can help you decide the best route for your Kansas husband wife with a view.

Listing husband and wife names typically involves placing the husband's name first, followed by the wife's name. However, preferences can vary, so discussing this within the couple before formalizing is helpful. When completing forms, always adhere to the guidelines provided to ensure proper documentation. This attention to detail plays a part in embracing life together as a Kansas husband wife with a view.

When writing a wife's name alongside her husband's name, the format generally follows the pattern of using 'and' or '&'. For example, 'Emily and Mark' is a common presentation. This format symbolizes their bond and partnership and shows mutual respect in formal settings. Many couples strive for this clarity as they build their lives, becoming a Kansas husband wife with a view.

Married couples filling out the W4 form should first determine their combined income to choose the correct withholding allowances. It’s recommended to check the IRS guidelines for additional deduction opportunities. By accurately completing this form, both husband and wife can manage withholding taxes effectively. This essential task is one more step toward solidifying their status as a Kansas husband wife with a view.