Kansas Foreign Corporation Registration Requirements

Description

How to fill out Kansas Business Incorporation Package To Incorporate Corporation?

There's no longer a requirement to squander hours searching for legal documents to adhere to your local state statutes.

US Legal Forms has assembled all of them in one location and improved their accessibility.

Our platform offers over 85k templates for any business and personal legal matters categorized by state and area of application. All forms are properly crafted and verified for legality, so you can feel confident in acquiring an up-to-date Kansas Foreign Corporation Registration Requirements.

Select the best suitable subscription plan and create an account or sign in. Make your subscription payment with a credit card or via PayPal to proceed. Choose the file format for your Kansas Foreign Corporation Registration Requirements and download it to your device. Print your form to complete it manually or upload the sample if you wish to use an online editor. Organizing formal documentation under federal and state laws and regulations is quick and uncomplicated with our library. Try US Legal Forms today to keep your records orderly!

- If you are acquainted with our platform and already possess an account, ensure your subscription is active before obtaining any templates.

- Log In to your account, select the document, and click Download.

- You can also return to all saved documents whenever necessary by opening the My documents tab in your profile.

- If you've not interacted with our platform previously, the procedure will require a few more steps to finalize.

- Here's how new users can acquire the Kansas Foreign Corporation Registration Requirements from our library.

- Examine the page content attentively to confirm it contains the sample you require.

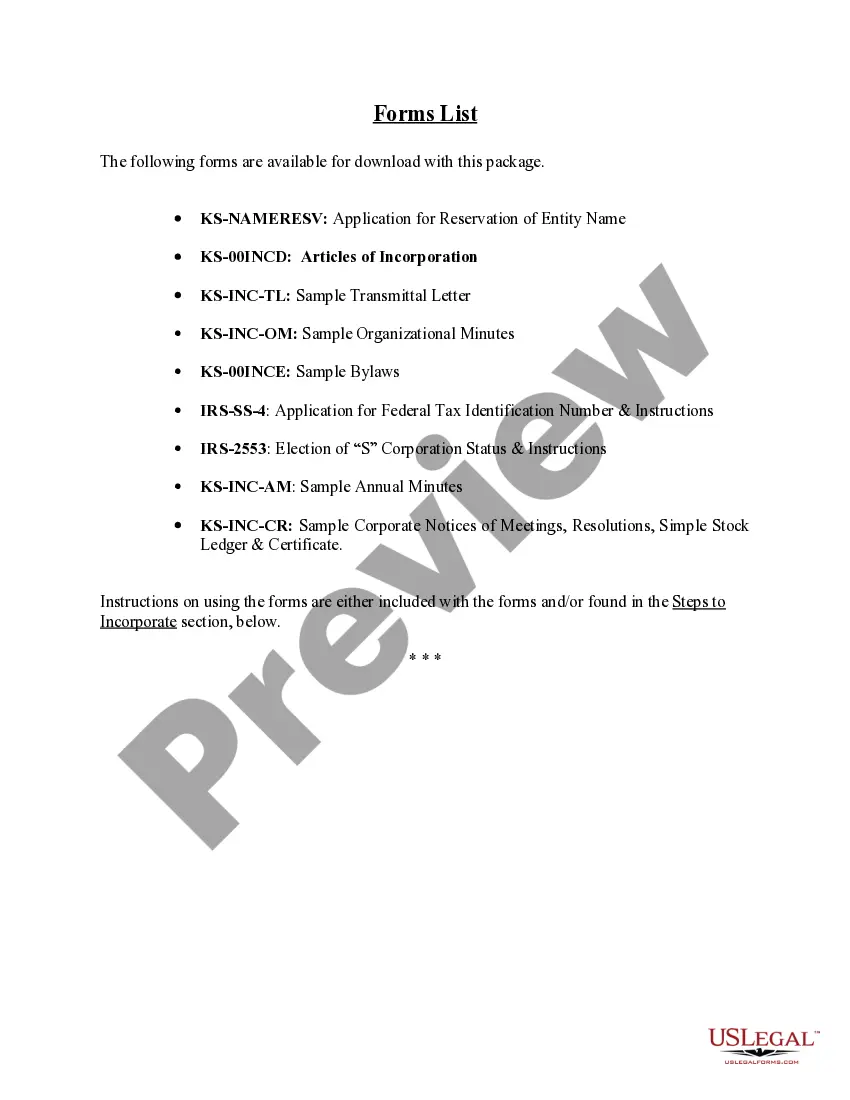

- To assist with this, utilize the form description and preview options if available.

- Utilize the Search bar above to look for another sample if the previous one did not suit your needs.

- Click Buy Now next to the template name when you locate the appropriate one.

Form popularity

FAQ

An agent is an individual or entity authorized to act on behalf of the corporation, especially for receiving legal documents. In contrast, an owner, also known as a shareholder, possesses equity in the company. Understanding these roles is essential for navigating the Kansas foreign corporation registration requirements and ensuring proper governance of your business.

Starting a corporation in Kansas involves several steps, including selecting a unique business name and filing articles of incorporation. After filing, you must also apply for a federal Employer Identification Number (EIN). Following these steps will fulfill the Kansas foreign corporation registration requirements and help establish your business in the state.

Kansas does not require a formal operating agreement for foreign corporations; however, having one is highly recommended. An operating agreement defines the management structure and operating procedures of your business. Even if it's not mandated, having this document helps clarify roles and responsibilities, which supports your compliance with the Kansas foreign corporation registration requirements.

Yes, you must designate a registered agent when registering a foreign corporation in Kansas. The registered agent receives official documents and legal notices on behalf of your business. This is a crucial part of meeting the Kansas foreign corporation registration requirements, as it helps maintain compliance and ensures timely communication.

Yes, if you plan to conduct business in Kansas as a foreign corporation, you must register. This involves filing the necessary documents with the Kansas Secretary of State. Meeting the Kansas foreign corporation registration requirements ensures your business operates legally and protects your interests.

Yes, a foreign corporation must file a US tax return if it conducts business that generates income in the US. This requirement may depend on various factors, including the nature of your activities and where your income is sourced. To ensure compliance with tax obligations, it is advisable to familiarize yourself with the Kansas foreign corporation registration requirements and consult a tax professional.

Foreign companies can operate in the US by following the necessary legal procedures, including obtaining a certificate of authority. This process often involves adhering to the Kansas foreign corporation registration requirements, hiring local employees, and establishing a presence in the market. Working with a platform like US Legal Forms can help you navigate the registration process smoothly.

A foreign corporation in the USA refers to a business entity that is incorporated outside the state where it intends to operate. For example, a corporation formed in another state or country must register in Kansas to legally conduct business there. Understanding the Kansas foreign corporation registration requirements is essential for any overseas company wishing to expand within the US.

Yes, a foreign company must register to conduct business in the US, which includes Kansas. This registration is necessary to ensure compliance with local laws and regulations. By fulfilling the Kansas foreign corporation registration requirements, your business gains legal recognition and access to the market.

Kansas foreign corporation registration requirements include filing a certificate of authority with the Secretary of State, submitting a copy of your corporate charter, and meeting any applicable licensing obligations. You must also provide details about your registered agent in Kansas. Additionally, your foreign corporation needs to comply with federal regulations and maintain good standing to conduct business effectively.