Kansas Business Incorporation Package to Incorporate Corporation

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

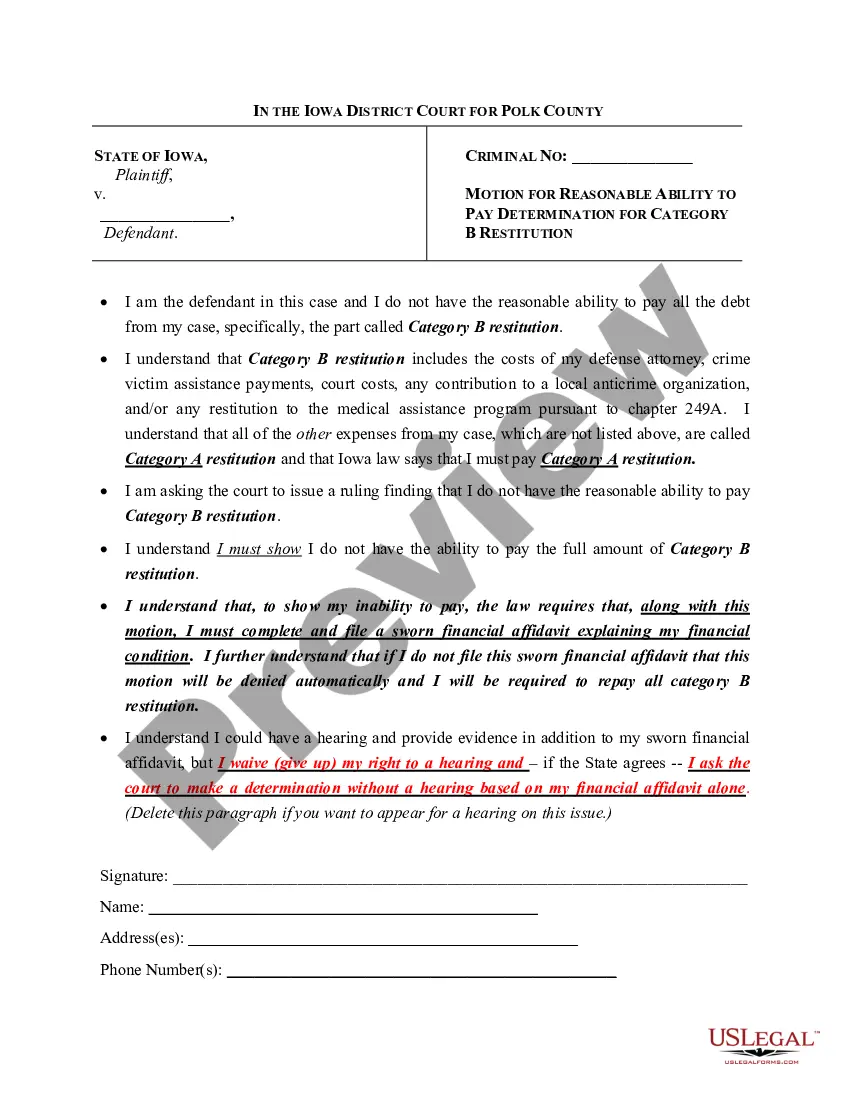

How to fill out Kansas Business Incorporation Package To Incorporate Corporation?

Searching for Kansas Business Incorporation Package to Set Up Corporation sample and completing them can be difficult.

To conserve a great deal of time, money, and effort, utilize US Legal Forms and discover the suitable sample specifically for your state in merely a few clicks.

Our lawyers prepare each and every document, so you only need to complete them.

You can print the Kansas Business Incorporation Package to Set Up Corporation template or fill it out using any online editor. No need to fret about making mistakes because your form can be used and submitted, and printed as many times as you desire. Try US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and navigate back to the form's webpage to download the sample.

- All your saved templates are stored in My documents and are available anytime for future use.

- If you haven’t signed up yet, you need to register.

- Review our comprehensive guidelines on how to acquire the Kansas Business Incorporation Package to Set Up Corporation form in just a few minutes.

- To obtain a valid form, verify its applicability for your state.

- View the form using the Preview option (if available).

- If there is a description, read it to comprehend the details.

- Click on Buy Now button if you found what you're looking for.

Form popularity

FAQ

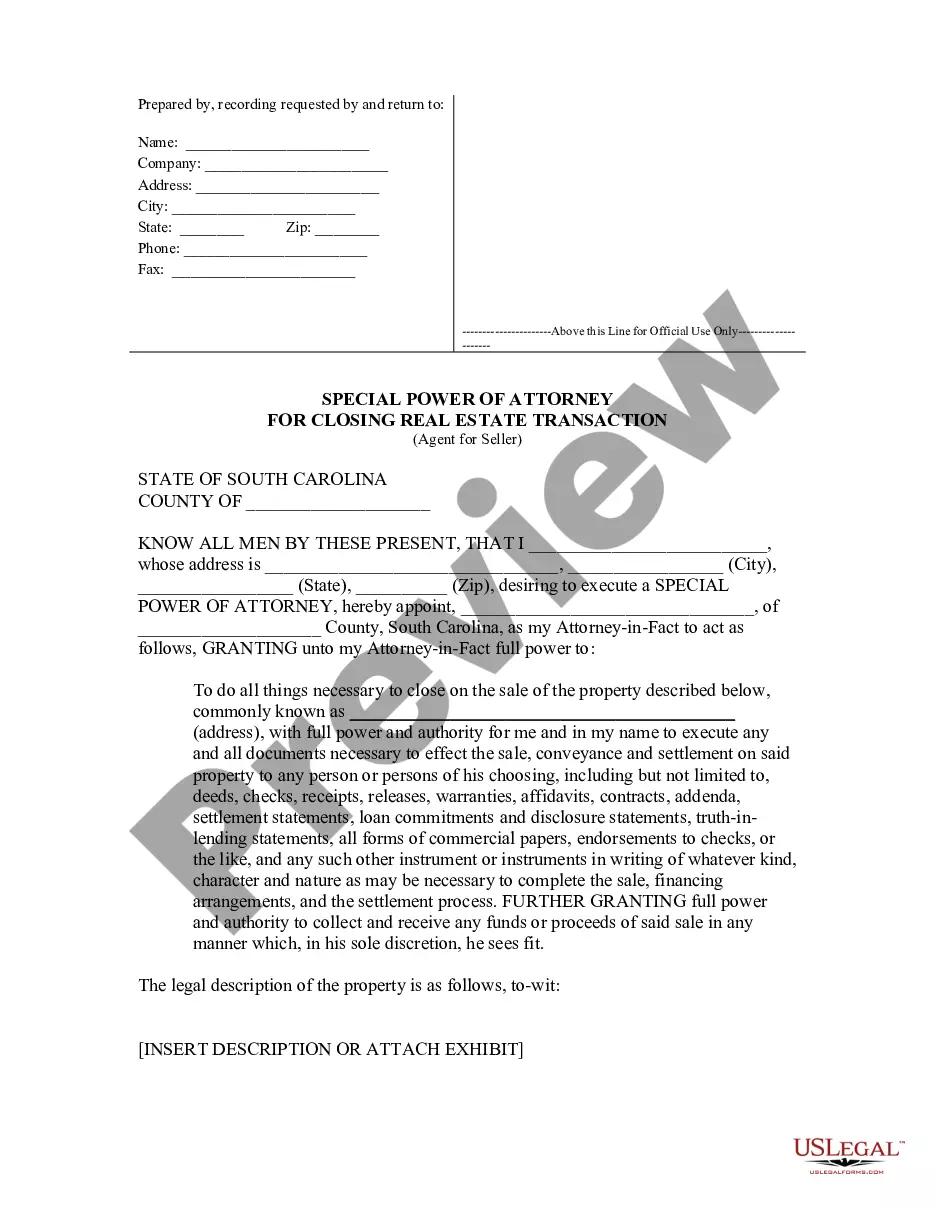

Business Name Reservation Form (Corps and LLCs) Articles of Incorporation (Corps only) Articles of Organization (LLCs only) Corporate Bylaws (Corps only) Operating Agreement (LLCs only)

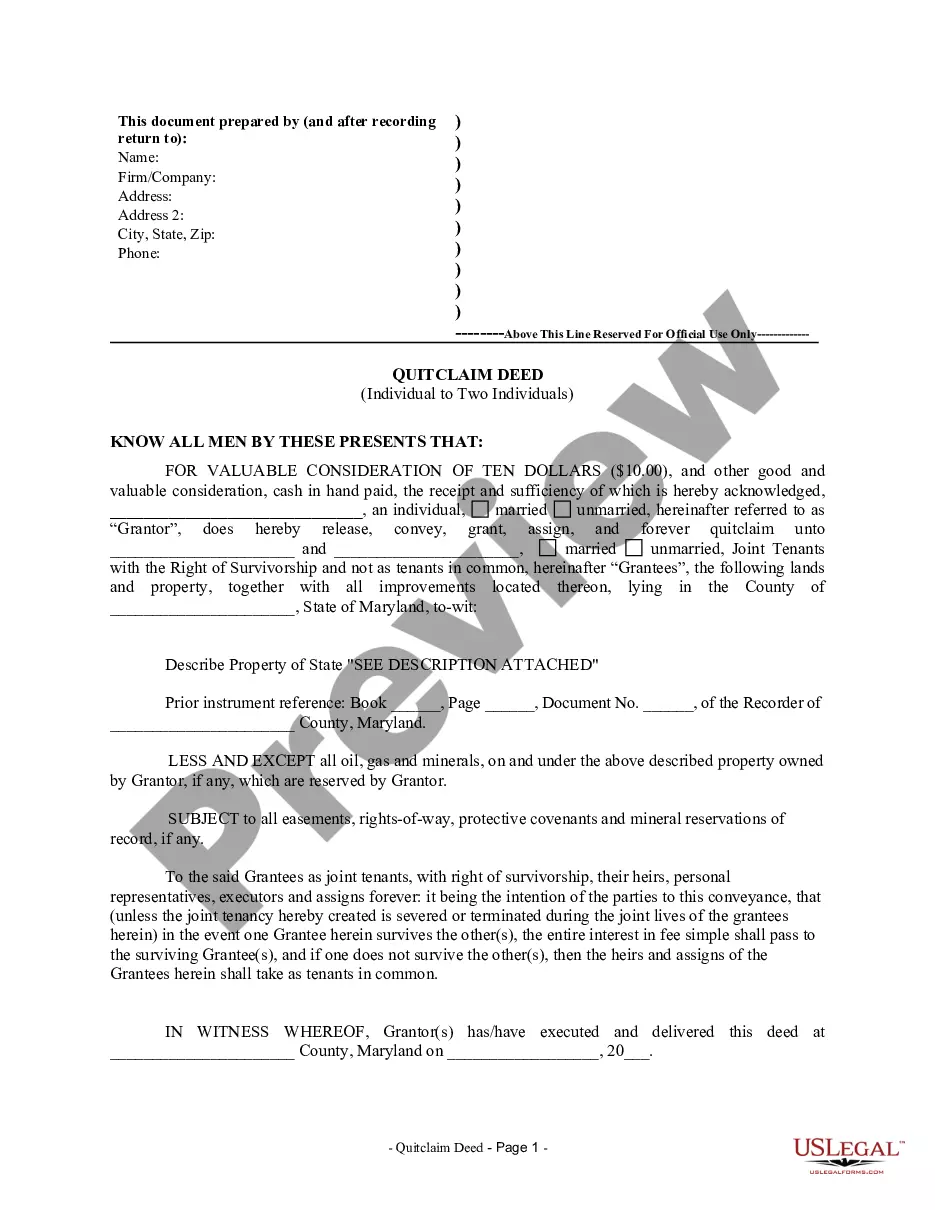

Do I need to incorporate my small business? Whether your team is composed of two people or 10, all businesses can benefit from incorporating. Advantages of forming a corporation or limited liability company (LLC) include: Personal asset protection.

To form a Kansas corporation, you must file articles of incorporation with the Secretary of State and pay a filing fee. As soon as you file the articles, the corporation exists as a legal entity.

To start a corporation in Kansas, you must file Articles of Incorporation with the Secretary of State. You can file the document online or by mail. The Articles of Incorporation cost $90 ($89 online) to file.

Registered Office. Business Activity. Director's Details. Shareholders' Details. Shareholders' Details. Secretary Details (Not Compulsory) Person with Significant Control (PSC) Details Where the person is not a director, shareholder or secretary.

Inc. is the abbreviation for incorporated. An incorporated company, or corporation, is a separate legal entity from the person or people forming it. Directors and officers purchase shares in the business and have responsibility for its operation. Incorporation limits an individual's liability in case of a lawsuit.

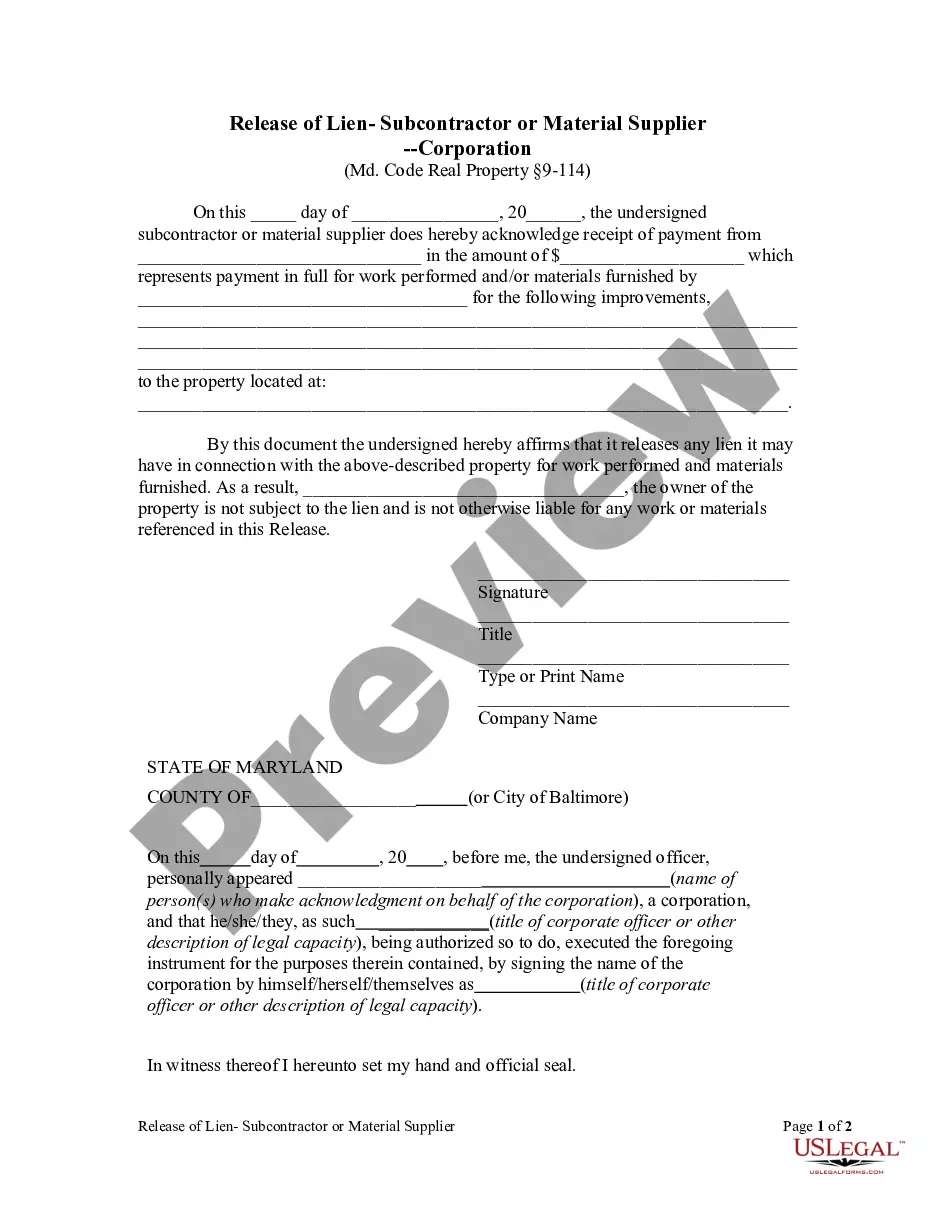

LLC registrants are required to file Articles of Organization accompanied by the necessary filing fee of either $165 for paper forms or $160 for online forms. Fees can change, contact the Secretary of State for the most recent fees.

One of the main reasons to form a corporation or LLC for a small business is to avoid personal liability for the business' debts. As we mentioned earlier, corporations and LLCs have their own legal existence. It's the corporation or LLC that owns the business, its assets, debts, and liabilities.

How much does it cost to form an LLC in Kansas? The Kansas Secretary of State charges $165 to file the Articles of Organization. You can reserve your LLC name with the Kansas Secretary of State for $30 when filing online or $35 when filing by mail.