Maryland Release of Lien - Subcontractor or Material Supplier - Corporation or LLC

About this form

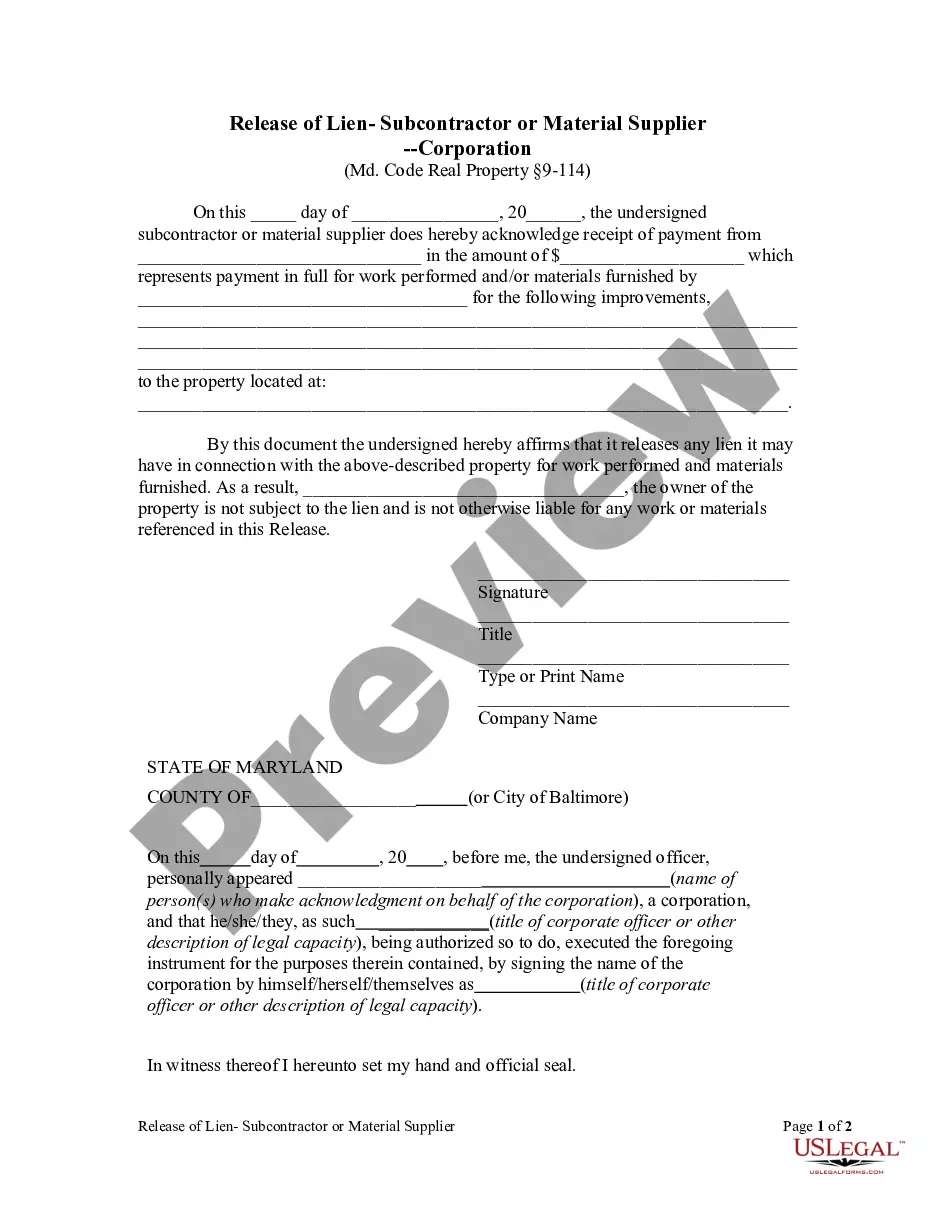

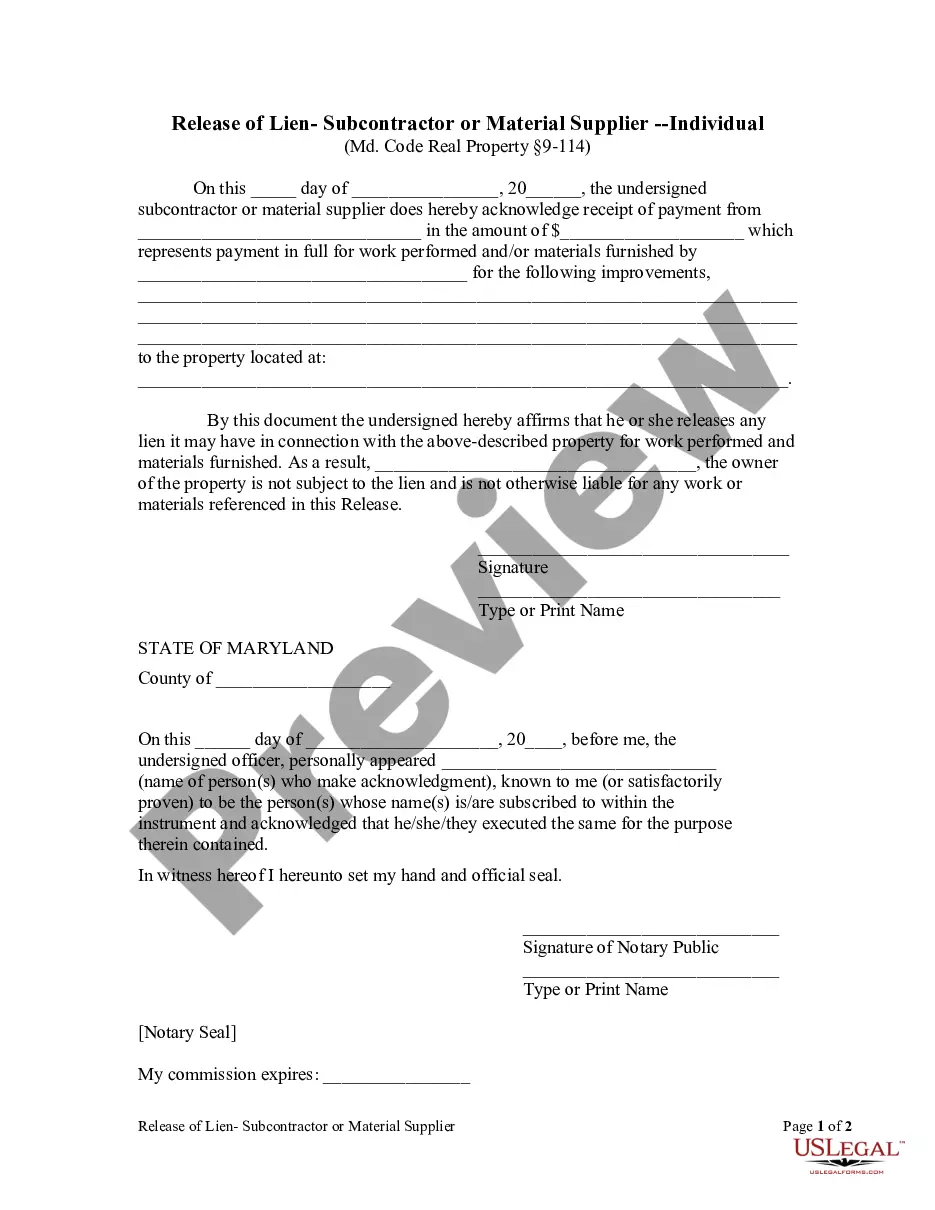

The Release of Lien - Subcontractor or Material Supplier is a legal document used by corporate or LLC subcontractors and material suppliers to confirm they have received full payment for their work and materials provided. This form explicitly states that any lien associated with the property for the work and materials is released, protecting the property owner from future claims related to the project. This distinguishes it from other lien releases by its specific applicability to corporate entities and subcontractors in the construction and materials supply sectors.

Form components explained

- Date of payment acknowledgment

- Identification of the payer (property owner)

- Details about the amount received

- Description of the work and materials furnished

- Statement of lien release

- Signatures of authorized representatives and a notary

State-specific requirements

This form is governed by Maryland law and must comply with Md. Code Ann. 9-114. Other states may have different requirements, so users should verify local laws applicable to lien releases.

When to use this document

This form is typically used when a corporate or LLC subcontractor or material supplier has completed their work on a property and has received final payment. By utilizing this release, the subcontractor or supplier protects themselves legally while also ensuring that the property owner is free from any claims related to unpaid work or materials. It's essential in construction projects to avoid any disputes over payment and lien rights after work is completed.

Who this form is for

This form is suitable for:

- Corporate subcontractors engaged in construction projects.

- LLCs supplying materials for property improvements.

- Contractors needing to release lien claims to facilitate payment processing and project completion.

- Property owners who require assurance against future lien claims from subcontractors or material suppliers.

Steps to complete this form

- Enter the date on which the payment was received.

- Fill in the name of the payer (property owner) and the payment amount.

- Provide details about the work performed and materials supplied.

- Complete the statement confirming the release of any lien.

- Sign the form and indicate the title and name of the corporation.

- Have the document notarized to ensure its legality.

Notarization guidance

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Common mistakes

- Failure to sign the form, which renders it invalid.

- Not providing complete information about the work performed.

- Leaving out the notary signature or seal where required.

- Incorrectly identifying the parties involved in the payment transaction.

Why complete this form online

- Convenience of downloading and completing the form from anywhere.

- Editable fields allow for quick customization.

- Ensures compliance with legal requirements and standards.

- Access to templates created by licensed attorneys ensures reliability.

Form popularity

FAQ

Legally, an unpaid contractor, subcontractor or supplier can file a lien (sometimes called a mechanic's lien) that could eventually force the sale of your home in place of compensation.Conversely, if the contractor who worked on your project does not pay for materials, a supplier could place a lien on your property.

To establish a lien, a contractor or subcontractor must file a petition in the circuit court for the county where the property is located within 180 days after completing work on the property or providing materials. It can be difficult to determine the work completion date. Notice For Subcontractors.

When payment issues arise, material suppliers can file mechanics liens. However, there are several rules that are unique to suppliers compared to the more commonly tackled procedures for contractors. When payment issues arise, material suppliers can file mechanics liens to get paid.

The simplest way to prevent liens and ensure that subcontractors and suppliers are paid is to pay with joint checks. This is when both parties endorse the check. Compare the contractor's materials or labor bill to the schedule of payments in your contract and the Preliminary Notices.

The simplest way to prevent liens and ensure that subcontractors and suppliers are paid is to pay with joint checks. This is when both parties endorse the check. Compare the contractor's materials or labor bill to the schedule of payments in your contract and the Preliminary Notices.

If a general contractor refuses to pay his subcontractors, they can make a claim against the payment bond. The surety company will pay out the subcontractors for at least part of their money and take the contractor to court.

A lien is essentially a claim for repayment of a debt. In the construction context, a lien is of considerable importance because it offers considerable power to a subcontractor to seek payment from an owner through the property itself for a debt owed to the subcontractor by a general contractor or other third party.

Material Lien means any Lien on any Property of the Company or its Subsidiaries (or any income or profits therefrom) having a book value of $1,000,000 or more.

Usually, anything that subcontractors would be liable for, general contractors may also be liable for (with the caveat that if the contractor has to pay for damages, the subcontractor who is legally responsible will often reimburse the general contractor).