Assumption Release Mortgagors With A Suit

Description

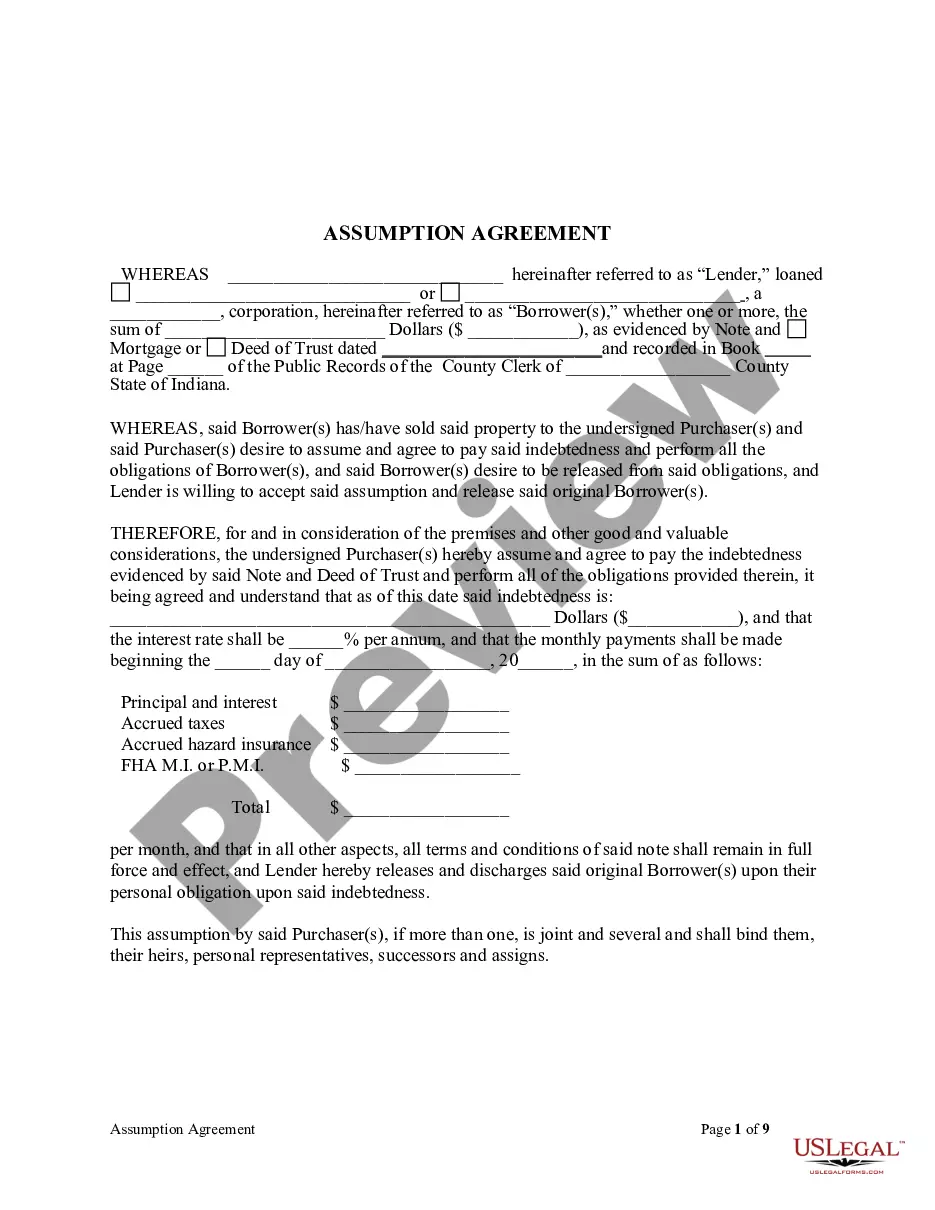

How to fill out Indiana Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

- If you're a returning user, log in to your account at US Legal Forms and download the required template by clicking the Download button. Please ensure your subscription is current; renew it if necessary.

- For new users, first confirm you've selected the right template by reviewing the Preview mode and form description to ensure it aligns with your local jurisdiction.

- If necessary, search for alternative templates using the Search tab to find one that suits your needs more accurately.

- Once you have the right document, click the Buy Now button and select your preferred subscription plan, which requires account registration.

- Proceed to make your purchase by entering your credit card information or by using your PayPal account.

- Finally, download the form and save it on your device to complete later. You can also retrieve it anytime from the My Forms section of your account.

With US Legal Forms, you gain access to a robust collection of over 85,000 forms, crafted to ensure you find the exact documentation you need efficiently.

Our service not only streamlines the process but also allows users to connect with premium experts for guidance. Get started today and empower yourself with precise legal documents tailored just for you.

Form popularity

FAQ

Removing someone's name from a mortgage without refinancing is generally complicated. You may need to get the lender's consent, and they might require the remaining borrower to qualify on their own. It often involves filing an assumption release mortgagors with a suit to make this change legally binding. Always consult with your lender for the best approach tailored to your situation.

To assume a mortgage, you typically need several essential documents. These often include your financial statements, proof of income, and any contractual agreements concerning the mortgage. Understanding the process of Assumption release mortgagors with a suit is vital as well. Make sure to prepare these documents carefully to facilitate a smooth transfer.

If you are sued and lose, the court might allow the creditor to seize certain assets to satisfy the judgment. This often includes bank accounts, wages, and sometimes real property, depending on your state laws. Being informed about your rights regarding Assumption release mortgagors with a suit can help you protect your assets. Engaging with a legal service can provide clarity on your situation.

A lawsuit can indeed affect your mortgage application negatively. Lenders may see ongoing lawsuits as potential risks, which could delay or deny your application. Understanding how Assumption release mortgagors with a suit works can help clarify your options. Consulting with legal and financial experts may provide you with strategies to mitigate these concerns.

Getting a mortgage after debt settlement is possible, but it may depend on your situation. Lenders typically evaluate your credit history and overall financial health. Being proactive about addressing your debts and understanding how Assumption release mortgagors with a suit can influence your application is crucial. Consider working with professionals to navigate this process.

Yes, a judgment can impact your ability to secure a mortgage. Lenders often view judgments as a sign of financial instability, which may hinder your approval. However, even if you have a judgment, you might still be able to obtain a mortgage under certain conditions. It's advisable to discuss options with lenders who understand Assumption release mortgagors with a suit.

Yes, you can still obtain a mortgage even if you are involved in a lawsuit. Lenders will review your financial situation and the impact of the lawsuit on your ability to repay. It's important to present your case clearly and ensure you have other strong financial metrics to support your application. Assumption release mortgagors with a suit might face additional scrutiny, but opportunities still exist.

To obtain a release of liability from a mortgage company, first, review your mortgage agreement for any clauses related to assumption release mortgagors with a suit. Next, contact your mortgage lender to discuss your situation and request the necessary forms. It is vital to provide any required documentation that proves you qualify for the release. Additionally, you may benefit from using US Legal Forms to access the appropriate legal documents that streamline this process.