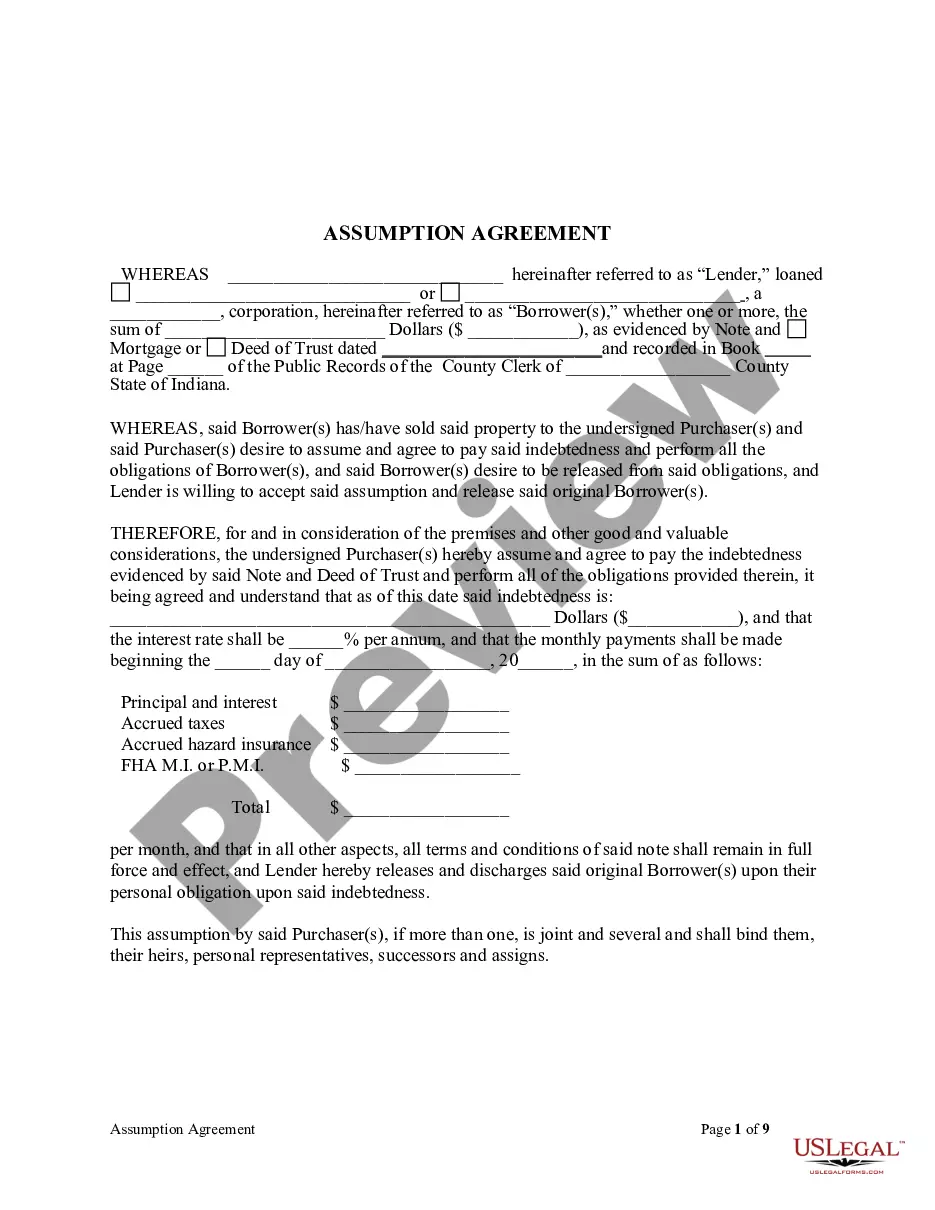

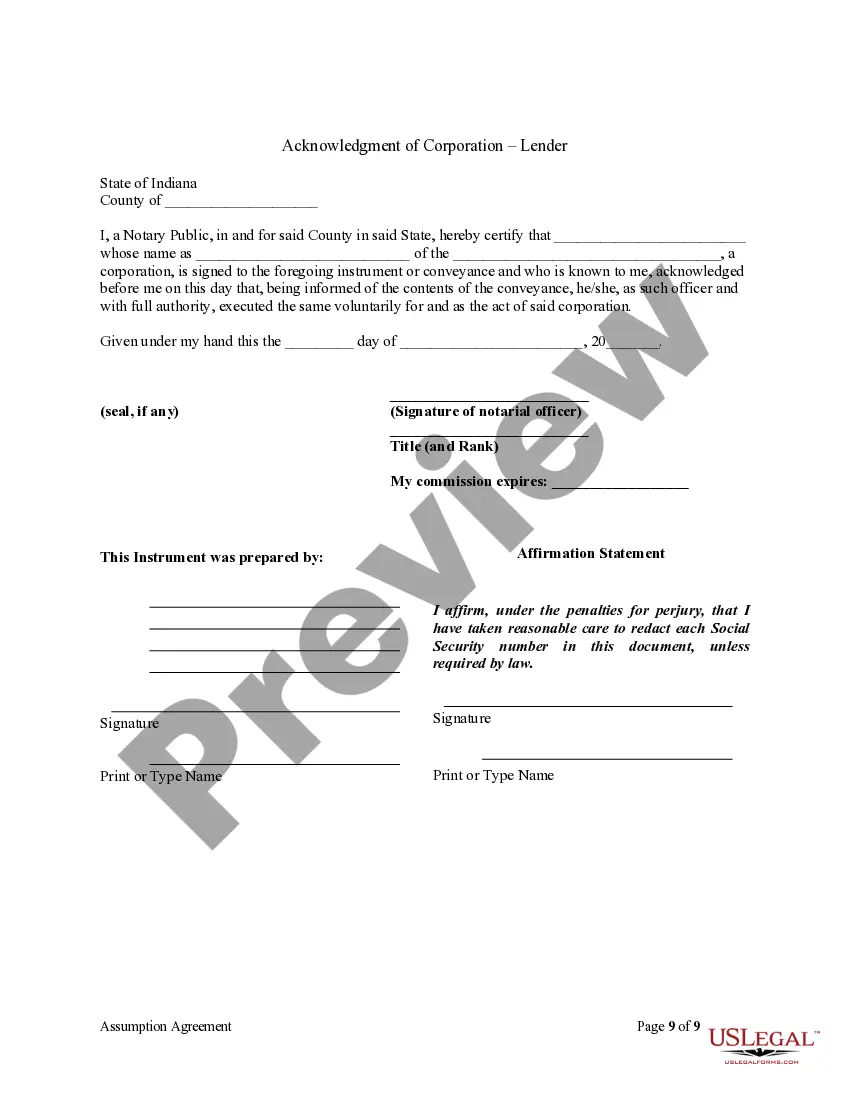

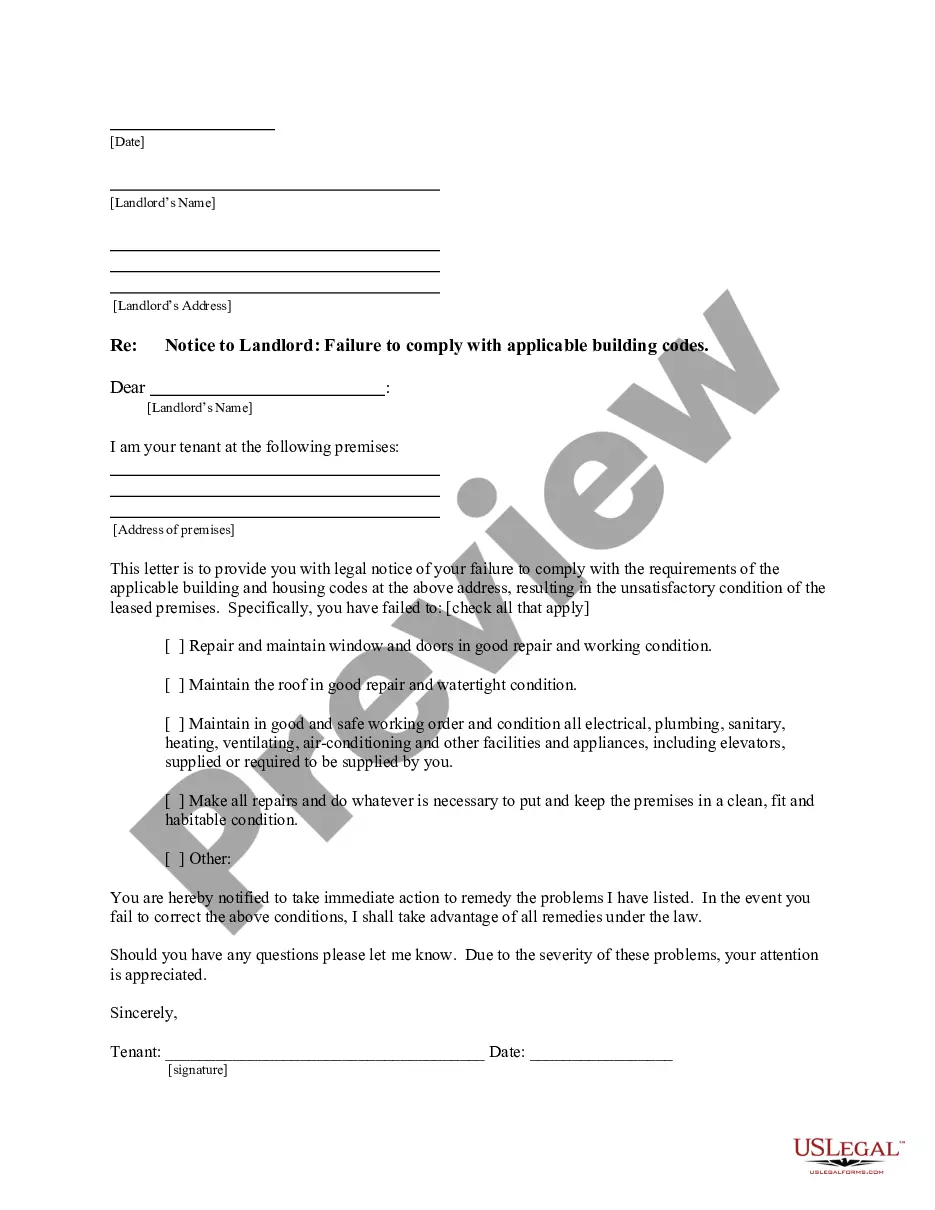

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

Indiana Assumption Agreement of Mortgage and Release of Original Mortgagors

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

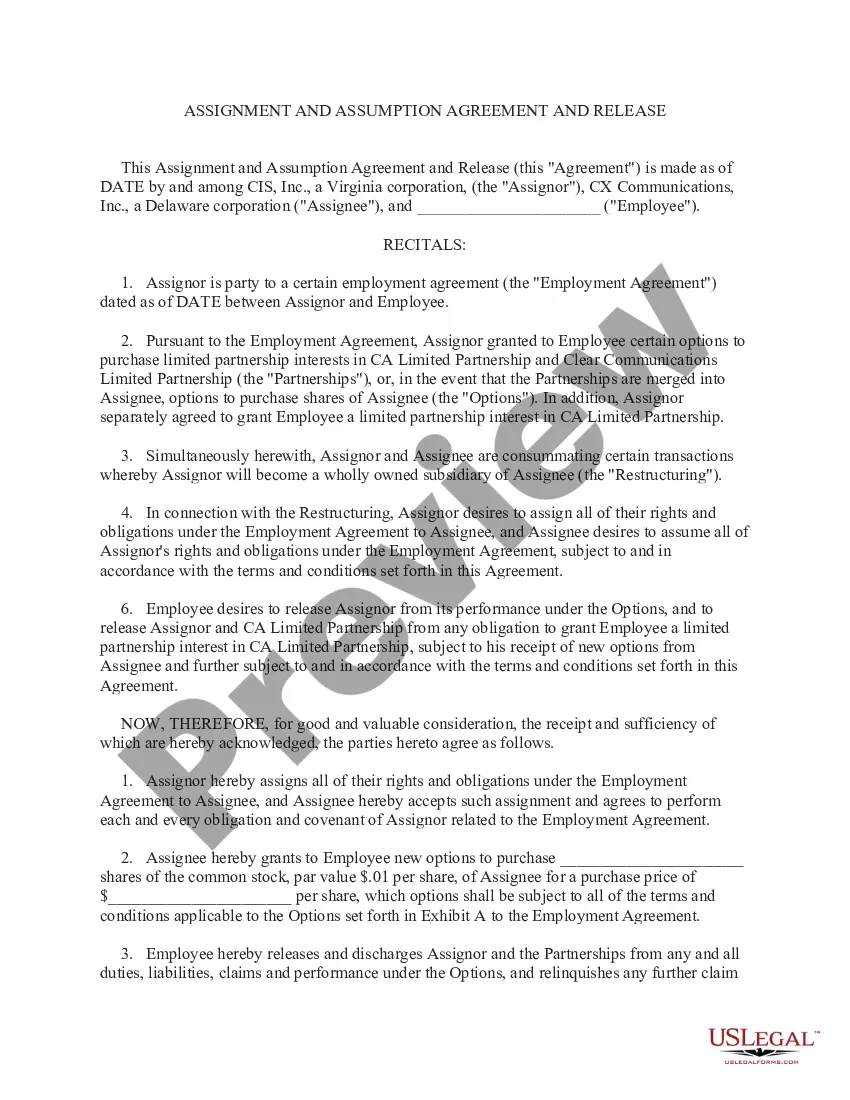

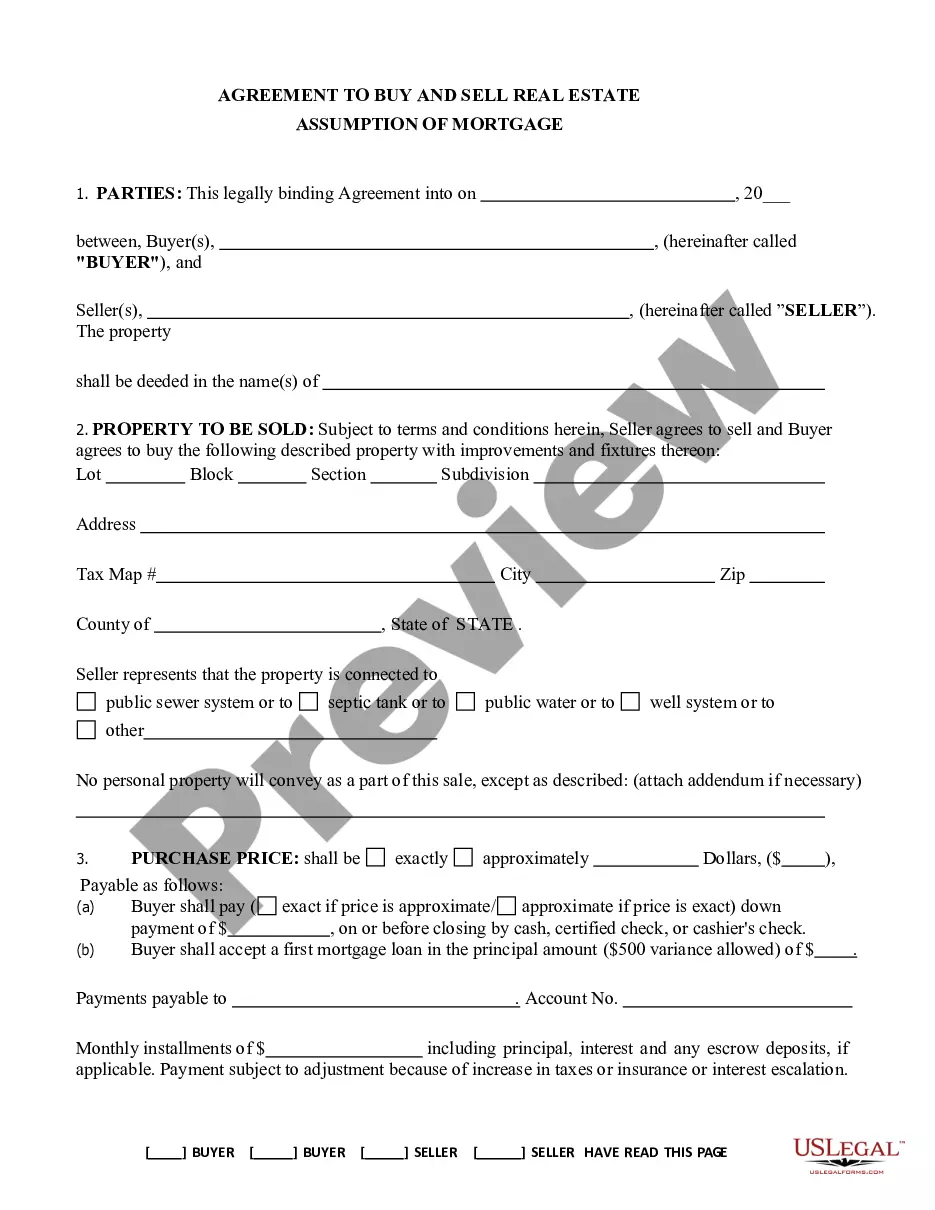

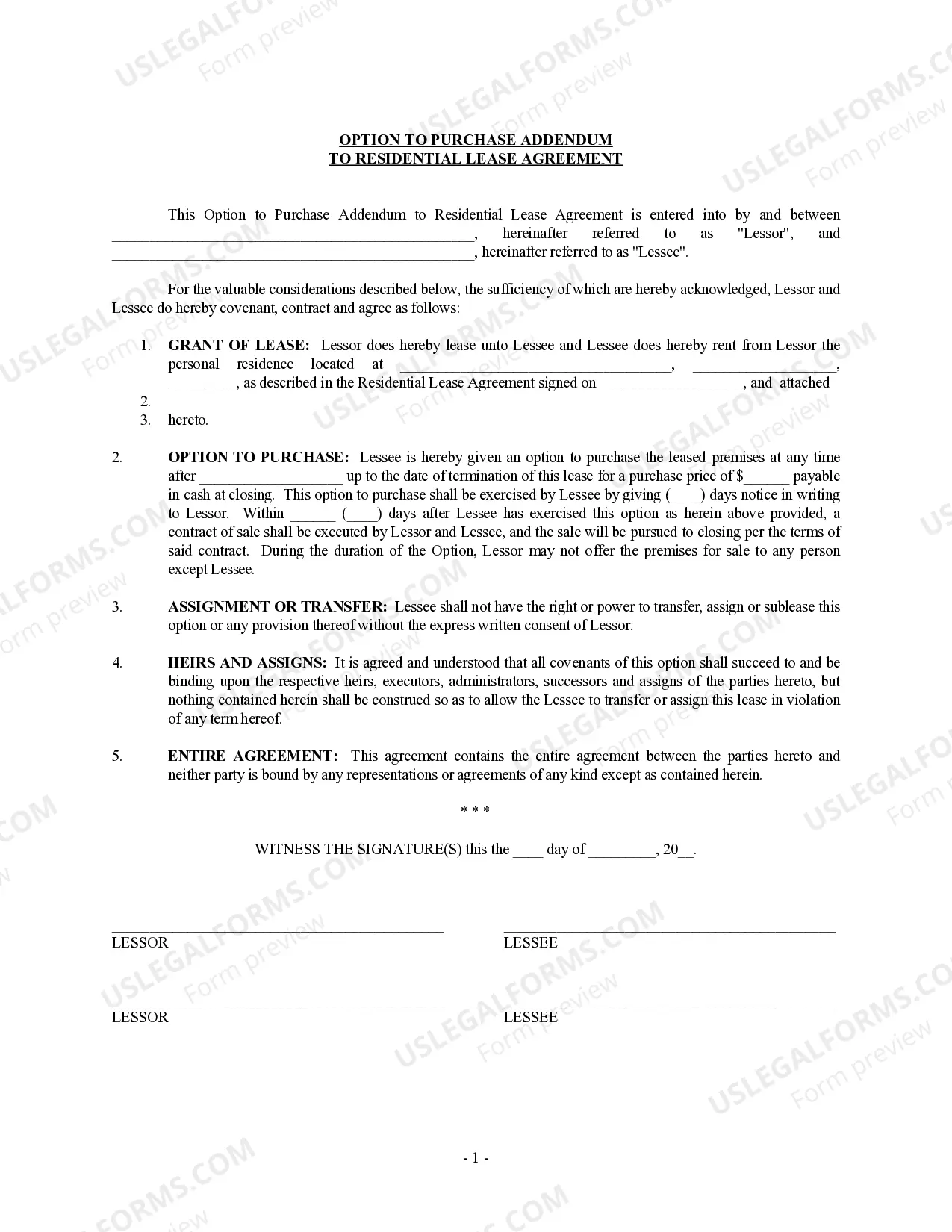

Assumption Agreement of Mortgage and Release of: A legal document that transfers the mortgage obligations from the original borrower to a new owner while simultaneously releasing the prior owner from liability. Mortgage Loan: A loan secured by the collateral of specified real estate property that the borrower is obliged to pay back with a predetermined set of payments. Loan Documents: Official paperwork that outlines the terms and conditions of a loan, including responsibilities and obligations of all parties involved.

Step-by-Step Guide to Completing an Assumption Agreement

- Review the Current Mortgage: Understand the terms of the existing mortgage loan, including interest rates and the balance due.

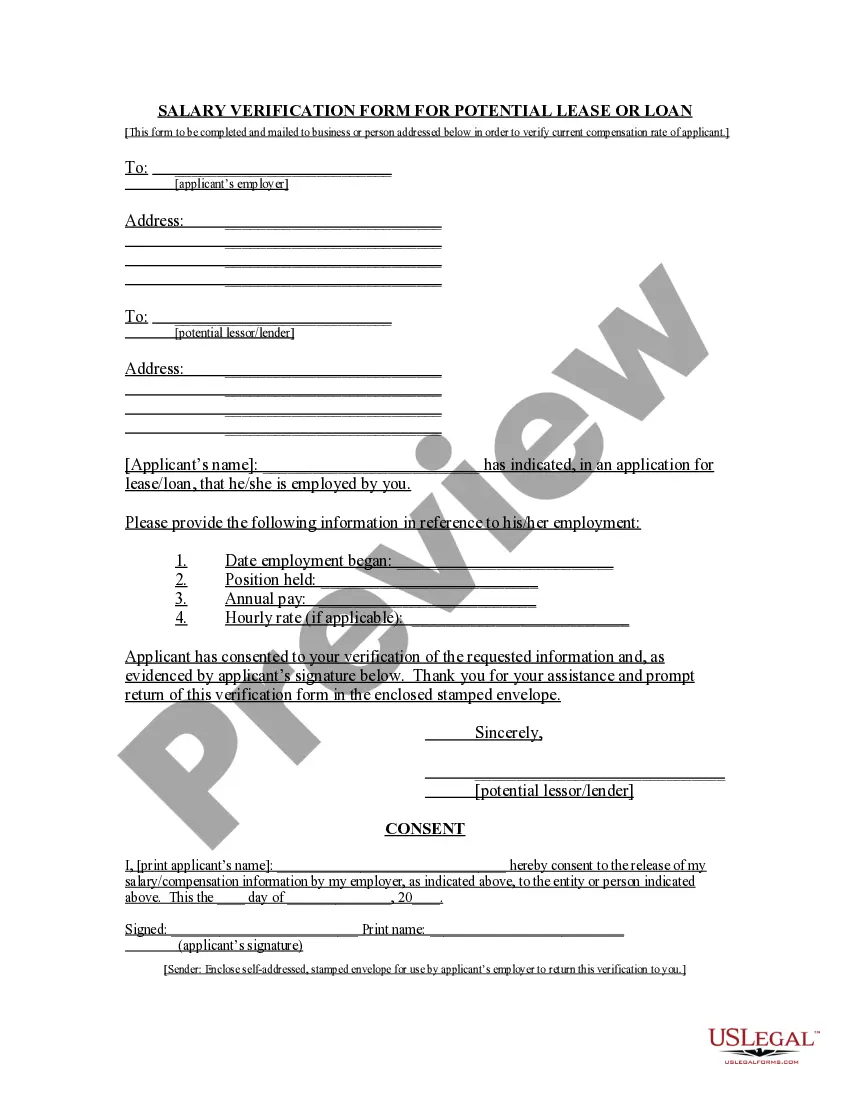

- Qualify for the Mortgage: The new borrower must qualify for the mortgage under current lender standards, potentially including credit checks and income verification.

- Negotiate Terms: Agree on the terms between the original borrower, the new borrower, and the lender regarding the assumption and release.

- Prepare the Loan Documents: Draft the assumption agreement along with any required ancillary documents, such as property transfer agreements.

- Secure Homeowner Insurance: Ensure the property is covered under a homeowner insurance policy, fulfilling requirements by lenders like Fannie Mae.

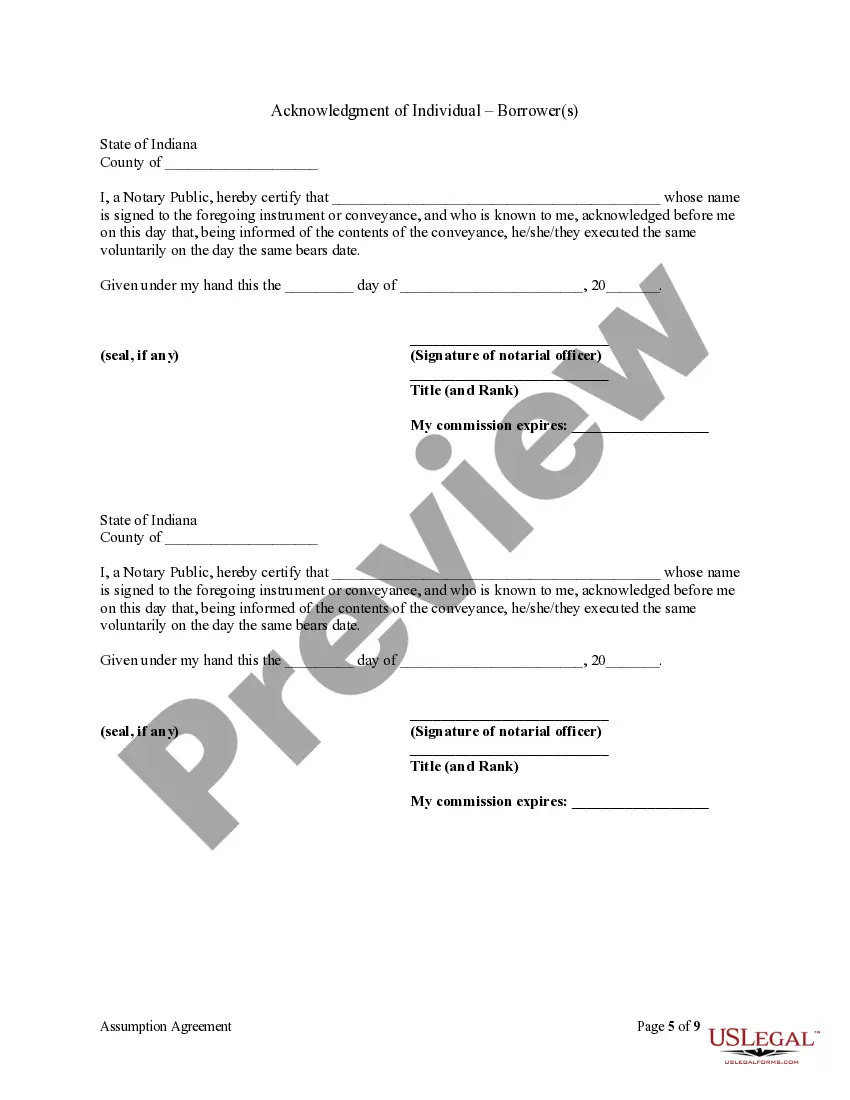

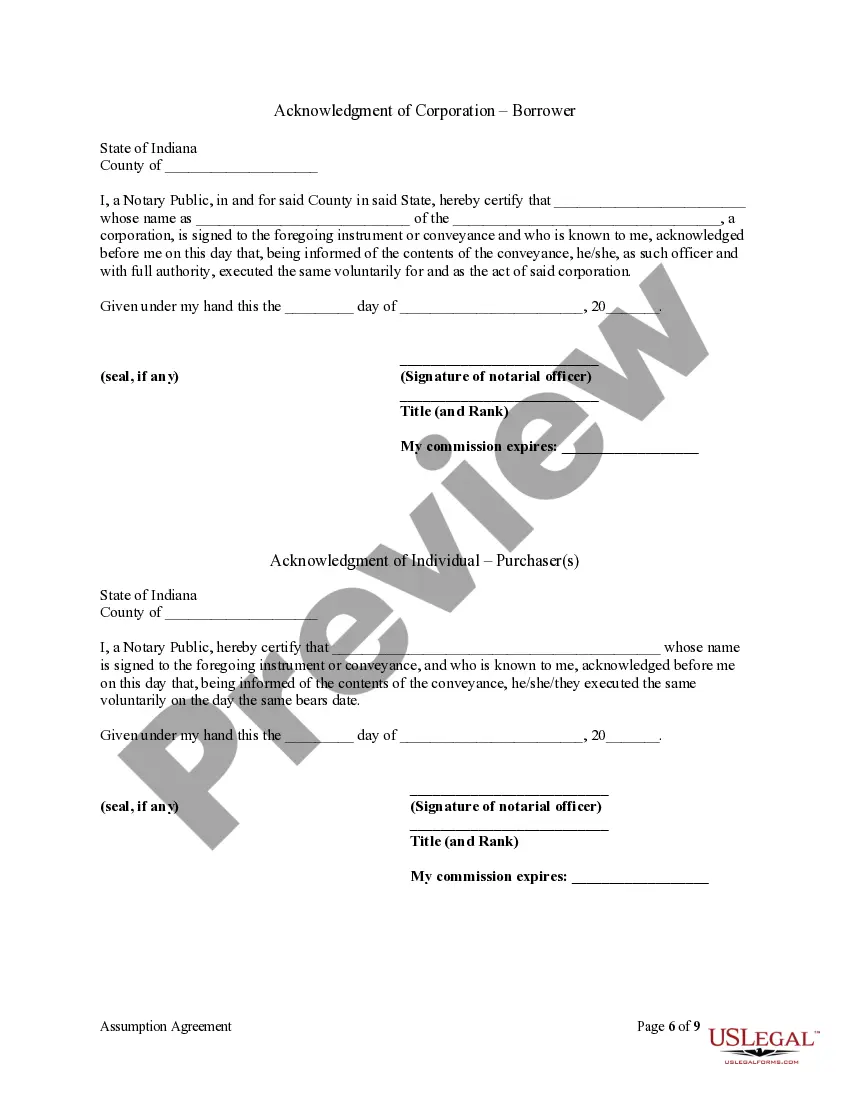

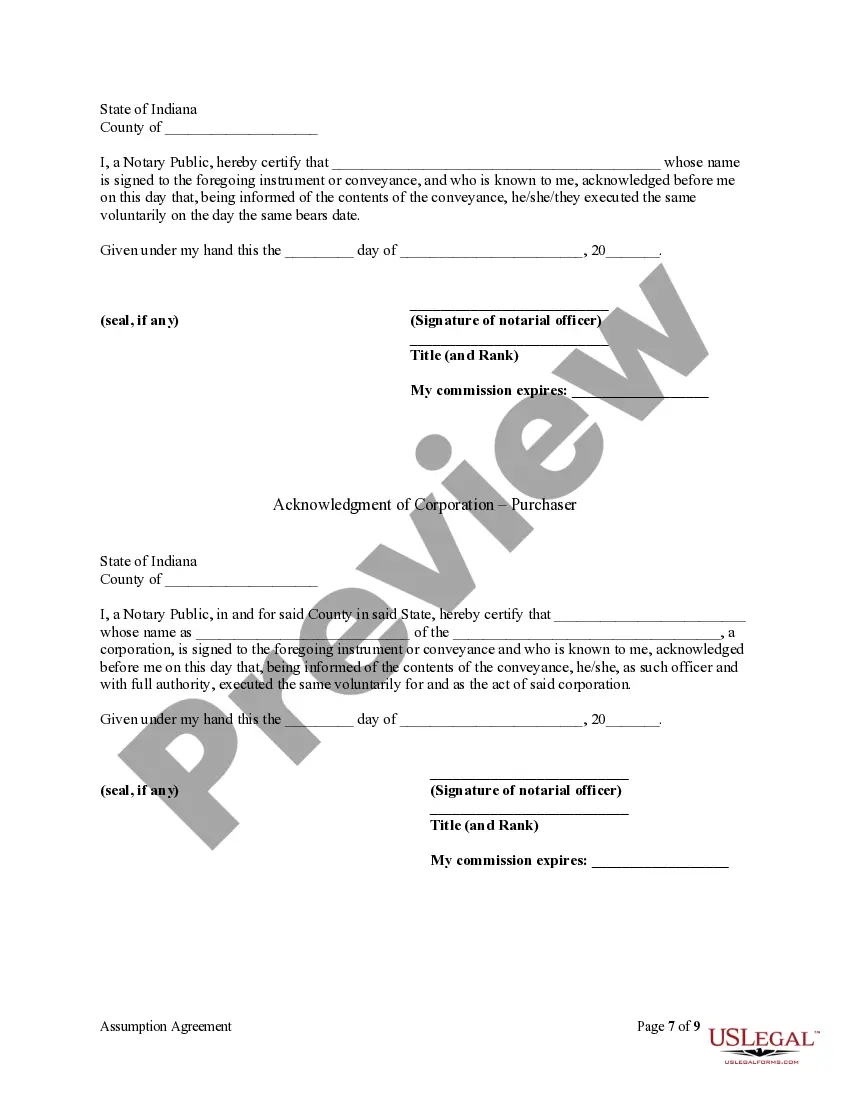

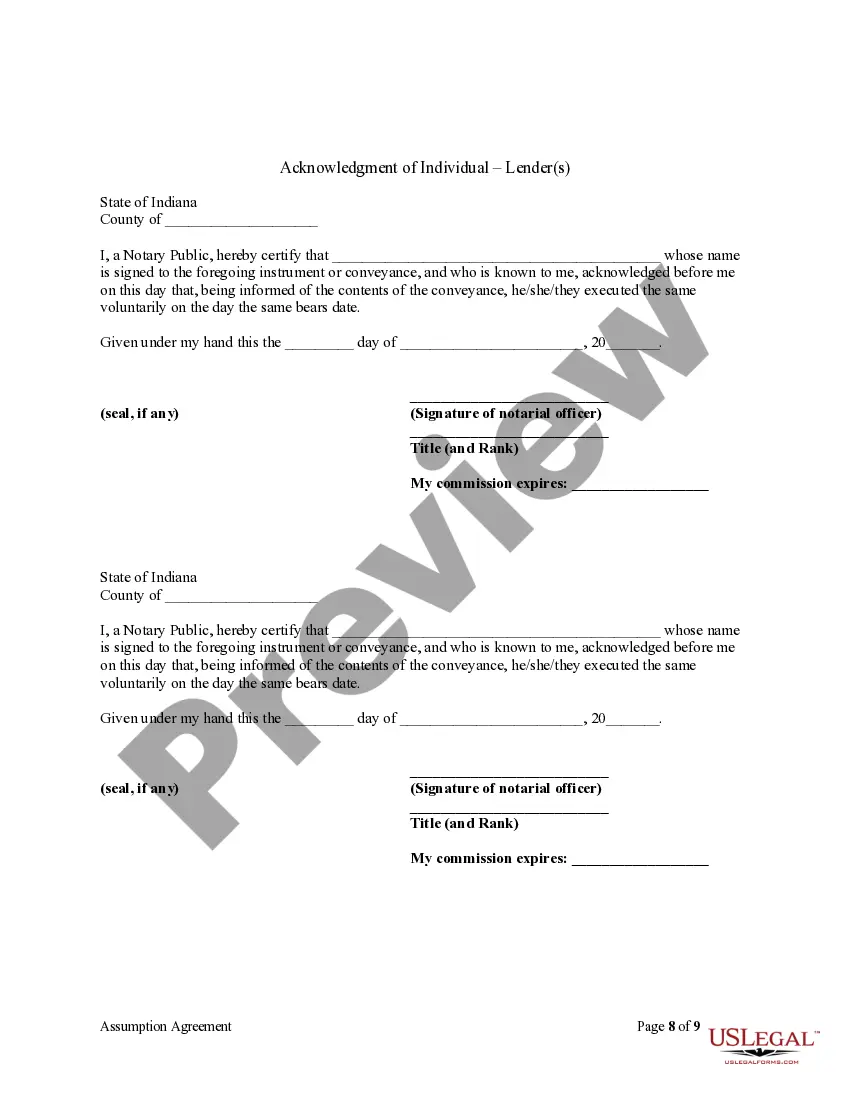

- Execute the Agreement: All parties must sign the agreement, often in the presence of a legal or real estate professional.

- Record the Agreement: File the agreement with local government bodies, such as in Marin County, to properly record the transfer and release.

Risk Analysis for Assumption Agreement of Mortgage

- Financial Risk: The new homeowner may fail to qualify for the mortgage under stricter lending conditions, potentially halting the process.

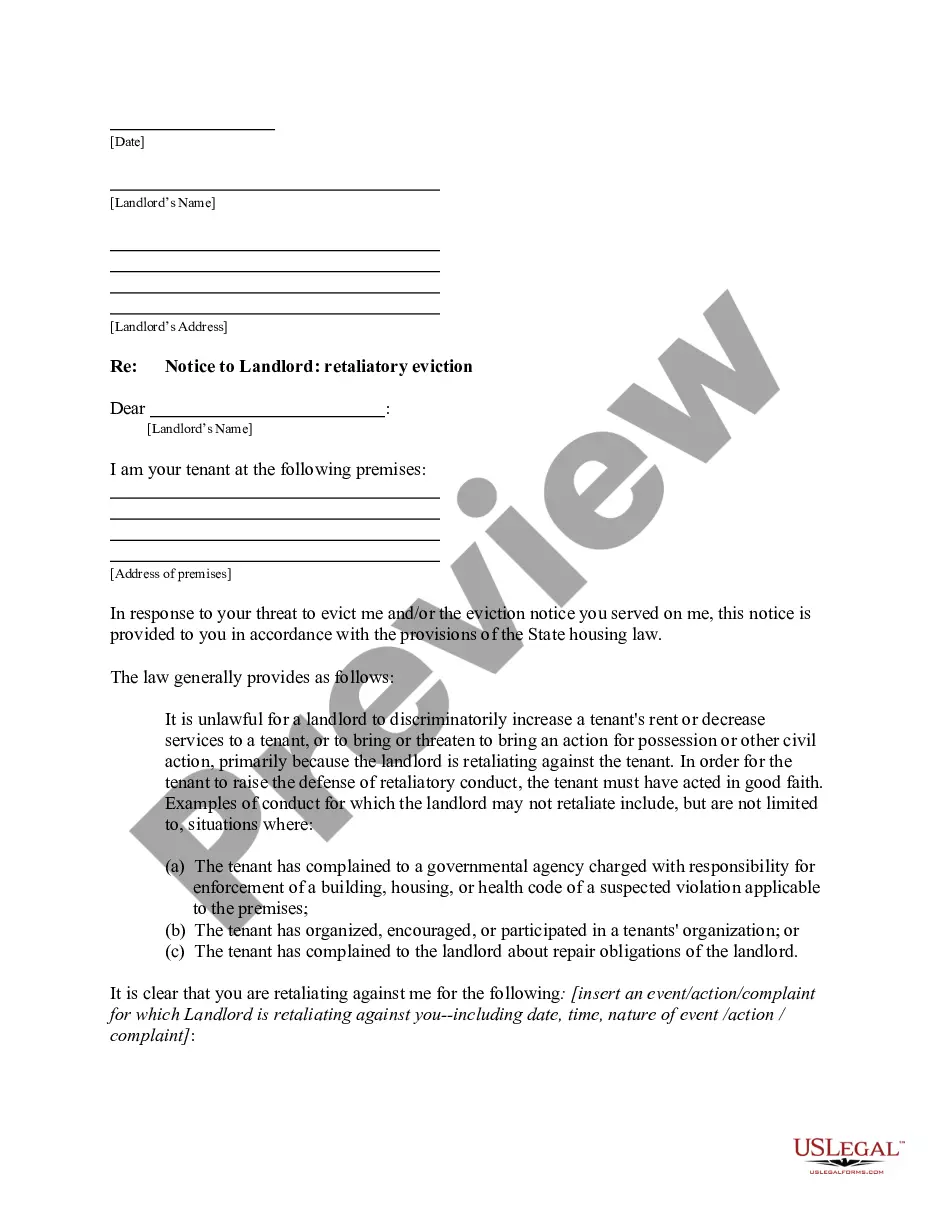

- Legal Risk: Insufficient documentation or improper filing can lead to legal disputes over property ownership and liabilities.

- Insurance Risk: Failure to secure appropriate homeowner insurance might lead to conflicts with lenders, especially federally backed ones like Fannie Mae, and risk of loss and liabilities.

FAQ

- What is the effective date in an assumption agreement? It is the date when the transfer of liability from the prior owner to the new owner legally becomes effective.

- Do all mortgage loans permit assumption? Not all; it's vital to verify whether the original loan agreement allows for assumption and under what conditions.

- What happens if the original borrower is not released? The original borrower remains legally liable for the mortgage despite the property transfer unless explicitly released in the agreement.

Best Practices

- Always consult with a legal professional to ensure all documents are correctly prepared and filed.

- Ensure thorough credit and financial checks on the new borrower to prevent future financial disputes.

- Communicate clearly and regularly with all parties involved, including lenders and legal entities, to facilitate a smooth transfer.

How to fill out Indiana Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

Locating the Indiana Assumption Agreement of Mortgage and Release of Original Mortgagors template and completing it might pose a challenge.

To conserve time, expenses, and energy, utilize US Legal Forms to quickly find the appropriate sample for your state with just a few clicks.

Our lawyers prepare all documents, so all you have to do is complete them. It is truly that easy.

Select your payment method as credit card or PayPal, save the form in your desired file format, and now you can print the Indiana Assumption Agreement of Mortgage and Release of Original Mortgagors template or complete it using any online editor. Don’t fret about errors since your template can be utilized, sent, and published repeatedly. Explore US Legal Forms and gain access to over 85,000 specific legal and tax documents for your state.

- Access your account by logging in and returning to the forms page to download the sample.

- All of your saved templates can be found in My documents, available for future use whenever needed.

- If you’re not yet subscribed, you should sign up.

- Review our detailed guidance on how to obtain the Indiana Assumption Agreement of Mortgage and Release of Original Mortgagors form in just a few minutes.

- To obtain a valid sample, verify its eligibility for your state.

- Examine the form using the Preview feature (if accessible).

- If a description is available, read it to understand the specifics.

- Click Buy Now if you have identified what you need.

Form popularity

FAQ

Unless you're assuming a loan from a relative, you generally must qualify for mortgage assumption once the home seller confirms they have an assumable loan. Generally speaking, the buyer must meet the same credit and income requirements applicable to a brand-new loan.

An assumable mortgage is an arrangement in where an outstanding mortgage and its terms can be transferred from the current owner to a buyer.

Advantages. If the assumable interest rate is lower than current market rates, the buyer saves money straight away. There are also fewer closing costs associated with assuming a mortgage. This can save money for the seller as well as the buyer.

Having an assumable loan might give a seller a marketing edge, particularly if mortgage rates have risen since the seller got the loan. For a buyer, assuming a mortgage can save thousands of dollars in interest payments and closing costs but it could require making a big down payment.

An assumable mortgage allows a buyer to take over the seller's mortgage. Once the assumption is complete, you take over the payments on a monthly basis, and the person you assume the loan from is released from further liability. If you assume someone's mortgage, you're agreeing to take on their debt.

What is a mortgage assumption agreement? It's actually pretty self-explanatory. A person who assumes a mortgage takes over a payment from the previous homeowner. Basically, the agreement shifts the financial responsibility of the loan to a different borrower.

An assumption clause is a provision in a mortgage contract that allows the seller of a home to pass responsibility for the existing mortgage to the buyer of the property. In other words, the new homeowner assumes the existing mortgage.

An assumable mortgage allows a buyer to take over the seller's mortgage. Once the assumption is complete, you take over the payments on a monthly basis, and the person you assume the loan from is released from further liability. If you assume someone's mortgage, you're agreeing to take on their debt.