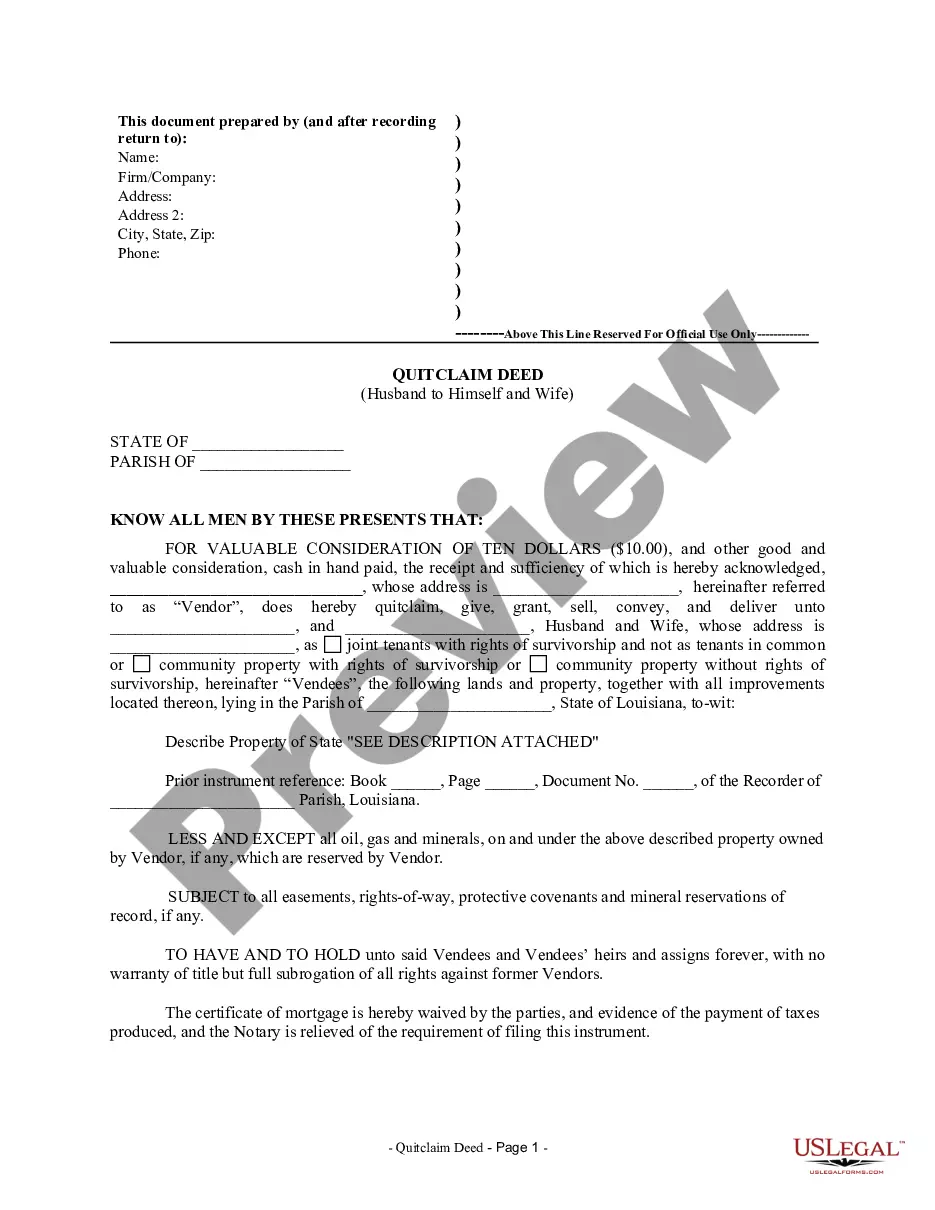

Louisiana Quitclaim Deed from Husband to Himself and Wife

Form popularity

FAQ

If the quitclaim deed requires the signature of all co-owners, the deed is invalid unless all co-owners have signed it and the deed is then delivered to the grantee.If one individual owns real estate and desires to add a co-owner such as a spouse, a quitclaim deed might be used.

Transfer property quickly and easily using this simple legal form. You can use a quitclaim deed to:transfer property you own by yourself into co-ownership with someone else. change the way owners hold title to the property.

The Louisiana quitclaim deed is used to transfer real estate in Louisiana from one person to another. A quitclaim has no guarantee or warranty attached to it.Signing A quitclaim deed must be authorized with the Grantor(s) (the Sellers) in front of two (2) witnesses and a notary public.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

A quitclaim deed is dangerous if you don't know anything about the person giving you the property. You should be sure that a person actually has rights to a property before signing it over with a quitclaim deed.

Once you sign a quitclaim deed and it has been filed and recorded with the County Clerks Office, the title has been officially transferred and cannot be easily reversed. In order to reverse this type of transfer, it would require your spouse to cooperate and assist in adding your name back to the title.

A signed quit claim deed overrides a will, because the property covered by the deed is not part of the estate at your mother's death.The deed needed to be notarized to be valid.

Quitclaim deeds are most often used to transfer property between family members.Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners divorce and one spouse's name is removed from the title or deed.

Unlike a general warranty deed, there's no guarantee made as to the ownership. There's no title search completed and no title insurance issued. Lenders wouldn't accept a quitclaim deed being used to purchase a property.