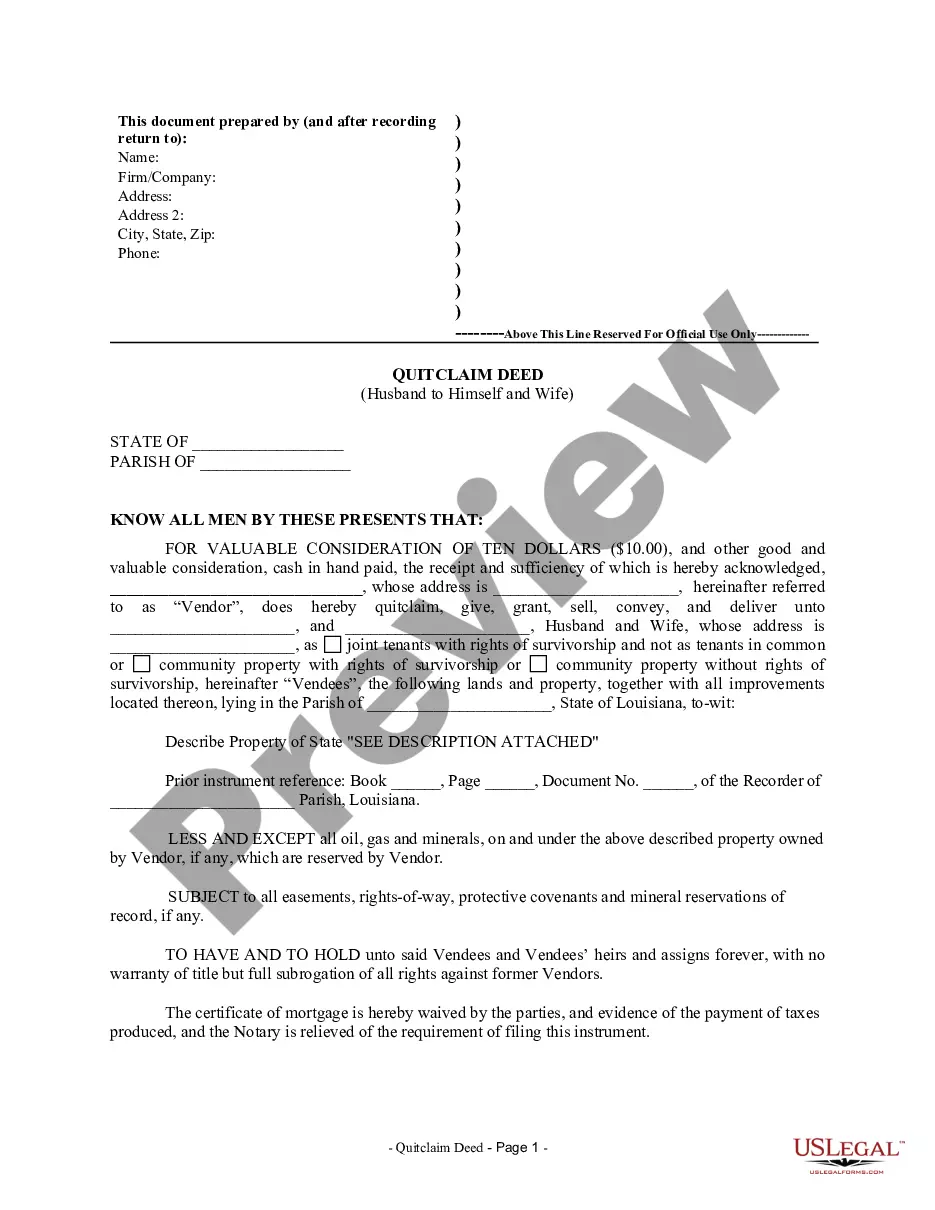

Louisiana Quitclaim Deed from Husband to Himself and Wife

About this form

The Quitclaim Deed from Husband to Himself and Wife is a legal document used to transfer property ownership from a husband to himself and his wife. Unlike warranty deeds, which guarantee clear title, a quitclaim deed conveys any interest the husband may have in the property without such guarantees. This form is especially useful in marital property transactions, allowing couples to clarify their ownership arrangements without the complexities of legal disputes.

Form components explained

- Identification of the parties involved as Grantor (husband) and Grantees (husband and wife).

- Property description outlining the specific land and improvements being conveyed.

- Statement of reservation for oil, gas, and minerals, if applicable.

- Joint tenancy designation with rights of survivorship.

- Waiver of the certificate of mortgage and evidence of tax payments.

When to use this form

This quitclaim deed is typically used in situations where a husband wishes to transfer property he owns to himself and his wife. Common scenarios include marriage, marital property arrangements, or simplifying property ownership for estate planning purposes. If existing property ownership needs to be clarified or restructured to include both spouses, this form is applicable.

Intended users of this form

- Married couples looking to change property ownership status.

- Husbands who want to add their wives to the title of property they currently own.

- Individuals seeking to clarify property rights and ownership in the event of changes in marital status.

Instructions for completing this form

- Identify the Grantor and Grantees with their full names and addresses.

- Provide a full legal description of the property being transferred.

- Indicate the consideration amount (e.g., ten dollars) for the transaction.

- Sign the deed in front of witnesses and ensure it's notarized.

- File the completed deed with the appropriate local government office to record the change in ownership.

Notarization guidance

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to adequately describe the property being transferred.

- Not signing or notarizing the deed properly, which could invalidate the transaction.

- Neglecting to verify the legal status of property ownership prior to completing the form.

Why complete this form online

- Convenience of downloading and filling out the form from home.

- Editable templates allow for easy customization of information.

- Forms are drafted by licensed attorneys to ensure legal compliance.

Looking for another form?

Form popularity

FAQ

If the quitclaim deed requires the signature of all co-owners, the deed is invalid unless all co-owners have signed it and the deed is then delivered to the grantee.If one individual owns real estate and desires to add a co-owner such as a spouse, a quitclaim deed might be used.

Transfer property quickly and easily using this simple legal form. You can use a quitclaim deed to:transfer property you own by yourself into co-ownership with someone else. change the way owners hold title to the property.

The Louisiana quitclaim deed is used to transfer real estate in Louisiana from one person to another. A quitclaim has no guarantee or warranty attached to it.Signing A quitclaim deed must be authorized with the Grantor(s) (the Sellers) in front of two (2) witnesses and a notary public.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

A quitclaim deed is dangerous if you don't know anything about the person giving you the property. You should be sure that a person actually has rights to a property before signing it over with a quitclaim deed.

Once you sign a quitclaim deed and it has been filed and recorded with the County Clerks Office, the title has been officially transferred and cannot be easily reversed. In order to reverse this type of transfer, it would require your spouse to cooperate and assist in adding your name back to the title.

A signed quit claim deed overrides a will, because the property covered by the deed is not part of the estate at your mother's death.The deed needed to be notarized to be valid.

Quitclaim deeds are most often used to transfer property between family members.Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners divorce and one spouse's name is removed from the title or deed.

Unlike a general warranty deed, there's no guarantee made as to the ownership. There's no title search completed and no title insurance issued. Lenders wouldn't accept a quitclaim deed being used to purchase a property.