Tennessee Statement of Termination of Limited Partnership

Description

How to fill out Tennessee Statement Of Termination Of Limited Partnership?

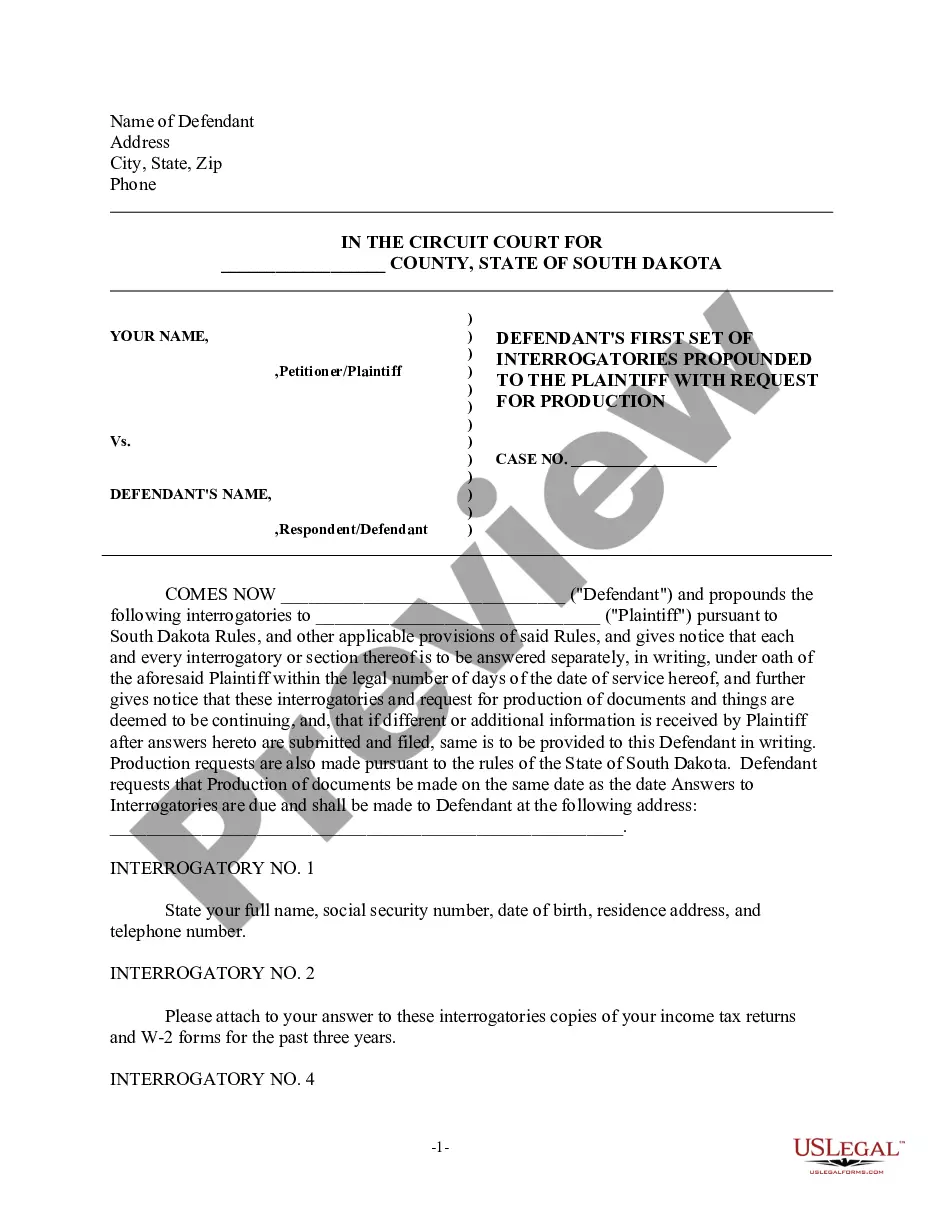

Preparing legal paperwork can be a real burden if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you obtain, as all of them comply with federal and state regulations and are verified by our specialists. So if you need to prepare Tennessee Statement of Termination of Limited Partnership, our service is the best place to download it.

Getting your Tennessee Statement of Termination of Limited Partnership from our catalog is as easy as ABC. Previously authorized users with a valid subscription need only log in and click the Download button once they locate the correct template. Later, if they need to, users can get the same document from the My Forms tab of their profile. However, even if you are new to our service, signing up with a valid subscription will take only a few moments. Here’s a quick instruction for you:

- Document compliance check. You should carefully examine the content of the form you want and make sure whether it suits your needs and meets your state law regulations. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library using the Search tab above until you find an appropriate blank, and click Buy Now once you see the one you need.

- Account registration and form purchase. Register for an account with US Legal Forms. After account verification, log in and select your most suitable subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Tennessee Statement of Termination of Limited Partnership and click Download to save it on your device. Print it to complete your paperwork manually, or use a multi-featured online editor to prepare an electronic copy faster and more efficiently.

Haven’t you tried US Legal Forms yet? Subscribe to our service today to get any formal document quickly and easily whenever you need to, and keep your paperwork in order!

Form popularity

FAQ

Submit a written Consent to Dissolution to the Tennessee Secretary of State. Submit any required annual reports to the Tennessee Secretary of State. Pay off any outstanding business debts. Pay any outstanding taxes and administrative fees.

To obtain a certificate of tax clearance, a business must file all returns to date and make all required payments. This includes filing a final franchise & excise tax return through the date of liquidation or the date the taxpayer ceased operations in Tennessee.

The first step in terminating a Tennessee LLC is to file Form SS-4246, Notice of Dissolution (Limited Liability Company) with the Department of State, Division of Business Services (DBS). After you file notice of dissolution and wind up your business, you will have to file the appropriate Articles of Termination.

Filing dissolution documents is the first step and requires the business to wind-up its business and affairs. Once that is complete and the entity has obtained a Certificate of Tax Clearance for Termination/Withdrawal from the Tennessee Department of Revenue, the business entity may file termination documents.

Follow these steps to closing your business: Decide to close.File dissolution documents.Cancel registrations, permits, licenses, and business names.Comply with employment and labor laws.Resolve financial obligations.Maintain records.

A Statement of Dissolution of Limited Partnership form may be filed using one of the following methods: E-file: Go to and use the online tool to complete the filing and pay the filing fee by credit card, debit card or e-check.

How can a member be removed from a TN LLC? Giving written notice of their intention to withdraw. Determination by a judge. Termination due to causes specified in the LLC's operating agreement or other documents.

Most account changes and closures can be handled through TNTAP, or by calling us at (615) 253-0600.