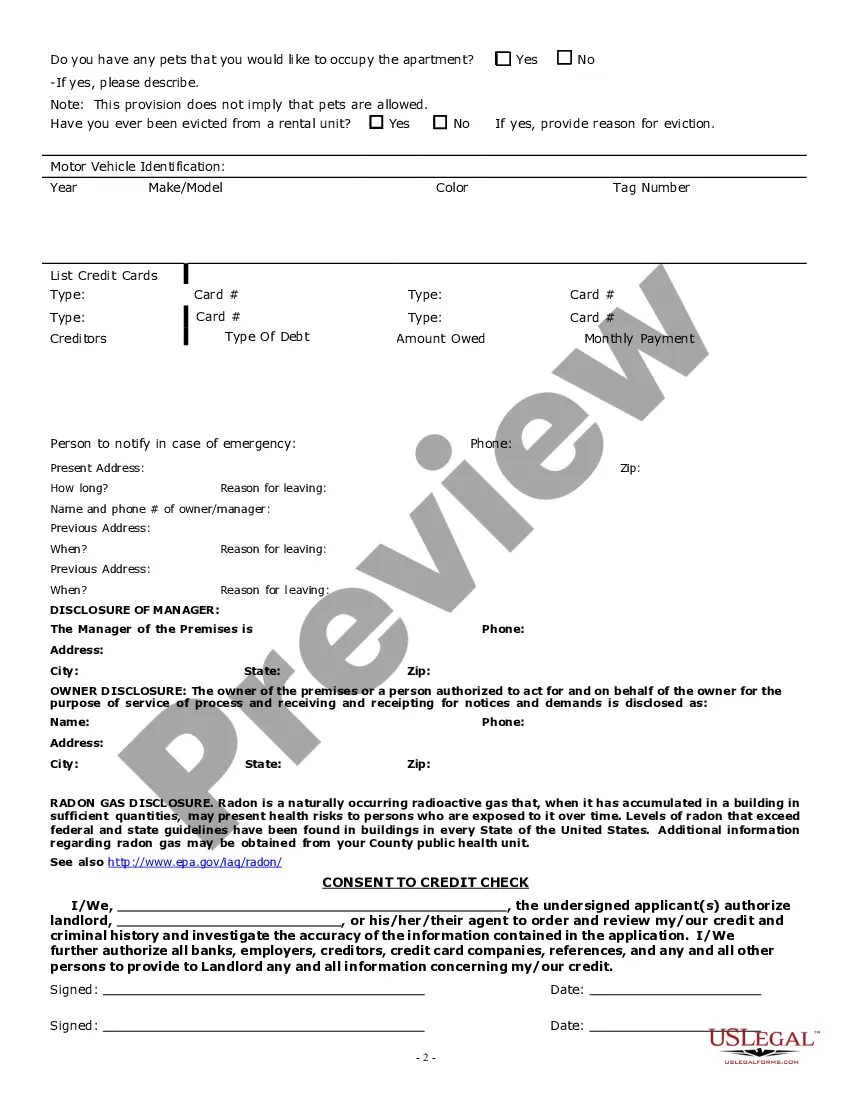

Rental Application Fee

Description

How to fill out Illinois Apartment Lease Rental Application Questionnaire?

- If you're a returning user, log in to your account to find the required document template. Always ensure your subscription is current; renew if necessary.

- For first-time users, start by reviewing the Preview mode and detailed form descriptions to ensure the selected document meets your specific needs and local jurisdiction requirements.

- If the form doesn't meet your needs, use the Search tab to find an alternative template that fits better. Once you find a compatible one, proceed to the next step.

- Click on the 'Buy Now' button and select your preferred subscription plan. Be sure to register for an account to gain access to our extensive library.

- Complete your purchase by entering your payment details through credit card or PayPal.

- Download your selected form to your device and access it anytime in the My Forms section of your profile.

With US Legal Forms, you have access to a vast collection of over 85,000 legal drafts and templates that are fillable and editable. This extensive library empowers both individuals and attorneys to execute legal documents efficiently.

Don’t let the complexities of legal forms overwhelm you. Start using US Legal Forms today to streamline your rental application process!

Form popularity

FAQ

To get rental application fees waived, start by directly communicating with the landlord or property manager. You can explain your situation and ask if they offer any waivers or discounts. Many landlords appreciate transparency and may accommodate genuine requests, especially if you provide strong references that demonstrate your reliability as a tenant.

In Florida, rental application fees are generally non-refundable unless specified otherwise in the lease agreement. This policy is intended to compensate landlords for the expenses incurred during the application process. As a potential tenant, it's essential to clarify the terms concerning rental application fees upfront. Tools like US Legal Forms can provide sample lease agreements that outline these details, helping you understand your rights.

In general, rental application fees are not tax deductible for tenants. However, landlords can potentially deduct these fees as a business expense if they collect them as part of their rental income. As a tenant, it's essential to review specific regulations in your state regarding rental application fees. Utilizing platforms like US Legal Forms can help clarify whether certain expenses, including rental application fees, may have tax implications.

Rental application fees are illegal in several states, including California, New York, and New Jersey. These states have specific laws prohibiting landlords from charging these fees to applicants. As a tenant, you should familiarize yourself with your local laws to understand your rights regarding rental application fees. Solutions like uslegalforms can provide valuable guidance on navigating these legal landscapes.