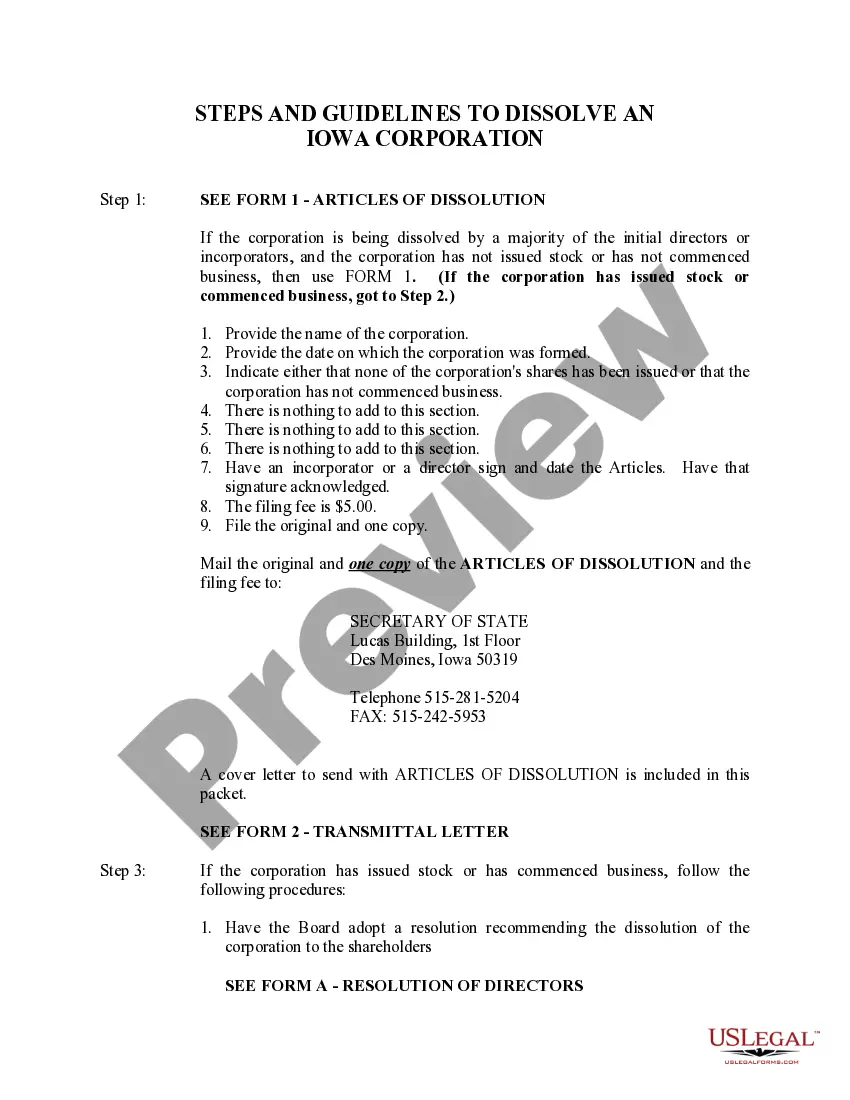

The dissolution of a corporation package contains all forms to dissolve a corporation in Iowa, step by step instructions, addresses, transmittal letters, and other information.

Dissolution Dissolve Corporation For Foreign

Description

How to fill out Dissolution Dissolve Corporation For Foreign?

Steering through the red tape of official documents and formats can be daunting, particularly when one is not engaged in that field professionally.

Even selecting the appropriate format for a Dissolution Dissolve Corporation For Foreign will be time-intensive, as it must be valid and accurate to the last character.

Nevertheless, you will find it significantly easier to select a suitable template from a source you trust.

Acquire the appropriate document in just a few straightforward steps: Enter the name of the file in the search box. Discover the right Dissolution Dissolve Corporation For Foreign among the results. Review the outline of the template or open its preview. When the format meets your requirements, click Buy Now. Continue to choose your subscription plan. Use your email and create a password to set up an account at US Legal Forms. Select a credit card or PayPal as your payment option. Save the template file on your device in your preferred format. US Legal Forms will save you time and energy in determining if the document you found online meets your specifications. Establish an account and gain unlimited access to all the templates you need.

- US Legal Forms is a service that streamlines the task of locating the correct documents online.

- US Legal Forms serves as a centralized repository for obtaining the most recent document samples, verifying their use, and downloading these samples for your completion.

- This is a collection over 85K forms relevant across various sectors.

- When searching for a Dissolution Dissolve Corporation For Foreign, you will not have to doubt its relevance as all documents are confirmed.

- Having an account with US Legal Forms ensures that you have all the necessary samples at your fingertips.

- Store them in your history or add them to the My documents collection.

- You can retrieve your saved documents from any device by simply clicking Log In on the library website.

- If you still lack an account, you can always search for the template you require.

Form popularity

FAQ

Yes, you should cancel your Employer Identification Number (EIN) if you decide to close your business. This helps clear up your tax records and prevents unauthorized use of your EIN in the future. Additionally, contacting the IRS to confirm the cancellation confirms proper closure. Thus, taking this step is essential when you dissolution dissolve corporation for foreign.

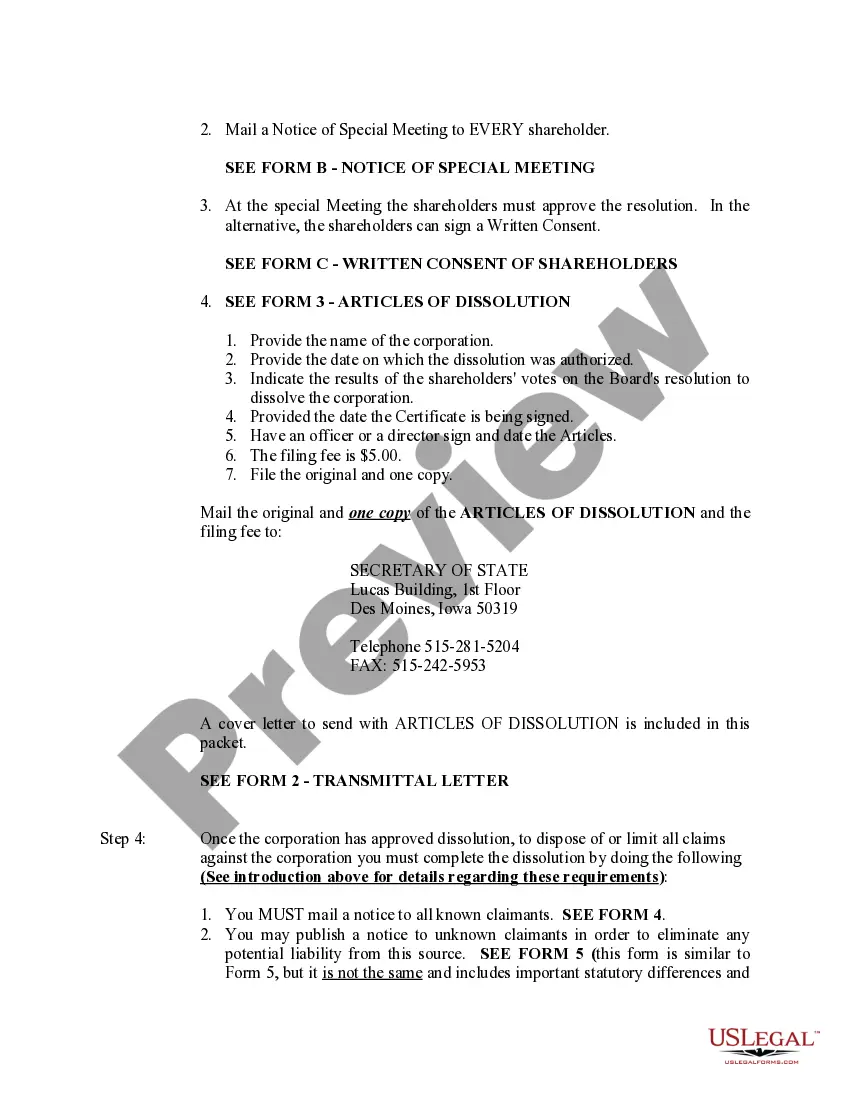

To dissolve a foreign entity, you must follow the specific dissolution laws of the state in which you formed your entity and the state in which it is registered. Typically, this involves filing paperwork with both states, settling debts, and notifying all relevant parties. For a seamless experience, consider using uslegalforms, which can provide the necessary templates and guidance for a smooth dissolution process. This is vital when you aim to dissolution dissolve corporation for foreign.

If you fail to file Form 966 when dissolving an S Corporation, you risk facing tax complications with the IRS. The IRS may continue to treat your corporation as an active entity, which could lead to ongoing tax filings and liabilities. This situation can add stress during the dissolution process, so make sure to file as part of your plan to dissolution dissolve corporation for foreign.

Filing Form 966 is necessary for an S Corporation to officially notify the IRS of the planned dissolution. This step is crucial in documenting your corporation's termination and prevents potential tax complications. Not completing this form may lead to misunderstandings with the IRS. Hence, if you are looking to dissolution dissolve corporation for foreign, it is essential to file Form 966.

Yes, S Corporations must file Form 966 if they are engaging in voluntary dissolution. This form informs the IRS of your intent to dissolve the corporation. Completing this form is significant as it documents the closure process and supports compliance. Remember, following the correct procedure helps ensure a smooth dissolution dissolve corporation for foreign.

Dissolving an S corporation requires several key steps. First, hold a meeting with shareholders to approve the dissolution, then file Articles of Dissolution with the state. After these steps, ensure you settle all debts, notify the IRS, and distribute any remaining assets. Following these guidelines will help you effectively dissolution dissolve corporation for foreign.

To notify the IRS of your corporation's dissolution, you need to file your final tax return. Indicate that it is for the year of dissolution and write 'Final Return' at the top of the form. Keep a copy for your records. This step is crucial for anyone looking to dissolution dissolve corporation for foreign.

The methods for dissolving a corporation include voluntary dissolution, involuntary dissolution, and using court proceedings. Voluntary dissolution is initiated by the corporation's governing body, while involuntary dissolution can be enforced by state authorities or through bankruptcy proceedings. Each method has distinct procedures and requirements, making it crucial to choose the best path based on your specific situation.

There are three primary modes of dissolving a corporation: voluntary dissolution, involuntary dissolution, and administrative dissolution. Voluntary dissolution occurs when the shareholders decide to close the business, while involuntary dissolution can happen due to legal action or failure to comply with state regulations. Administrative dissolution is enacted by the state for failures like not filing necessary documents, emphasizing the importance of staying compliant.

A corporation might dissolve due to financial difficulties, such as consistent losses that make operations unsustainable. Another common reason is the decision by shareholders to sell the business or retire from the market. Both scenarios highlight the importance of making strategic business decisions, including the option to dissolve and properly manage that process.