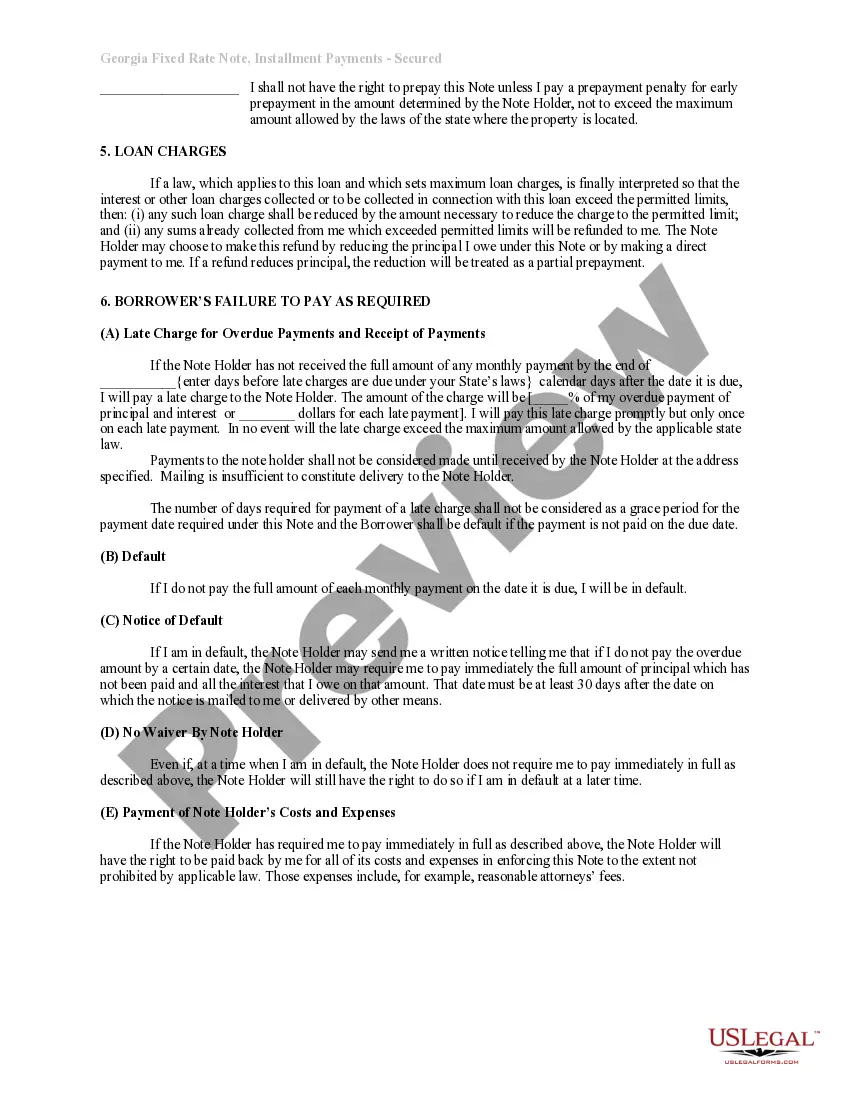

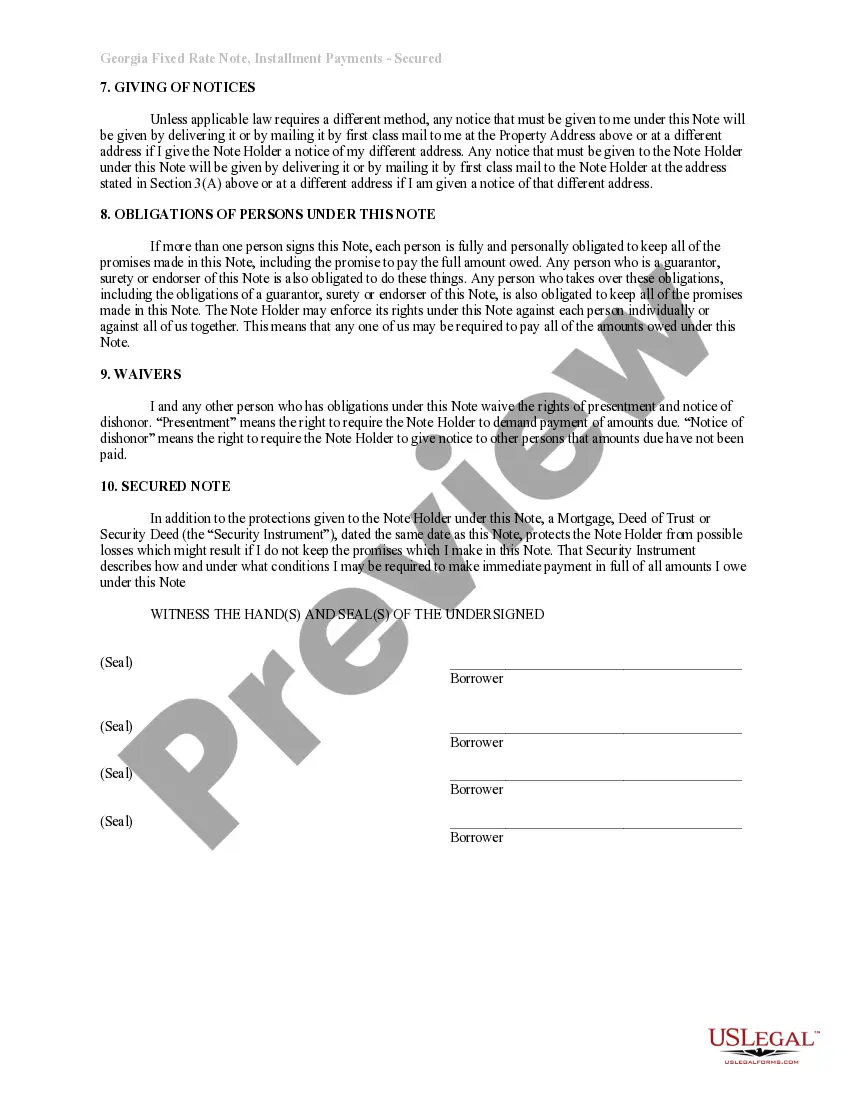

Promissory Note Template Georgia With Personal Guarantee

Description

How to fill out Georgia Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

Red tape requires exactness and correctness.

If you do not manage completing documents like the Promissory Note Template Georgia With Personal Guarantee on a regular basis, it may lead to certain misunderstandings.

Choosing the proper template from the outset will guarantee that your document submission goes smoothly and avert any hassles of re-submitting a file or repeating the same task from the beginning.

If you are not a registered user, finding the required template will involve a few additional steps: Search for the template using the search tool. Ensure the Promissory Note Template Georgia With Personal Guarantee you have found is valid for your state or locality. Open the preview or read the description providing details on the use of the template. If the result meets your search criteria, click the Buy Now button. Choose the appropriate option from the suggested subscription plans. Sign in to your account or create a new one. Complete the purchase using a credit card or PayPal. Save the form in your preferred format. Locating the correct and updated templates for your paperwork takes just a few minutes with an account at US Legal Forms. Eliminate the bureaucratic issues and simplify your form management.

- You can always discover the correct template for your documentation in US Legal Forms.

- US Legal Forms is the largest online repository of forms that contains over 85 thousand templates across various topics.

- You can obtain the latest and most suitable version of the Promissory Note Template Georgia With Personal Guarantee simply by searching for it on the platform.

- Find, save, and store templates in your account or review the description to confirm you have the appropriate one available.

- With an account at US Legal Forms, you can conveniently gather, keep in one location, and browse the templates you've saved for quick access.

- Once on the website, click the Log In button to sign in.

- Then, navigate to the My documents page, where your forms are organized.

Form popularity

FAQ

A Georgia promissory note must be signed and dated by the borrower and a witness. It should also be notarized.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

Follow the steps below to complete the Master Promissory Note:Navigate to the website: "Log In."Enter your FSA ID and Password.Under the "Complete Aid Process" heading, select "Complete Master Promissory Note."Select the appropriate loan type.Enter Your Personal Information.More items...

Personal Guarantee: Taking Responsibility A promissory note alone may not be enough to secure the loan your business needs. That's why your promissory note could include a personal guarantee. Since a promissory note is basically just an IOU, a lender will want some kind of collateral to secure the loan.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.