Georgia Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Understanding this form

The Georgia Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal document that outlines a borrower's promise to repay a loan secured by residential property. This form details the terms of the loan, including the principal amount, interest rate, and repayment schedule. Unlike other loan agreements, this promissory note specifically indicates that the loan is backed by residential real estate, providing additional protection for the lender.

What’s included in this form

- Borrower's promise to pay: A clear statement of the borrower's commitment to repay the loan amount with interest.

- Interest rate: Specifies the annual interest rate applied to the unpaid principal.

- Payment terms: Details the monthly payment schedule, including the date payments are due and the total duration of the loan.

- Prepayment provisions: Outlines the borrower's right to pay off the principal early and any applicable prepayment penalties.

- Secured note information: Indicates that this note is secured by a mortgage or deed of trust on the property.

- Default and notice provisions: Clarifies the consequences of failing to make timely payments and how the lender may proceed in the event of default.

When to use this form

This form should be used when a borrower is looking to secure a loan using residential real estate as collateral. It is ideal for situations where a home or other residential property will be used to back the loan, such as when buying a house or refinancing an existing mortgage. It is also applicable for personal loans between individuals where the borrower offers real estate as security for the debt.

Intended users of this form

- Homeowners seeking to finance a property purchase with a loan secured by the home itself.

- Individuals loaning money to friends or family who want to formalize the agreement with collateral.

- Lenders looking for a legally binding document to protect their investment in residential real estate.

- Real estate investors who need structured financing for their property acquisitions.

How to prepare this document

- Identify the parties involved: Clearly state the names of the borrower and lender.

- Specify the loan details: Document the principal amount, interest rate, and repayment terms.

- Enter property information: Include the address of the residential property being used as collateral.

- Outline payment schedule: Indicate the due date for monthly payments and the start date of the repayment period.

- Review and sign: Ensure all parties understand the terms and sign where indicated, sealing the agreement.

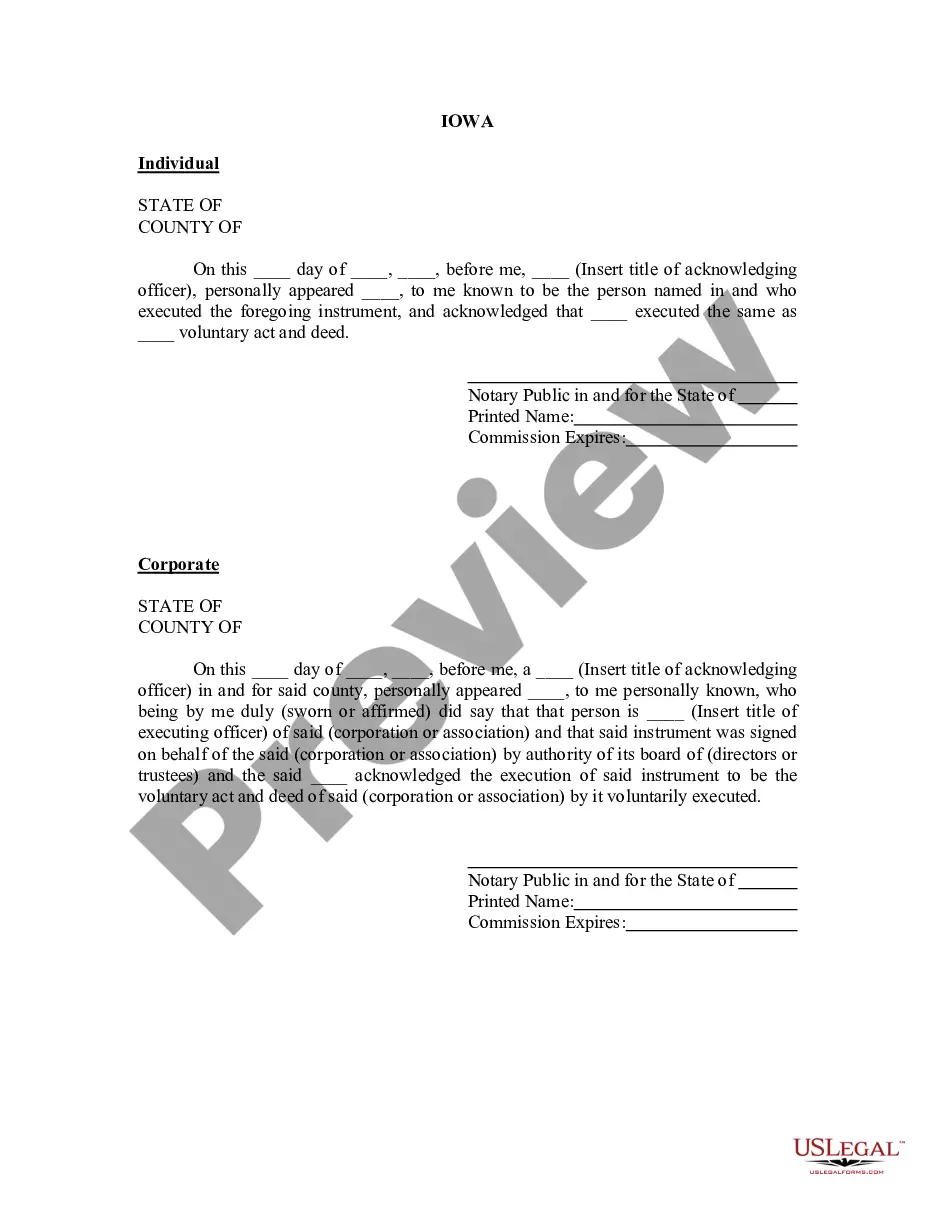

Is notarization required?

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to specify the correct interest rate or payment terms.

- Not providing a clear description of the property being used as collateral.

- Missing signatures or dates from either the borrower or lender.

- Overlooking the consequences of default or late payments.

Why complete this form online

- Convenient access: Download and complete the form from anywhere, at any time.

- Editability: Customize the form to suit specific terms and conditions before finalizing.

- Legal reliability: Use a professionally drafted form to ensure compliance with Georgia law.

Quick recap

- The Georgia Installments Fixed Rate Promissory Note is essential for securing a loan with residential real estate.

- Clear payment terms and interest rates help protect the interests of both borrower and lender.

- Using this form can prevent misunderstandings and legal issues regarding repayment.

Looking for another form?

Form popularity

FAQ

Reporting interest from a promissory note involves including it as income on your tax return. For a Georgia Installments Fixed Rate Promissory Note Secured by Residential Real Estate, you should keep a record of the interest payments you receive. You typically report this income on Schedule B of your Form 1040. Consulting a tax professional can also guide you on proper reporting, ensuring compliance with IRS regulations.

In Georgia, notarization is not strictly required for a promissory note to be valid. However, having your Georgia Installments Fixed Rate Promissory Note Secured by Residential Real Estate notarized can enhance its legal standing and provide additional proof of the agreement. Moreover, it can help prevent disputes later on. Thus, while it's not mandatory, it's a wise step for clear documentation.

In Georgia, notarization of a promissory note is not strictly required, but having it notarized adds credibility and can be beneficial in cases of disputes. Notarization provides an extra layer of protection for both parties involved in the transaction. It is wise to consider notarizing your Georgia Installments Fixed Rate Promissory Note Secured by Residential Real Estate to ensure enforceability and clarity. Alternatively, using a service like US Legal Forms can guide you through necessary steps for proper documentation and compliance.

You can obtain a promissory note for your mortgage through various sources, including financial institutions, legal services, or online platforms like US Legal Forms. These sources often provide customizable templates specifically for Georgia Installments Fixed Rate Promissory Note Secured by Residential Real Estate. By using a reputable service, you ensure that your note meets state requirements and addresses your unique situation.

To secure a promissory note with real property, you need to create a security agreement that describes the property and states that it secures the note. This document must clearly outline the terms of the promissory note and the rights of the parties involved. Additionally, you should record the agreement in the appropriate county office to provide public notice of your security interest. This process can enhance the stability of your investment in a Georgia Installments Fixed Rate Promissory Note Secured by Residential Real Estate.

To fill out a promissory note sample, start by including the date, amount borrowed, and the names of the borrower and lender. Next, specify the repayment schedule and interest rate, referencing features of the Georgia Installments Fixed Rate Promissory Note Secured by Residential Real Estate. Finally, ensure that both parties sign the document, as this grants it legal validity and protects your interests.

Promissory notes are typically recorded as public documents and accessible shortly after the closing. The trustee maintains the original deed until the loan is satisfied. When the loan is paid off, the trustee automatically records a deed of reconveyance at the county recorder's office for safekeeping.

Although a promissory note is usually written on a computer and printed out or a pre-made form is filled out, a handwritten promissory note signed by both parties is legal and will stand up in court.

Writing the Promissory Note Terms You don't have to write a promissory note from scratch. You can use a template or create a promissory note online.

In order for a promissory note to be valid, both the lender and the borrower must sign the documentation. If you are a co-signer for the loan, you are required to sign the promissory note. Being a co-signer requires you to repay the loan amount in the instance that the borrower defaults on payment.