Amend 6.4

Description

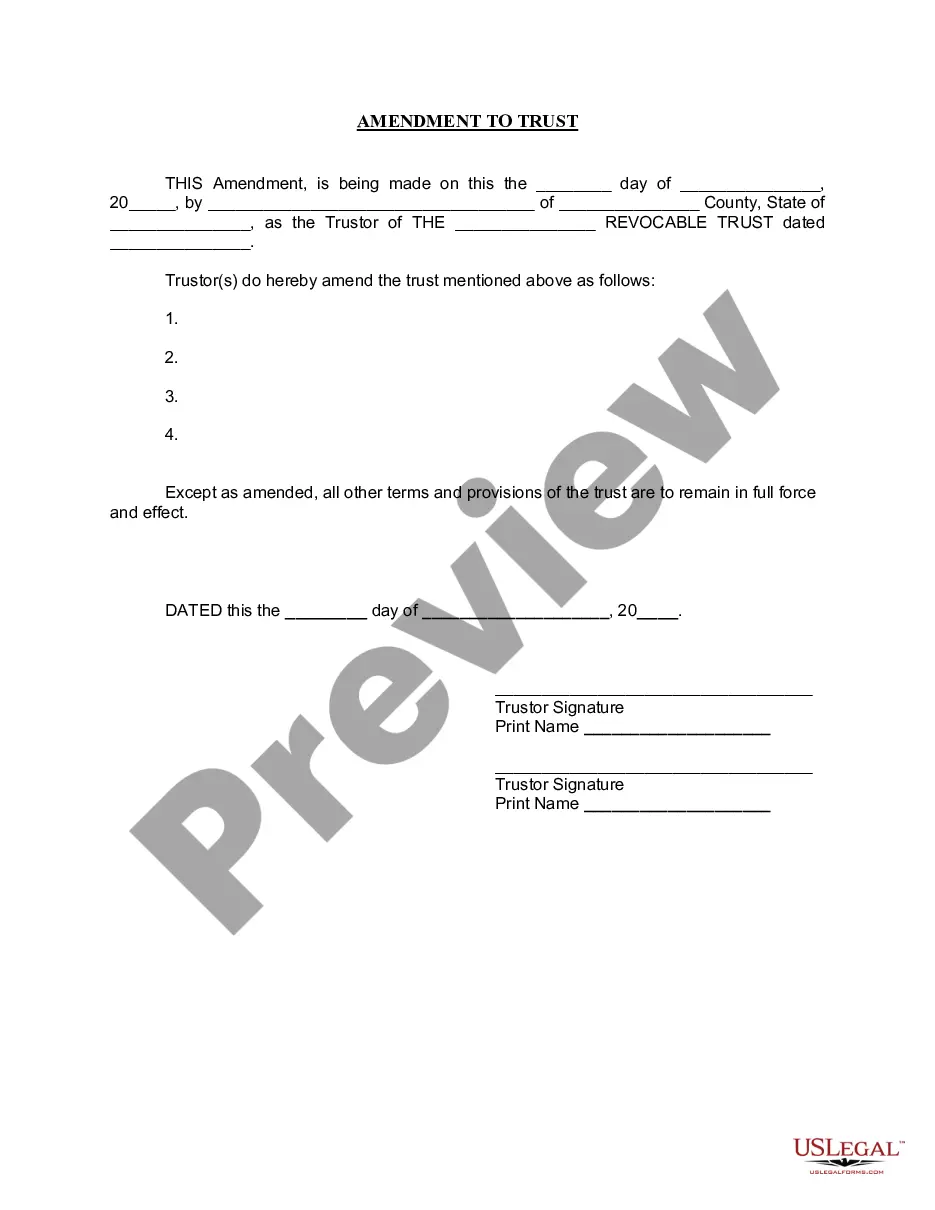

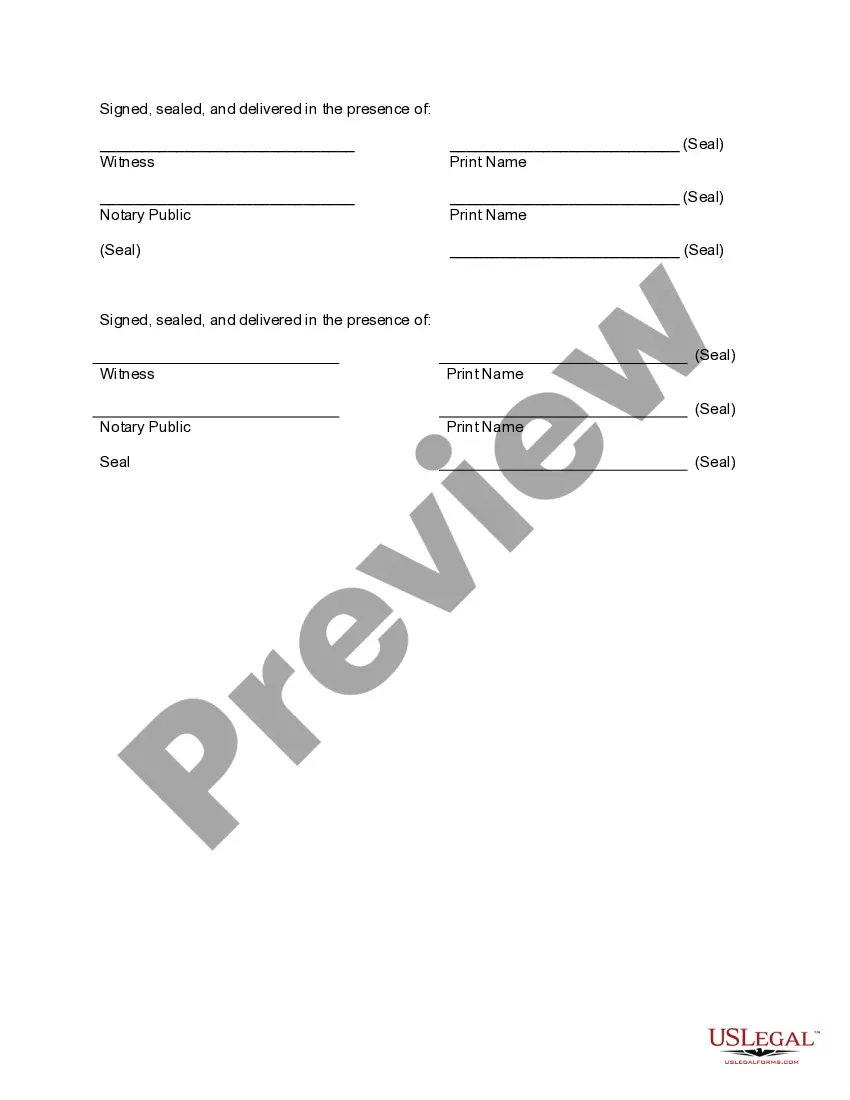

How to fill out Georgia Amendment To Living Trust?

- If you are a returning user, log in to your account and download the desired form template by clicking the Download button after confirming that your subscription is active. Renew it if needed.

- For first-time users, begin by reviewing the Preview mode and form descriptions. Ensure that you select a form that aligns with your requirements and local jurisdiction.

- If there's a need for a different template, utilize the Search tab to find the correct document. Once you find it, proceed to the next step.

- To acquire your chosen document, click the Buy Now button. Select a subscription plan, then create an account to access the extensive resource library.

- Complete your purchase by entering your credit card details or utilizing your PayPal account.

- Finally, download the form and save it to your device. Access it anytime in the My Forms section of your profile.

Utilizing US Legal Forms simplifies the process of obtaining legal templates and ensures that your documents are accurate and comply with relevant laws.

Ready to get started? Visit US Legal Forms today to find the template you need and experience the benefits of an extensive library of legal forms.

Form popularity

FAQ

Getting a constitutional amendment is a challenging process due to the high level of consensus required. The two-thirds proposal and the three-fourths ratification thresholds ensure that amendments reflect a broad agreement among states and Congress. This high barrier helps maintain stability in the Constitution, making it resilient to fleeting political trends. For those looking to navigate this complexity, US Legal provides resources that can guide you through the steps necessary to effectively pursue an amendment.

The Constitution can be amended in several ways, specifically through congressional proposals or state conventions. More specifically, the four methods include proposals by two-thirds of Congress, proposals by two-thirds of state conventions, ratification by three-fourths of state legislatures, or ratification through conventions in three-fourths of states. It's interesting to note how these methods reflect the balance between federal and state powers. To simplify understanding of these processes, US Legal offers detailed explanations that clarify each option.

To get a constitutional amendment, you must first initiate the proposal process. This can be done through Congress or a convention of states, as outlined previously. Once either method is utilized, the amendment must gain approval from the majority in both houses of Congress or the necessary number of state legislatures. It's crucial to engage with legal experts, like those at US Legal, who can provide valuable insights and support concerning procedural requirements.

In the United States, a constitutional amendment can be proposed by either two-thirds of both the House of Representatives and the Senate or by a convention called for by two-thirds of state legislatures. This means that the power to amend the Constitution lies within elected officials and state lawmakers, reflecting the will of the people. Once proposed, the amendment must then be ratified by three-fourths of the states, ensuring broad support. If you need guidance on the amendment process, consider resources provided by US Legal to help navigate these steps.

Amended returns can indeed be filed electronically, but you must use approved tax software that accommodates Form 1040-X. Check with your software provider to verify that they allow electronic amendments, as this can save you time and effort. For streamlined filing solutions, consider accessing US Legal Forms resources that guide you through the amendment process.

Yes, you can file an amended return electronically using certain tax preparation software that supports this feature. Ensure that your software is capable of submitting Form 1040-X electronically, as not all platforms offer this option. If you prefer, you can also visit US Legal Forms for assistance with electronic filing.

To file an amended form, you must obtain Form 1040-X from the IRS website or your tax preparation software. Fill in the details of the changes you are making, and ensure you provide a clear explanation. After you complete the form, mail it to the IRS following the provided instructions. If you want reliable templates, consider using US Legal Forms for guidance.

Filing an amendment on your H&R Block account is straightforward. First, log in and locate the tax return for the year you wish to amend. Then, select the option to amend, which will lead you to complete Form 1040-X and address your changes directly on the platform. For added clarity and accuracy, you can refer to resources available on US Legal Forms.

To file an amendment on H&R Block, sign in to your account, select your tax year, and then choose the option to amend your return. Follow the prompts to fill out Form 1040-X, which will guide you through the necessary changes. If you need further assistance, consider using US Legal Forms for detailed instructions and templates tailored for H&R Block.

To amend an already submitted tax return, you need to complete Form 1040-X. This form allows you to explain the changes and corrections you want to make. Be sure to include any necessary documentation that supports your amendments, and send it to the appropriate IRS address for your state. Using a platform like US Legal Forms can simplify this process, providing templates and guidance.