Amend 4.66

Description

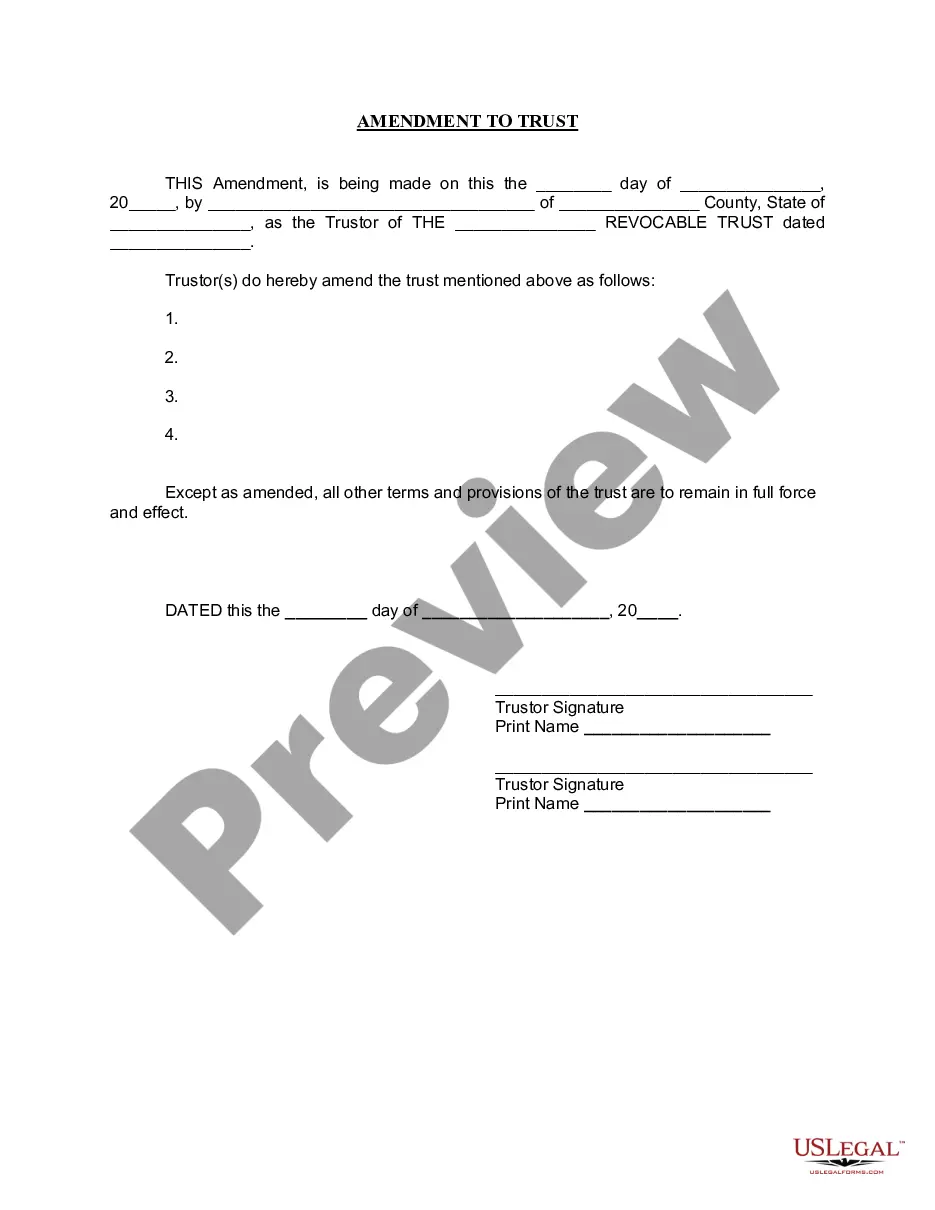

How to fill out Georgia Amendment To Living Trust?

- Log in to your existing US Legal Forms account. If you're new, create an account to begin. Ensure your subscription is active before proceeding.

- Browse the library and locate the pertinent form related to amendment 4.66. Utilize the Preview mode to verify that it meets your requirements and adheres to local jurisdiction guidelines.

- If needed, use the Search tab to find alternative templates that may be more suited to your needs.

- Once you have the correct document, click 'Buy Now' to select a subscription plan that fits your needs. You will need to register an account for access to the document library.

- Complete your purchase by entering your credit card details or using your PayPal account for payment.

- Finally, download your amended form. It will be saved on your device and can be accessed anytime through the 'My Forms' menu in your profile.

In conclusion, with US Legal Forms, amending 4.66 is a seamless process that ensures the precision and legality of your documents. Access their library today and simplify your legal documentation needs.

Ready to get started? Visit US Legal Forms now and take advantage of their extensive resources!

Form popularity

FAQ

Amending your tax return can be worthwhile, especially if it leads to a lower tax bill or a refund. If you discover mistakes or missing deductions after your initial filing, taking the time to amend can ultimately benefit you. Use resources like US Legal Forms to ensure the process is smooth, secure, and accurate.

Yes, you can file an amended return electronically if you use tax software that supports this feature. Many online tax services now allow for the electronic filing of Form 1040-X, making it easier to amend your return. Explore options like US Legal Forms, which can guide you through the electronic filing process with ease.

Filing a motion to amend requires you to prepare a formal document outlining the changes you intend to make. Include specific reasons and supporting evidence for the amendment. You can then submit this motion to the relevant court or institution, using US Legal Forms for streamlined templates.

To file an amended return, you should start by obtaining Form 1040-X, which is specifically designed for this purpose. Fill it out with accurate information regarding your original filing and any changes. After completing the form, submit it to the IRS either by mail or through an online platform like US Legal Forms, which simplifies the process and ensures accuracy.

Yes, it is often worth it to amend a tax return, especially if you discover that you are eligible for a refund due to missed deductions or credits. Filing an amended return can also correct errors that might affect your tax liability. If you are unsure about how to navigate this process, uslegalforms provides guidance and resources to help you amend 4.66 with confidence.

The most common mistake made on taxes is incorrect information on forms, such as misspelled names or wrong Social Security numbers. These kinds of errors can lead to delays and complications in processing your return. It’s essential to double-check your information before submitting your tax return, especially if you plan to amend 4.66 later.

An amended 1040X should include your personal information, the original amounts reported, and the corrected amounts. Additionally, provide explanations for each change, as this helps the IRS understand your amendments. Remember to attach any necessary documentation that supports the changes to ensure a smooth process when you amend 4.66.

Yes, you can amend your tax return by yourself using the IRS Form 1040X. This form allows you to make corrections to previously filed returns. If you find errors or realize you missed opportunities for deductions, amending your return is a practical step. Always ensure you follow IRS guidelines for completing the form when you decide to amend 4.66.

Yes, you can amend your tax return even after you have already filed. If you need to make corrections or add new information, completing the 1040X form is the first step. To make this process smoother, consider using US Legal Forms to help ensure everything is completed correctly during the Amend 4.66.

An amended tax return is qualified for situations such as correcting errors, updating filing status, or claiming overlooked deductions. If you realize there are mistakes or missed information on your initial return, it's important to file a 1040X. For guidance throughout the Amend 4.66 process, platforms like US Legal Forms can provide valuable resources tailored to your specific needs.