Trustee Fiduciário

Description

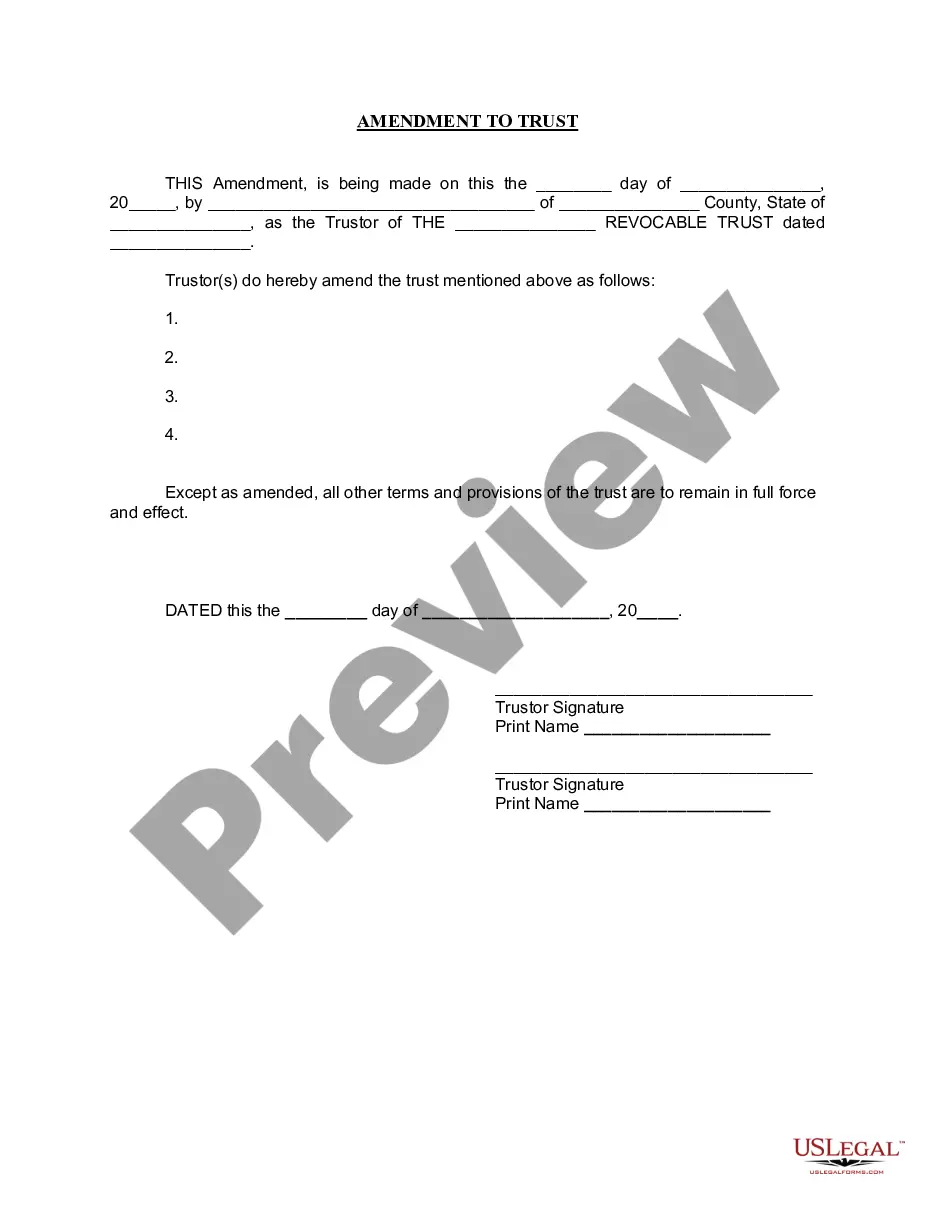

How to fill out Florida Amendment To Living Trust?

- If you're a returning user, log in to your account to download the required form directly from your dashboard. Ensure your subscription is current; if it’s not, consider renewing it promptly.

- For first-time users, start by previewing the form catalog and read the relevant descriptions to find a suitable template that meets your requirements and complies with your local jurisdiction.

- If needed, utilize the Search feature to identify additional templates that fit your needs. Make sure to verify their relevance before proceeding.

- Opt to purchase the document by selecting the Buy Now option. Choose a subscription plan that aligns with your needs, and create an account to unlock full access.

- Complete your payment using your credit card or PayPal, then download your selected form. You can find it later in the My Forms section for easy access.

Using US Legal Forms empowers individuals to swiftly secure the legal documents they require, thereby removing the complexities typically associated with legal paperwork.

Get started today and take advantage of our extensive library of over 85,000 editable legal forms tailored to suit your needs.

Form popularity

FAQ

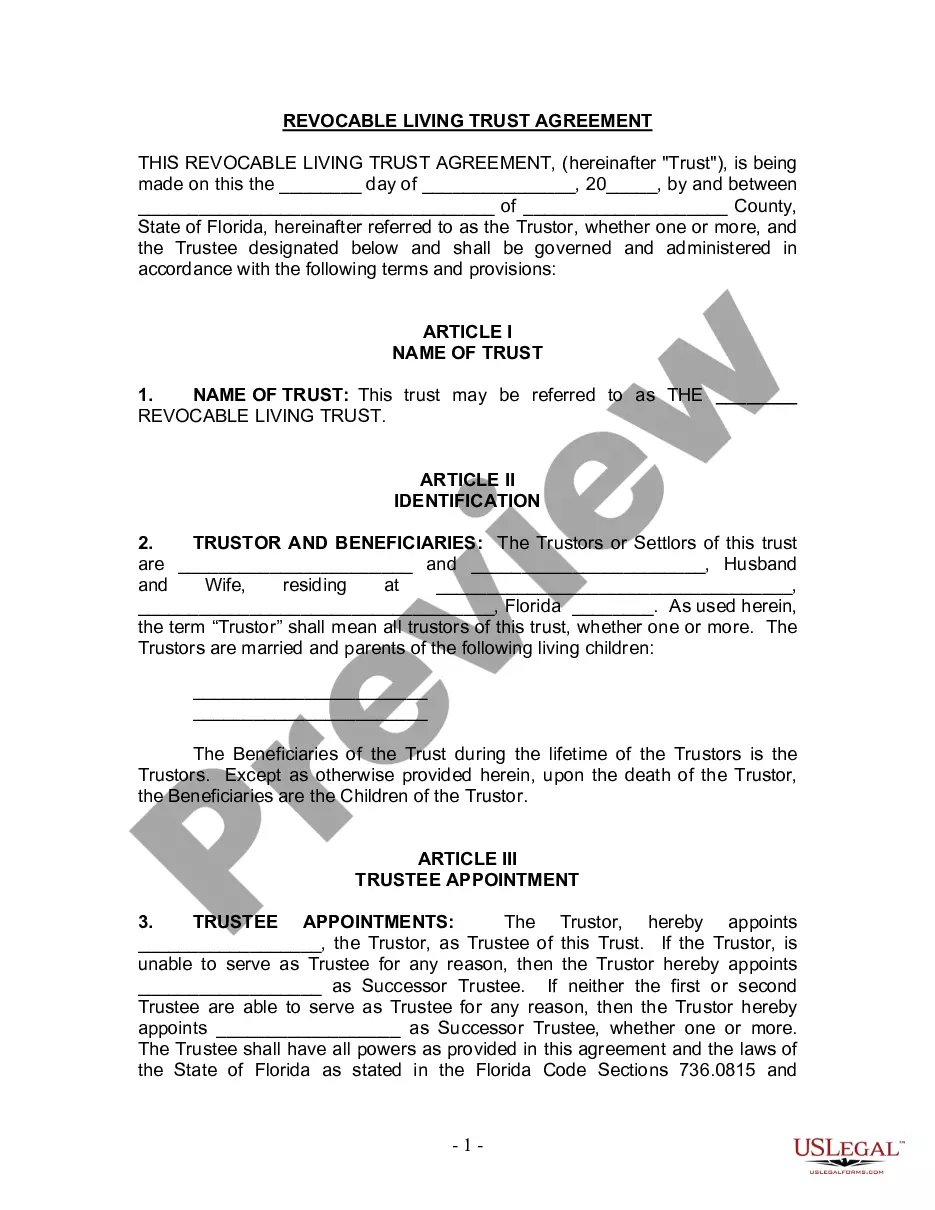

The best person to serve as a trustee fiduciário is someone who combines trustworthiness, financial acumen, and a clear understanding of your wishes. This could be a reputable professional, such as a lawyer or accountant, who can bring an objective perspective. Consider your specific needs and the complexity of your trust when making this choice. USLegalForms can aid you in evaluating potential trustees and understanding their roles.

An example of a trustee fiduciário name could be something simple like 'John Doe' or it could be a more formal representation such as 'Jane Smith, Trustee of the Smith Family Trust.' Ultimately, the name you choose should reflect the individual or organization responsible for managing the trust's assets. If you need assistance with naming conventions or legal requirements, USLegalForms can provide you with the necessary templates and information.

A suitable trustee fiduciário is someone who possesses integrity, financial insight, and a genuine commitment to fulfilling their duties. This could be a family member, a trusted friend, or a qualified professional in financial matters. They should be capable of managing both the emotional and practical aspects of administering your trust. By exploring the USLegalForms resources, you can gain a deeper understanding of what qualities are essential in a trustee.

Choosing a trustee fiduciário involves thoughtful consideration of several factors. First, assess the person’s familiarity with financial and legal matters, as these skills are vital for managing the trust’s assets. You should also consider their reliability and willingness to take on this important responsibility. The resources available on the USLegalForms platform can provide you with insights and tools to help you in this selection process.

Choosing a trustee fiduciário is a crucial decision that can impact the effectiveness of your trust. Ideally, you should name someone you trust completely, such as a family member, close friend, or a professional like an attorney or a financial advisor. Consider their ability to manage assets, handle financial matters, and remain impartial during difficult decisions. On the USLegalForms platform, you can find guidance on selecting a suitable trustee to ensure your trust operates smoothly.

To report irrevocable trust income, the trustee fiduciário must complete IRS Form 1041 and provide beneficiaries with a Schedule K-1 detailing their share of the income. Beneficiaries are then responsible for reporting the amounts on their personal tax returns. Accurate reporting of trust income helps ensure all tax obligations are fulfilled effectively and accurately.

In New York, any trust that generates income must file a state tax return, which includes both irrevocable and revocable trusts. The trustee fiduciário must be aware of this obligation to ensure compliance with state tax laws. Filing the NY trust return involves reporting income and deductions, ensuring all tax responsibilities are met.

An irrevocable trust does not typically issue Form 1099 to report income. Instead, it follows the procedures for filing Form 1041 and providing Schedule K-1 to beneficiaries. If the trust makes distributions to individuals or businesses that warrant a 1099, the trust may need to issue one. Staying informed about these requirements is essential for managing trust income.

Irrevocable trust income is reported on IRS Form 1041, which the trustee fiduciário files on behalf of the trust. If the trust distributes income to beneficiaries, those amounts are reported on the beneficiaries’ tax returns via Schedule K-1. Keeping meticulous records of distributions helps streamline this reporting process and ensure compliance.

Trustee income should be reported on Form 1040 as part of the beneficiary’s income. The beneficiary receives a Schedule K-1 that summarizes their share of the income and deductions. It's crucial to review the information on the K-1 closely to ensure accurate reporting on your tax return. Properly reporting this income minimizes the risk of errors.