Revocable Trust Tax Filing Requirements

Description

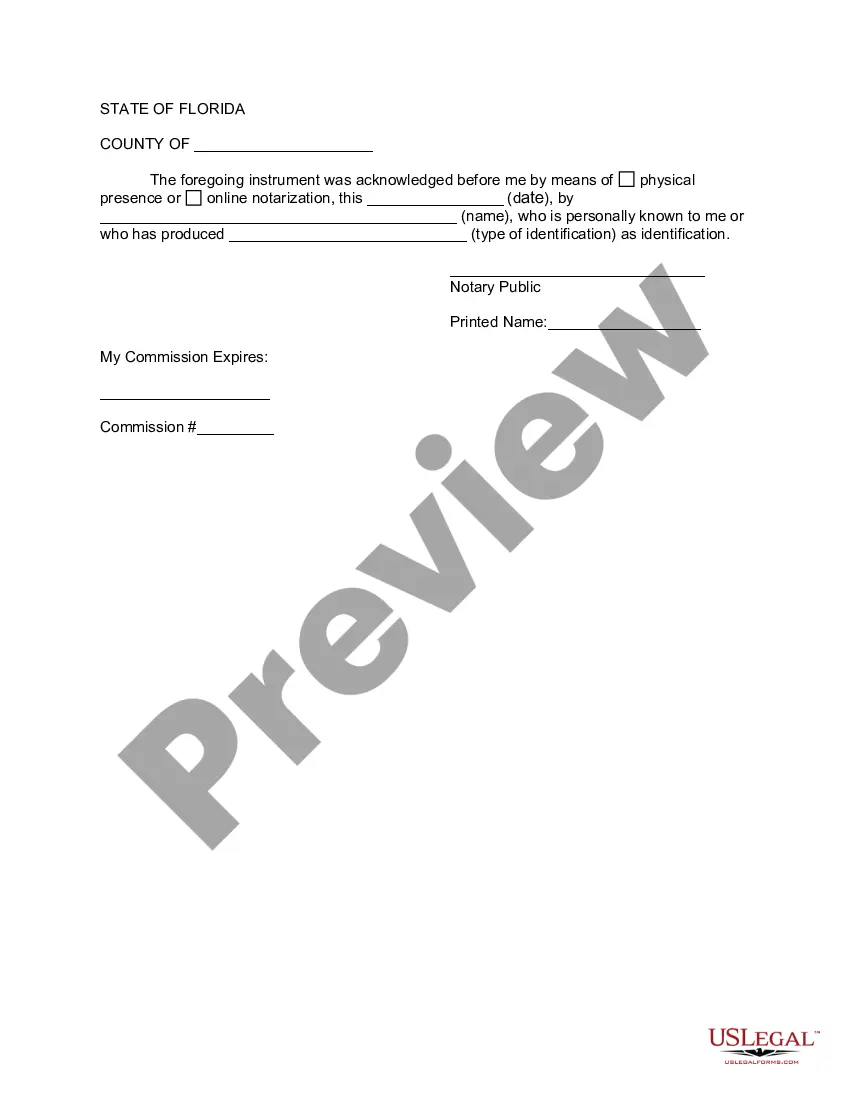

How to fill out Florida Amendment To Living Trust?

Managing legal documents and processes can be a lengthy addition to your day. Revocable Trust Tax Filing Requirements and similar forms generally require you to locate them and find the optimal way to fill them out accurately.

For this reason, whether you're addressing financial, legal, or personal issues, utilizing a comprehensive and user-friendly online directory of forms at your disposal will be extremely beneficial.

US Legal Forms is the top online platform for legal templates, featuring over 85,000 state-specific documents and numerous tools to help you complete your paperwork effortlessly.

Explore the collection of relevant documents accessible with just a single click.

Then, follow the steps below to finish your form: Ensure you have located the correct form by using the Review feature and examining the form details. Choose Buy Now once ready, and select the subscription plan that suits your requirements. Click Download, then fill out, sign, and print the form. US Legal Forms has 25 years of experience helping customers manage their legal documents. Acquire the form you require today and simplify any process without hassle.

- US Legal Forms provides you with state- and county-specific documents available at any time for download.

- Safeguard your document management processes by using a premium service that enables you to create any form within minutes without incurring extra or hidden charges.

- Simply Log In to your account, locate Revocable Trust Tax Filing Requirements, and obtain it immediately from the My documents section.

- You can also access previously saved documents.

- Is this your first time using US Legal Forms? Register and set up your account in just a few minutes, and you'll have access to the form collection and Revocable Trust Tax Filing Requirements.

Form popularity

FAQ

The grantor may set up a revocable trust, which will distribute the assets after the child reaches a certain age. Then the beneficiary could use the assets as they wish. Grantors can alter the beneficiaries throughout their lifetime and change the terms with this type of trust.

When trust beneficiaries receive distributions from the trust's principal balance, they don't have to pay taxes on this disbursement. The Internal Revenue Service (IRS) assumes this money was taxed before being placed into the trust. Gains on the trust are taxable as income to the beneficiary or the trust.

In general, Form 8855, Election To Treat a Qualified Revocable Trust as Part of an Estate, must be filed by the due date for Form 1041 for the first tax year of the related estate. This applies even if the combined related estate and electing trust don't have sufficient income to be required to file Form 1041.

Revocable Trusts Typically during the creator's lifetime, the taxpayer identification number of the trust will be the creator's Social Security number. All items of income, deduction and credit will be reported on the creator's personal income tax return, and no return will be filed for the trust itself.

You must file Form 1041 for a domestic trust that has: Any taxable income for the tax year. Gross income of $600 or more (regardless of taxable income) A beneficiary who is a non-resident alien.