Revocable Trust Amendment Form With Decimals

Description

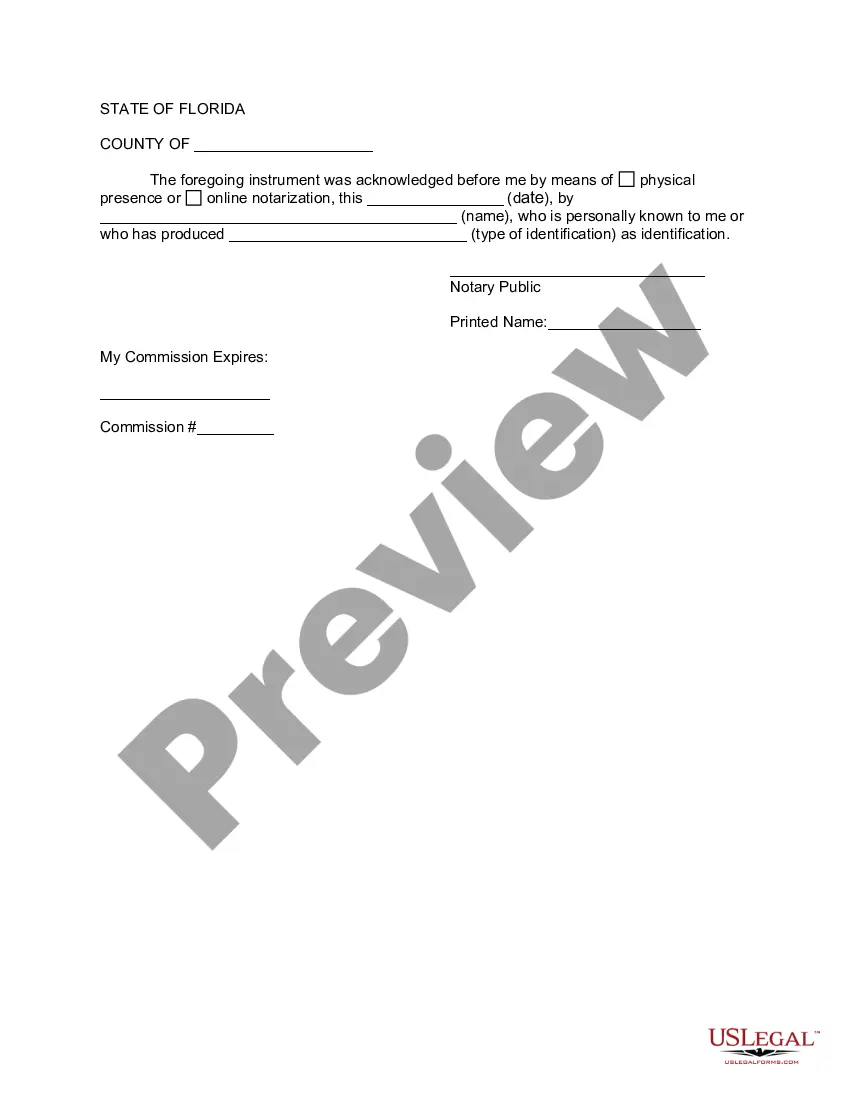

How to fill out Florida Amendment To Living Trust?

Creating legal documents from the beginning can frequently be daunting.

Specific situations may require extensive research and significant financial investment.

If you’re looking for a simpler and more cost-effective method of preparing the Revocable Trust Amendment Form With Decimals or any other documents without unnecessary complications, US Legal Forms is always available to assist you.

Our online library of over 85,000 current legal documents covers nearly every area of your financial, legal, and personal matters.

Review the form preview and descriptions to confirm you have located the document you need. Verify that the template you choose adheres to the laws and regulations of your state and county. Select the most appropriate subscription plan to acquire the Revocable Trust Amendment Form With Decimals. Download the document, then complete, sign, and print it. US Legal Forms has a solid reputation and over 25 years of expertise. Join us now and make document preparation easy and efficient!

- With just a few clicks, you can instantly access compliant templates for your state and county, meticulously crafted by our legal experts.

- Utilize our website whenever you require dependable services to quickly find and download the Revocable Trust Amendment Form With Decimals.

- If you’re familiar with our site and have set up an account previously, simply Log In, select your form, and download it or re-download it anytime from the My documents section.

- Don’t have an account? No worries. It only takes a few minutes to create one and navigate the catalog.

- However, before diving straight into downloading the Revocable Trust Amendment Form With Decimals, consider these suggestions.

Form popularity

FAQ

It's important to know what you want to change and where in your trust document this information lives (such as the article number you're amending). Fill out the amendment form. Complete the entire form. It's important to be clear and detailed in describing your changes.

A trust amendment that can be used to modify an existing California revocable trust instrument. This trust amendment allows a client to modify a revocable trust instrument without creating an entirely new trust instrument or restating an existing revocable trust instrument in its entirety.

If there is no amendment clause in the Trust Deed, any amendment has to be done with the permission of a Civil Court. Once the Civil Court has allowed permission for amendment, it is not open on the part of the Income Tax Officer or any other person to challenge such amendment.

Checking and Savings (Cash) Accounts Before retitling CDs into your trust, you should first check to make sure that no early withdrawal penalties will apply. If a penalty will apply, you may need to wait until those CDs mature and then make the transfer.

The general rule is both grantors must die for a revocable trust to become irrevocable. However, there are legal ways to change the general rule for co-grantors. This means the parties that established the revocable trust have the legal power to set the rules for the trust.