Account Corporation Form For Tax

Description

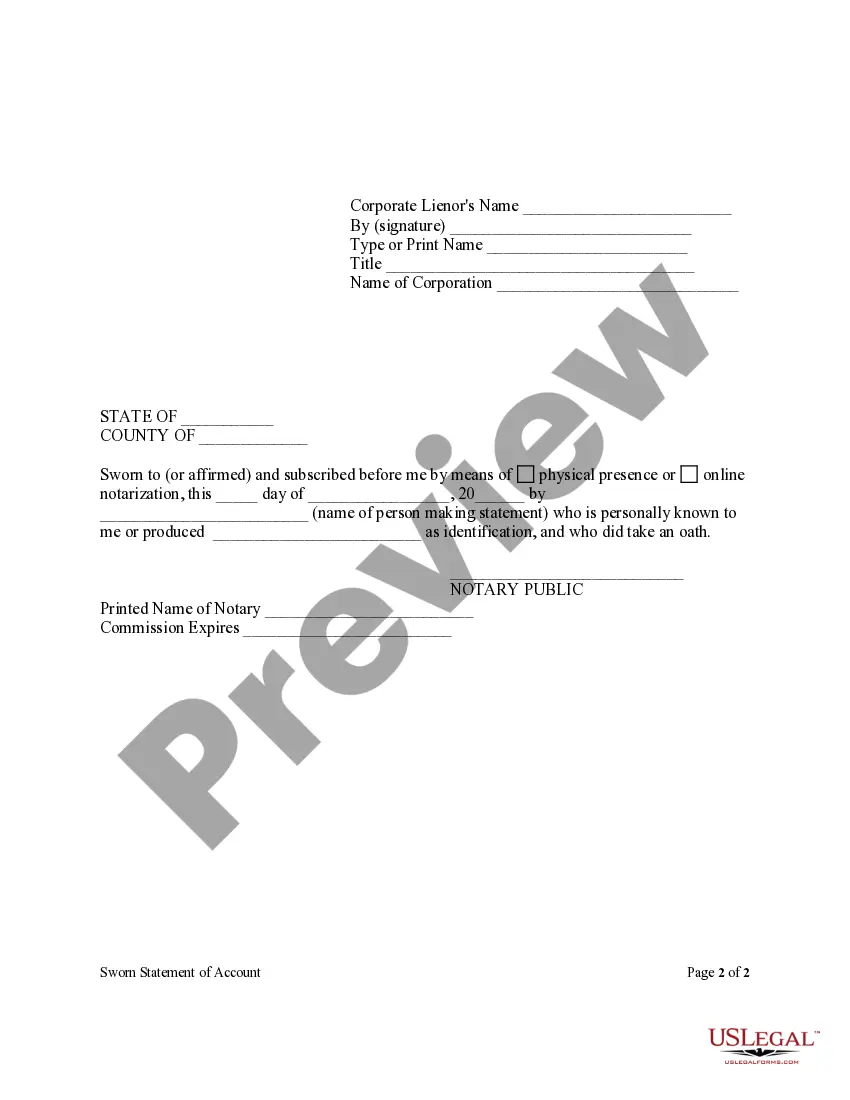

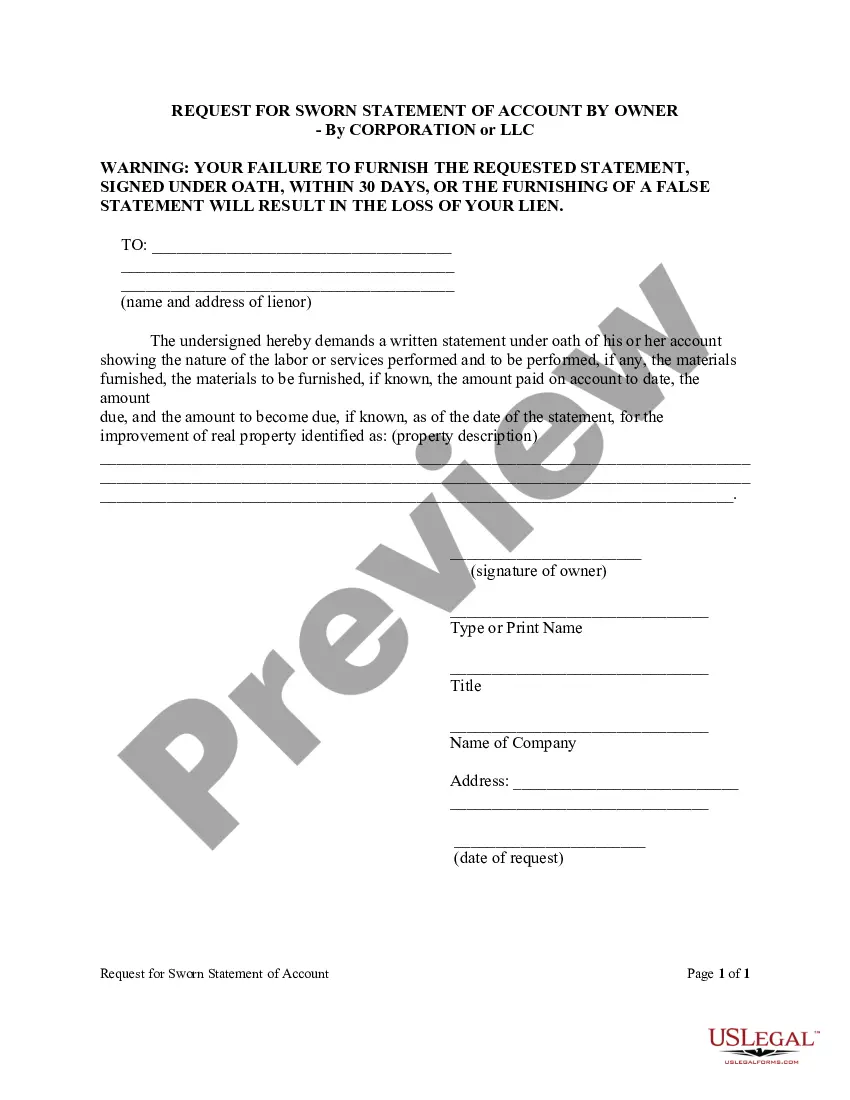

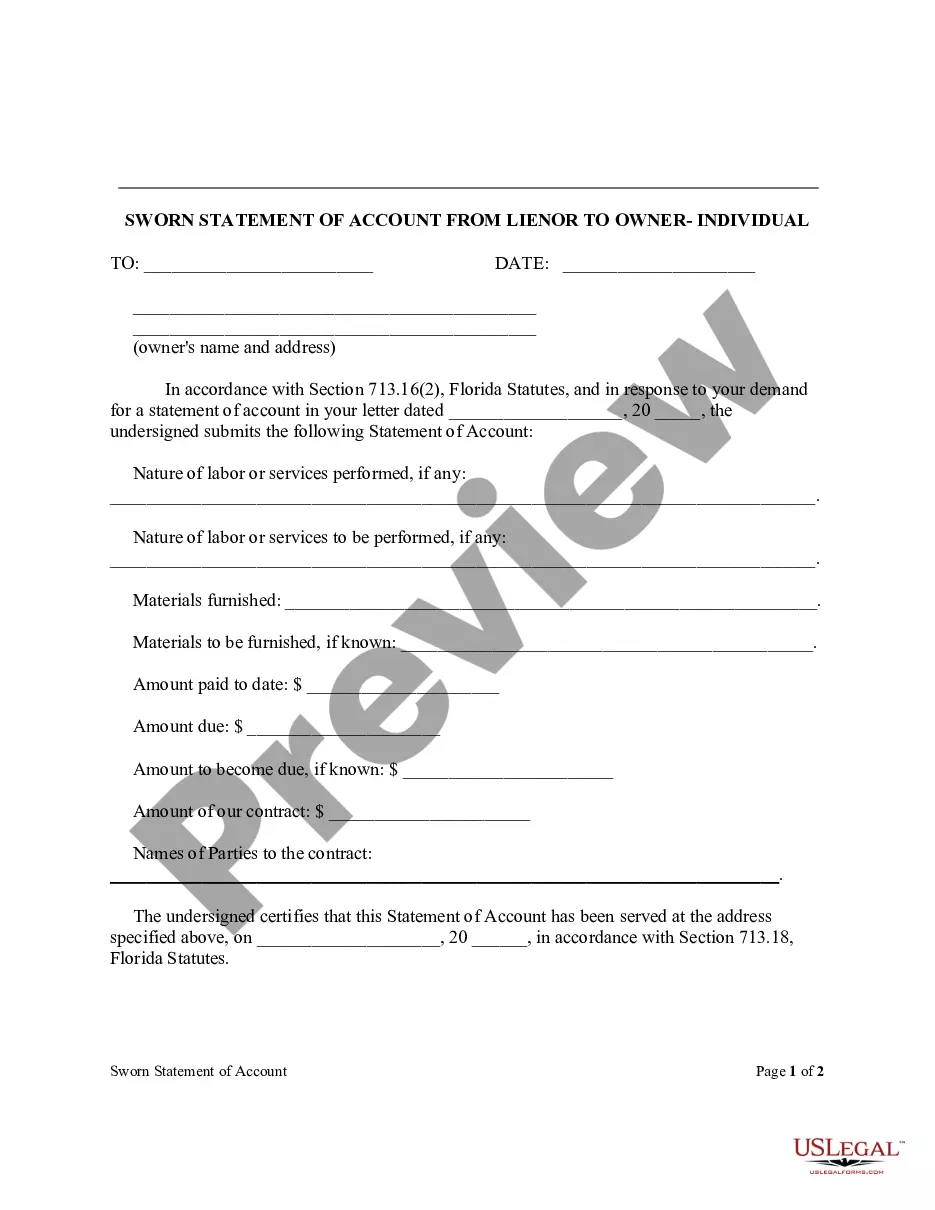

How to fill out Florida Sworn Statement Of Account From Lienor To Owner - Construction - Mechanic Liens - Corporation Or LLC?

- Log in to your account on the US Legal Forms website if you are a returning user. Ensure your subscription is active, or renew it if necessary.

- For new users, familiarize yourself with the platform by checking out the Preview mode and detailed descriptions of forms. Verify that the chosen form meets your specific needs and jurisdiction.

- Search for other relevant templates if necessary. If you spot an inconsistency, use the Search feature at the top to find accurate options.

- Proceed to purchase your selected form by clicking on the Buy Now button, choosing your preferred subscription plan. Make sure to create an account to unlock all resources.

- Complete your transaction by entering your payment information for either a credit card or PayPal, ensuring a seamless purchasing experience.

- Once purchased, download the form to your device for immediate use. Access your document anytime through the My Forms section of your profile.

Using US Legal Forms allows you to efficiently execute legal documents while benefiting from an extensive library of over 85,000 fillable forms. With premium experts available for assistance, you can ensure your documents are not only completed but are legally sound.

Ready to simplify your legal process? Start using US Legal Forms today and experience the convenience of a robust and user-friendly platform.

Form popularity

FAQ

To record estimated tax payments for your corporation, you should track these payments separately in your financial records. Ensure you document the payment date, amount, and purpose. For comprehensive support, use resources like US Legal Forms that detail how to manage the Account corporation form for tax efficiently, ensuring you stay compliant and informed.

Yes, you can file Form 1120 yourself. However, many individuals find it complex, especially when navigating through various deductions and credits. Using an online service like US Legal Forms can make this process smoother. It provides detailed guidance on the Account corporation form for tax, helping you complete your filing accurately.

To classify your LLC as an S Corporation, you need to file Form 2553 with the IRS and meet specific eligibility criteria. This election allows you to benefit from income pass-through taxation while avoiding double taxation. Select the right account corporation form for tax to maximize your LLC's financial efficiency.

An LLC is not automatically classified as either an S Corporation or a C Corporation; it depends on elections made by the LLC’s members. An LLC can choose to be taxed as a C Corp or S Corp by filing the appropriate forms with the IRS. It’s vital to understand your classification for proper tax management, including the right account corporation form for tax.

Form 1065 is used for partnerships, not for S Corporations or C Corporations. This form assists in reporting the income, deductions, and credits of a partnership. If you are unsure about which account corporation form for tax applies to your situation, consulting with a professional or using tools like uslegalforms can be beneficial.

An LLC can choose between different tax treatments, including filing as a C Corporation using Form 1120 or as an S Corporation using Form 1120S if it meets eligibility requirements. The choice depends on your business goals and structure. Selecting the correct account corporation form for tax can optimize your tax strategy.

Form 4626 is used for calculating the Alternative Minimum Tax (AMT) for corporations. While many corporations do not need to file this form, it is necessary if your corporation has to calculate AMT. Knowing the relevant account corporation form for tax requirements can save you from penalties.

You can determine if your LLC is classified as an S Corporation by checking if you have filed Form 2553 with the IRS. This form allows your LLC to elect S Corp status if eligible. It’s important to know your business classification so you can file the correct account corporation form for tax purposes.

Form 1120 is specifically for C Corporations. This form is used to report income, gains, losses, deductions, and to calculate the federal corporate income tax. Knowing the right account corporation form for tax can help you manage your corporate tax responsibilities efficiently.

An LLC typically files Form 1065 if it has multiple members, while a single-member LLC might file Schedule C with Form 1040. However, if your LLC elects to be treated as an S Corporation, you would file Form 1120S. Understanding the correct account corporation form for tax is essential for compliance and optimizing your tax obligations.