Account Amount Contract For The Future

Description

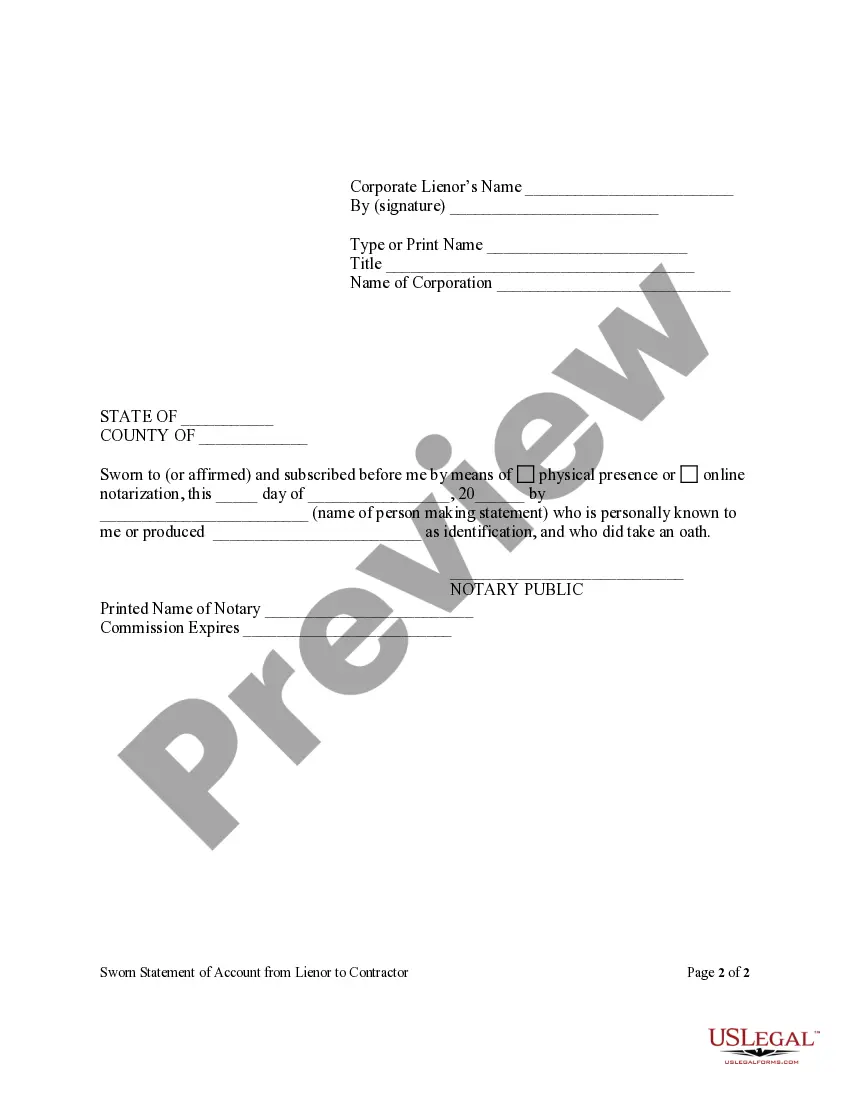

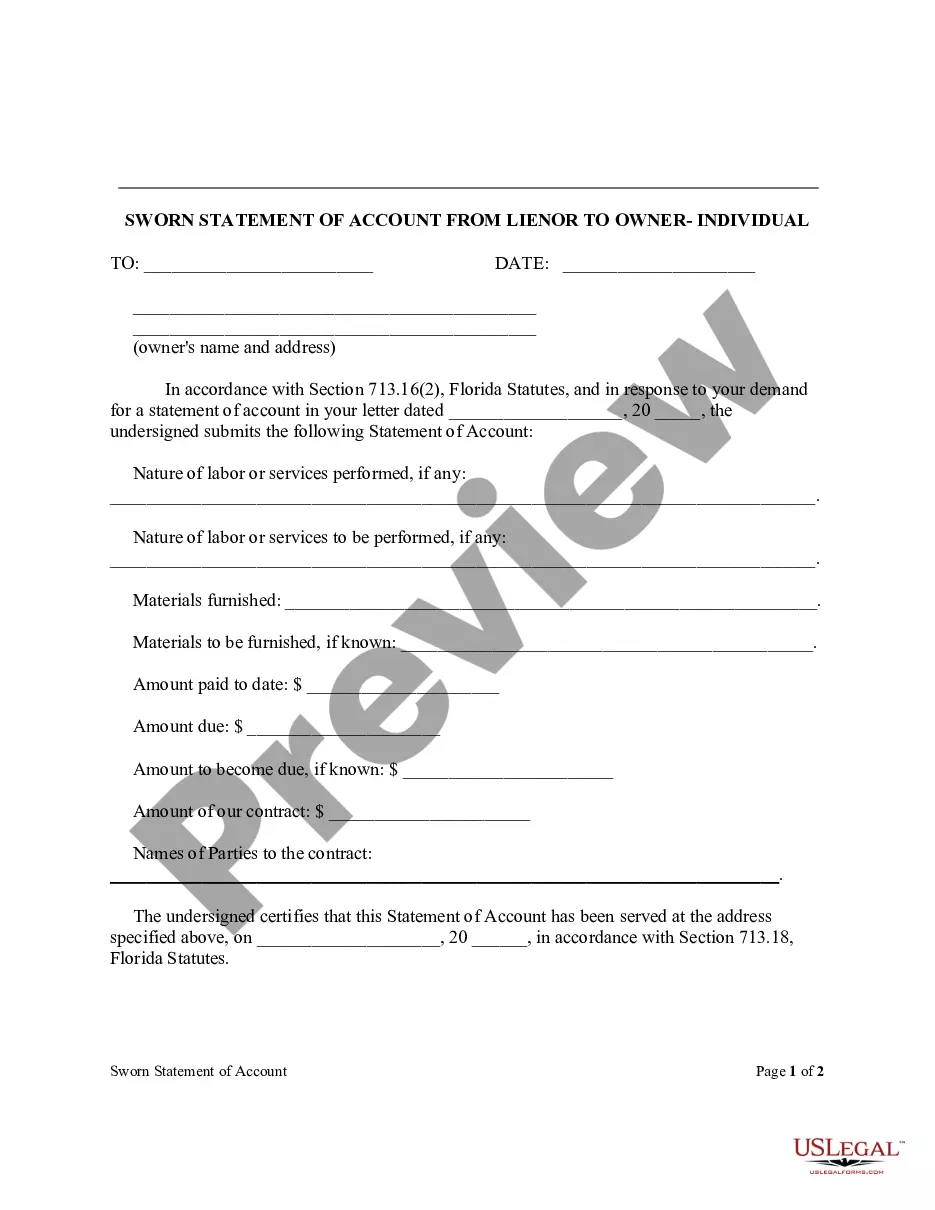

How to fill out Florida Sworn Statement Of Account From Lienor To Contractor - Corporation?

- If you're a returning user, log in to your account and navigate to the necessary form template. Click the Download button, ensuring your subscription is active; if it’s not, renew per your payment plan.

- For new users, verify the form description and Preview mode to make sure it meets your needs and adheres to local jurisdiction regulations.

- If you don’t find the right template, utilize the Search tab above to locate alternatives that suit your requirements.

- Once satisfied, click the Buy Now button to select your desired subscription plan. Registration for an account is necessary to access our extensive library.

- Complete your purchase by entering your credit card information or opting for PayPal to pay for the subscription.

- After your purchase, download your form and save it to your device. You can also access it later through the My Forms section of your profile.

US Legal Forms empowers both individuals and attorneys by providing a vast collection of over 85,000 legal forms, ensuring that you have all the options you need at your fingertips. Additional assistance from premium experts guarantees that your documents are filled out accurately and remain legally valid, offering peace of mind during the process.

Take the first step towards securing your legal needs today – visit US Legal Forms and start your journey towards a hassle-free documentation experience!

Form popularity

FAQ

To write a contract amount, it is essential to express it clearly, stating the exact figure or rate agreed upon by both parties. Ensure you mention the currency and include any necessary payment terms related to the amount. Accurate representation of the contract amount is vital in your account amount contract for the future for clarity and enforceability.

When writing a contract for payment, include clear payment terms, such as the amount, due date, and payment method. Specify penalties for late payments and any conditions that may affect the payment schedule. Clarity in these terms promotes agreement and compliance, especially for your account amount contract for the future.

Filling out a contract agreement involves entering necessary details such as the parties' names, effective date, and the terms of the agreement. When completing an account amount contract for the future, ensure all relevant financial details and responsibilities are clearly defined. A meticulous approach reduces disputes and aligns expectations effectively.

To write a contract number, begin by establishing a consistent format. Most providers often use a combination of letters and numbers, such as a prefix indicating the year, followed by a sequence number. By structuring contract numbers this way, you enhance clarity while facilitating easier reference to your account amount contract for the future.

A contract number serves as a unique identifier for a specific agreement. For instance, if you enter into an account amount contract for the future, the contract might be labeled as 'C2023-001' to distinguish it from others. This helps parties track their agreements efficiently and maintain organized records.

Futures contracts are created through a standardized agreement between buyers and sellers, often facilitated by a futures exchange. These exchanges set the terms, including the delivery date and quantity of the asset involved. Understanding this process enhances your knowledge of the account amount contract for the future.

The four types of futures contracts are commodity contracts, which cover physical goods; financial contracts that include stocks and bonds; index contracts that track market indices; and currency contracts related to foreign exchange rates. Each type offers unique advantages and strategies for investment. Knowing these distinctions can help you choose the best account amount contract for the future to meet your goals. This strategic approach can enhance your trading success.

The four main types of futures contracts include commodity futures, financial futures, index futures, and currency futures. Each type serves distinct purposes and is tied to different underlying assets. Understanding these categories can aid in making informed decisions about an account amount contract for the future. This knowledge can be beneficial for traders and investors alike.

To report a futures contract on your tax return, first gather all relevant trading information, including profits and losses. Utilize IRS Form 6781 for reporting your gains and losses from futures trading, ensuring to apply the 60 40 rule where applicable. This attention to detail will help you maintain compliance with your account amount contract for the future and can simplify your tax preparation process.

The effective tax rate for futures can vary based on gains and your overall income level. Traders benefit from the 60 40 rule, which allows a portion of gains to be taxed at lower rates. Knowing how these rates apply to your account amount contract for the future can help you optimize your tax strategy.