Claim Lien Form With Notary

Description

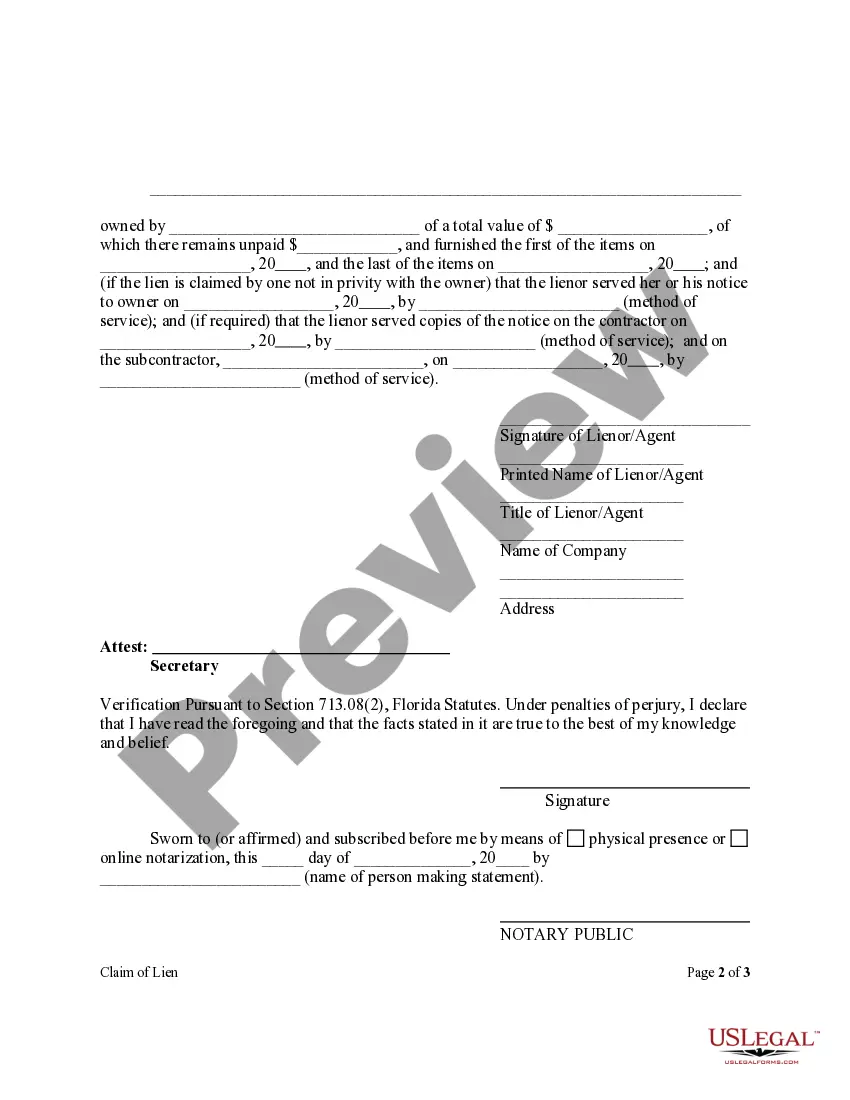

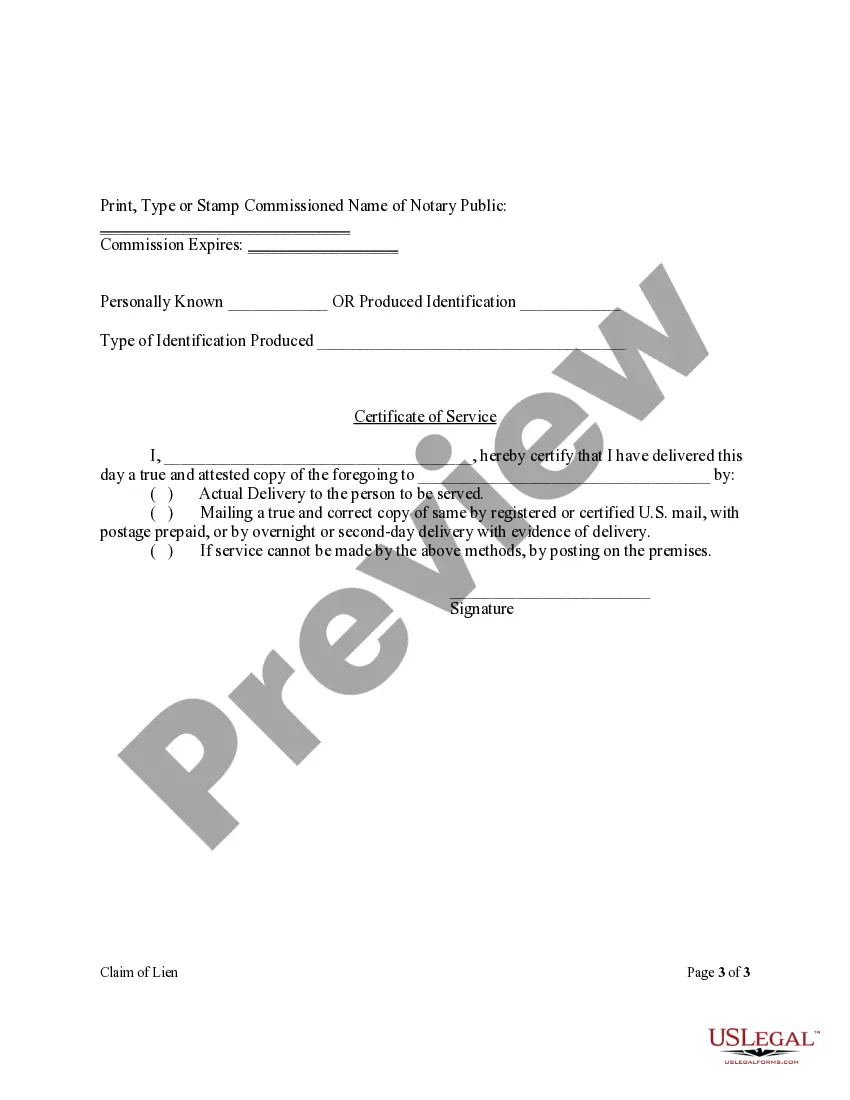

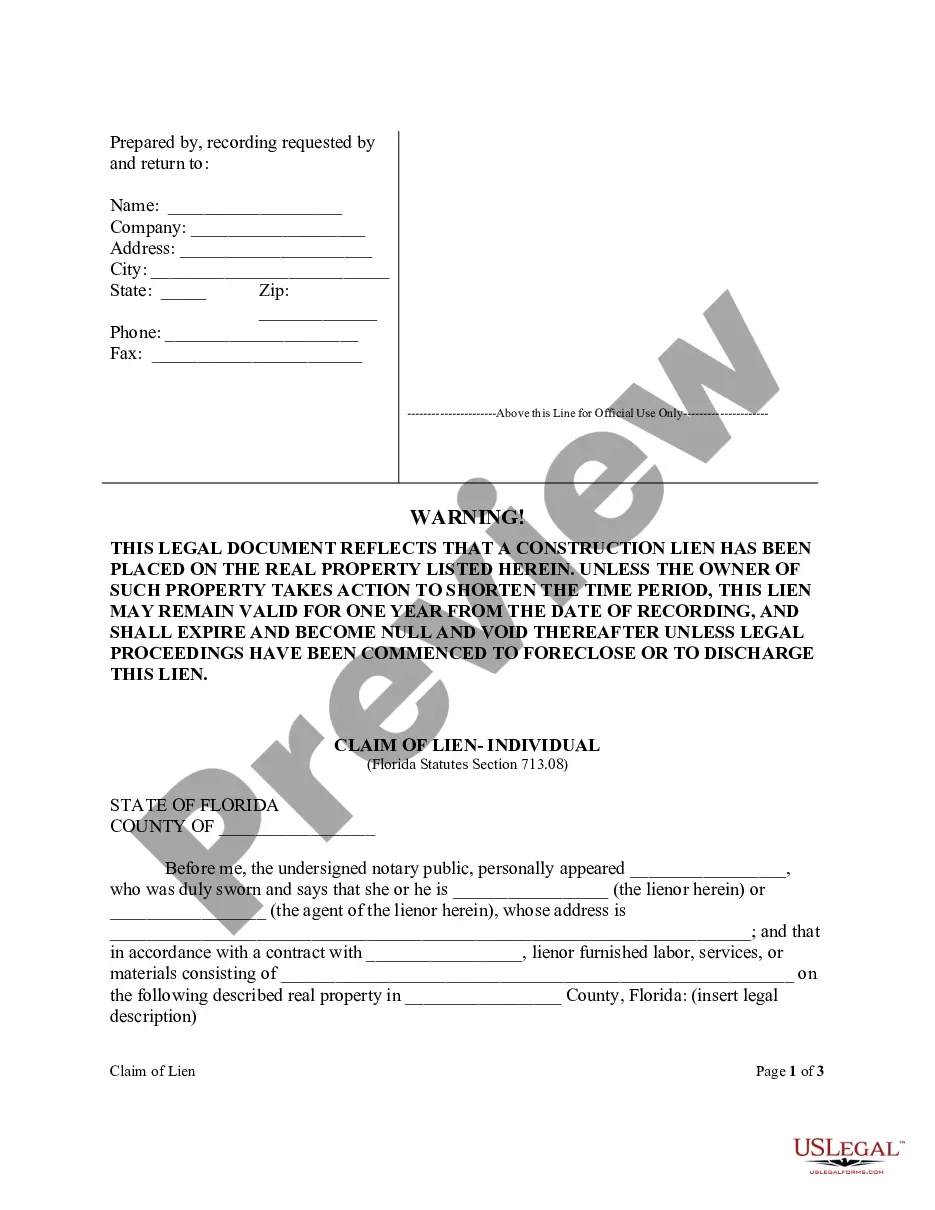

How to fill out Florida Claim Of Lien Form - Construction - Mechanic Liens - Corporation Or LLC?

Legal administration can be daunting, even for skilled experts.

When searching for a Claim Lien Form With Notary and not having the opportunity to spend time locating the suitable and current version, the processes can be anxiety-inducing.

Tap into a valuable resource library of articles, guidelines, and manuals related to your issue and requirements.

Save time and effort seeking the documents you require, and utilize US Legal Forms’ enhanced search and Review feature to locate Claim Lien Form With Notary and download it.

Benefit from the US Legal Forms online archive, supported by 25 years of experience and trustworthiness. Transform your everyday document management into a straightforward and user-friendly process today.

- If you hold a membership, Log In to your US Legal Forms account, search for the document, and download it.

- Check your My documents section to review the documents you have previously downloaded and manage your folders as desired.

- If it’s your initial experience with US Legal Forms, create a free account and gain unlimited access to all the platform’s benefits.

- Here are the steps to follow after acquiring the document you need.

- Ensure it is the correct form by previewing it and verifying its details.

- Utilize state- or county-specific legal and business documents.

- US Legal Forms accommodates any needs you may possess, ranging from personal to business paperwork, all in one location.

- Employ sophisticated tools to complete and manage your Claim Lien Form With Notary.

Form popularity

FAQ

To set up a revocable living trust in Florida, you'll need to follow these requirements: The trust must be created and signed by you. You must transfer assets into the trust. There must be a successor trustee named.

SERVICESFEESCONSULTATIONFREETRUST - SINGLE$600TRUST - MARRIED$650TRUST - A/B$1,85016 more rows

Since living trusts are not required to be filed with the Florida courts following a person's death, it is difficult to gauge the number of trusts vs. the number of wills (which are required to go through probate, therefore are public).

While it is true that with the information available on the Internet, you might be able to draw up your own living trust, there are numerous valid reasons why you should have an experienced Ayo and Iken Florida estate attorney prepare your living trust.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.

(In Florida, two witnesses are required; a witness statement automatically prints out with the Florida trust document.) But you do need to sign your living trust document in front of a notary public for your state. If you create a shared living trust, both of you need to sign the trust document in front of the notary.