Power Of Attorney For Business

Description

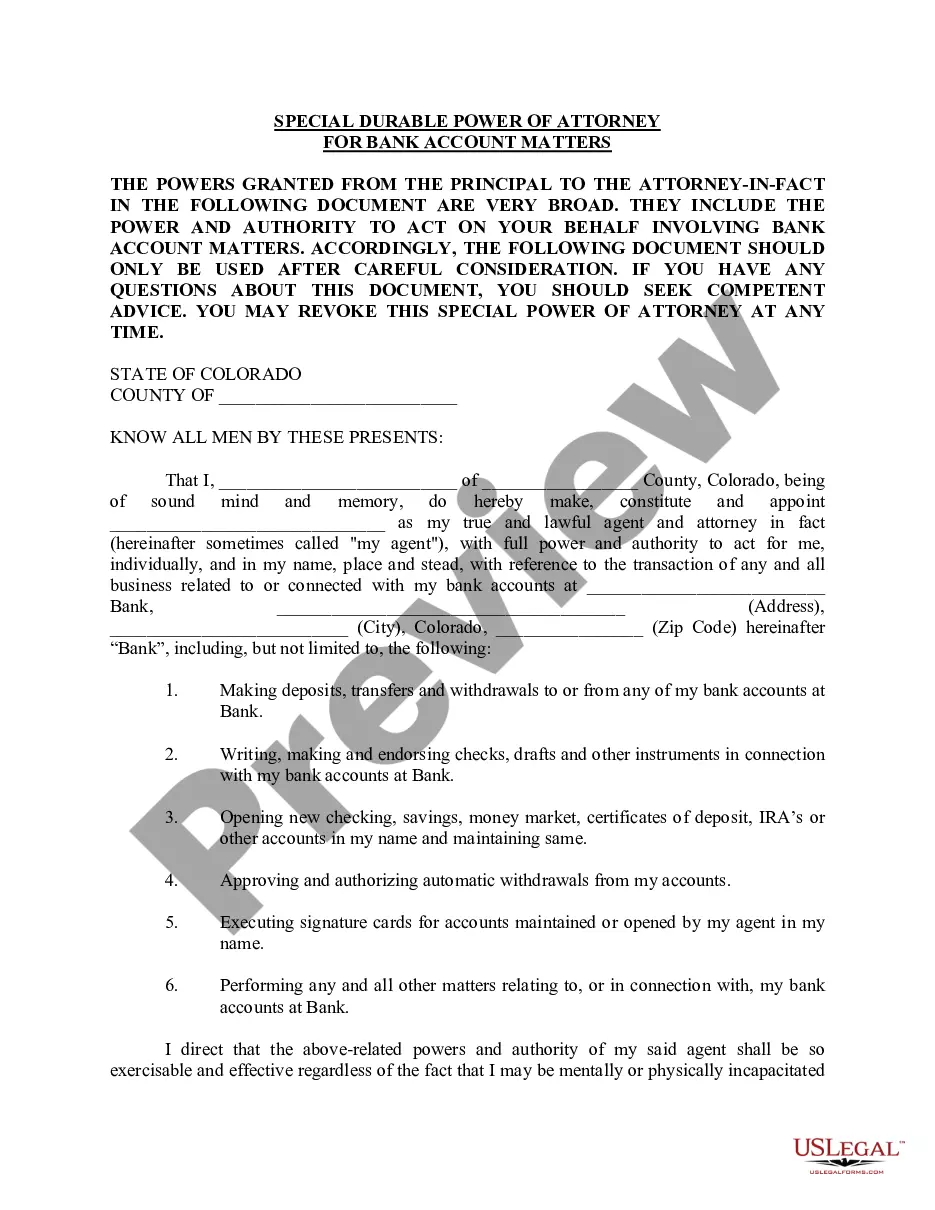

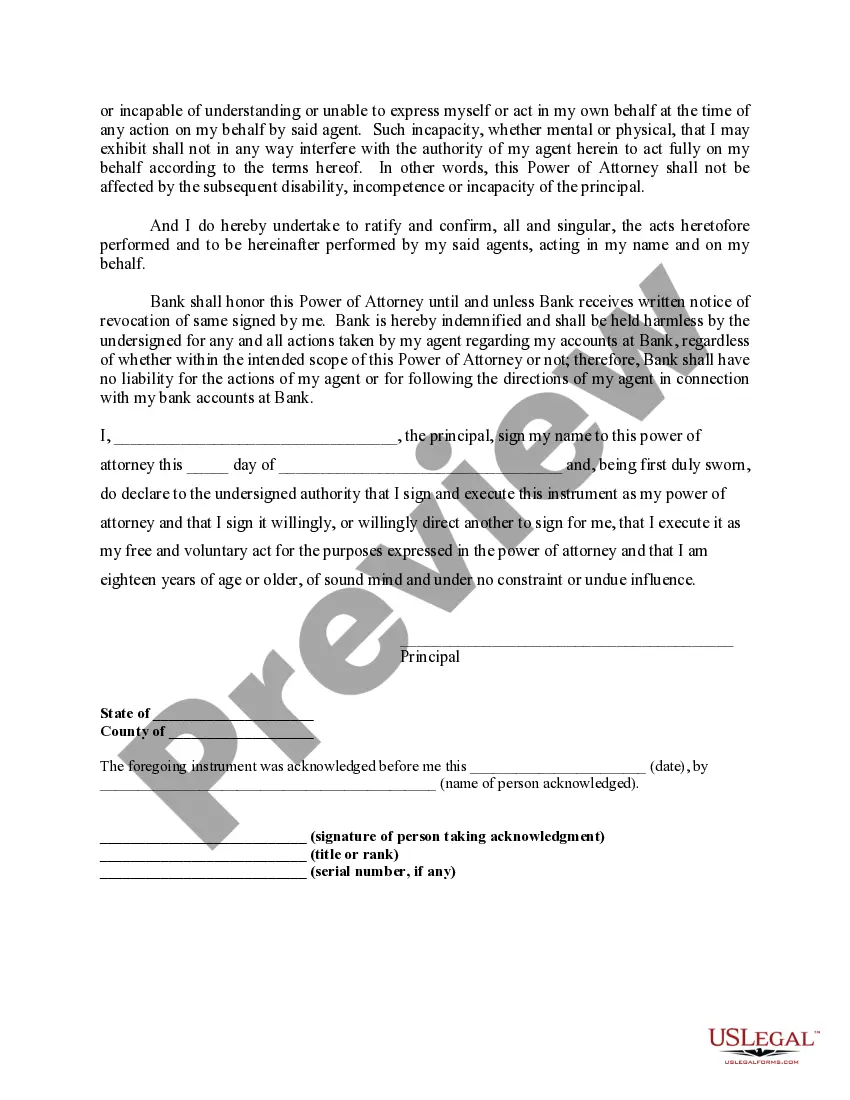

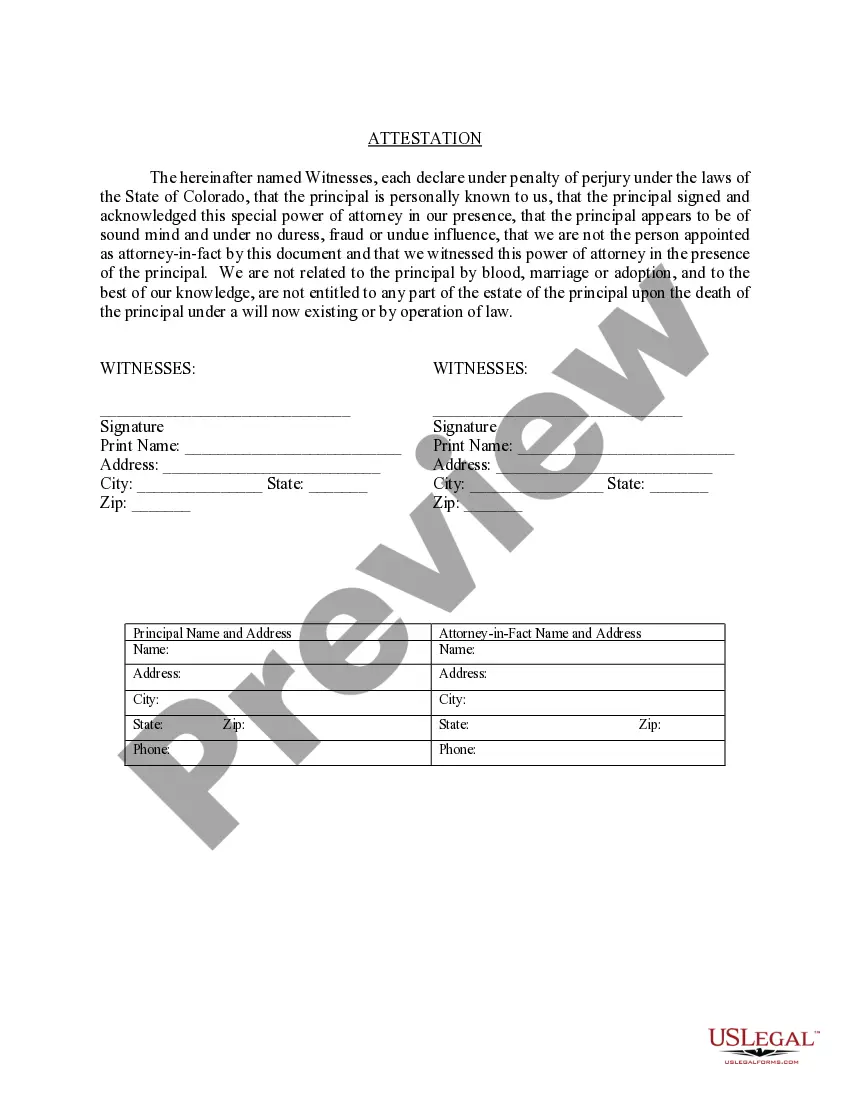

How to fill out Colorado Special Durable Power Of Attorney For Bank Account Matters?

- If you are a returning user, log in to your account and download the necessary form template by clicking the Download button. Ensure your subscription is current, or renew it as needed.

- For first-time users, start by checking the Preview mode and form description to confirm you have selected the correct power of attorney that fits your local jurisdiction.

- If you must search for another template, use the Search tab to explore options until you find one that meets your requirements.

- Once you've found the appropriate form, click the Buy Now button and select your desired subscription plan. You’ll need to register for an account to unlock access to the entire library.

- Complete your purchase by entering your credit card details or using your PayPal account for payment.

- Finally, download the form and save it to your device. You can also access your document in the My Forms section of your profile at any time.

With over 85,000 easy-to-fill forms and an extensive library, US Legal Forms stands out in the market by providing a robust collection of documents at competitive prices.

Don't hesitate—take advantage of US Legal Forms today and ensure your business documents are executed flawlessly!

Form popularity

FAQ

The most recommended type of power of attorney for business often depends on your specific needs. A durable POA is frequently suggested because it remains in effect regardless of your ability to manage affairs. This flexibility ensures continued oversight of your business operations. By utilizing US Legal Forms, you can easily create a tailored power of attorney document suitable for your circumstances.

Yes, an LLC can grant power of attorney to individuals to act on its behalf. This allows the appointed person to manage business transactions, sign contracts, or handle legal matters effectively. To ensure compliance with state laws, it is advisable to draft the document accurately and have it signed by the necessary parties. Implementing a power of attorney for business can streamline operations and enhance efficiency.

A statutory power of attorney (POA) and a durable POA serve different purposes in business management. A statutory POA generally has specific limitations set by state laws, while a durable POA remains in effect even if you become incapacitated. It is critical to choose the right type based on your business needs. By understanding these differences, you can make informed decisions about your power of attorney for business.

Selecting the right person for power of attorney is crucial for effective business management. Ideally, you should choose someone trustworthy, responsible, and knowledgeable about your business's operations. This agent should understand your goals and values, ensuring they make decisions that align with your vision. If you are unsure, consider consulting with a legal professional to help guide your choice.

Yes, a power of attorney for business can provide access to bank accounts. This authority allows your agent to manage financial matters, including handling transactions and monitoring account balances. However, it is essential to clearly specify the extent of this access in the document. By defining the limits of authority, you can ensure that your financial interests remain protected.

A legal power of attorney cannot make decisions about voting in elections, changes to a will, or personal health care choices. These decisions require personal consent and cannot be delegated. Understanding the limitations of a power of attorney for business is essential in estate planning and company operations.

A lawyer can protect your business by ensuring compliance with laws and regulations. They help prevent legal disputes and provide advice on various business decisions. Additionally, creating a power of attorney for business with their assistance can empower a trusted individual to make decisions for your company when you cannot.

An attorney for a business provides legal support tailored to your company’s needs. They draft contracts, resolve disputes, and guide compliance with laws. Furthermore, they can assist in creating a power of attorney for business, ensuring that you have a reliable representative when needed.

A power of attorney for a business is a legal document that grants one person the authority to act on behalf of another in business matters. This encompasses making decisions about operations, finances, and more. It is crucial for ensuring that your business runs smoothly, especially if you are unavailable.

A business attorney provides legal guidance to protect your company’s interests. They assist in navigating contracts, disputes, and compliance issues. By consulting with a lawyer, you also gain insights on creating a power of attorney for business, which can safeguard your operations.