What is Power of Attorney?

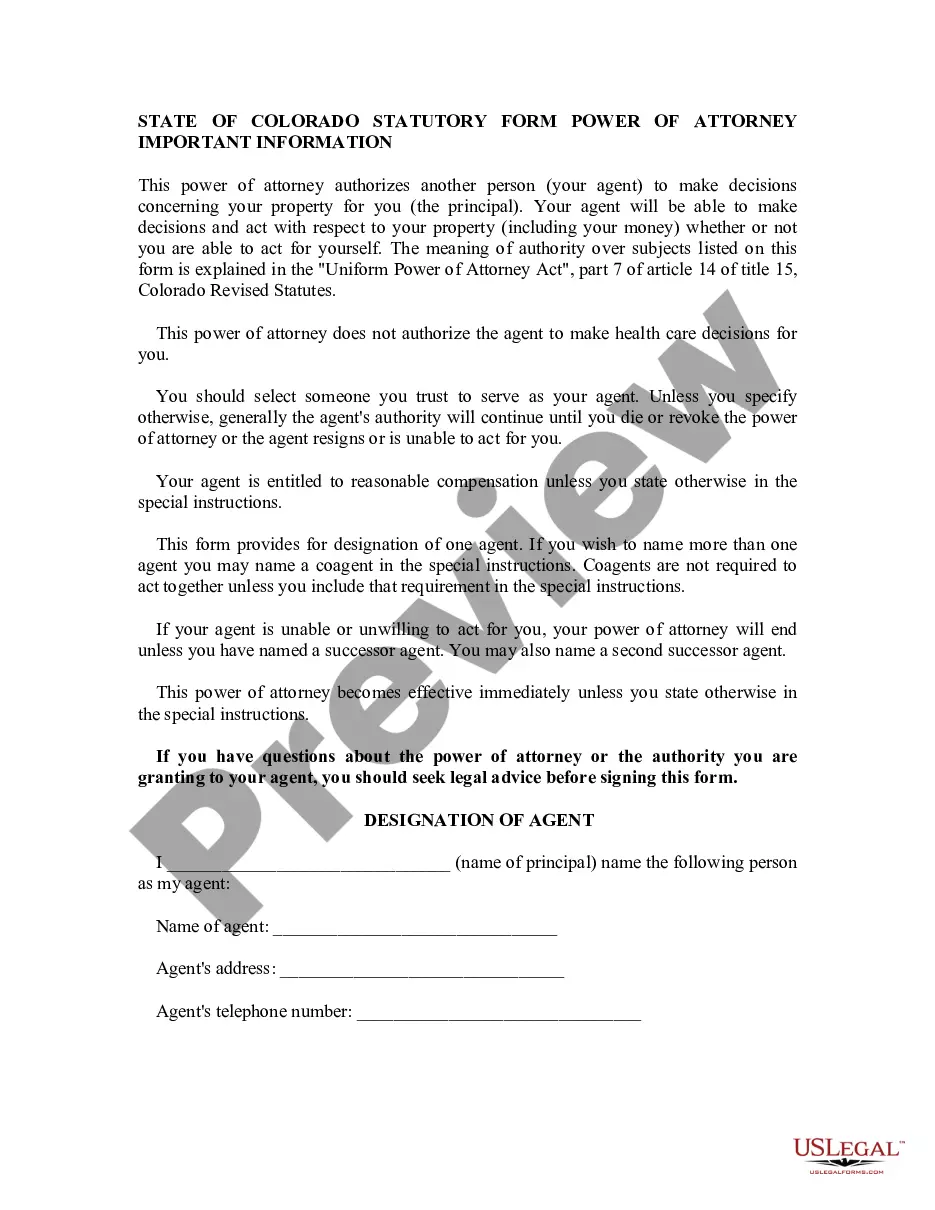

Power of Attorney documents enable one person to make decisions on behalf of another. They are often used when individuals cannot manage their affairs. Explore state-specific templates for your needs.

Power of Attorney documents allow individuals to designate others for decision-making. Attorney-drafted templates are quick and user-friendly.

Essential documents for planning and managing your legal affairs during later life stages, providing convenience and peace of mind.

Designate someone to manage your finances and property, even if you become incapacitated.

Designate someone to manage your property and finances if you become unable to do so, ensuring your affairs are handled according to your wishes.

Protect your interests with essential legal forms for health and financial decisions, all conveniently bundled in one package.

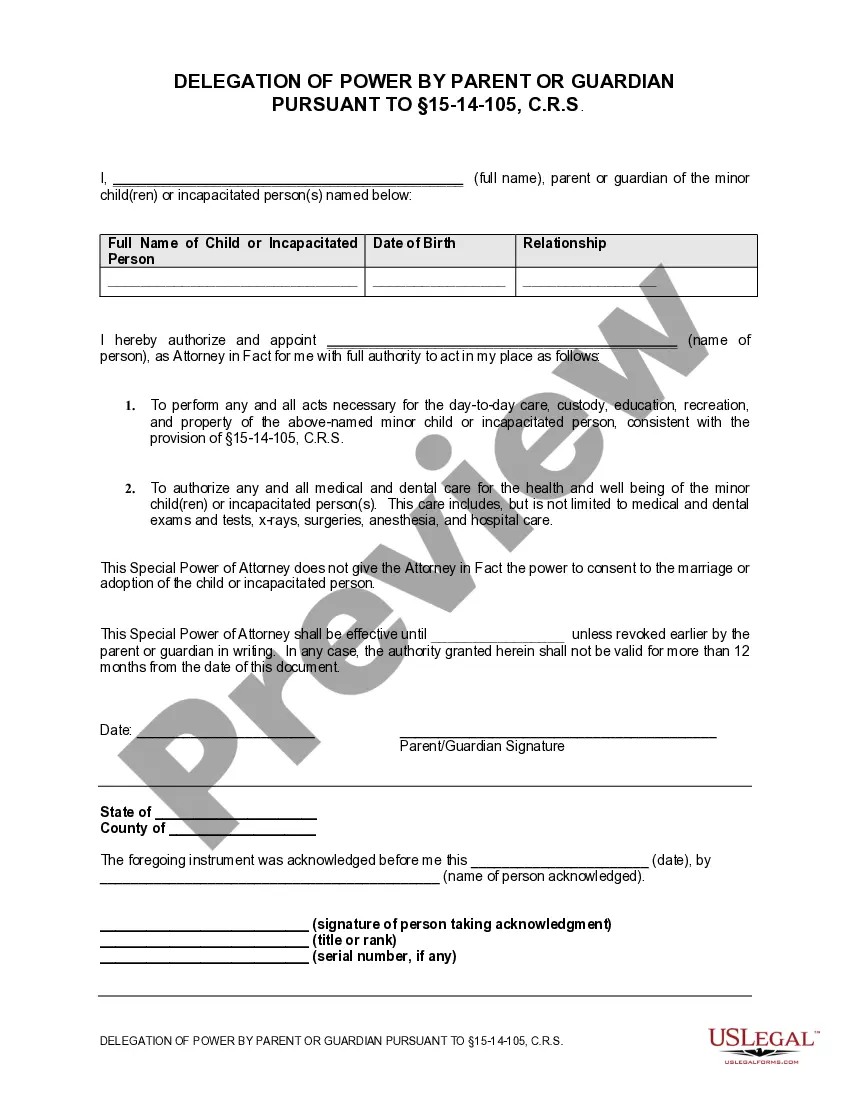

Authorize someone to make day-to-day decisions for your child or incapacitated person during a specific period.

Grant authority for handling your bank accounts, even if you become incapacitated. Ideal for ensuring your financial matters are managed when you can't do so yourself.

Ensure your medical treatment wishes are honored with this convenient package of essential legal forms.

Designate someone to make healthcare decisions for you when you're unable to communicate your wishes, ensuring your medical preferences are honored.

Create personalized instructions for medical treatment decisions to guide caregivers when you cannot express your wishes.

Authorize someone you trust to manage your property when you're unable to do so. This durable power of attorney ensures your financial matters are handled appropriately.

Power of Attorney documents can cover financial and medical decisions.

Choosing a reliable agent is crucial for effective representation.

Documents may require notarization or witnesses for validity.

Different types serve various purposes based on individual needs.

Power of Attorney can be revoked at any time by the principal.

Begin quickly with these straightforward steps.

Not necessarily; a trust serves different purposes and can provide additional benefits.

If you do not establish a Power of Attorney, decisions may default to the court.

Review your plan regularly, especially after major life events, to ensure it reflects your wishes.

Beneficiary designations can override provisions in your will or trust, so they should be coordinated.

Yes, you may appoint separate agents for financial and healthcare decisions.