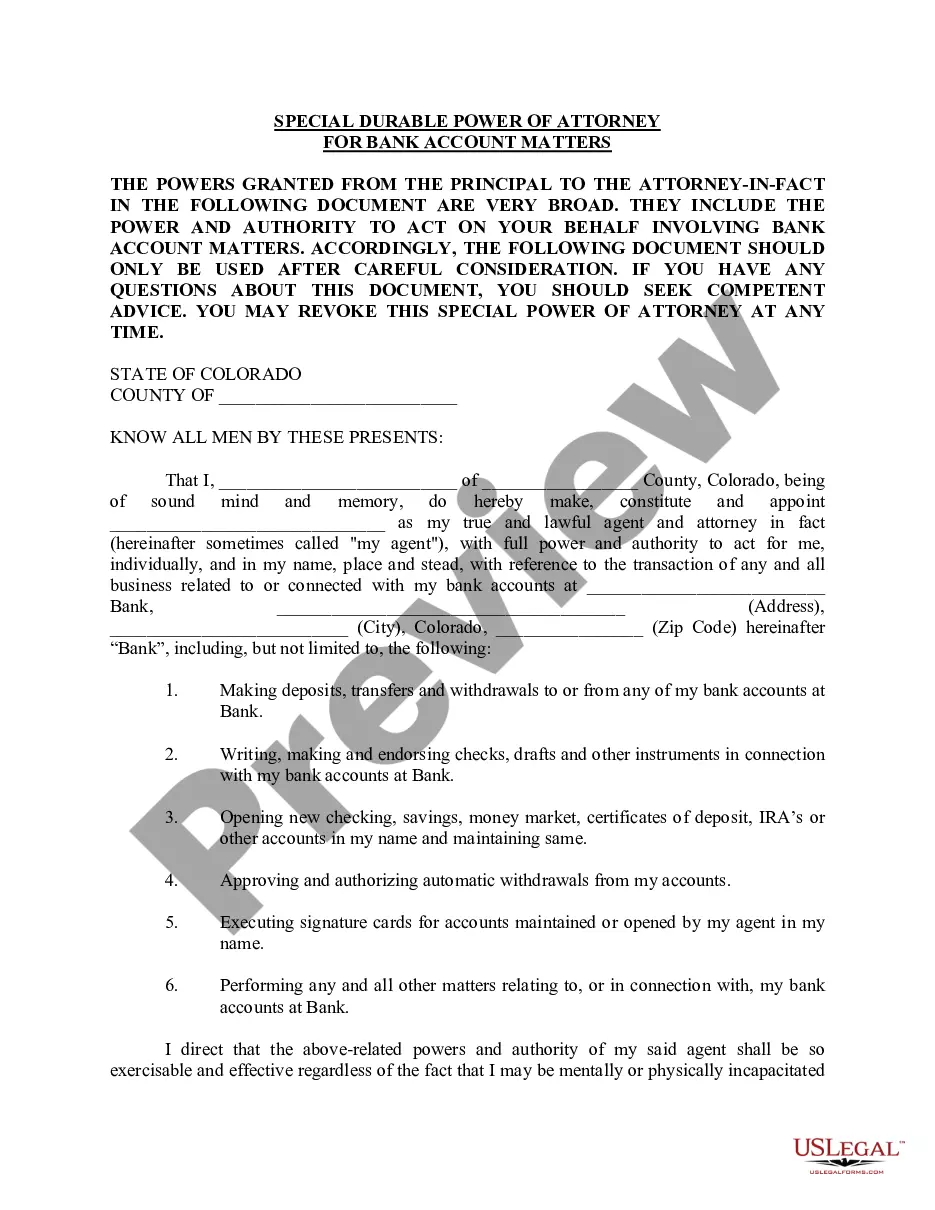

Colorado Special Durable Power of Attorney for Bank Account Matters

Description

Key Concepts & Definitions

Special Durable Power of Attorney for Bank Account - This is a legal document that grants a designated person or 'agent' the authority to handle specific banking matters on behalf of the 'principal'. The 'durable' aspect indicates that the power remains effective even if the principal becomes incapacitated.

Step-by-Step Guide

- Choose an Agent: Select a trusted person who will act as your agent. This should be someone reliable and with some understanding of financial matters.

- Draft the Document: Either consult with a lawyer to draft a special durable power of attorney or use a legally approved template specific to your state.

- Define Powers: Specifically state which banking activities the agent is allowed to handle. This can include withdrawing money, writing checks, or managing bank accounts.

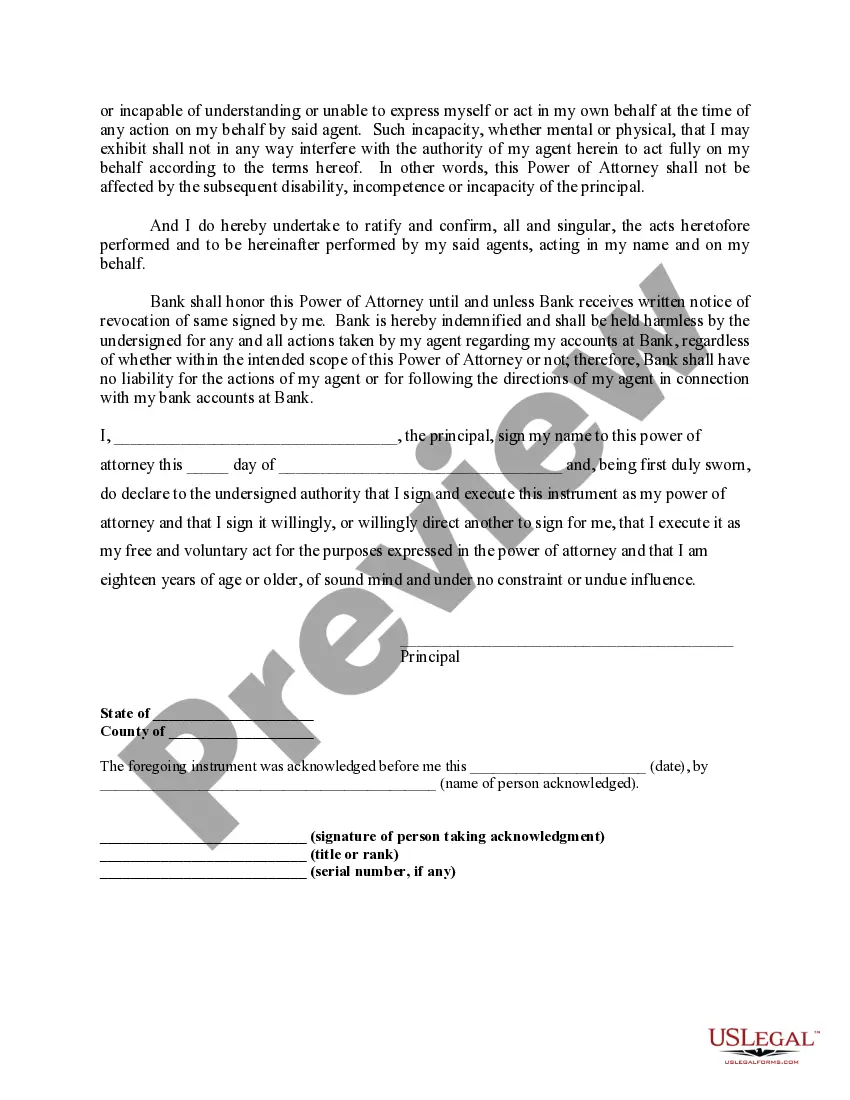

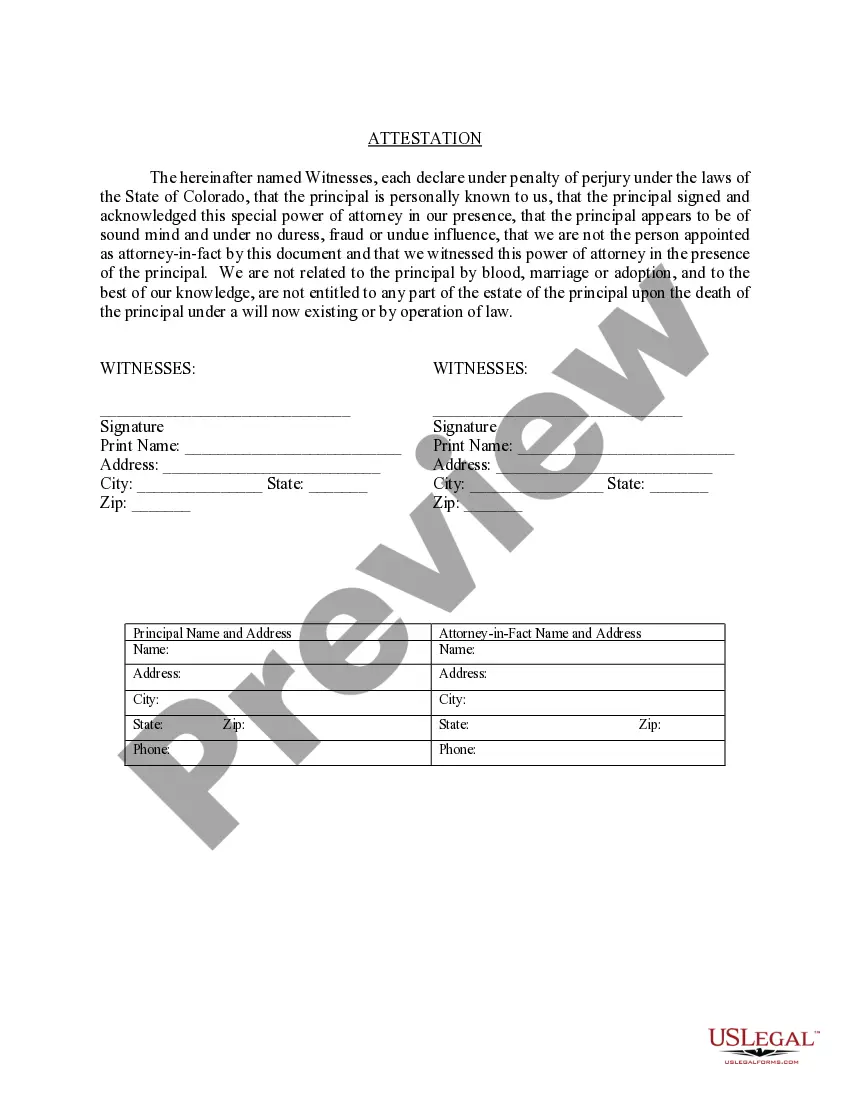

- Sign and Notarize: Sign the document in front of a notary to make it legally binding.

- Inform the Bank: Provide the bank with a copy of the notarized document so they recognize the authority of your agent.

Risk Analysis

- Financial Mismanagement: The agent might mismanage the bank account either unintentionally due to lack of expertise or intentionally, which can lead to financial losses.

- Legal Challenges: If not drafted properly, the power of attorney might be disputed or not recognized by the bank or other entities.

- Revocation Issues: If the principal wants to revoke the power, it must be done formally and all relevant parties must be informed to avoid further use of the granted powers.

Pros & Cons

- Pros:

- Allows financial management continuity in case the principal cannot manage their own affairs.

- Can be limited to specific functions, thereby reducing risks.

- Cons:

- Potential for abuse if the agent is not meticulously chosen.

- Legal fees involved in drafting and notarizing the document.

Key Takeaways

Important Points: Always choose a trustworthy agent, clearly define the powers granted, and ensure the document complies with state laws to avoid potential legal issues.

How to fill out Colorado Special Durable Power Of Attorney For Bank Account Matters?

The higher volume of paperwork you need to generate - the more anxious you become.

You can find numerous templates for Colorado Special Durable Power of Attorney for Bank Account Matters online, however, you are unsure which ones to trust.

Eliminate the difficulty of locating samples by utilizing US Legal Forms. Obtain precisely drafted documents that comply with state requirements.

Enter the required information to set up your account and complete your order with PayPal or a credit card. Choose a suitable document format and download your copy. You can find all files you download in the My documents section. Simply access it to prepare a new version of the Colorado Special Durable Power of Attorney for Bank Account Matters. Even when utilizing professionally prepared templates, it is still important to consider consulting your local attorney to verify that your completed form is accurate. Achieve more for less with US Legal Forms!

- If you possess a subscription to US Legal Forms, Log In to your account, and you will see the Download option on the webpage for the Colorado Special Durable Power of Attorney for Bank Account Matters.

- If this is your first time using our website, follow the registration steps provided below.

- Ensure that the Colorado Special Durable Power of Attorney for Bank Account Matters is valid in your state.

- Verify your choice by reviewing the description or using the Preview feature if available for the chosen file.

- Click Buy Now to initiate the registration process and select a payment plan that meets your requirements.

Form popularity

FAQ

A Power of Attorney works with bank accounts by granting your agent the ability to make financial decisions on your behalf. This includes accessing accounts, making deposits and withdrawals, and managing transactions. A Colorado Special Durable Power of Attorney for Bank Account Matters ensures that these powers are clearly defined, allowing your agent to act confidently and efficiently in managing your finances.

While a durable power of attorney offers significant benefits, there can be disadvantages as well. One major concern is the potential for misuse if the agent acts dishonestly. Additionally, some individuals may feel uncomfortable giving such authority to another person. Using a Colorado Special Durable Power of Attorney for Bank Account Matters gives you the power to specify your agent's responsibilities, providing a clearer framework.

The choice between a Power of Attorney and a joint bank account depends on your individual needs. A POA allows you to designate specific powers while keeping your account separate, which can protect your assets. On the other hand, a joint account gives full access to both parties. Using a Colorado Special Durable Power of Attorney for Bank Account Matters can help manage finances without the complexities that come with joint accounts.

Yes, a durable power of attorney can cover bank accounts, allowing your designated agent to manage banking matters on your behalf. This type of POA remains effective even if you become incapacitated, providing peace of mind. A Colorado Special Durable Power of Attorney for Bank Account Matters clearly specifies these financial powers, ensuring your agent can effectively handle your transactions.

A legal power of attorney cannot make decisions about a person's own health care, alter a will, or make decisions regarding parental rights for minor children. These limitations emphasize the importance of having separate legal documents for specific needs. Understanding the scope of a Colorado Special Durable Power of Attorney for Bank Account Matters ensures that you can manage finances without overstepping legal boundaries.

Banks often have strict requirements for accepting a Power of Attorney (POA) to protect themselves from fraud and liability. They want to ensure that the document is legally valid and clearly outlines the authority granted. A Colorado Special Durable Power of Attorney for Bank Account Matters can help clarify the scope of authority, which may ease some concerns for financial institutions.

A power of attorney grants authority to manage financial and legal matters on someone's behalf. This includes handling bank accounts, paying bills, and making investment decisions. By using a Colorado Special Durable Power of Attorney for Bank Account Matters, you can designate specific financial responsibilities to ensure your interests are handled effectively and efficiently.

Some decisions are beyond the authority of a power of attorney. For instance, you cannot make personal medical decisions if you haven’t been explicitly given that power, nor can you alter the principal's will or make decisions that violate their wishes. Understanding these limitations is crucial when preparing a Colorado Special Durable Power of Attorney for Bank Account Matters, to ensure you operate within the legal framework.

Being a power of attorney comes with responsibilities that can be daunting. You uphold the trust placed in you by managing someone else's finances, which can lead to emotional and ethical pressures. Additionally, you can be held liable for decisions that negatively impact the individual's financial status, highlighting the importance of understanding the scope of a Colorado Special Durable Power of Attorney for Bank Account Matters.

A general Power of Attorney (POA) allows you to appoint someone to make decisions on your behalf in many areas, while a financial Power of Attorney specifically focuses on financial matters. If you need authority over bank account decisions, a Colorado Special Durable Power of Attorney for Bank Account Matters is essential. This form empowers your agent to manage only your financial interests, ensuring that your specific needs are met.