Pr Deed Colorado Withholding

Description

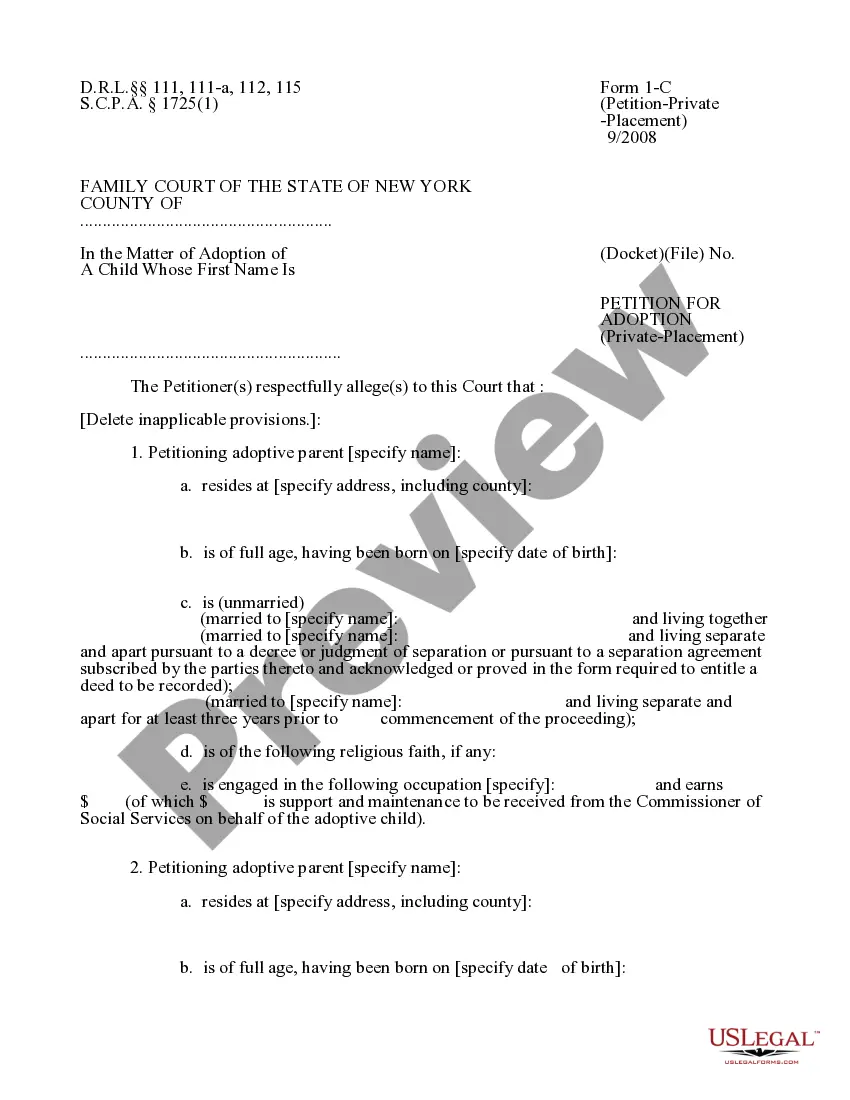

How to fill out Colorado Deed Of Distribution - Personal Representative To Two Individuals?

Legal administration can be perplexing, even for the most seasoned professionals.

When you seek a Pr Deed Colorado Withholding and don't have the opportunity to invest time searching for the correct and current version, the process can become taxing.

Gain access to a valuable repository of articles, guides, handbooks, and materials relevant to your situation and needs.

Conserve time and effort searching for the forms you require, while taking advantage of US Legal Forms’ sophisticated search and Preview feature to find Pr Deed Colorado Withholding and obtain it.

Leverage the US Legal Forms online catalogue, backed by 25 years of expertise and reliability. Streamline your routine document management into a seamless and user-friendly process today.

- If you hold a monthly subscription, Log In to your US Legal Forms account, search for the document, and acquire it.

- Check your My documents section to review the documents you've previously downloaded as well as to manage your files as needed.

- If this is your first experience with US Legal Forms, create a free account and gain unlimited access to all the platform's features.

- Here are the steps to follow after obtaining the document you need.

- Confirm this is the correct form by previewing it and reviewing its details.

- Ensure that the template is validated in your state or county.

- Utilize state- or region-specific legal and business documents.

- US Legal Forms meets all your needs, ranging from personal to corporate paperwork, all in one location.

- Employ cutting-edge tools to complete and manage your Pr Deed Colorado Withholding.

Form popularity

FAQ

The amount withheld will be the lesser of two percent of the sales price of the interest in the property or the net proceeds that would otherwise be due to the seller as shown on the closing settlement statement.

How to fill out a W-4: step by step Step 1: Enter your personal information. ... Step 2: Account for all jobs you and your spouse have. ... Step 3: Claim your children and other dependents. ... Step 4: Make other adjustments. ... Step 5: Sign and date your form.

You are not required to complete form DR 0004. For most taxpayers, completing the Colorado Employee Withholding Certificate (DR 0004(opens in new window)) may increase your take-home pay, reduce your Colorado withholding, and reduce your refund when you file your Colorado income tax return.

Colorado 2% Withholding (DR 1083) In general, sales of Colorado real property valued at more than $100,000 and made by non-residents of Colorado, are subject to a withholding tax in anticipation of any Colorado income tax that could be due on the gain of the sale.