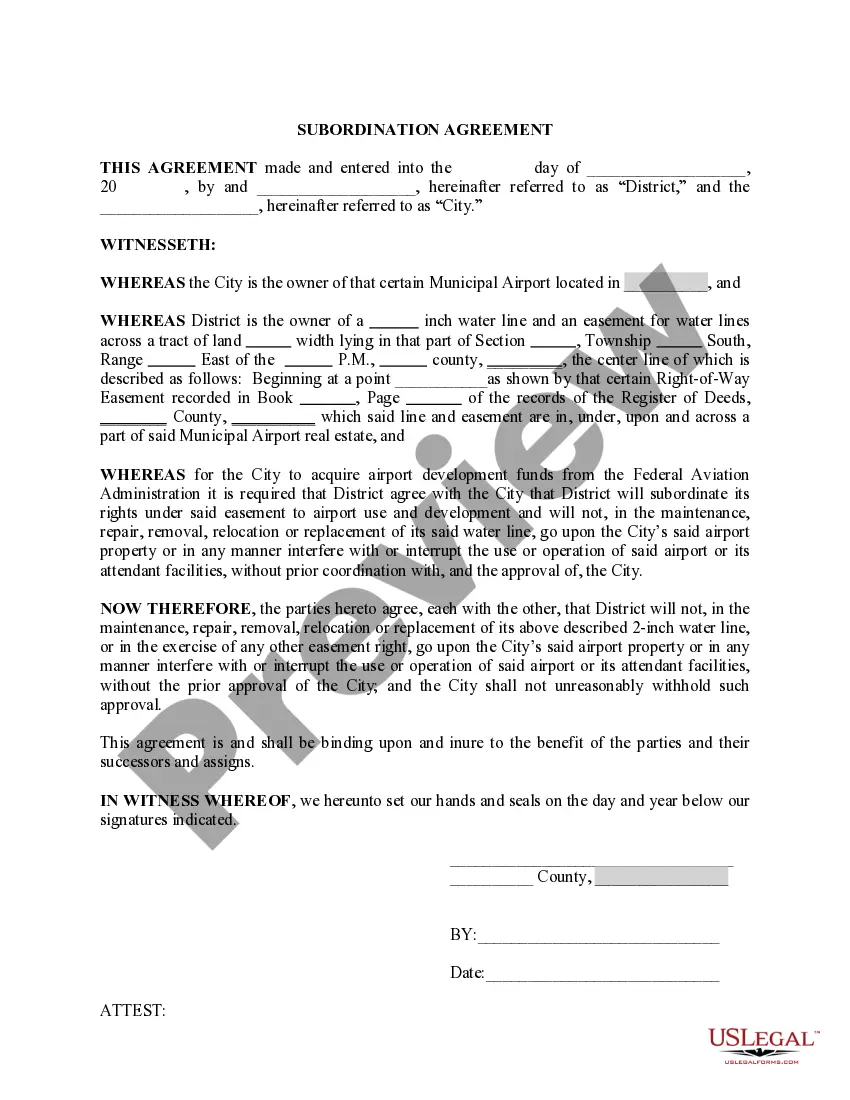

Ca Estate Planning Document With Example

Description

How to fill out California Estate Planning Questionnaire And Worksheets?

Obtaining legal document samples that meet the federal and local regulations is crucial, and the internet offers numerous options to choose from. But what’s the point in wasting time looking for the correctly drafted Ca Estate Planning Document With Example sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the greatest online legal library with over 85,000 fillable templates drafted by attorneys for any professional and personal case. They are easy to browse with all papers grouped by state and purpose of use. Our professionals stay up with legislative changes, so you can always be sure your form is up to date and compliant when obtaining a Ca Estate Planning Document With Example from our website.

Obtaining a Ca Estate Planning Document With Example is easy and quick for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you need in the preferred format. If you are new to our website, adhere to the guidelines below:

- Examine the template using the Preview option or through the text outline to make certain it meets your needs.

- Browse for a different sample using the search function at the top of the page if necessary.

- Click Buy Now when you’ve found the right form and choose a subscription plan.

- Create an account or sign in and make a payment with PayPal or a credit card.

- Select the best format for your Ca Estate Planning Document With Example and download it.

All documents you find through US Legal Forms are reusable. To re-download and complete previously saved forms, open the My Forms tab in your profile. Take advantage of the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

You may wish to open an estate bank account to manage the estate's assets or to pay expenses that may be incurred in the administration of the estate. You can use the estate bank account to deposit the proceeds from the sale of the deceased's property or pay expenses such as income tax or municipal property taxes.

One way to avoid probate is to set up joint tenancy with right of survivorship on property and bank accounts. This means that when one owner dies, their share automatically passes to the surviving owner.

The many components include a will, tax planning, life insurance, funeral preparation, charitable giving, beneficiary designation, and arrangements for minors. It can also involve arranging for end-of-life care and the possibility of incapacitation through the use of a power of attorney document.

Below are three key issues advisors and financial planners should keep in mind for their affected clients. Dying without a will or power of attorney. ... Division of property. ... Beneficiary designations.

While opening an estate account might seem like a complicated, unnecessary step for an executor of an estate, it's actually the ideal vehicle for administration purposes and helps reduce an executor's liability exposure.