California Foreclosure Process

Description

How to fill out California Eviction In Foreclosure Package?

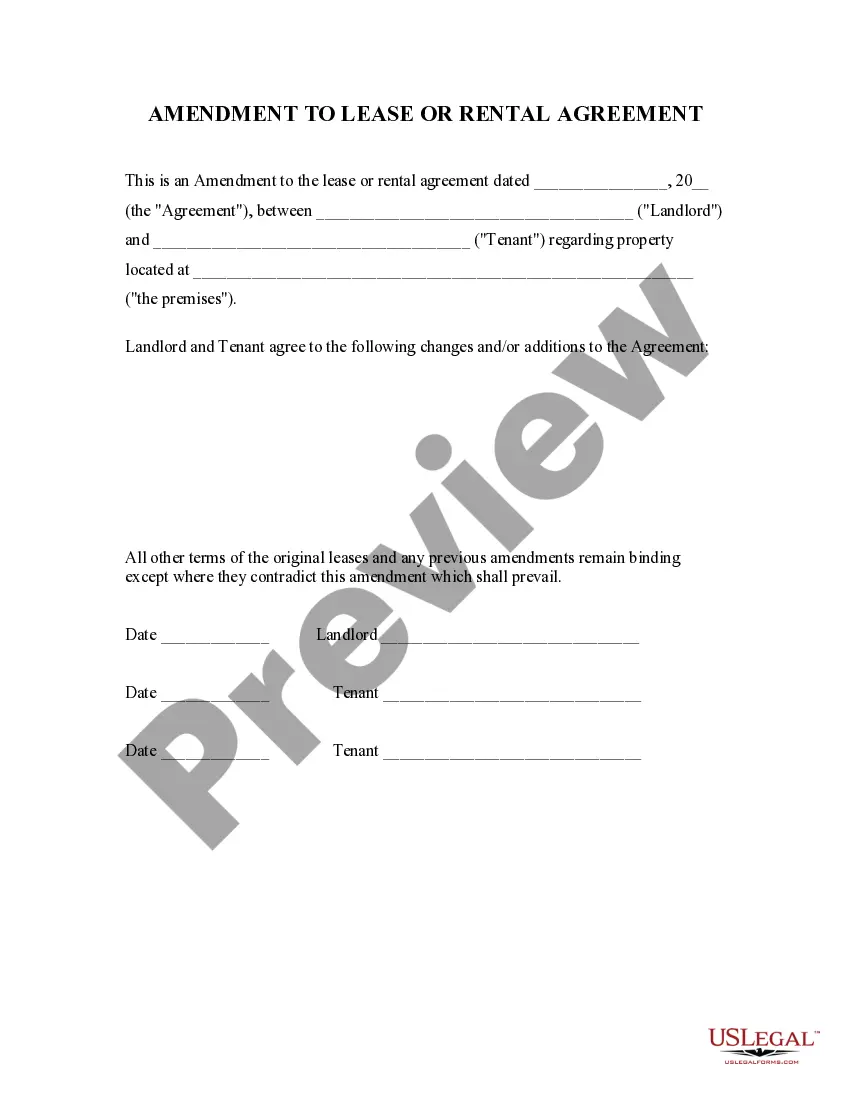

Obtaining legal document examples that comply with federal and state laws is crucial, and the web presents a multitude of choices. However, why squander time searching for the right California Foreclosure Procedure example online when the US Legal Forms digital library already compiles such templates in one location.

US Legal Forms is the most extensive online legal resource with more than 85,000 fillable templates crafted by attorneys for various business and personal situations. They are easy to navigate, with all documents categorized by state and intended use. Our experts stay current with legal changes, ensuring your form is always updated and compliant when you acquire a California Foreclosure Procedure from our site.

Acquiring a California Foreclosure Procedure is straightforward and quick for both existing and new members. If you possess an account with an active subscription, Log In and store the template you need in the desired format. If you are a newcomer to our site, follow the guidelines below.

All templates available through US Legal Forms are reusable. To re-download and complete previously saved forms, access the My documents section in your account. Experience the most extensive and user-friendly legal documentation service!

- Review the template using the Preview feature or through the text outline to ensure it meets your requirements.

- Search for another template using the search tool at the top of the page if necessary.

- Click Buy Now once you've found the appropriate document and select a subscription option.

- Create an account or Log In and complete your payment with PayPal or a credit card.

- Choose the format for your California Foreclosure Procedure and download it.

Form popularity

FAQ

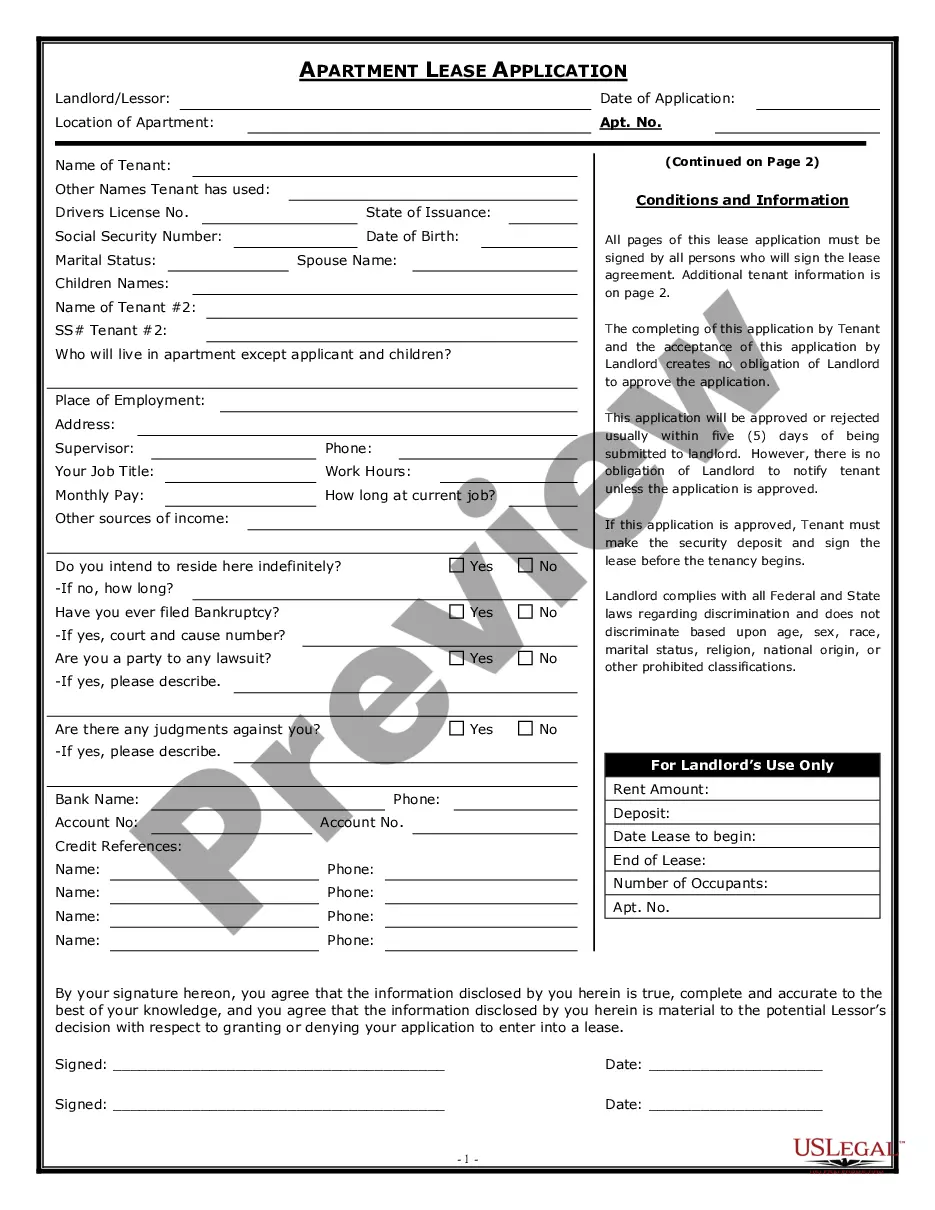

The 120-day foreclosure rule in California requires lenders to wait 120 days after a homeowner misses a payment before filing for foreclosure. This rule aims to provide borrowers ample time to take action and avoid losing their home. Knowing this timeline can empower you to seek assistance or negotiate with your lender. Utilizing services from USLegalForms can help clarify your rights during the California foreclosure process.

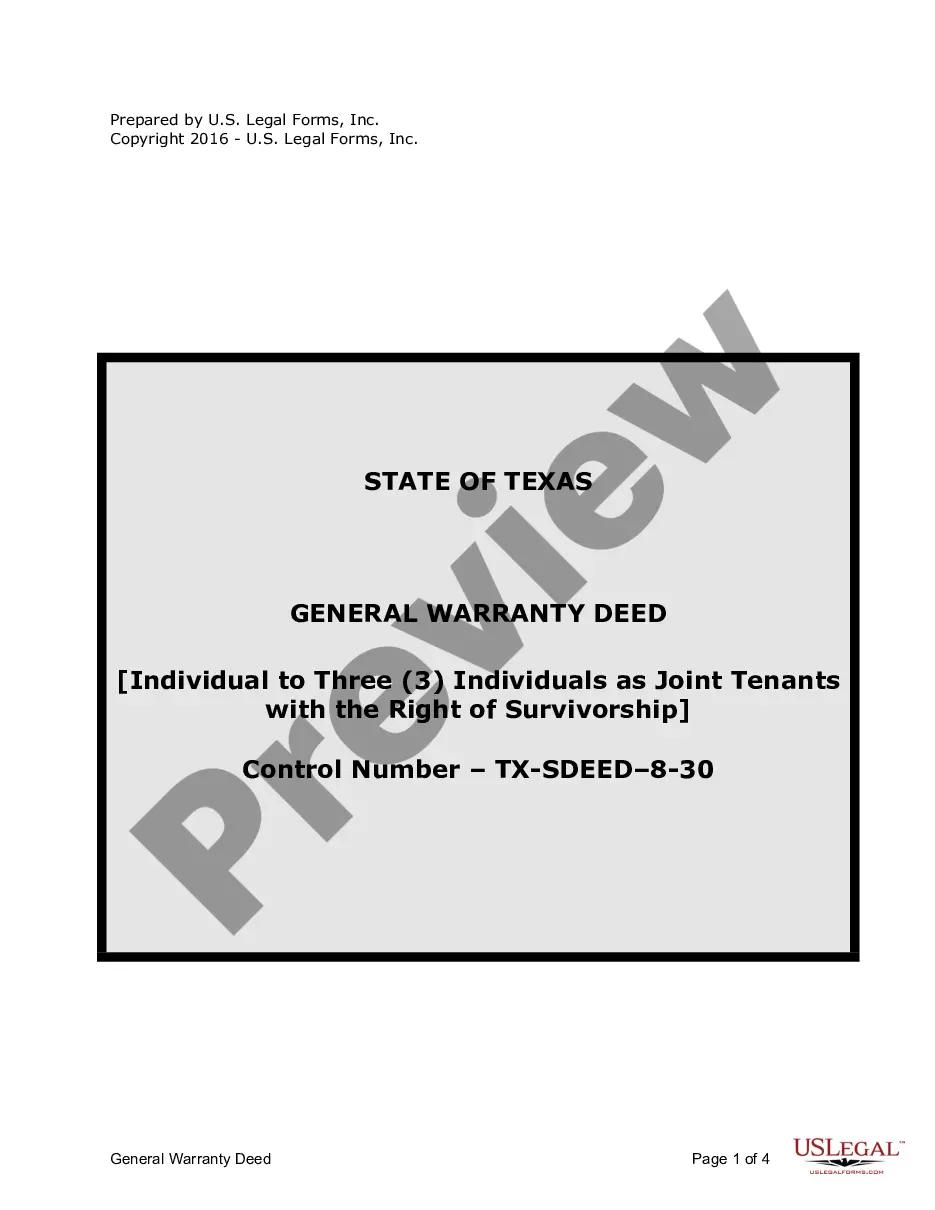

Under California laws, lenders can pursue a foreclosure case through the courts, but they almost always use non-judicial foreclosure instead. The non-judicial process can be completed in approximately 120 days (4 months). However, the timeline can sometimes be 200 days or more.

Judicial foreclosures are rare and occur only when a lender initiates a lawsuit against the borrower. The more common type of foreclosure in California is non-judicial. A non-judicial foreclosure is initiated by the lender when the borrower is in default.

The California foreclosure process can last up to 200 days or longer. Day 1 is when a payment is missed; your loan is officially in default around day 90. After 180 days, you'll receive a notice of trustee sale. About 20 days later, your bank can then set the auction.

AB 2170: Prioritizing Eligible Bidders and Ensuring Transparency AB 2170 introduced a significant shift in the foreclosure process for Institutions and investors. It mandates that Institutions prioritize ?Eligible Bidders? during the initial 30-day window after listing a real estate-owned (REO) property for sale.

California changed its law at the beginning of the 2023 to require that certain sellers of foreclosed properties containing one to four residential units only accept offers from eligible bidders during the first 30 days after a property is listed.