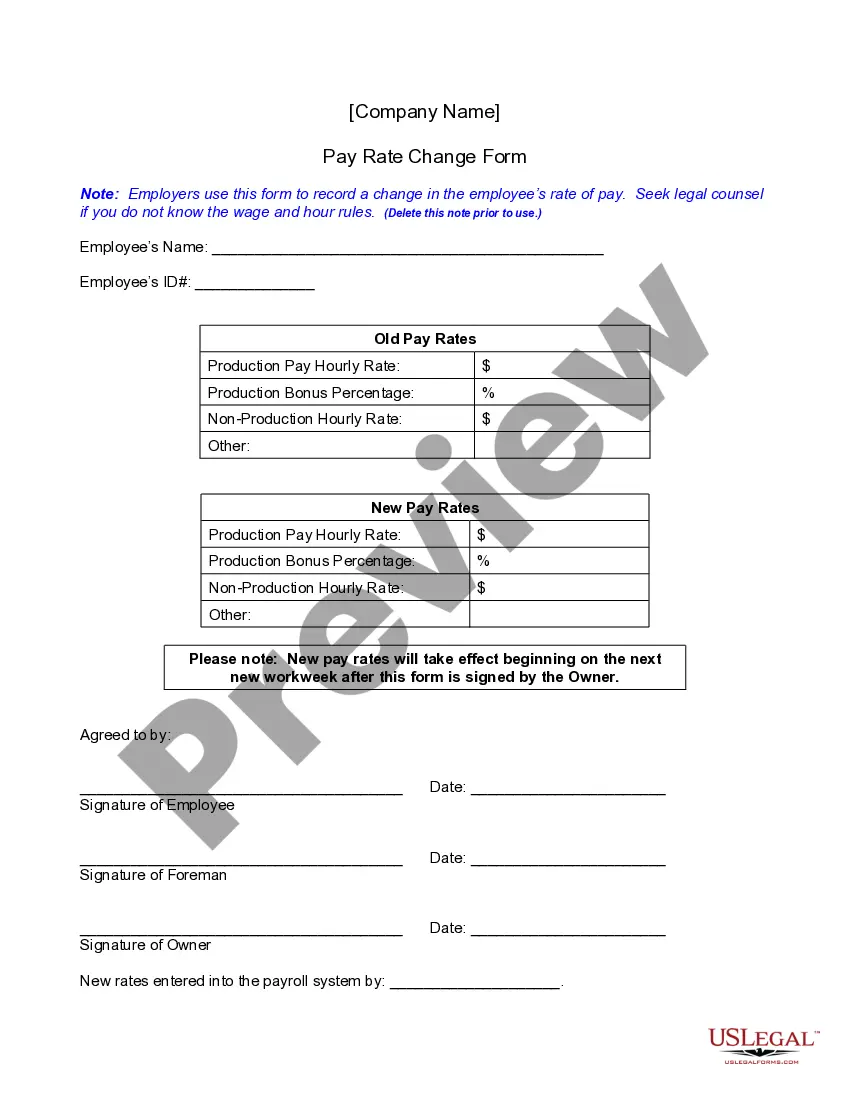

Pay Rate Change Form With Tax

Description

How to fill out California Pay Rate Change Form?

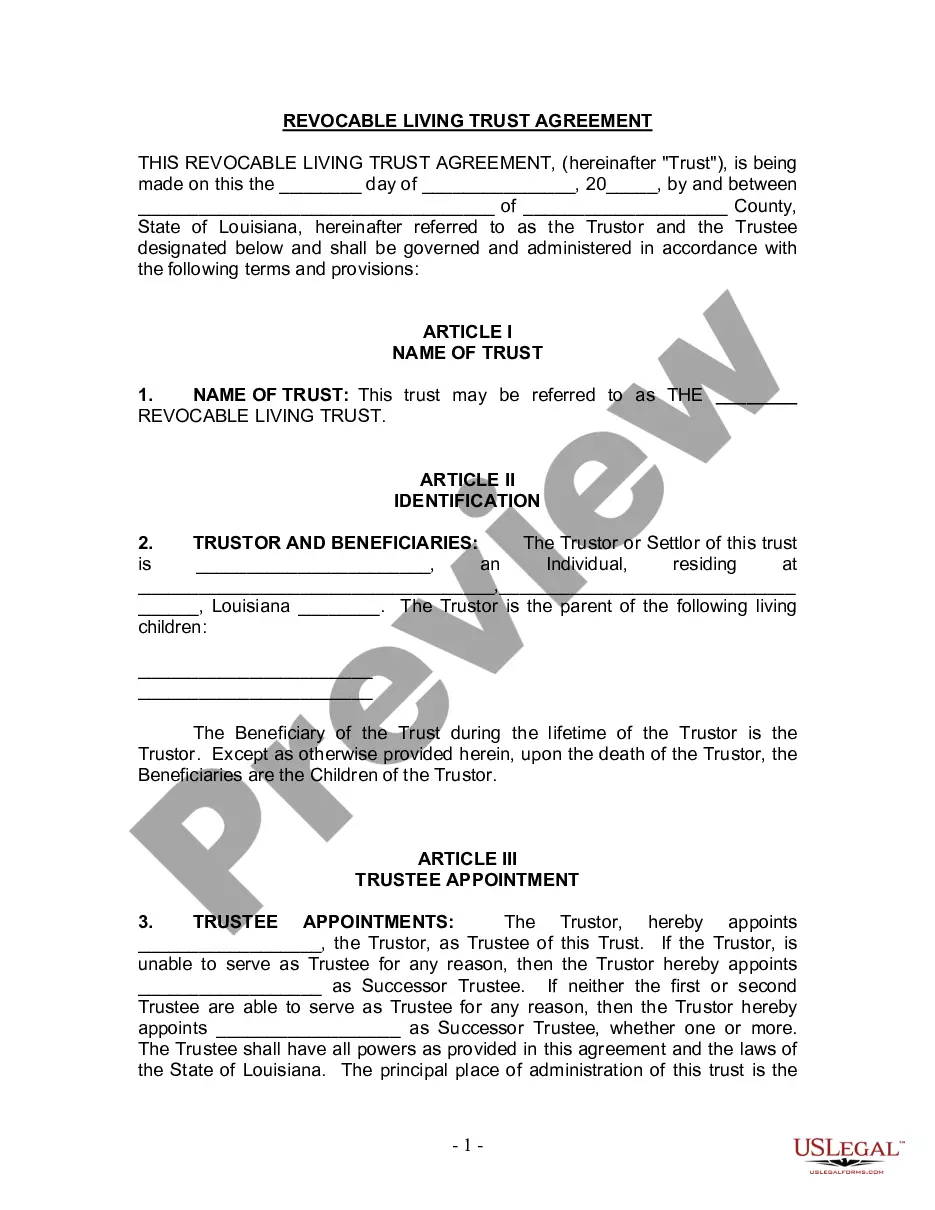

Legal document managing might be overwhelming, even for experienced experts. When you are looking for a Pay Rate Change Form With Tax and do not get the time to spend searching for the right and updated version, the processes might be demanding. A robust web form catalogue could be a gamechanger for anybody who wants to deal with these situations successfully. US Legal Forms is a industry leader in web legal forms, with more than 85,000 state-specific legal forms available anytime.

With US Legal Forms, you are able to:

- Gain access to state- or county-specific legal and business forms. US Legal Forms handles any demands you could have, from individual to business documents, all-in-one place.

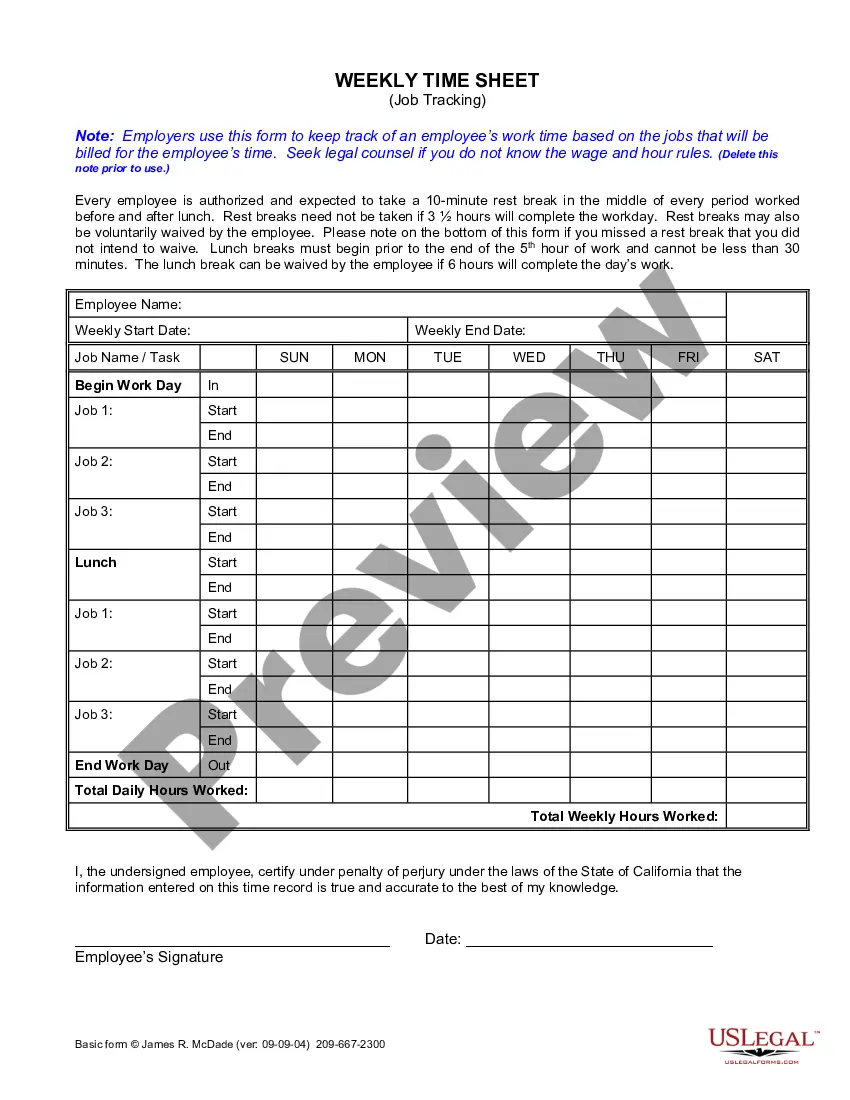

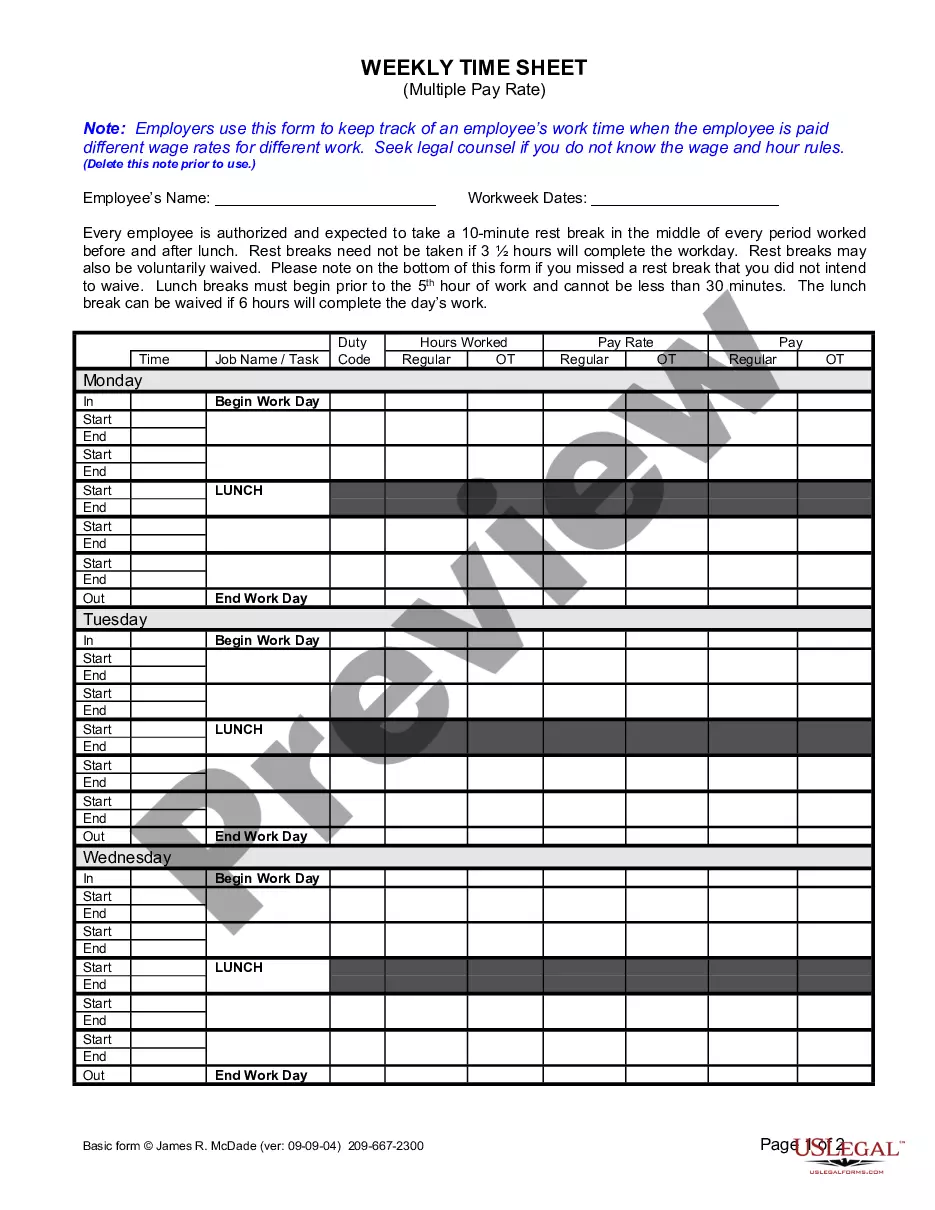

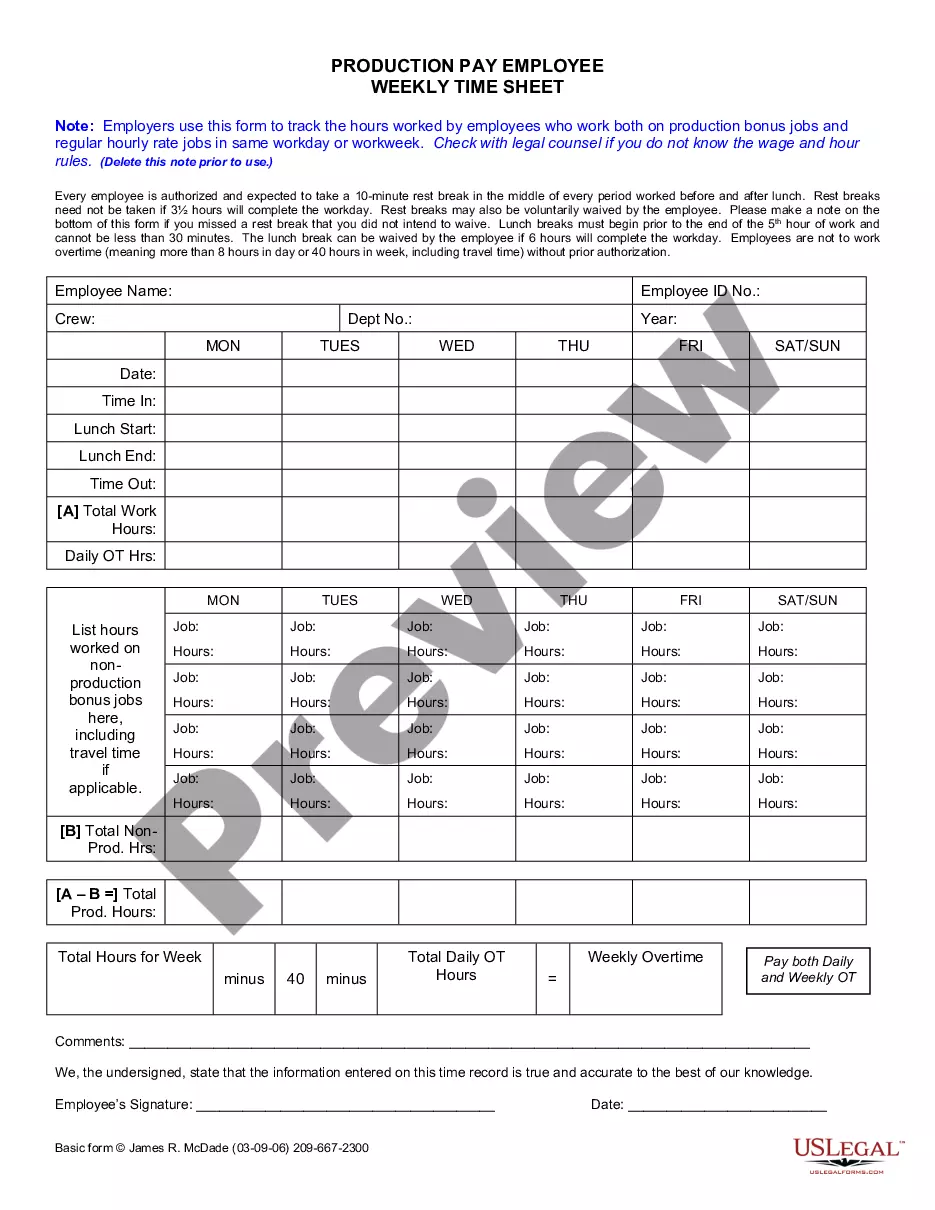

- Employ advanced resources to accomplish and control your Pay Rate Change Form With Tax

- Gain access to a resource base of articles, instructions and handbooks and materials related to your situation and needs

Save time and effort searching for the documents you will need, and use US Legal Forms’ advanced search and Preview tool to find Pay Rate Change Form With Tax and acquire it. For those who have a subscription, log in to your US Legal Forms account, look for the form, and acquire it. Take a look at My Forms tab to see the documents you previously downloaded and also to control your folders as you see fit.

If it is your first time with US Legal Forms, register an account and obtain limitless usage of all benefits of the library. Listed below are the steps for taking after accessing the form you need:

- Verify it is the proper form by previewing it and reading through its description.

- Ensure that the sample is acknowledged in your state or county.

- Select Buy Now when you are ready.

- Choose a subscription plan.

- Find the format you need, and Download, complete, sign, print out and deliver your document.

Enjoy the US Legal Forms web catalogue, supported with 25 years of experience and reliability. Enhance your daily document administration in to a smooth and user-friendly process today.

Form popularity

FAQ

Change Your Withholding To change your tax withholding you should: Complete a new Form W-4, Employee's Withholding Allowance Certificate, and submit it to your employer. Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer.

How to Fill Out a W-2 Tax Form? - YouTube YouTube Start of suggested clip End of suggested clip Box one shows gross wages tips. And any other compensation received by an employee. While box 2MoreBox one shows gross wages tips. And any other compensation received by an employee. While box 2 shows the total amount of federal income tax withheld from employee wages for the year.

Submit a new Form W-4 to your employer if you want to change the withholding from your regular pay. Complete Form W-4P to change the amount withheld from pension, annuity, and IRA payments. Then submit it to the organization paying you.

Claiming 1 reduces the amount of taxes that are withheld from weekly paychecks, so you get more money now with a smaller refund. Claiming 0 allowances may be a better option if you'd rather receive a larger lump sum of money in the form of your tax refund.

How to fill out Form W-2 Box A: Employee's Social Security number. ... Box B: Employer Identification Number (EIN) ... Box C: Employer's name, address, and ZIP code. ... Box D: ... Boxes E and F: Employee's name, address, and ZIP code. ... Box 1: Wages, tips, other compensation. ... Box 2: Federal income tax withheld. ... Box 3: Social Security wages.