California Revocable Trust With Two Trustees

Description

How to fill out California Revocation Of Living Trust?

Regardless of whether it's for professional reasons or personal issues, everyone must handle legal matters at some stage in their lifetime. Filling out legal documents requires meticulous attention, starting with selecting the correct form template. For example, if you choose an incorrect version of the California Revocable Trust With Two Trustees, it will be rejected upon submission. Thus, it is crucial to have a trustworthy source for legal paperwork such as US Legal Forms.

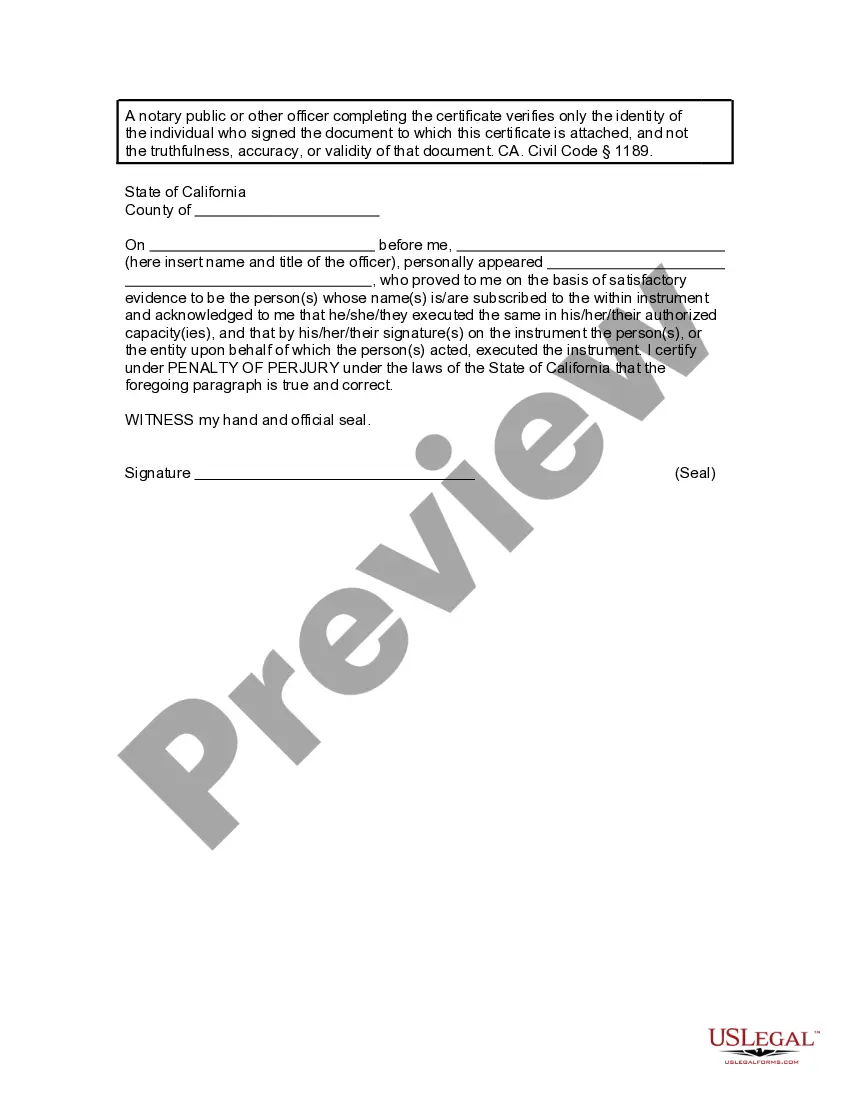

If you wish to acquire a California Revocable Trust With Two Trustees template, follow these simple instructions: Get the template you require using the search bar or catalog navigation. Review the form’s description to ensure it aligns with your situation, state, and county. Click on the form’s preview to inspect it. If it is not the correct form, return to the search feature to locate the California Revocable Trust With Two Trustees template you need. Obtain the file if it satisfies your criteria. If you already possess a US Legal Forms account, just click Log in to access previously stored documents in My documents. If you do not have an account yet, you can get the form by clicking Buy now. Choose the appropriate pricing option. Complete the profile registration form. Select your payment method: use a credit card or PayPal account. Choose the document format you desire and download the California Revocable Trust With Two Trustees. Once it is downloaded, you can fill out the form using editing software or print it and fill it out by hand. With a comprehensive US Legal Forms catalog available, you never have to waste time searching for the right template online. Take advantage of the library’s user-friendly navigation to find the right form for any circumstance.

Choose the appropriate pricing option. Complete the profile registration form. Select your payment method: use a credit card or PayPal account. Choose the document format you desire and download the California Revocable Trust With Two Trustees. Once it is downloaded, you can fill out the form using editing software or print it and fill it out by hand. With a comprehensive US Legal Forms catalog available, you never have to waste time searching for the right template online. Take advantage of the library’s user-friendly navigation to find the right form for any circumstance.

- Regardless of whether it's for professional reasons or personal issues, everyone must handle legal matters at some stage in their lifetime.

- Filling out legal documents requires meticulous attention, starting with selecting the correct form template.

- For example, if you choose an incorrect version of the California Revocable Trust With Two Trustees, it will be rejected upon submission.

- Thus, it is crucial to have a trustworthy source for legal paperwork such as US Legal Forms.

- If you wish to acquire a California Revocable Trust With Two Trustees template, follow these simple instructions.

- Get the template you require using the search bar or catalog navigation.

- Review the form’s description to ensure it aligns with your situation, state, and county.

- Click on the form’s preview to inspect it.

- If it is not the correct form, return to the search feature to locate the California Revocable Trust With Two Trustees template you need.

- Obtain the file if it satisfies your criteria.

- If you already possess a US Legal Forms account, just click Log in to access previously stored documents in My documents.

- If you do not have an account yet, you can get the form by clicking Buy now.

Form popularity

FAQ

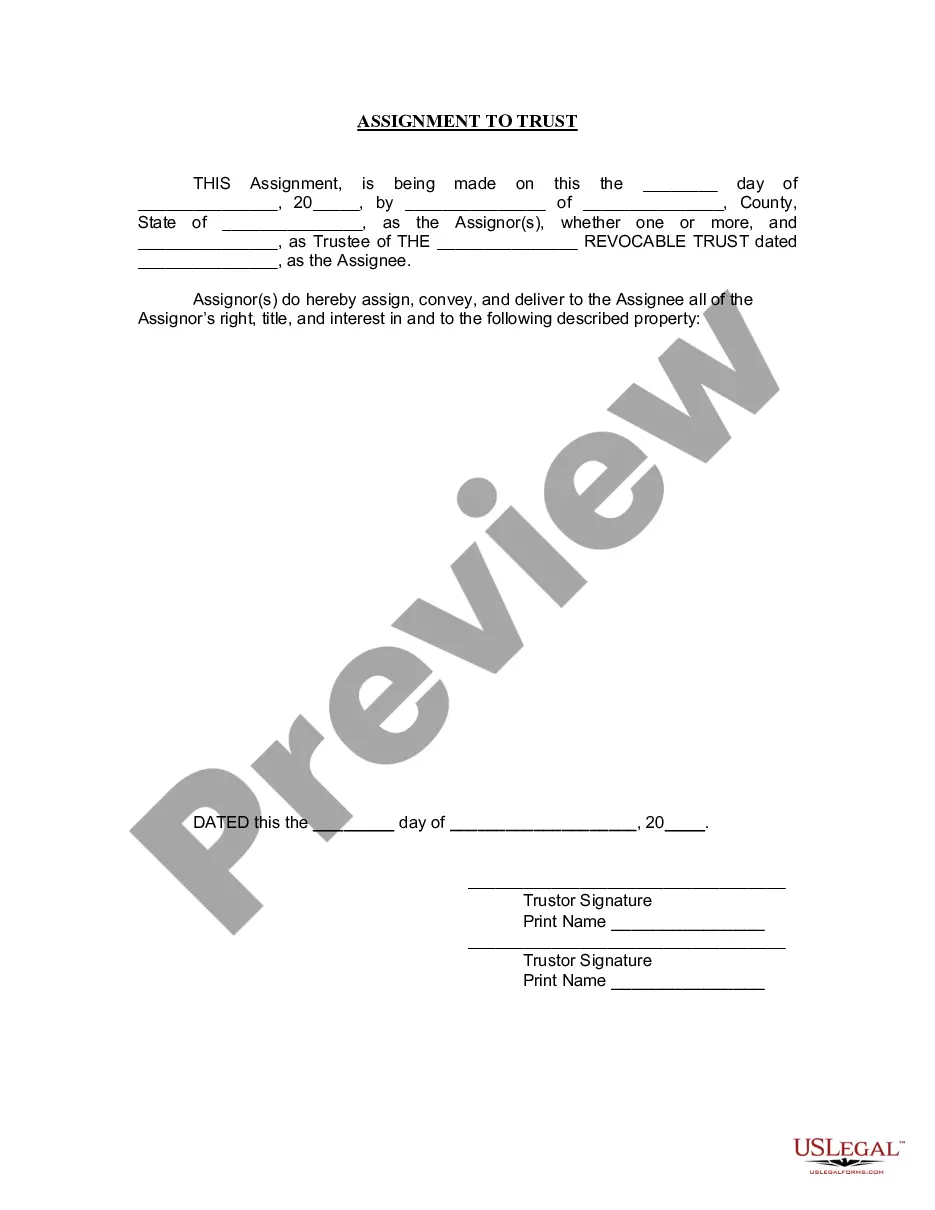

To add a co-trustee to your California revocable trust with two trustees, you will need to review the trust document for any specific provisions regarding trustee appointments. If the document allows for it, you can execute an amendment to the trust, clearly naming the new co-trustee. It's also essential to inform all current trustees and beneficiaries about this change to maintain transparency. If you need assistance, consider using US Legal Forms, which offers resources and templates to help you navigate this process smoothly.

Yes, you can have two trustees in a family trust. This setup is often beneficial as it allows family members to work together in managing the trust's assets. By establishing a California revocable trust with two trustees, you can foster collaboration and ensure that family interests are represented in decision-making.

A revocable trust can have multiple trustees, but it is common to have one or two. Having two trustees can offer greater oversight and shared responsibilities. When creating a California revocable trust with two trustees, ensure that both parties are willing to collaborate to effectively manage the trust.

In California, co-trustees generally cannot act independently unless the trust document allows for it. Decisions typically require mutual agreement to ensure that both trustees are aligned in their actions. This collaborative approach is vital in a California revocable trust with two trustees to maintain trust integrity and accountability.

A trust with co-trustees operates collaboratively, where both trustees share responsibilities and make decisions together. This arrangement can enhance the trust's management, especially in a California revocable trust with two trustees. Communication and cooperation are essential for ensuring smooth operations and fulfilling the trust's objectives.

Yes, a revocable trust can have multiple grantors. This is often the case in joint trusts created by couples. When establishing a California revocable trust with two trustees, having more than one grantor can facilitate shared control and benefits over the trust's assets.

The decision to have one or two trustees depends on your specific needs and preferences. While one trustee can act quickly and independently, two trustees in a California revocable trust can promote fairness and transparency in managing the trust. Consider your comfort with collaboration when making this choice.

Yes, a revocable trust can have two trustees. This arrangement allows both trustees to oversee the trust's management and distribution of assets. By establishing a California revocable trust with two trustees, you can enhance decision-making processes and reduce the burden on a single trustee.

Yes, a trust can have two trustees. In fact, having two trustees can provide checks and balances, ensuring that decisions are made collaboratively. This setup can be advantageous in a California revocable trust with two trustees, as it allows for shared responsibilities and diverse perspectives in managing the trust's assets.

Yes, you can have multiple trustees on a California revocable trust with two trustees. This arrangement allows both individuals to manage the trust's assets and make decisions collaboratively. Having two trustees can provide a system of checks and balances, ensuring that all decisions are made fairly and transparently. If you are considering setting up a California revocable trust with two trustees, uslegalforms can help you navigate the process smoothly.