California Deed Ca Withholding

Description

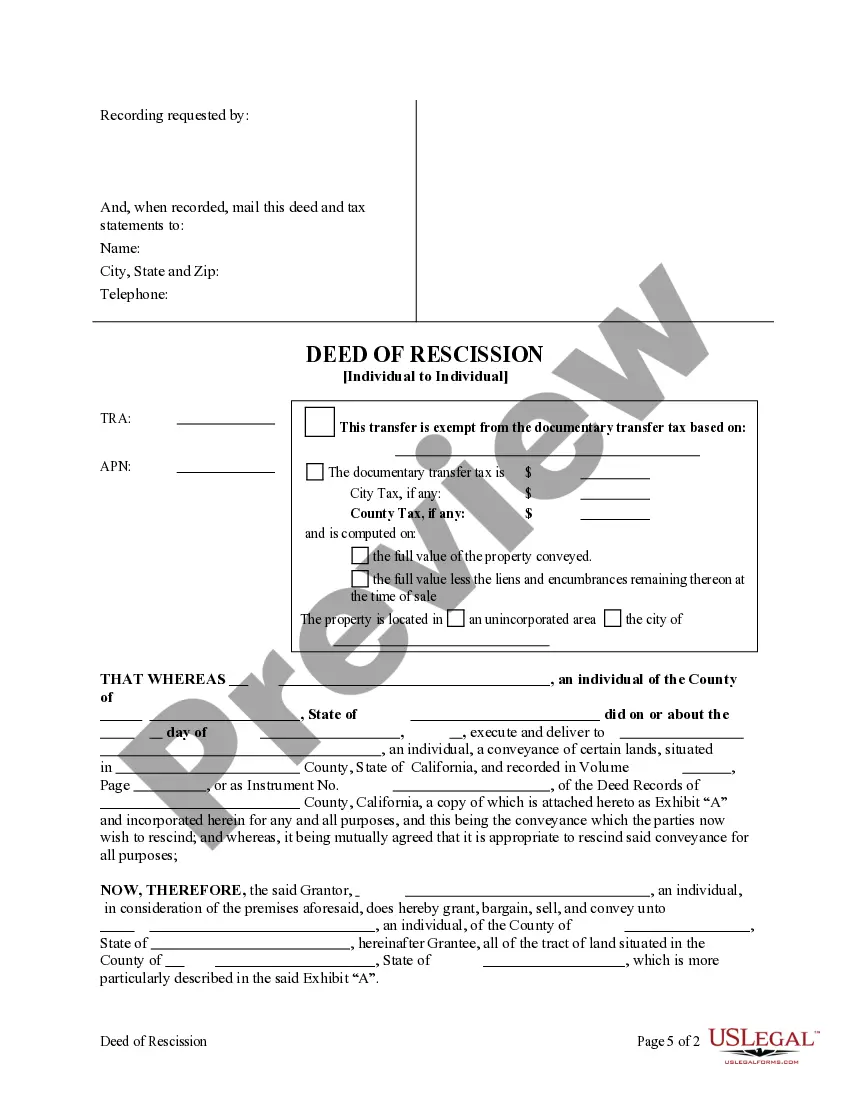

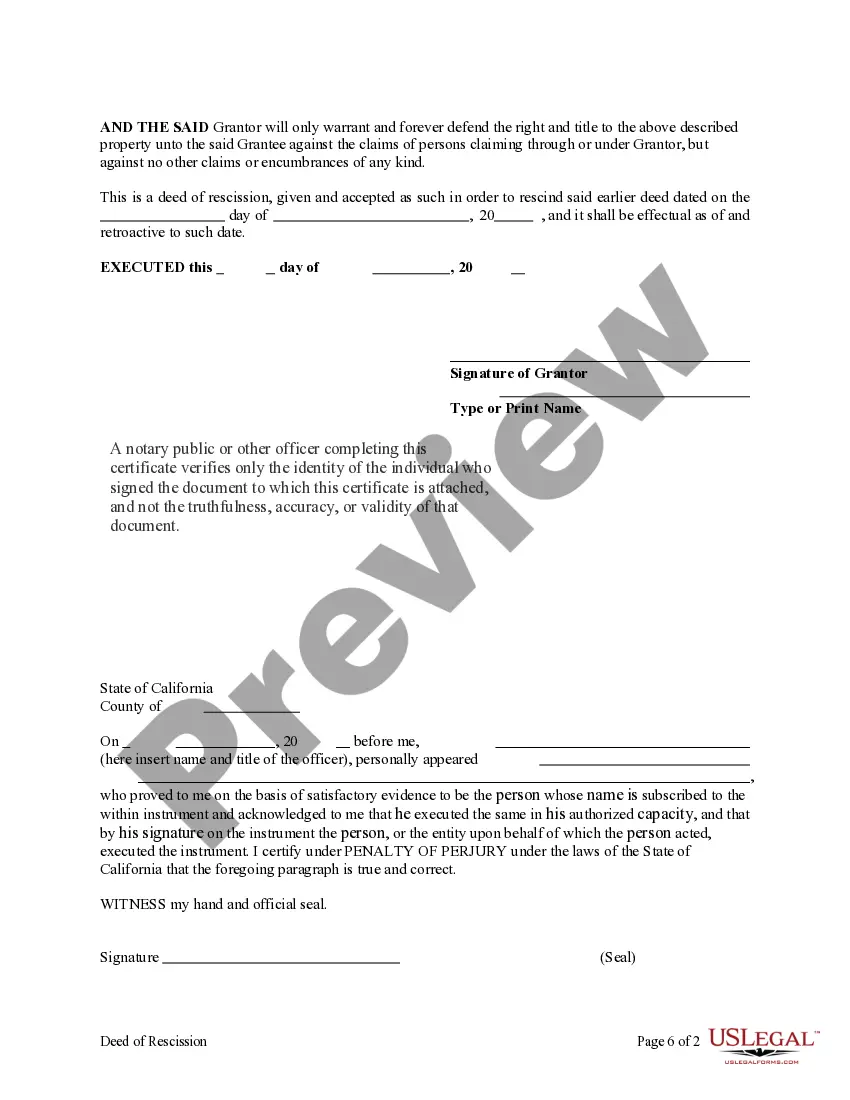

How to fill out California Deed Of Rescission - Individual To Individual?

It’s evident that you can’t transform into a legal specialist instantly, nor can you ascertain how to swiftly create California Deed Ca Withholding without a specialized background.

Drafting legal documents is a lengthy process necessitating specific education and expertise.

So why not entrust the drafting of the California Deed Ca Withholding to the experts.

You can revisit your forms from the My documents tab at any point. If you’re a current customer, you can simply Log In, and find and download the template from the same tab.

Regardless of the intent of your documents—be it for financial, legal, or personal use—our platform has you covered. Try US Legal Forms today!

- Begin by locating the form you need using the search bar at the top of the page.

- Preview it (if this option is available) and read the accompanying description to ascertain whether California Deed Ca Withholding is what you’re looking for.

- Restart your search if you require another form.

- Create a free account and select a subscription plan to purchase the template.

- Click Buy now. Once the payment is accomplished, you can obtain the California Deed Ca Withholding, complete it, print it, and send or dispatch it by mail to the necessary individuals or organizations.

Form popularity

FAQ

No, in Maine, you do not need to notarize your will to make it legal. However, Maine allows you to make your will "self-proving" and you'll need to go to a notary if you want to do that. A self-proving will speeds up probate because the court can accept the will without contacting the witnesses who signed it.

This is a significant clarification which expressly allows someone other than the principal to physically sign the document. A power of attorney must be notarized to be effective in Maine.

Power of attorney for health care. An adult or emancipated minor with capacity may execute a power of attorney for health care, which may authorize the agent to make any health care decision the principal could have made while having capacity. The power must be in writing and signed by the principal and 2 witnesses.

In order to revoke a Power of Attorney, you simply write or type a statement which includes the following: Name and date; You wish to revoke the Power of Attorney; Specify the date the original Power of Attorney was signed; Specify the person or persons named as your agent(s); and, Your signature.

A Power of Attorney (PoA) can be revoked while the principal is mentally sound. If the principal passes away, it is automatically canceled. To revoke a PoA, the principal must provide written notice to the agent, sign the document in the presence of a notary public, and deliver it to the agent.

PART I ? Power of Attorney Form 2848-ME allows you to authorize one or more representatives. Representatives must be individuals, i.e., you cannot name a firm as your representative but you can name a person or persons at the firm.

PART I ? Power of Attorney Form 2848-ME allows you to authorize one or more representatives. Representatives must be individuals, i.e., you cannot name a firm as your representative but you can name a person or persons at the firm.

Any power of attorney automatically ends at your death. A durable POA also ends if: You revoke it. As long as you are mentally competent, you can revoke your document at any time.