California Gift Deed Without Blood Relation

Description

How to fill out California Gift Deed For Individual To Individual?

Drafting legal documents from scratch can often be intimidating. Certain scenarios might involve hours of research and hundreds of dollars spent. If you’re looking for a an easier and more affordable way of creating California Gift Deed Without Blood Relation or any other forms without the need of jumping through hoops, US Legal Forms is always at your fingertips.

Our online collection of over 85,000 up-to-date legal documents addresses almost every aspect of your financial, legal, and personal matters. With just a few clicks, you can quickly get state- and county-compliant forms diligently prepared for you by our legal professionals.

Use our platform whenever you need a trusted and reliable services through which you can easily locate and download the California Gift Deed Without Blood Relation. If you’re not new to our website and have previously created an account with us, simply log in to your account, locate the template and download it away or re-download it at any time in the My Forms tab.

Don’t have an account? No problem. It takes minutes to set it up and navigate the catalog. But before jumping directly to downloading California Gift Deed Without Blood Relation, follow these recommendations:

- Review the form preview and descriptions to make sure you are on the the document you are searching for.

- Make sure the template you choose conforms with the regulations and laws of your state and county.

- Choose the right subscription option to buy the California Gift Deed Without Blood Relation.

- Download the form. Then complete, certify, and print it out.

US Legal Forms has a spotless reputation and over 25 years of expertise. Join us now and turn form completion into something simple and streamlined!

Form popularity

FAQ

It is a voluntary transfer of ownership from one individual to another without exchanging money or consideration. The transfer of ownership is immediate and irrevocable, and once the gift deed is executed, the donor cannot revoke or cancel the gift.

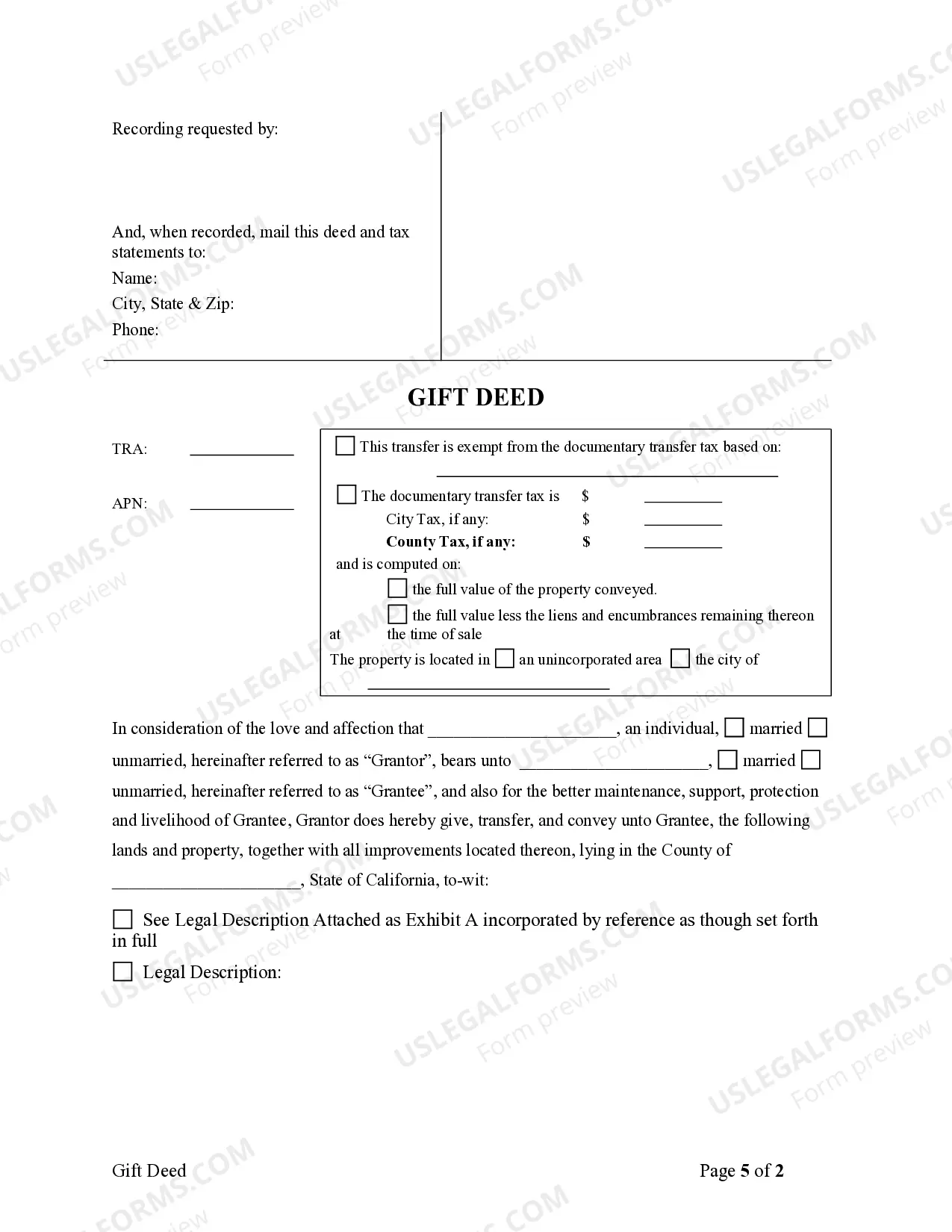

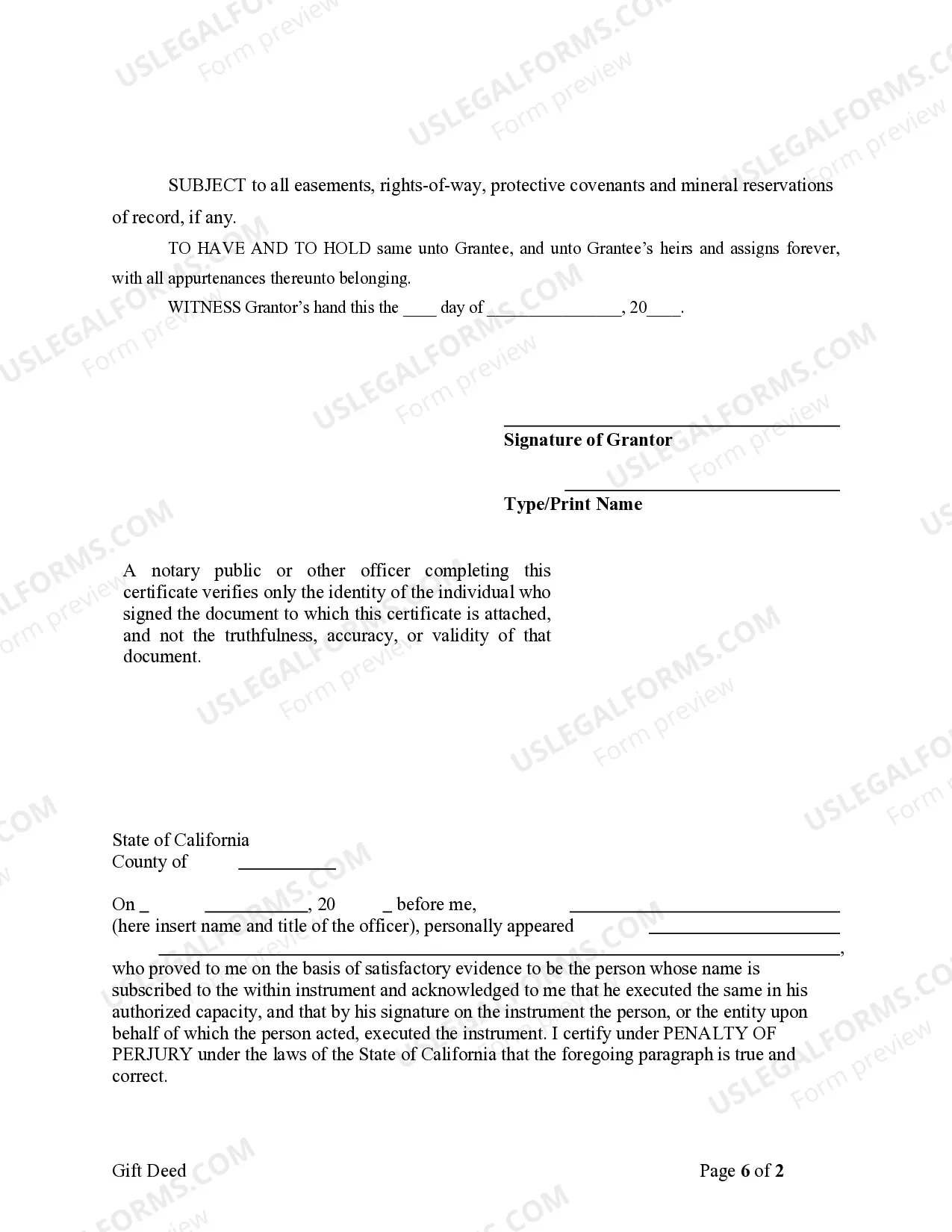

From here, the process looks like this: Choose the most appropriate deed. Prepare the deed. Complete the deed with accurate information about the property and the person being added. Sign the deed in the presence of a notary public. File the deed with the county recorder's office. Update the property records.

This is usually done using a gift deed, though the deed type may vary in different cases. Work with a real estate attorney to complete, notarize and file the deed in full compliance with the law.

A property can be gifted during the owner's lifetime, or written into an estate plan to transfer the property upon the owner's death. Title can change hands with some routine paperwork and filings with the county recorder's office.

Each grantor must sign the deed in the presence of a notary public for a valid transfer. All signatures must be original. In California, when real property is conveyed as a gift, no transfer tax is due, pursuant to Cal. R&T Code 11930.