California Gift Deed for Individual to Individual

Understanding this form

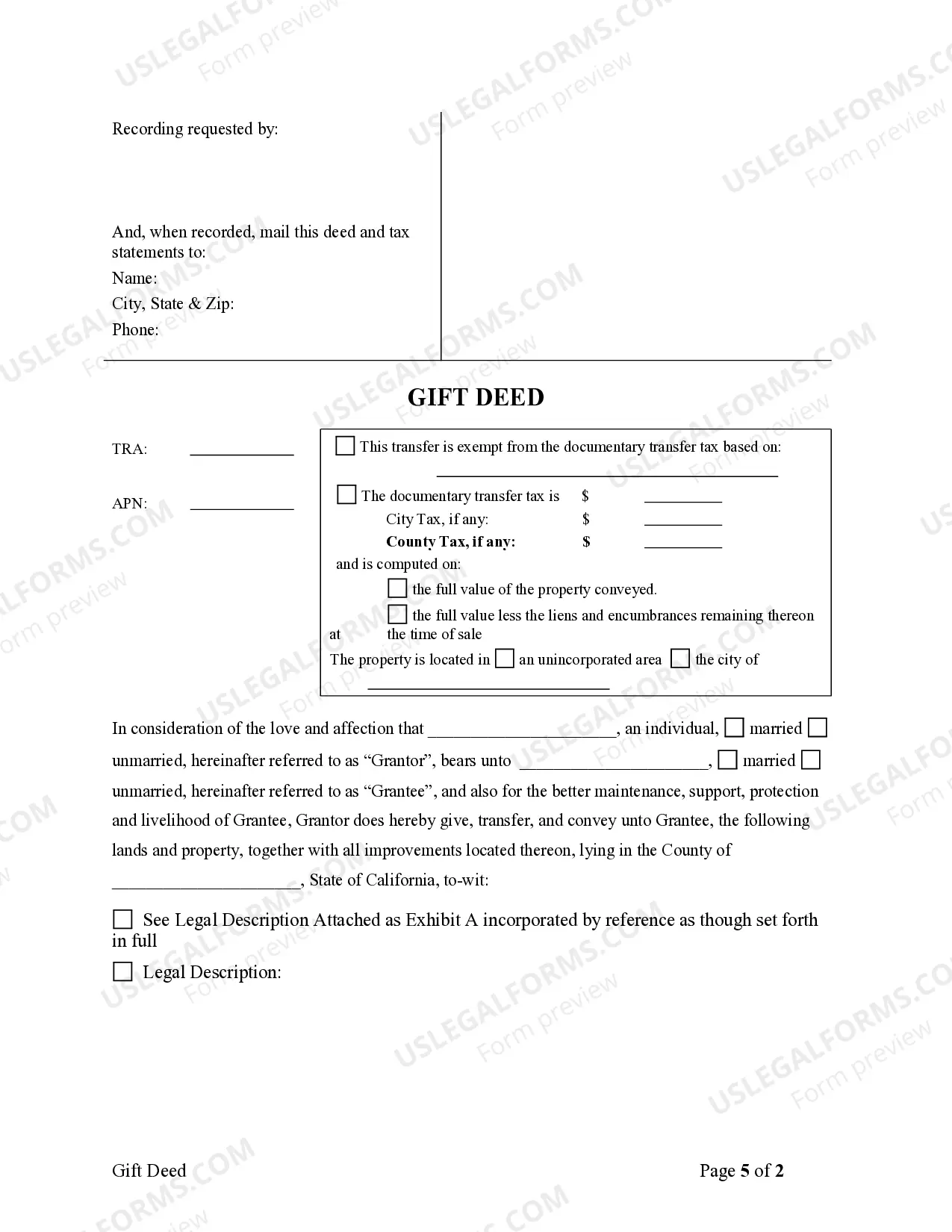

The California Gift Deed for Individual to Individual is a legal document used for transferring property from one individual to another as a gift. This form is specifically designed for property transactions in California and differs from standard sales deeds, as it indicates that no payment is received in exchange for the property. It formalizes the transfer of ownership, ensuring that the recipient receives legal title without incurring a purchase obligation.

Key parts of this document

- Grantor Information: Identify the person giving the gift.

- Grantee Information: Specify the person receiving the gift.

- Property Description: Clearly describe the property being transferred.

- Exemption Clause: Indicate if the transfer qualifies for exemption from transfer tax.

- Signatures: Include the signatures of both the grantor and a witness.

- Date of Transfer: Record the date the deed is signed.

When this form is needed

This form should be used in situations where an individual wishes to transfer ownership of real property to another individual as a gift. Common scenarios include family members transferring property to one another, such as parents gifting a home to their child, or friends giving property without any expectation of repayment. It is also useful in estate planning to facilitate the transfer of property without the need for a sale.

Who can use this document

- Individuals looking to gift real property to another person.

- Family members transferring property to relatives, such as home or land.

- Friends wanting to gift property without financial compensation.

- Those involved in estate planning who want to simplify the transfer of assets.

How to prepare this document

- Identify the grantor and grantee, including their full legal names.

- Provide a complete description of the property being gifted, including its address and parcel number.

- Specify the date on which the transfer is to take effect.

- Sign and date the form in the presence of a witness, who will also sign.

- If applicable, indicate any exemptions from transfer tax on the form.

Does this form need to be notarized?

This form does not typically require notarization unless specified by local law. However, it is advisable to have it notarized to enhance its legality and prevent potential disputes regarding the gift transfer.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to provide accurate property descriptions can lead to disputes.

- Not including full names and contact information for both parties.

- Neglecting to get the signature of a witness, which may invalidate the deed.

- Forgetting to mention any transfer tax exemptions when applicable.

- Leaving the date of transfer blank can cause confusion later.

Advantages of online completion

- Convenience of downloading and printing the form at any time.

- Editability allows customization for specific circumstances.

- Access to professionally drafted documents ensures legal reliability.

- Time-saving compared to traditional legal consultation processes.

Summary of main points

- The California Gift Deed is used to transfer property as a gift without any payment.

- Proper completion is essential to ensure the validity of the transfer.

- Understanding state-specific requirements can help avoid legal complications.

Looking for another form?

Form popularity

FAQ

To transfer property from one person to another in California, you can use a California Gift Deed for Individual to Individual. This legal document allows you to formally gift property without the need for financial compensation. First, complete the gift deed form with both parties' names and property details. Once you sign the document and have it notarized, file it with your local county recorder's office to ensure the transfer is official.

The best way to add someone to a deed in California is by utilizing a California Gift Deed for Individual to Individual, especially if you are transferring ownership as a gift. This method is straightforward and provides clear legal documentation of the change. Always consider the potential consequences of this transfer and how it aligns with your long-term plans. Engaging with a qualified attorney can help ensure that you make the best decision.

To add a person to a deed in California, you can use a California Gift Deed for Individual to Individual to formalize the transfer. First, gather all required information and ensure you have the proper legal form. After completing the deed, sign it before a notary and file it with the county's recorder office. This process legally records the change and protects your interests.

Adding someone to a deed in California using a California Gift Deed for Individual to Individual can have tax implications. This transfer may be subject to gift tax, depending on the property's value and your relationship with the recipient. Additionally, consider how this action might affect property taxes and capital gains tax in the future. It is wise to consult a tax professional to understand your specific situation.

To perform a quitclaim deed in California, you need to prepare the document and include the names of the parties involved. A California Gift Deed for Individual to Individual can simplify the transfer process if you are gifting the property. Once completed, you must sign the deed in front of a notary and file it with your county recorder’s office. This ensures that the transaction is public and legally binding.

Yes, you can add someone to your house deed in California using a California Gift Deed for Individual to Individual. This process allows you to transfer ownership rights to another individual. It is important to understand the implications of adding someone to your deed, as this could affect future sales or inheritances. Consulting with a legal professional can help clarify your options.

To leave property to a family member, the use of a California Gift Deed for Individual to Individual can be an effective solution. This deed ensures that your intent to gift the property is documented and legally recognized. It can help eliminate potential issues in the future, such as property disputes. Make sure to discuss your plans with a legal professional to safeguard your wishes.

The best way to transfer a property title between family members is often through a California Gift Deed for Individual to Individual. This deed offers a straightforward method to legally convey ownership without a sale. By using this deed, families can avoid unnecessary complications and taxes associated with selling property. Consult a legal expert to guide you through crafting the deed properly.

A quit claim deed and a gift deed serve different purposes. A quit claim deed transfers whatever interest the grantor has in the property, while a California Gift Deed for Individual to Individual specifically conveys property without any monetary exchange. The gift deed is often more formal, requiring documentation that establishes the intent to make a gift. Understanding these differences can help make informed choices during property transfers.

The most common way to transfer ownership of property is through a deed. A California Gift Deed for Individual to Individual is particularly popular among families wishing to pass down property without a financial exchange. This method provides clarity in ownership and helps to avoid disputes in the future. Ensure all necessary documentation is completed to avoid complications.