Gift Deed Form With Nota

Description

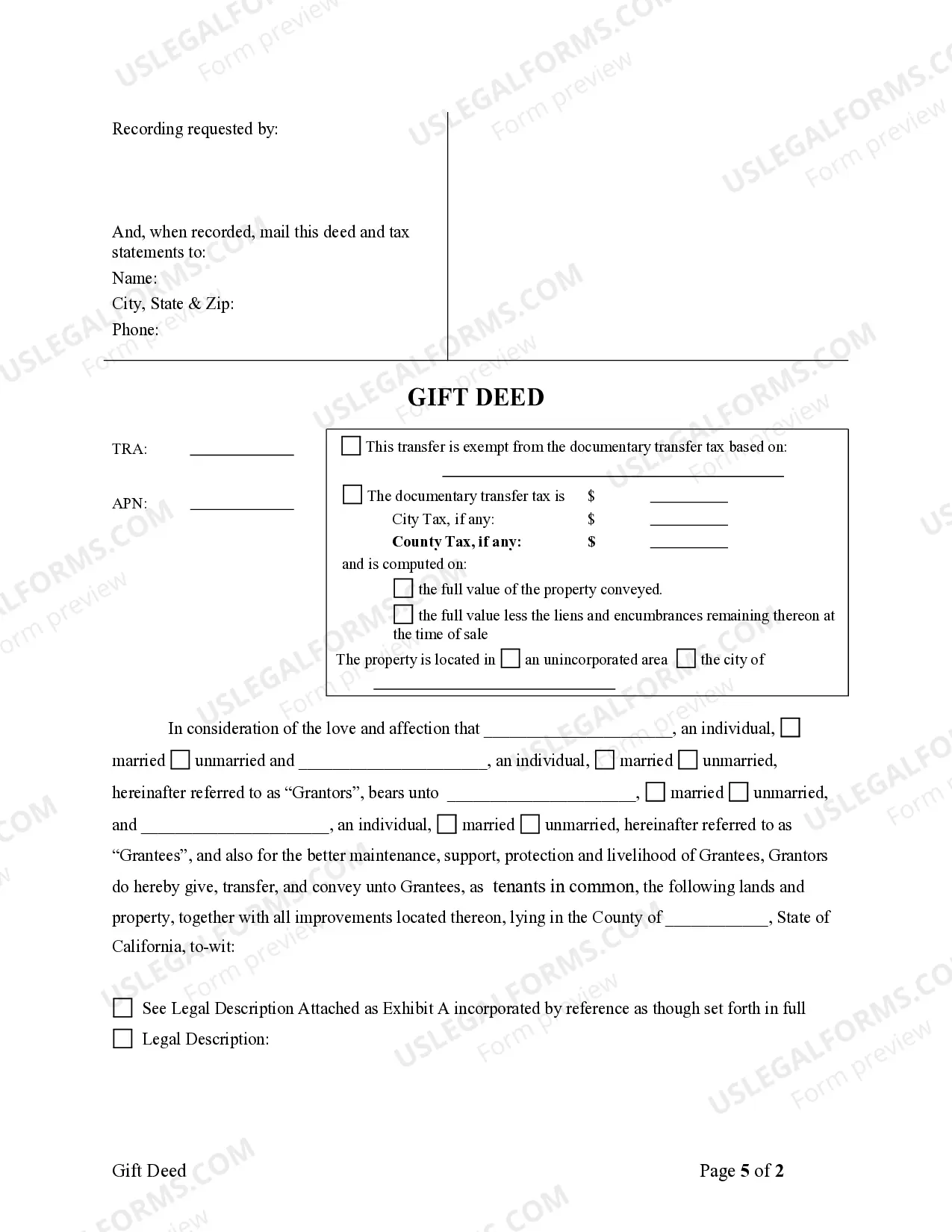

How to fill out California Gift Deed - From Two Individual Grantors To Two Individual Grantees?

- Sign in to your US Legal Forms account if you are a returning user, and download the required template by clicking the 'Download' button. Confirm that your subscription remains active.

- If you are a new user, start by browsing the form preview and description to select the correct gift deed form with nota that aligns with your locality's regulations.

- In case you need a different template, utilize the Search feature to find alternatives. Ensure that the form meets your requirements before proceeding.

- Purchase the document by clicking the 'Buy Now' button and choose a subscription plan that suits you. Registration will grant you access to a wide range of legal resources.

- Complete your payment by entering your credit card information or using your PayPal account, ensuring a smooth transaction.

- Finally, download the gift deed form with nota to your device, and access it anytime via the 'My Forms' section in your account.

Utilizing US Legal Forms provides a robust collection of legal documents that are meticulously crafted to provide accuracy and compliance. With over 85,000 fillable templates, the service ensures both individuals and legal professionals can swiftly execute necessary paperwork.

In conclusion, acquiring your gift deed form with nota is a streamlined experience with US Legal Forms. Don't hesitate—start your legal journey today by exploring the vast resources available!

Form popularity

FAQ

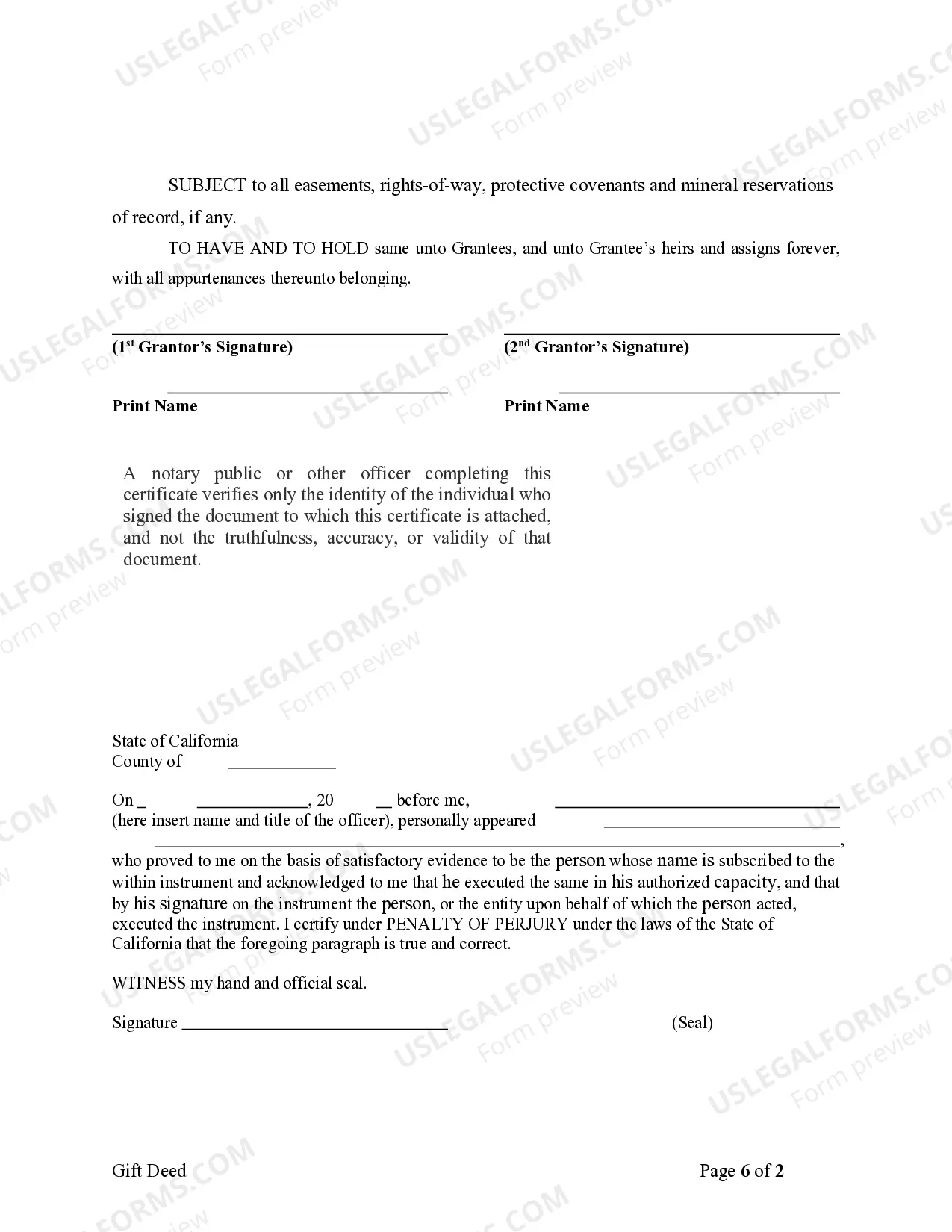

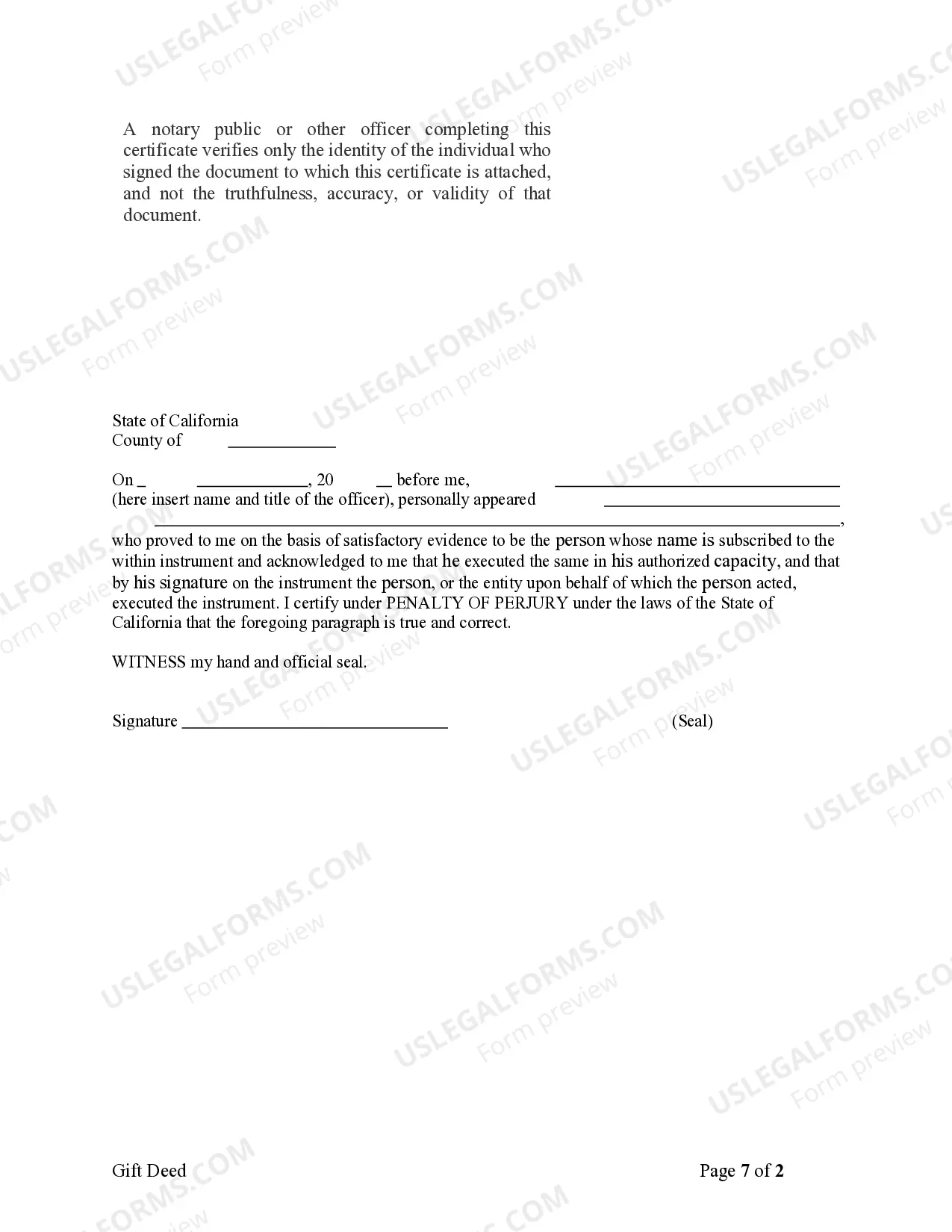

To legally gift a house, you need to complete a gift deed form with nota, ensuring that it is signed by both parties. You will also need to have the deed notarized, then record it with the local authority. Follow your local regulations and consider using professional services to ensure everything is in compliance. This process makes the gift legal and official.

The gift tax on a house in California depends on the fair market value of the property being gifted. The IRS allows an annual exclusion, which means you won't owe taxes on gifts below a certain threshold. However, if you exceed this amount, you may need to file a gift tax return. Utilizing a gift deed form with nota can help clarify the transaction's intent and possible tax implications.

For a gift deed form with nota in California, certain requirements must be met. Both the donor and recipient need to sign the deed, and it must be notarized. Additionally, to ensure validity, the deed needs to be recorded with the county recorder’s office. Following these steps ensures a smooth transfer of ownership.

Whether it is better to inherit a house or receive it as a gift depends on individual circumstances. An inheritance typically comes with a step-up in basis, potentially reducing capital gains taxes when you sell. On the other hand, a gift deed form with nota may allow you to immediately use or enjoy the property without the constraints of probate. Consider your financial situation and long-term goals.

To avoid gift tax on property in California, consider utilizing the annual exclusion amount allowed by the IRS. By gifting less than this amount each year, you can avoid triggering the tax. Additionally, using a gift deed form with nota may provide clearer documentation of your intent. Always consult a tax professional to ensure compliance with tax laws.

While a gift deed form with nota can simplify the transfer of property, there are disadvantages to consider. The recipient may face gift taxes, and the donor can lose control over the property. Additionally, once a gift deed is executed, it can be challenging to reverse. Be sure to weigh these factors before proceeding.

Yes, you can gift someone a house in California using a gift deed form with nota. This legal document allows you to transfer ownership of the property without receiving any payment. Ensure that the deed is properly executed and recorded to avoid future disputes. It is an effective way to pass on your property without the complexities of a sale.

Yes, you can gift a house to someone in North Carolina using a gift deed form with nota. This legal document facilitates the transfer of property ownership without monetary exchange. It is essential to ensure that the gift deed form is properly executed and recorded to avoid future disputes. Utilizing a reliable platform like uslegalforms can provide you with the necessary templates and guidance to create a valid gift deed form with nota, ensuring a smooth transfer process.

Filling out a gift letter affidavit involves stating the details of the gift clearly and accurately. Include information about the giver, receiver, and description of the gift. If you decide to use a gift deed form with nota, it will guide you through the required information, making the process easier and more organized.

Not all letters require notarization; it depends on their purpose and the preferences of the parties involved. For instance, financial institutions often require notarized documents for significant transactions. If you choose to utilize a gift deed form with nota, you can ensure that your letter meets any necessary notarial requirements.