Amendment Living Trust With The Bank

Description

How to fill out Arizona Amendment To Living Trust?

- If you're a returning user of US Legal Forms, log in to your account and select your desired form template by clicking the Download button. Ensure your subscription is active or renew it if needed.

- For first-time users, start by previewing the form descriptions and ensure you've selected the appropriate template that aligns with your requirements and local jurisdiction.

- If you need to explore additional templates, use the Search tab at the top to find the exact document. Once you find what you need, proceed to the next step.

- Purchase your chosen document by clicking the Buy Now button and selecting your preferred subscription plan. You will need to create an account for full access to the form library.

- Complete your purchase by entering your credit card information or using your PayPal account to pay for the subscription.

- Download your form and save it to your device. You can access your purchased template anytime through the My Forms section of your profile.

By following these steps, you will have a comprehensive and legally sound amendment living trust ready for your bank. US Legal Forms not only streamlines the process but also ensures that you have access to premium experts should you need assistance.

Start your estate planning today with US Legal Forms and secure your peace of mind!

Form popularity

FAQ

Amending a trust can be straightforward, especially when you follow the right steps. To amend a living trust with the bank, you usually need to prepare a formal document that outlines the changes you wish to make. It's wise to work with legal professionals or use reliable online platforms like US Legal Forms to ensure your amendments meet all legal requirements. By appropriately documenting your amendment living trust with the bank, you can maintain control over your assets while adapting to your current needs.

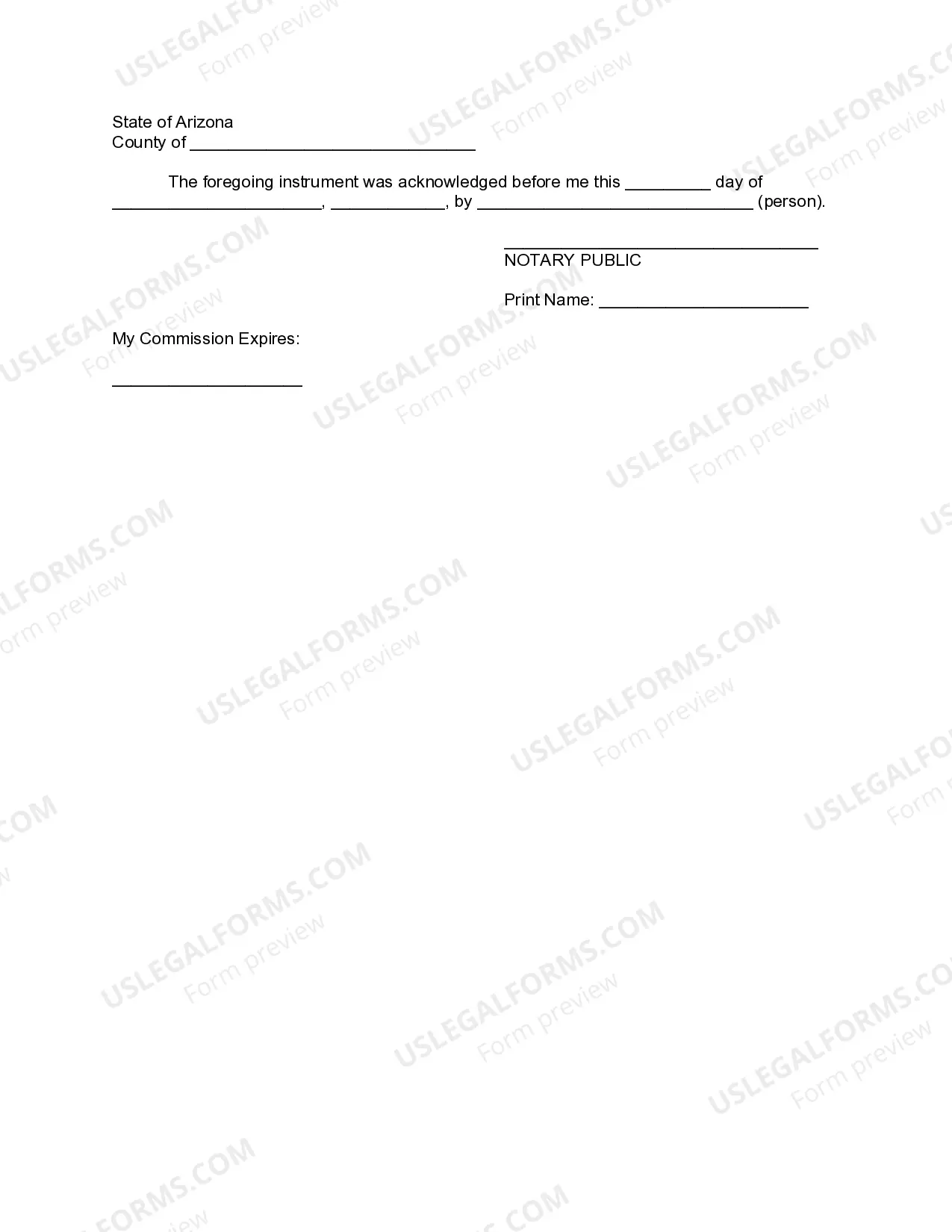

Writing an amendment to a living trust requires careful consideration and attention to detail. Start by clearly identifying the original trust document and specify the changes you want to make. Utilize the tools provided by platforms like uslegalforms to ensure that the amendment aligns with legal standards. After drafting your amendment, remember to sign it and, if necessary, have it notarized for added validity.

Including your bank account in an amendment living trust with the bank can simplify the transfer of assets upon your passing. This process can help avoid probate, making it easier for your beneficiaries to access funds without unnecessary delays. However, it's crucial to evaluate your financial situation and consult with an attorney or financial advisor to determine the best approach.

Certain bank accounts, such as joint accounts or accounts used solely for business purposes, typically should not be included in an amendment living trust with the bank. Additionally, individual retirement accounts (IRAs) and health savings accounts (HSAs) often have specific beneficiary designations that may conflict with trust provisions. Since these accounts have unique rules, it's essential to review your specific situation with a legal or financial expert.

You do not necessarily need a lawyer to make changes to a trust, but consulting one can be beneficial. If you feel confident about your understanding, you can amend a living trust with the bank on your own. However, a legal expert can provide advice and ensure that all amendments comply with state laws, which can help avoid future complications. USLegalForms offers resources that can help you navigate the process effectively, even without a lawyer.

Writing an amendment to a living trust involves specifying the changes you want to make clearly. You should start by identifying the original living trust and then outline the specific amendments. It is important to include the date and any signatures required, especially if the living trust has been funded with bank assets. Using USLegalForms can streamline this process, offering templates that guide you through drafting an effective amendment living trust with the bank.

Changing a living trust is not necessarily difficult, but it does require careful attention to detail. When you want to amend a living trust with the bank, it is essential to follow the proper steps to ensure everything is in order. In some cases, banks may request documentation or further verification that can add some complexity. However, utilizing resources from USLegalForms can provide a clear path for making those amendments smoothly.

A common mistake parents make when setting up a trust fund is not properly funding it. Simply creating a trust document does not guarantee that the intended assets will be protected or distributed according to their wishes. It is crucial for parents to ensure that all relevant accounts and properties are transferred into the trust. Periodically reviewing and amending a living trust with the bank can further minimize oversight and ensure alignment with their goals.

A potential disadvantage of a family trust includes the loss of direct control over assets. Once assets are transferred into the trust, the trustee manages them according to the terms outlined in the trust document. This can be challenging if family dynamics are complex. Additionally, regular amendments may be necessary to address changing family situations, including when working with banks and financial institutions.

Placing bank accounts into a living trust can be beneficial as it helps avoid probate and simplifies asset management. When you amend a living trust with the bank, it allows for easier access to funds during your lifetime and provides a clear plan for distribution after passing. However, it's important to consider how this decision aligns with your overall financial strategy and estate plan.