199 Respectfully Client For Windows 10

Description

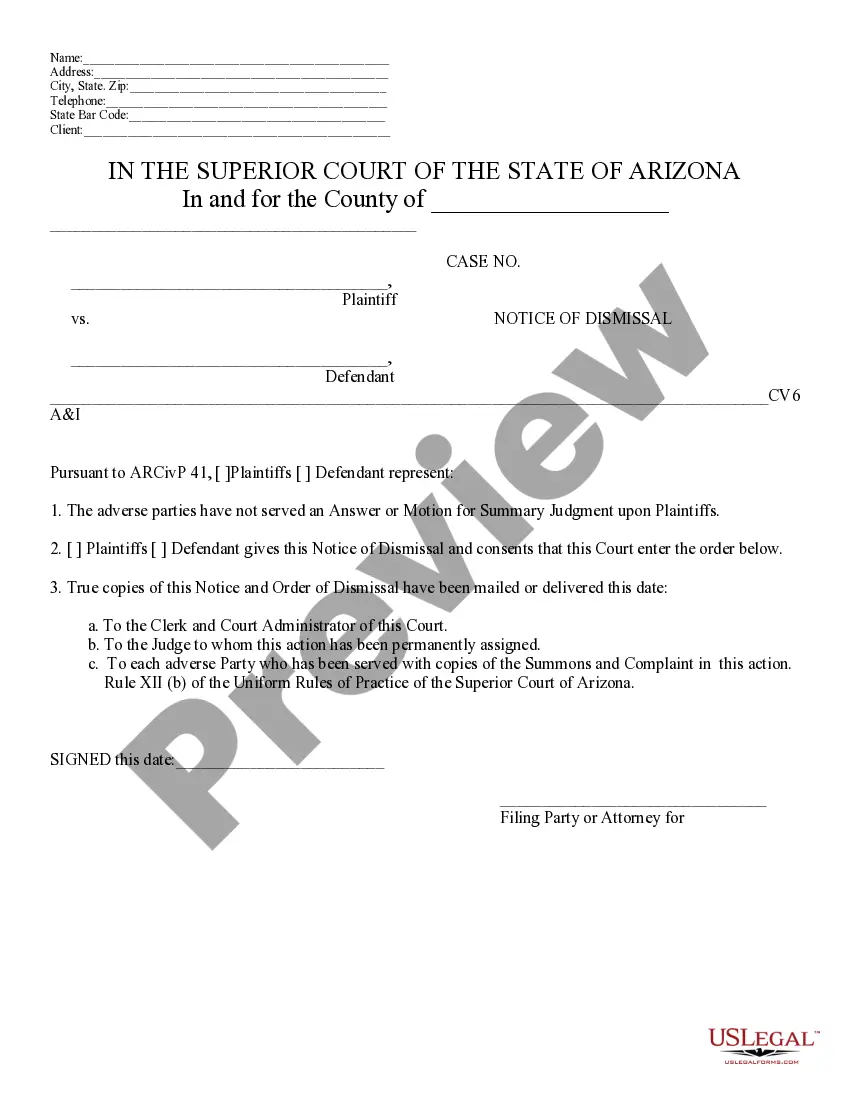

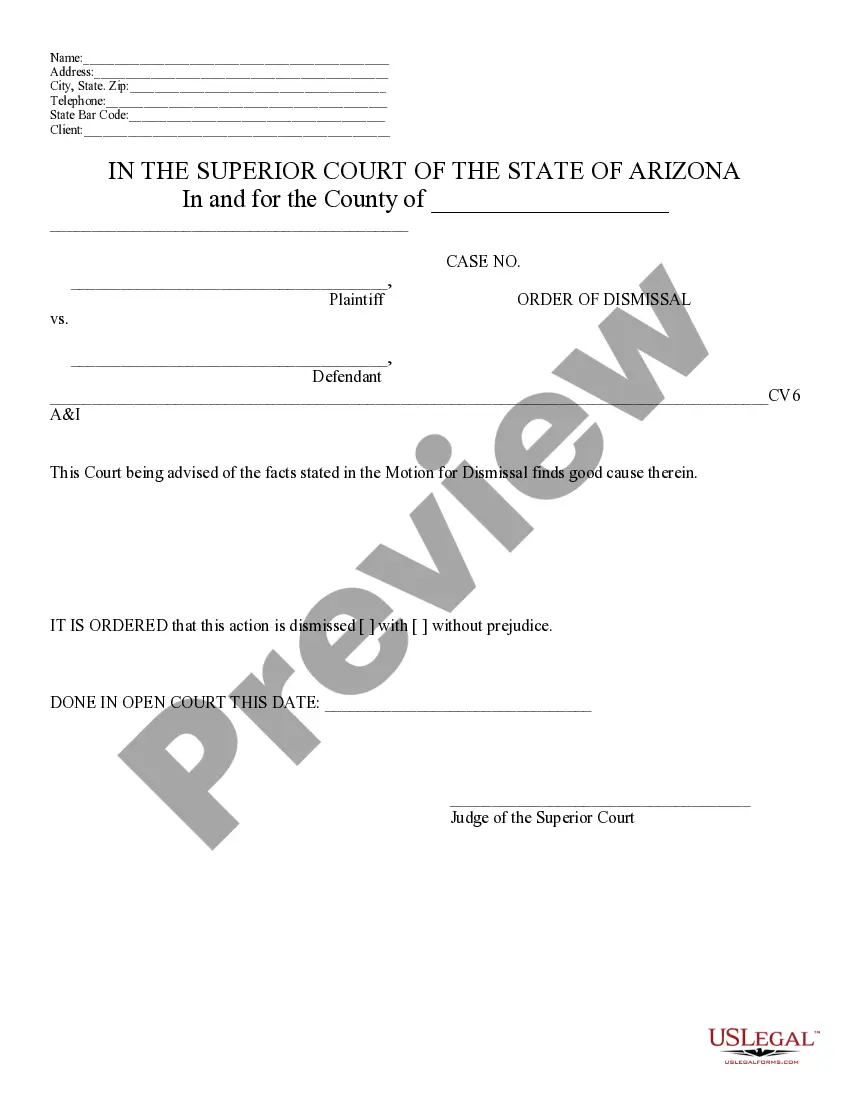

How to fill out Arizona Motion For Dismissal?

It’s no secret that you can’t become a legal professional immediately, nor can you learn how to quickly prepare 199 Respectfully Client For Windows 10 without the need of a specialized set of skills. Putting together legal documents is a time-consuming process requiring a particular education and skills. So why not leave the preparation of the 199 Respectfully Client For Windows 10 to the pros?

With US Legal Forms, one of the most extensive legal template libraries, you can find anything from court paperwork to templates for internal corporate communication. We understand how crucial compliance and adherence to federal and state laws are. That’s why, on our platform, all forms are location specific and up to date.

Here’s how you can get started with our platform and get the form you require in mere minutes:

- Find the document you need by using the search bar at the top of the page.

- Preview it (if this option provided) and check the supporting description to determine whether 199 Respectfully Client For Windows 10 is what you’re looking for.

- Start your search again if you need a different form.

- Set up a free account and choose a subscription option to buy the form.

- Pick Buy now. Once the payment is through, you can download the 199 Respectfully Client For Windows 10, fill it out, print it, and send or send it by post to the designated individuals or organizations.

You can re-gain access to your documents from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and locate and download the template from the same tab.

Regardless of the purpose of your documents-be it financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

1099 Explained: Step by step, line by line Payer information box. Located in the top left corner of the form, this is where you enter your company information. ... Payer TIN. ... Recipient's TIN. ... Recipient's name and address. ... FATCA filing requirement. ... Account number. ... Box 1: Non-Employee Compensation. ... Box 2: (Blank)

Yes, you can handwrite a 1099 or W2, but be very cautious when doing so. The handwriting must be completely legible using black ink block letters to avoid processing errors. The IRS says, ?Although handwritten forms are acceptable, they must be completely legible and accurate to avoid processing errors.

You can complete these copies online for furnishing statements to recipients and for retaining in your own files. Filing dates. Section 6071(c) requires you to file Form 1099-NEC on or before January 31, using either paper or electronic filing procedures.

1. Gather the required information The total amount you paid them during the tax year. Their legal name. Their address. Their taxpayer identification number (likely their Social Security Number, unless they're a Non-Resident or Resident Alien)

Basic 1099-NEC Filing Instructions. To complete a 1099-NEC, you'll need to supply the following data: Business information ? Your Federal Employer ID Number (EIN), your business name and your business address. Recipient's ID Number ? The recipient's Social Security number or Federal Employer ID Number (EIN).