What Does Deed With Life Estate Mean

Description

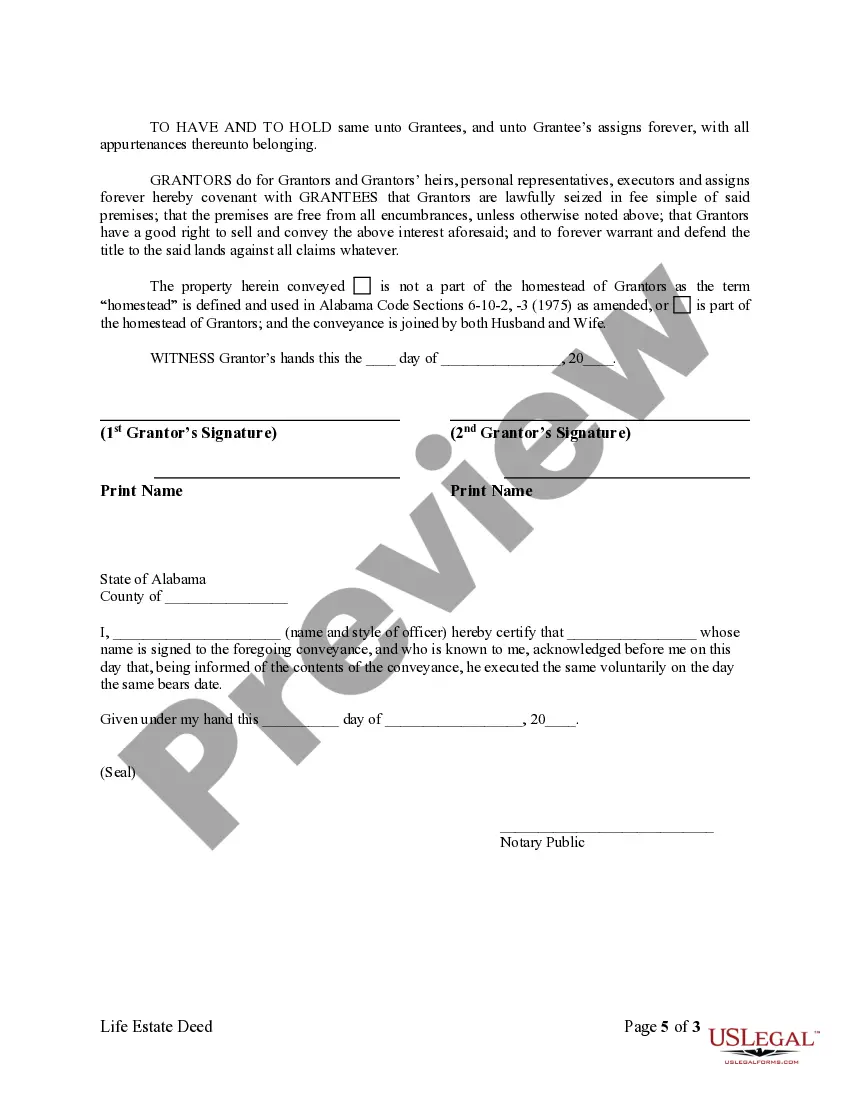

How to fill out Alabama Warranty Deed For Retention Of Life Estate (Husband And Wife To Husband And Wife)?

- If you have used US Legal Forms previously, log in to retrieve the required form template by clicking the Download button. Ensure your subscription is active; renew if necessary.

- For first-time users, begin by checking the Preview mode and form description to confirm the document meets your specific needs and complies with local regulations.

- Use the Search tab to find alternative templates if needed. Make sure the chosen document is suitable before proceeding.

- Purchase your document by selecting the Buy Now button and opting for your desired subscription plan. You'll need to register for an account to access the library.

- Complete your payment by entering your credit card or using your PayPal account to finalize the subscription.

- After your purchase, download the form and save it on your device. You can access this document anytime in the My Forms section of your account.

US Legal Forms is designed to empower both individuals and attorneys by providing a wide array of forms, ensuring that you can quickly create legally sound documents.

With over 85,000 editable legal forms available, plus access to premium expert support, US Legal Forms is your go-to source for all legal documentation needs. Start exploring today to streamline your legal process!

Form popularity

FAQ

One significant advantage of a life estate deed is that it allows you to retain control and use of the property during your lifetime while ensuring it passes directly to your chosen beneficiary upon your death. This can simplify the transfer process and help avoid issues with probate. Additionally, it can provide peace of mind, knowing that your loved ones will inherit the property without added complications.

Selling a house that is in a life estate can be complicated because the life tenant usually cannot sell the property without the remainderman's agreement. If both parties agree, they can move forward with the sale, but it's essential to understand that the life tenant will still maintain their rights until death. Before proceeding, consulting with a legal advisor or using a service like US Legal Forms is wise to ensure compliance with all legal requirements.

Yes, a life estate deed typically overrides the provisions of a will concerning the property involved. When a life estate is established, the transfer of ownership to the remainderman occurs automatically upon the life tenant's death, regardless of what the will states. Therefore, if you are considering setting up a life estate deed, you should be aware of its implications on your estate planning.

One disadvantage of a life estate deed is that the life tenant cannot sell or mortgage the property without the consent of the remainderman. Furthermore, the life estate does not shield the property from creditors, and the property may still be subject to claims. Lastly, complications may arise if the life tenant wishes to move or if the remainderman wants to make changes to the property.

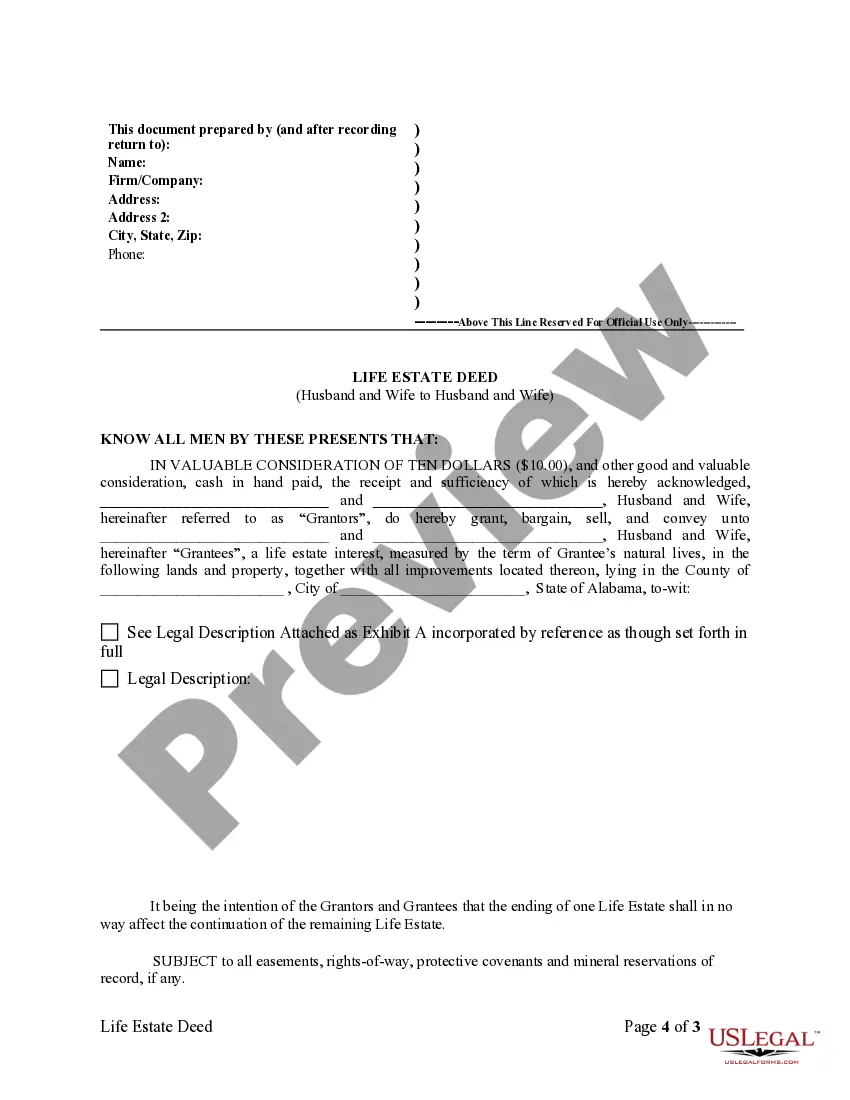

The primary purpose of a life estate is to facilitate property transfer while still allowing the original owner rights to the property during their lifetime. This arrangement helps reduce probate costs and ensures that the property goes directly to the chosen remainderman after the life tenant's death. Additionally, life estates can provide a sense of security for the life tenant, as they retain the right to stay in their home.

A life estate on a deed refers to a property arrangement where one person, known as the life tenant, holds the right to live in and use the property for their lifetime. After the life tenant passes away, the property then transfers to another designated person or party, known as the remainderman. Essentially, this legal structure provides a way of transferring property while allowing the original owner to maintain control and use it during their lifetime.

To navigate a life estate, you might consider changing the ownership structure or negotiating with the remainderman. Creating a new legal agreement could allow for modifications, but both parties must agree to the terms. Alternatively, consulting with legal experts can help you explore options like selling or gifting the property while maintaining estate planning goals. Using platforms like US Legal Forms can provide templates and guidance for these complex transactions.

Many individuals establish a deed with a life estate to maintain control over their property while securing a future benefit for their heirs. This arrangement allows them to live in the property for their lifetime, while ensuring it passes to the next owner upon their death. Additionally, setting up a life estate can help avoid probate, streamlining the transfer process. This makes life estates an attractive option for estate planning.

When you hold a deed with a life estate, it limits your control over the property. You cannot sell or mortgage the property without the consent of the remainderman. After your death, the property passes directly to the remainderman, which may not align with your wishes. It's essential to consider these drawbacks before creating a life estate.

Understanding what does deed with life estate mean includes acknowledging potential disadvantages. One significant drawback is that you cannot easily sell the property without considering the future rights of the remainder beneficiaries if you do. Additionally, while you maintain control during your lifetime, this arrangement may complicate estate planning or involve legal disputes after your passing. Seeking advice through services like US Legal Forms can help clarify these concerns.