Louisiana Petition to Quiet Tax Title

What is this form?

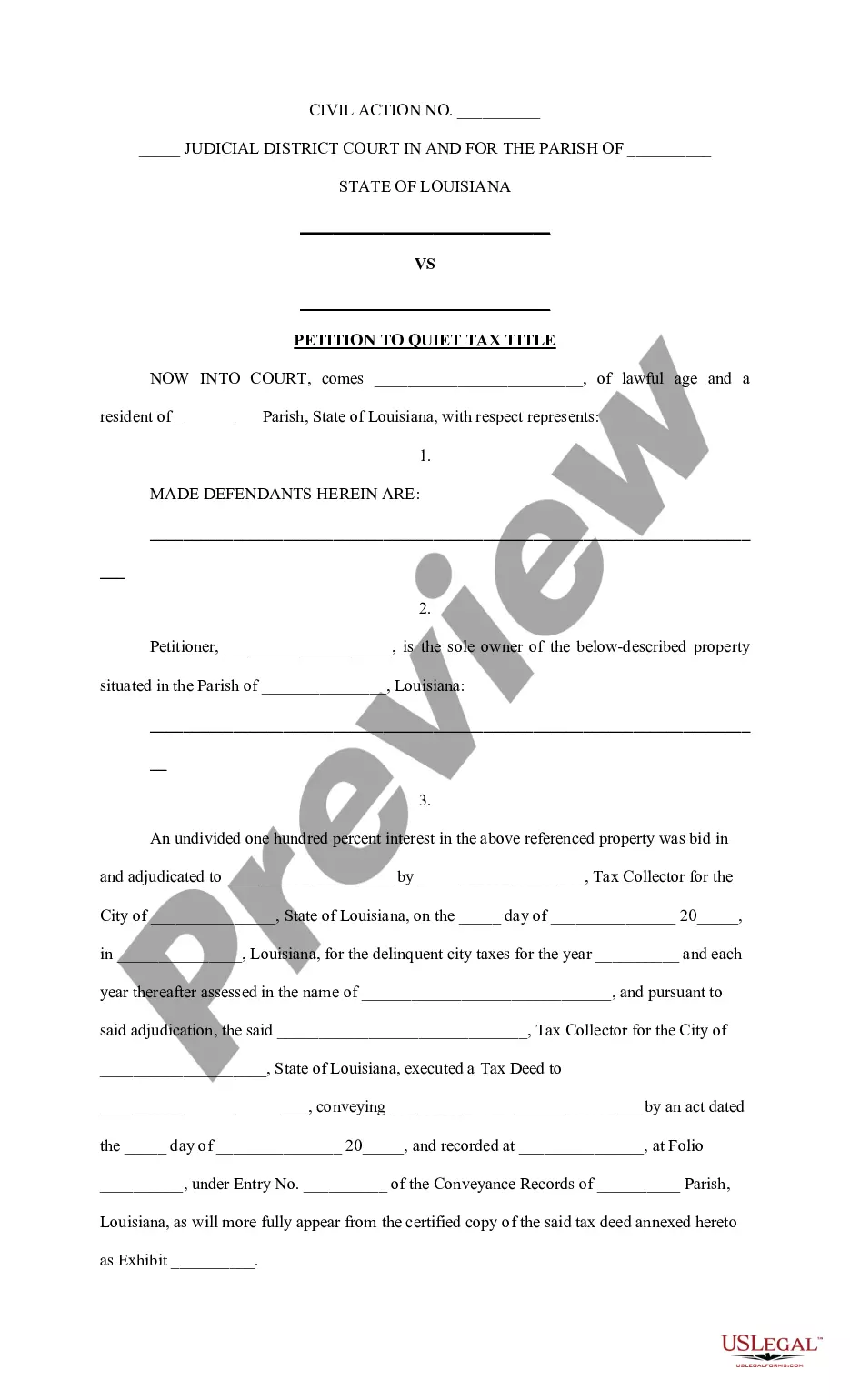

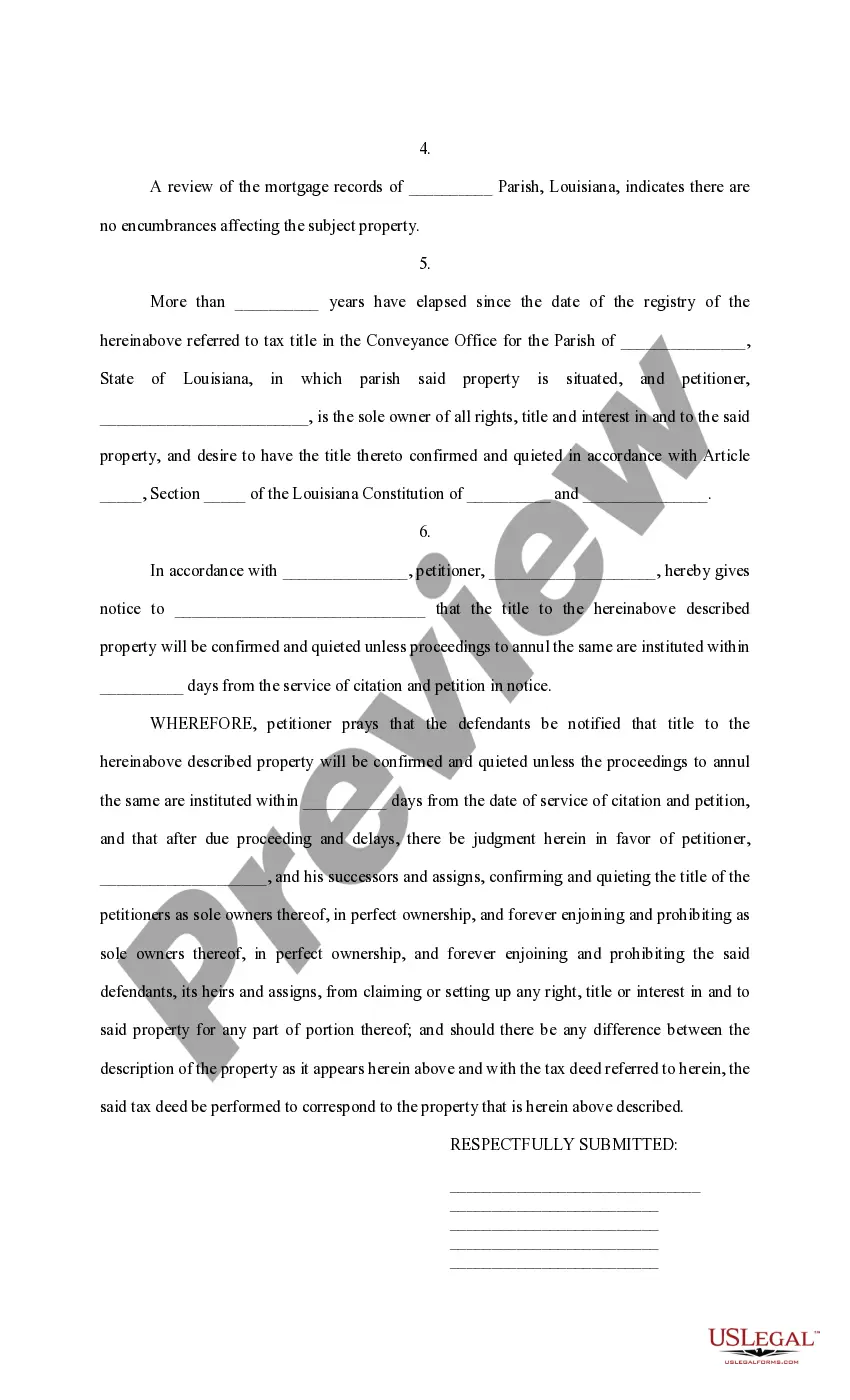

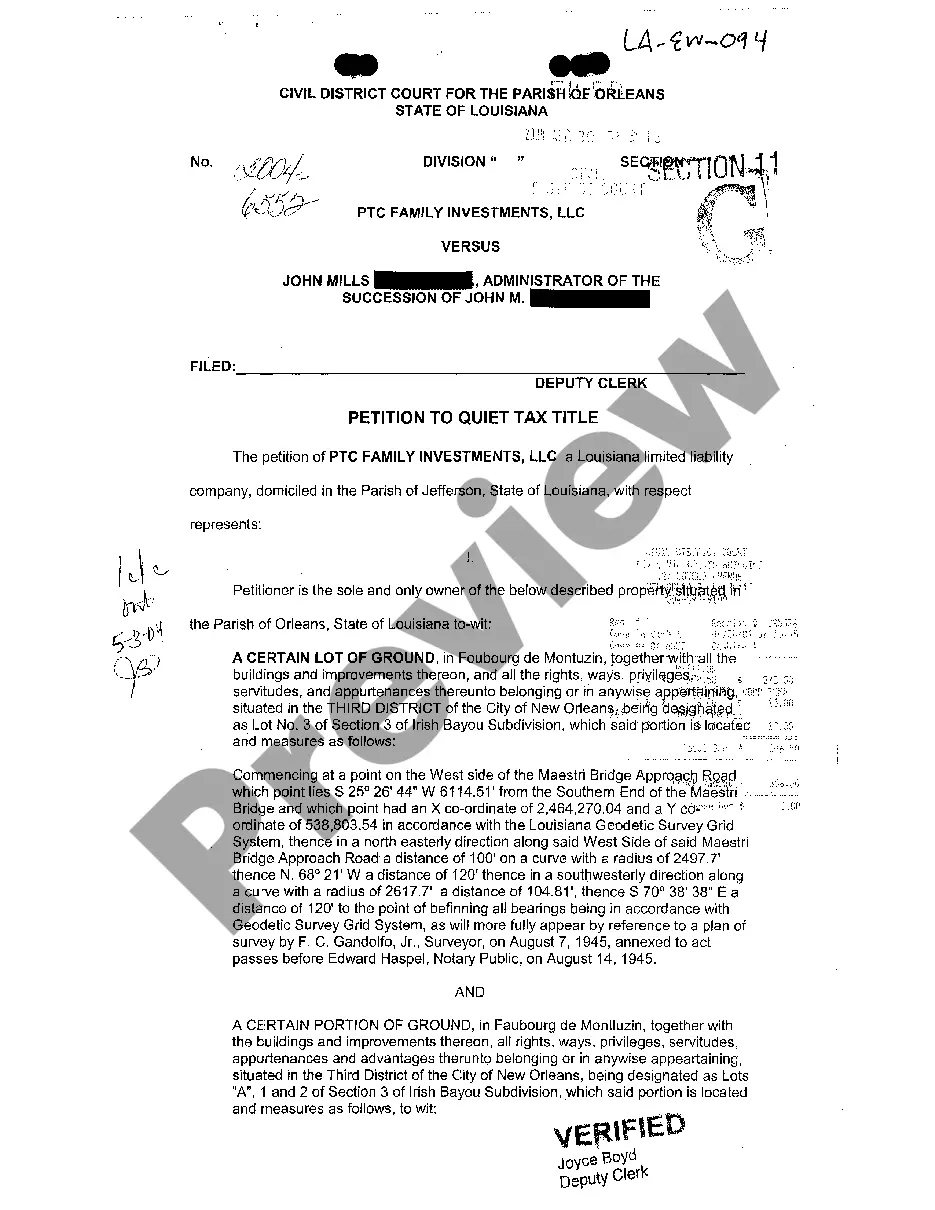

The Petition to Quiet Tax Title is a legal document that seeks a court ruling to confirm an individual's or entity's ownership of a property against any potential claims or interests from other parties. This form is crucial for those who want to ensure their title to a specific parcel of land is clear and free from disputes, distinguishing it from other title-related forms by its focus on tax title issues specifically.

Key components of this form

- Judicial District Court information - Specifies the court handling the case.

- Parties involved - Identifies the petitioner and named defendants.

- Property description - Details the property in question, including its location and adjudication history.

- Tax deed details - Explains the history of tax assessments and ownership transfers.

- Notice requirements - Outlines the procedure for notifying other parties about the petition.

- Judgment request - Specifies the relief sought from the court regarding title confirmation.

Common use cases

This form is appropriate to use when you have purchased property at a tax sale but face challenges to your title from other parties. If there are existing or potential disputes regarding the ownership or claims against your property, filing a Petition to Quiet Tax Title provides a legal mechanism to resolve these issues and secure your rights as the property owner.

Who should use this form

- Property owners who have acquired land through tax sales.

- Individuals or businesses facing claims or interests from other parties regarding their real estate title.

- Anyone needing to confirm the validity of their title for future transactions or uses.

How to complete this form

- Identify the parties involved: Fill in your name as the petitioner and the names of any defendants.

- Provide a detailed description of the property: Include its physical address and specifics related to the tax title.

- Document the tax deed information: State who the property was adjudicated to and record any relevant dates.

- Enter required notice details: Specify the time frame for other parties to contest the petition.

- Sign and date the petition: Make sure to sign in the appropriate places to validate the document.

Does this document require notarization?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Common mistakes

- Failing to accurately describe the property, which can lead to disputes.

- Not naming all interested parties as defendants, potentially invalidating the petition.

- Missing deadlines for notice requirements, which may affect the validity of the judgment.

Benefits of completing this form online

- Convenience: Quickly download and complete the form at your own pace.

- Editability: Tailor the form to fit your specific property details without hassle.

- Reliability: Access professionally drafted documents that comply with legal standards.

Form popularity

FAQ

Definition. A special legal proceeding to determine ownership of real property. A party with a claim of ownership to land can file an action to quiet title, which serves as a sort of lawsuit against anyone and everyone else who has a claim to the land.

The remedy of quieting of title is governed by Article 476 and 477 of the Civil Code, which state:The plaintiff must have legal or equitable title to, or interest in the real property which is the subject-matter of the action. He need not be in possession of said property.

Louisiana is classified as a Redemption Deed State. The municipal or parish tax collector oversees the sale which is an oral public auction. Tax deeds are sold with a 3 year right of redemption. Investors receive a rate of return of 1% per month, or 12% annually.

Louisiana is classified as a Redemption Deed State. The municipal or parish tax collector oversees the sale which is an oral public auction. Tax deeds are sold with a 3 year right of redemption.The state also mandates a flat penalty rate of 5% due to the deed holder upon property redemption.

Why would a property owner file a quiet title suit?the owner against liabilities and losses resulting from title defects. A lender's title insurance policy generally protects. the lender against the possibility that the lender's lien cannot be enforced.

In Louisiana, failing to pay your property taxes will lead to a tax sale.But you'll eventually lose ownership of the property permanently if you don't pay off the debt during what's called a redemption period after the sale.

Silent deeds, known as quiet title actions, are used to "quiet" opposition to title rights on a property. If you are not entirely sure that your title is clear of all known or unknown encumbrances or challenges, filing a quiet title action is how to proceed in many cases.

When two or more persons have adverse claims to the same property, any of them may file a quiet title action. The purpose of the quiet title action is to eliminate an adverse claim to a legal interest in the property and to establish, perfect, or quiet the title in the property in one or more of the claimants.

A lawsuit for quiet title must be brought in local Superior Court. To begin the lawsuit, the plaintiff (the lender or homeowner) files a complaint with the court followed by a Notice of Pendency of Action (a Lis Pendens) that is recorded with the county recorder and filed with the court.