Louisiana Sample Petition To Quiet Tax Title

Description

Key Concepts & Definitions

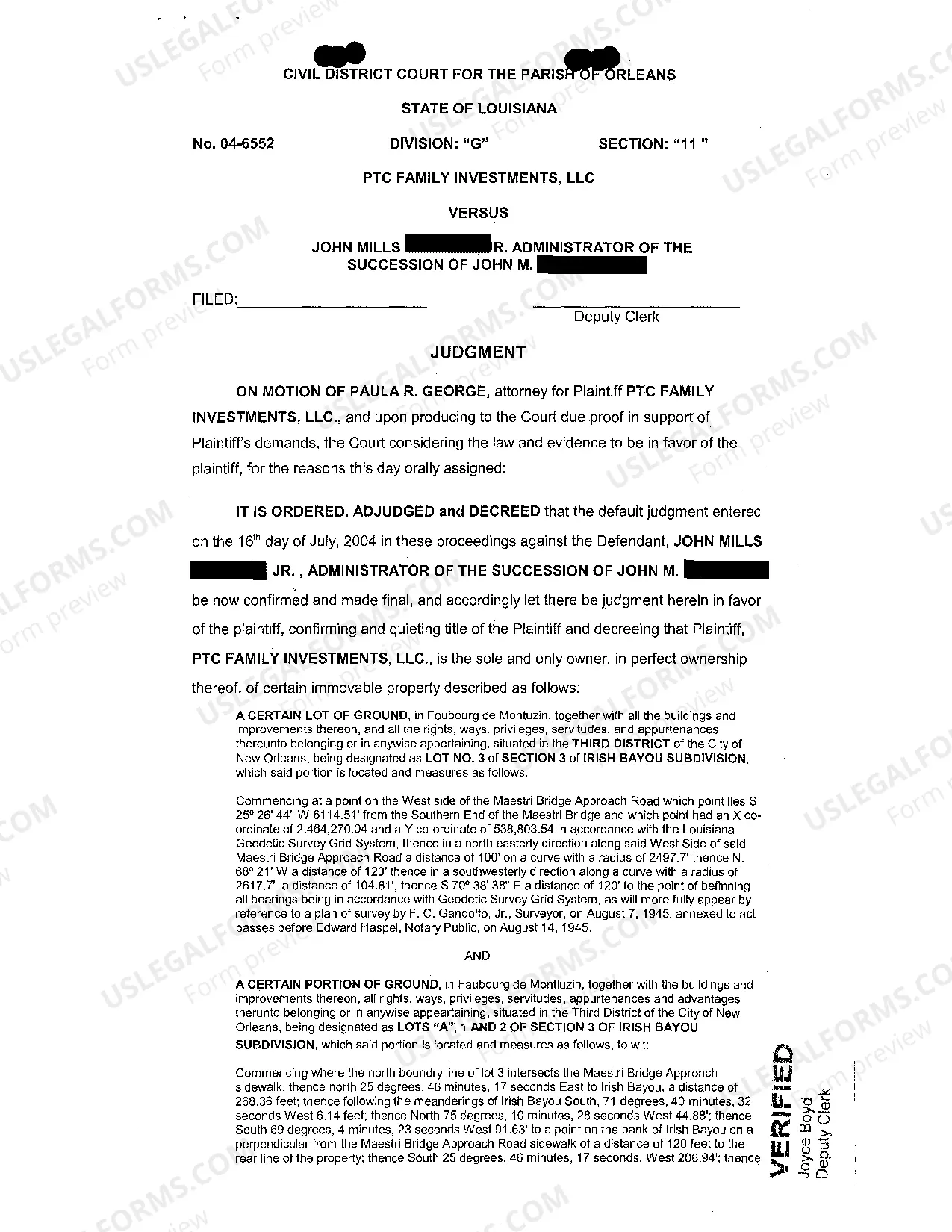

Quiet Title Action: A legal process to resolve disputes over property ownership, typically to clear a title of any liens or other encumbrances. A tax title is acquired when a property is sold due to non-payment of taxes. A sample petition to quiet tax title is a document submitted to a court to initiate this process.

Step-by-Step Guide

- Verify Ownership: Ensure that the title you wish to quiet reflects your ownership and that you have grounds to file the petition.

- Research Liens and Encumbrances: Confirm all details regarding existing liens, disputes, or encumbrances on the property.

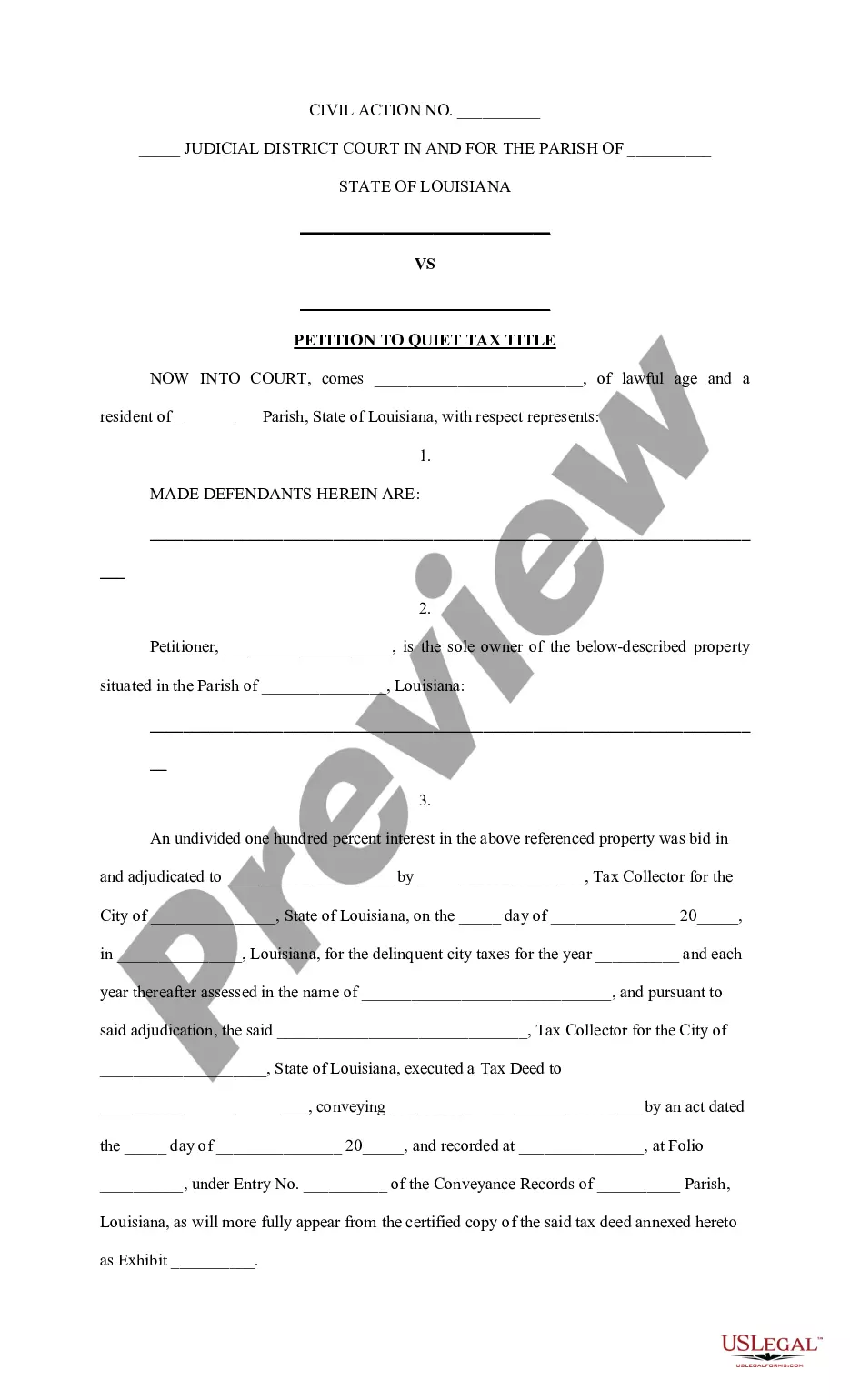

- Prepare the Petition: Draft the petition using legal help, including all key details like property description, basis for the petition, and desired outcome.

- File the Petition: Submit the completed petition to the appropriate court, along with necessary fees.

- Serve Involved Parties: Legally notify any parties affected by the action, such as previous owners or lien holders.

- Attend the Hearing: Participate in the court hearing, presenting evidence supporting your claim to the property's title.

- Observe Court Decision: Follow through with any actions the court orders based on its ruling.

Risk Analysis

Potential Legal Challenges: Other claimants might contest the ownership, leading to a lengthy legal process.

Financial Risk: Unforeseen costs could arise from legal fees, court costs, or settlement amounts if other parties present strong opposing claims.

Property Value Impact: A contested title can negatively impact the property's market value, affecting resale or financing.

Key Takeaways

Understanding the process of a quiet title action, especially for tax-related issues, is crucial for property investors and owners facing title discrepancies. Effective preparation and legal guidance are paramount.

Common Mistakes & How to Avoid Them

- Insufficient Documentation: Always maintain thorough records and documentation regarding property ownership and tax payments.

- Failure to Notify Affected Parties: Ensure all relevant parties are properly served to avoid legal repercussions or delays.

- Lack of Legal Representation: Consider hiring an attorney specialized in real estate law to guide through the complex legal landscape.

FAQ

What is a sample petition to quiet tax title? A sample document used as a blueprint to file a legal claim resolving property ownership disputes due to tax issues.

How long does the process take? The timeline can vary significantly, often taking several months to over a year depending on the case complexity and court backlog.

How to fill out Louisiana Sample Petition To Quiet Tax Title?

You are invited to the foremost legal document repository, US Legal Forms.

Here you will discover any template, such as the Louisiana Sample Petition To Quiet Tax Title forms, and download them (as many as you desire or require).

Prepare official documents within a few hours, instead of days or weeks, without having to spend a fortune with a lawyer.

Examine the description (if available) to determine if it’s the correct template. Look at more details with the Preview option. If the sample aligns with your requirements, just click Buy Now. To establish your account, select a pricing plan. Use a credit card or PayPal to sign up. Download the file in your preferred format (Word or PDF). Print the document and complete it with your or your business’s information. Once you’ve filled out the Louisiana Sample Petition To Quiet Tax Title, forward it to your lawyer for validation. It’s an additional step but an essential one for ensuring complete coverage. Join US Legal Forms now and gain access to thousands of reusable templates.

- Access your state-specific form in just a few clicks and have confidence knowing it was created by our licensed attorneys.

- If you’re already a registered user, simply Log In to your account and click Download next to the Louisiana Sample Petition To Quiet Tax Title you need.

- Since US Legal Forms is online, you will always have access to your saved documents, regardless of the device you're using.

- View them in the My documents section.

- If you haven't created an account yet, what are you waiting for.

- Follow our instructions below to get started.

- If this is a state-specific document, verify its validity in your state.

Form popularity

FAQ

Definition. A special legal proceeding to determine ownership of real property. A party with a claim of ownership to land can file an action to quiet title, which serves as a sort of lawsuit against anyone and everyone else who has a claim to the land.

In Louisiana, failing to pay your property taxes will lead to a tax sale.But you'll eventually lose ownership of the property permanently if you don't pay off the debt during what's called a redemption period after the sale.

A quiet title action usually takes 8-10 weeks to complete. The process may take longer or may be shorter depending on certain factors surrounding the dispute such as the Court rulings on certain matters.

Louisiana Property Tax Rates The property tax rates that appear on bills are denominated in millage rate. A mill is equal to $1 of tax for every $1,000 of net assessed taxable value. If your net assessed taxable value is $10,000 and your total millage rate is 50, your taxes owed will be $500.

Louisiana is classified as a Redemption Deed State. The municipal or parish tax collector oversees the sale which is an oral public auction. Tax deeds are sold with a 3 year right of redemption.The state also mandates a flat penalty rate of 5% due to the deed holder upon property redemption.

When homeowners fail to pay their property taxes, some tax jurisdictions choose to hold tax deed home sales to make back the money they are owed. Interested buyers can register to participate as a bidder on these homes in a tax deed auction.

Why would a property owner file a quiet title suit?the owner against liabilities and losses resulting from title defects. A lender's title insurance policy generally protects. the lender against the possibility that the lender's lien cannot be enforced.

Property tax is a tax paid on property owned by an individual or other legal entity, such as a corporation. Most commonly, property tax is a real estate ad-valorem tax, which can be considered a regressive tax. It is calculated by a local government where the property is located and paid by the owner of the property.

If the original owner does not redeem the property in three years from the filing of the tax sale certificate, the new purchaser may file a lawsuit to quiet the title to obtain full ownership. (LA R.S. 66) In simple terms, the purchaser sues the former owner for ownership.