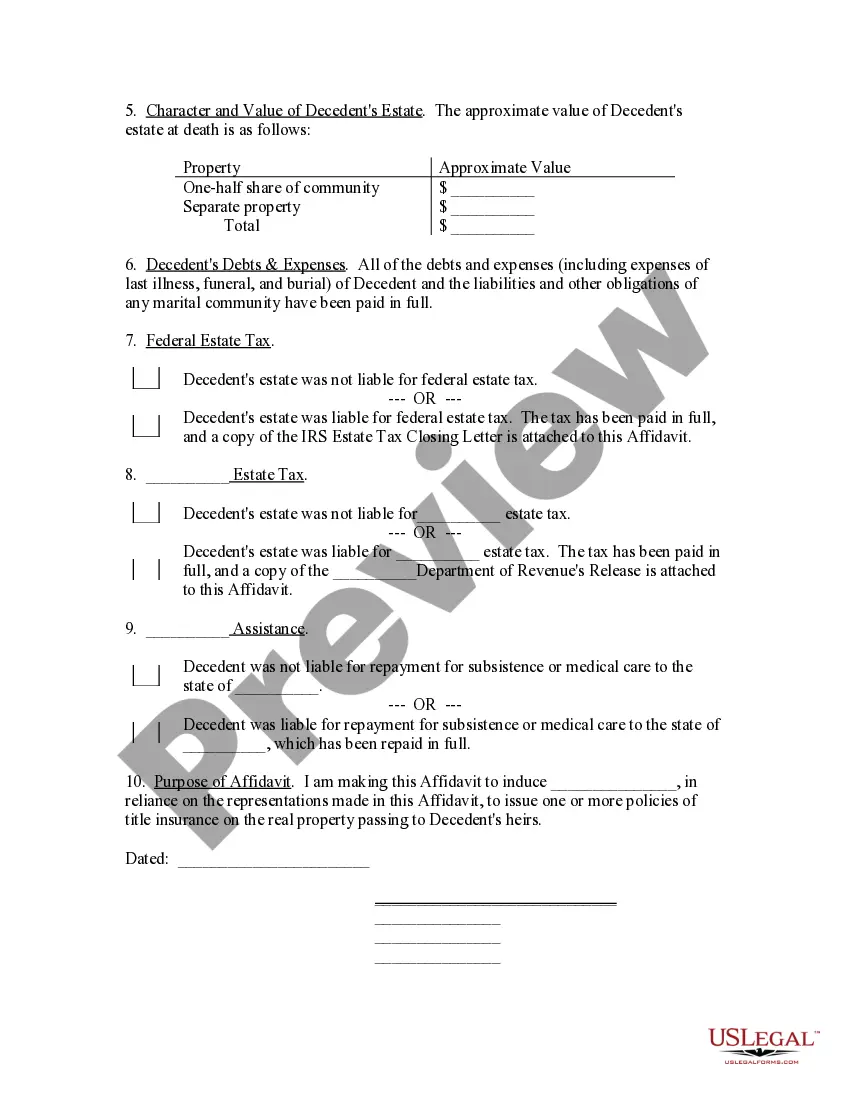

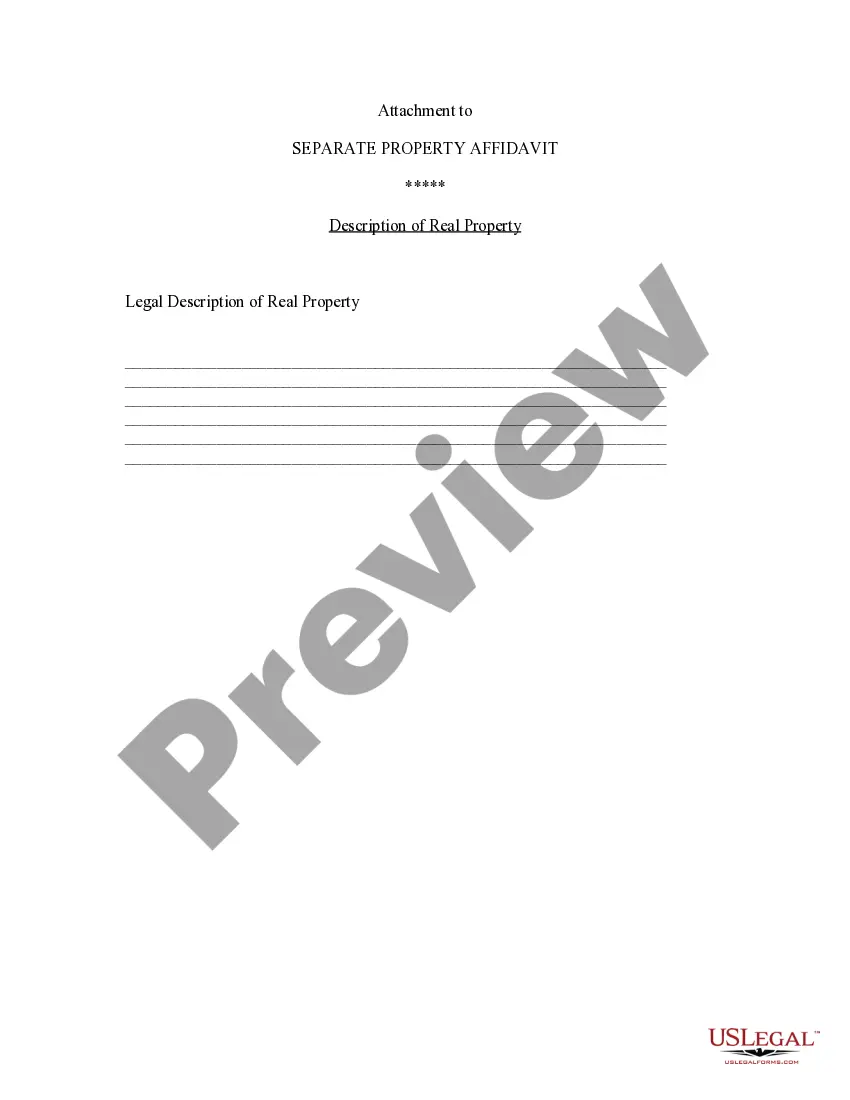

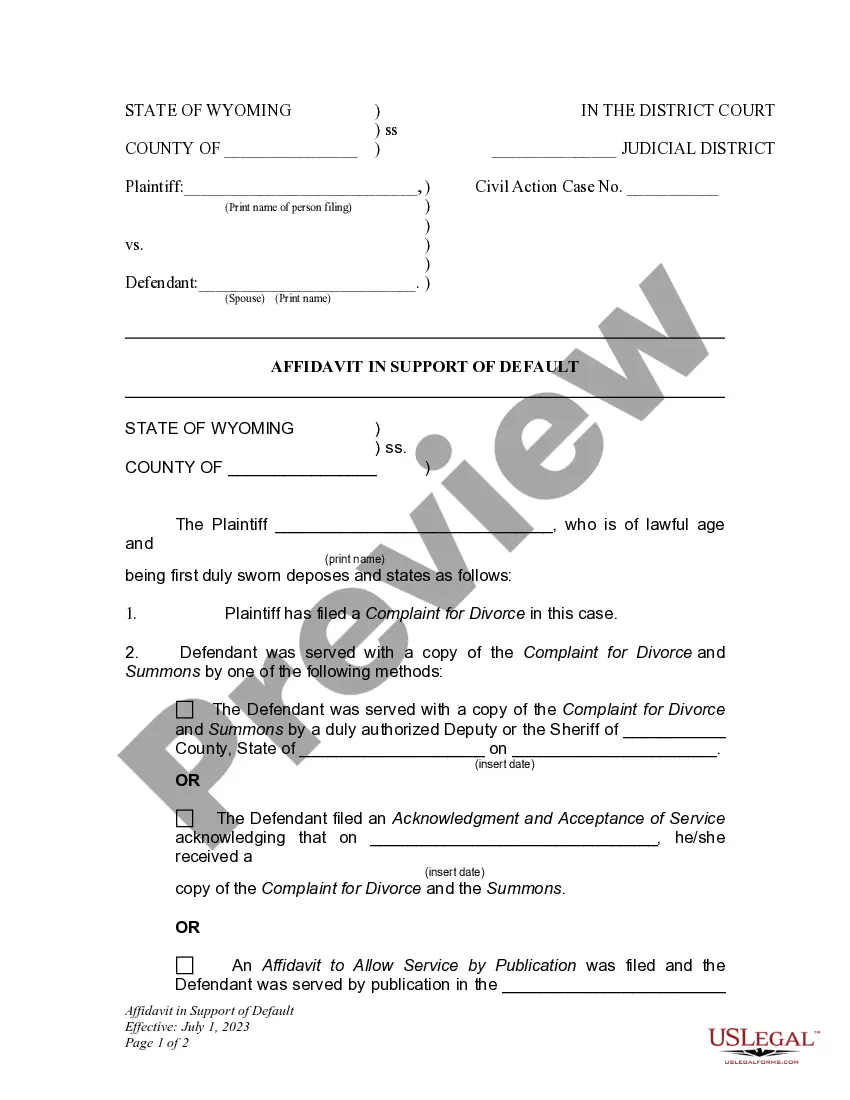

Lack of Probate Affidavit- Separate Property is a document used to prove that a deceased person’s separate property is not subject to probate. Separate property is property that is not subject to the laws of intestate succession and is not subject to probate. This document is used to declare that the property is separate property and does not need to go through the probate process. There are two types of Lack of Probate Affidavit- Separate Property: a Small Estate Affidavit and a Spousal Property Petition. The Small Estate Affidavit is used when the value of the separate property is below a certain threshold, typically $150,000 in most states. A Spousal Property Petition is used when the separate property is jointly owned by a surviving spouse and the deceased spouse. This document is used to declare that the property is the surviving spouse’s sole property and not subject to probate.

Lack of Probate Affidavit- Separate Property

Description

How to fill out Lack Of Probate Affidavit- Separate Property?

If you’re searching for a way to appropriately prepare the Lack of Probate Affidavit- Separate Property without hiring a lawyer, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reputable library of formal templates for every private and business scenario. Every piece of documentation you find on our online service is drafted in accordance with federal and state laws, so you can be sure that your documents are in order.

Adhere to these simple instructions on how to acquire the ready-to-use Lack of Probate Affidavit- Separate Property:

- Ensure the document you see on the page meets your legal situation and state laws by examining its text description or looking through the Preview mode.

- Type in the form name in the Search tab on the top of the page and choose your state from the list to locate an alternative template in case of any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Create an account with the service and choose the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The blank will be available to download right after.

- Choose in what format you want to get your Lack of Probate Affidavit- Separate Property and download it by clicking the appropriate button.

- Upload your template to an online editor to fill out and sign it rapidly or print it out to prepare your paper copy manually.

Another wonderful thing about US Legal Forms is that you never lose the paperwork you purchased - you can pick any of your downloaded blanks in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

1300. In all proceedings governed by this code, an appeal may be taken from the making of, or the refusal to make, any of the following orders: (a) Directing, authorizing, approving, or confirming the sale, lease, encumbrance, grant of an option, purchase, conveyance, or exchange of property.

Lack of probate affidavit" means a signed and notarized document (by any heir)declaring that the affiant or affiants are the rightful heir or heirs to the property and containing the following information: (i) The names of the affiant or affiants; (ii) The relationship of the affiant or affiants to the decedent; (iii)

This form may be used to collect the unclaimed property of a decedent without procuring letters of administration or awaiting probate of the decedent's will if you are entitled to the decedent's property under Section 13101 of the California Probate Code.

(Revised: 01/2021) Probate Code section 13100 provides for the collection or transfer of a decedent's personal property without the administration of the estate or probate of the will.

A Lack of Probate affidavit may be used when the deceased owned less than $100,000.00 in personal property and did not own real estate. With an affidavit, you do not go to court to direct the distribution of property. The successor or beneficiary can claim any of the belongings of the deceased.

Maximum Value of Small Estate: $166,250?$184,500 To use the affidavit for small estates under Probate Code §13100, the value of an estate must be no larger than $184,500. (For deaths prior to April 1, 2022, the maximum value of an estate that could use the small estate affidavit was $166,250.)

Non-probate property is passed along by: A contract with a beneficiary designation, such as a life insurance policy, an IRA or pension, or a profit-sharing plan. A right to survivorship for property held as joint tenants with the right of survivorship, or in a Payable on Death account.

Section 13050 - Property excluded in determining property of estate of decedent (a) For the purposes of this part: (1) Any property or interest or lien thereon that, at the time of the decedent's death, was held by the decedent as a joint tenant, or in which the decedent had a life or other interest terminable upon the