Sample Letter for Bringing Account Current

Understanding this form

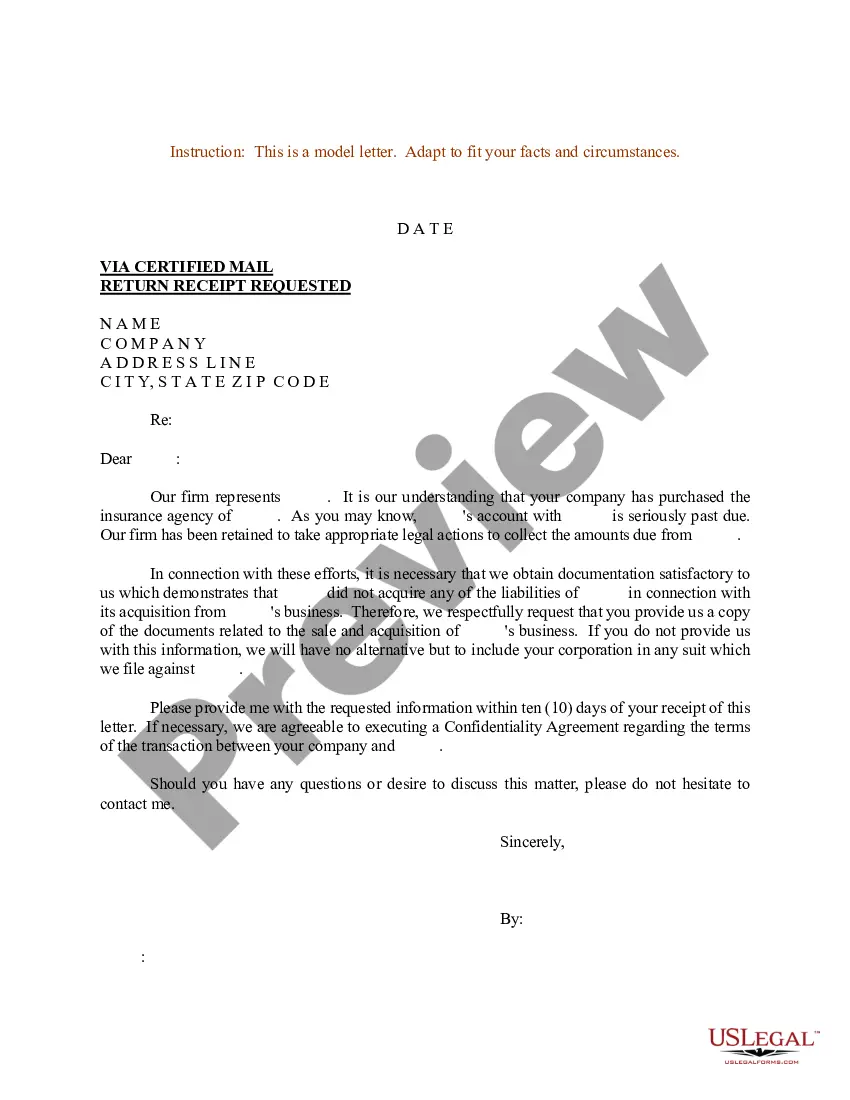

The Sample Letter for Bringing Account Current is a legal document used to formally communicate an outstanding account balance. This letter serves to inform a party that their account is not current and outlines the necessary steps that need to be taken to rectify the situation. Unlike other general letters, this form specifically addresses the requirements for bringing an account back to a current standing, often in a legal context related to defaults and potential actions to recover owed amounts.

Key parts of this document

- Date of the letter.

- Recipient's name and contact information.

- Reference to the account and individuals involved.

- Statement regarding the default and outstanding amounts.

- Instructions for payment and discussion of potential legal actions.

- Signature of the sender.

Situations where this form applies

This form should be used when a party holds a financial obligation that has not been met, and there is a need to formally communicate this status. It is particularly relevant in situations involving defaults on loans, rent, or any payment arrangements where the creditor seeks to collect overdue funds or prepare for possible legal action.

Who needs this form

- Creditors seeking to reclaim overdue amounts.

- Property managers or landlords notifying tenants of unpaid rent.

- Financial institutions reminding borrowers of missed payments.

- Anyone needing to initiate a formal request for payment.

Completing this form step by step

- Identify and enter the date on which you are sending the letter.

- Fill in the recipient's name and contact information accurately.

- Clearly reference the involved parties and account details.

- Outline the specific defaulted amounts and any required actions.

- Sign and date the letter at the bottom, including your printed name.

Is notarization required?

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to include accurate dates and contact information.

- Not specifying the outstanding amounts clearly.

- Leaving out important details about the default or next steps.

- Not signing the letter before sending.

Advantages of online completion

- Convenient access to a professionally drafted letter.

- Editability allows for customization to fit specific situations.

- Reliable format meets legal standards for correspondence.

Looking for another form?

Form popularity

FAQ

Pay the Entire Past-Due Balance. DNY59 / Getty Images. Catch Up. Negotiate a Pay for Delete. Consolidate the Account. Settle the Account. File for Bankruptcy. Seek Consumer Credit Counseling.

Create an accounts receivable aging report. Act quickly. Consider working out a payment plan. Send past-due notices and letters. Call in the cavalry.

If you've fallen behind on your credit card or loan payments, your lender may talk to you about "bringing your account current." That's another way of saying that you make a payment large enough to satisfy any past due balance that's accumulated since you made your last payment.

When a debtor stops paying and the number of days since the most recent payment reaches 120 days, the account is no longer considered current and the creditor is required to write-off the debt. This doesn't mean the debtor is no longer responsible for the loan or that the debt is forgiven.

A late payment, also known as a delinquency, will typically fall off your credit reports seven years from the original delinquency date. For example: If you had a 30-day late payment reported in June 2017 and bring the account current in July 2017, the late payment would drop off your reports in June 2024.

An indicator of stage of an invoice in relation to the payment. There are six different payment statuses: payment not submitted, payment submitted, payment authorized, payment in manual review, payment cleared and payment failed.

The account current is a summary statement detailing the financial performance of an individual insurance agent's business over a specified period.The account current is the basis for the paper trail as premiums paid by policyholders travel between insurance provider, agencies, and agents.

Re: What mean ( Pay status: current) if the account is closed. Current is what you want on accounts. If an account is marked "current" the baddies drop off at 7 years and continues to report as a positive TL.