Tennessee Heirship Affidavit - Descent

What is this form?

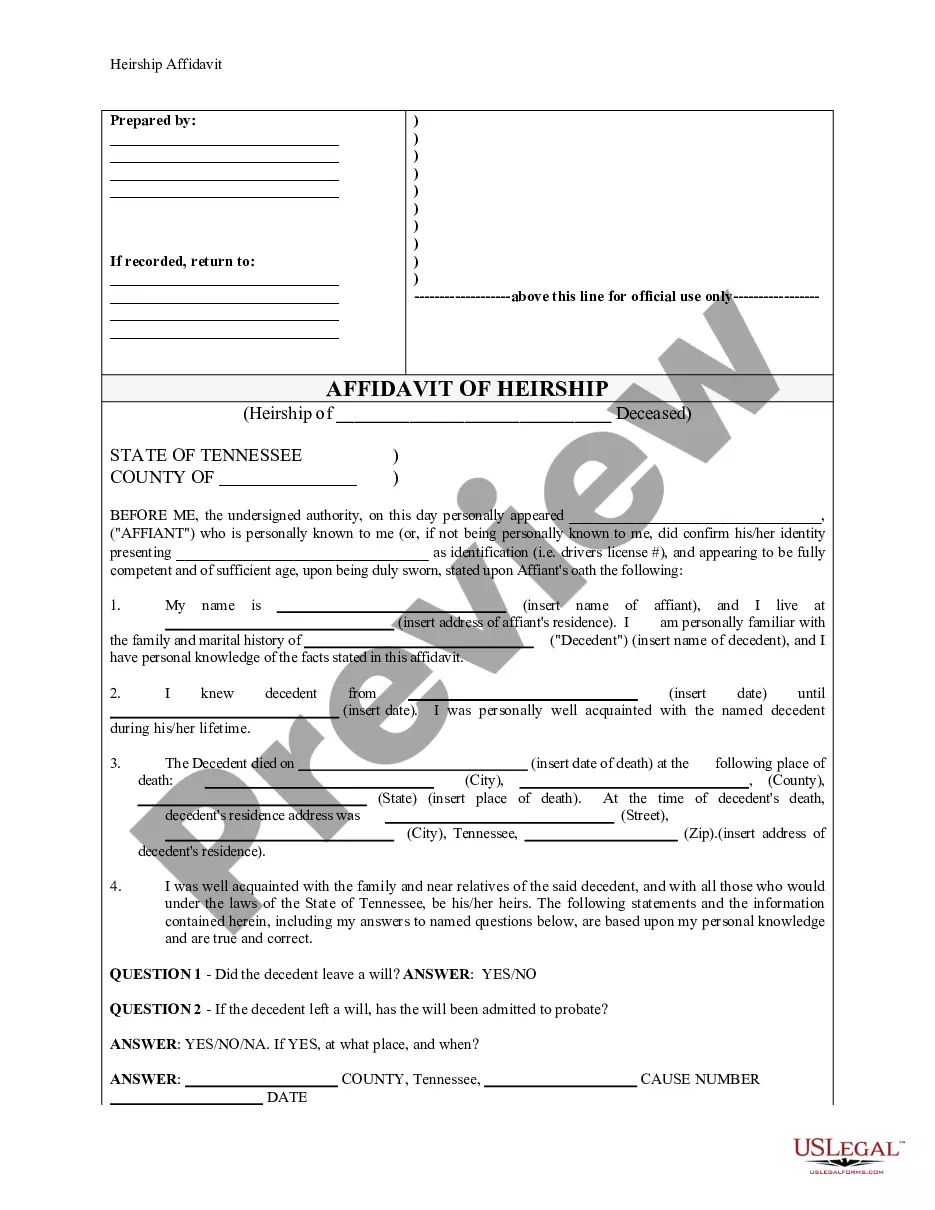

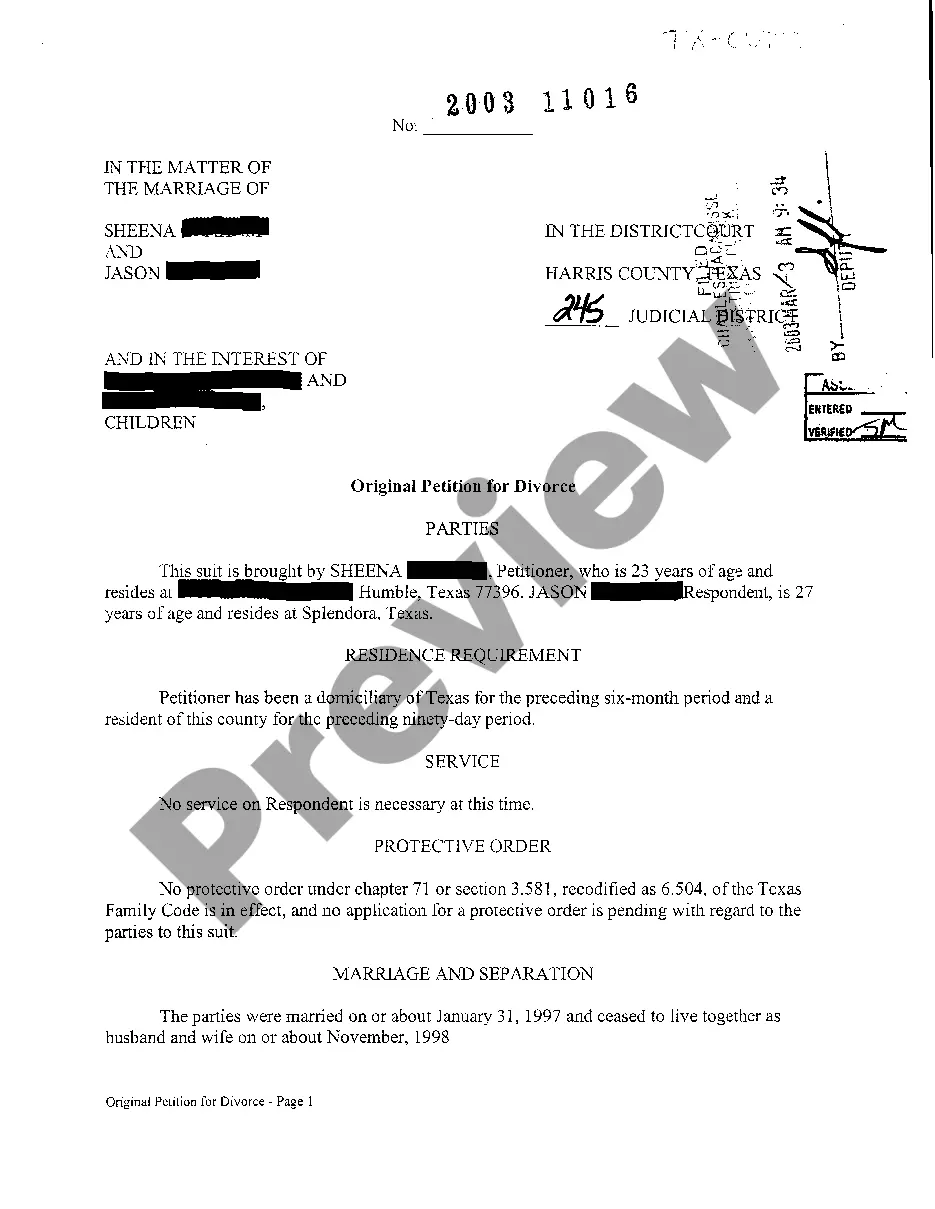

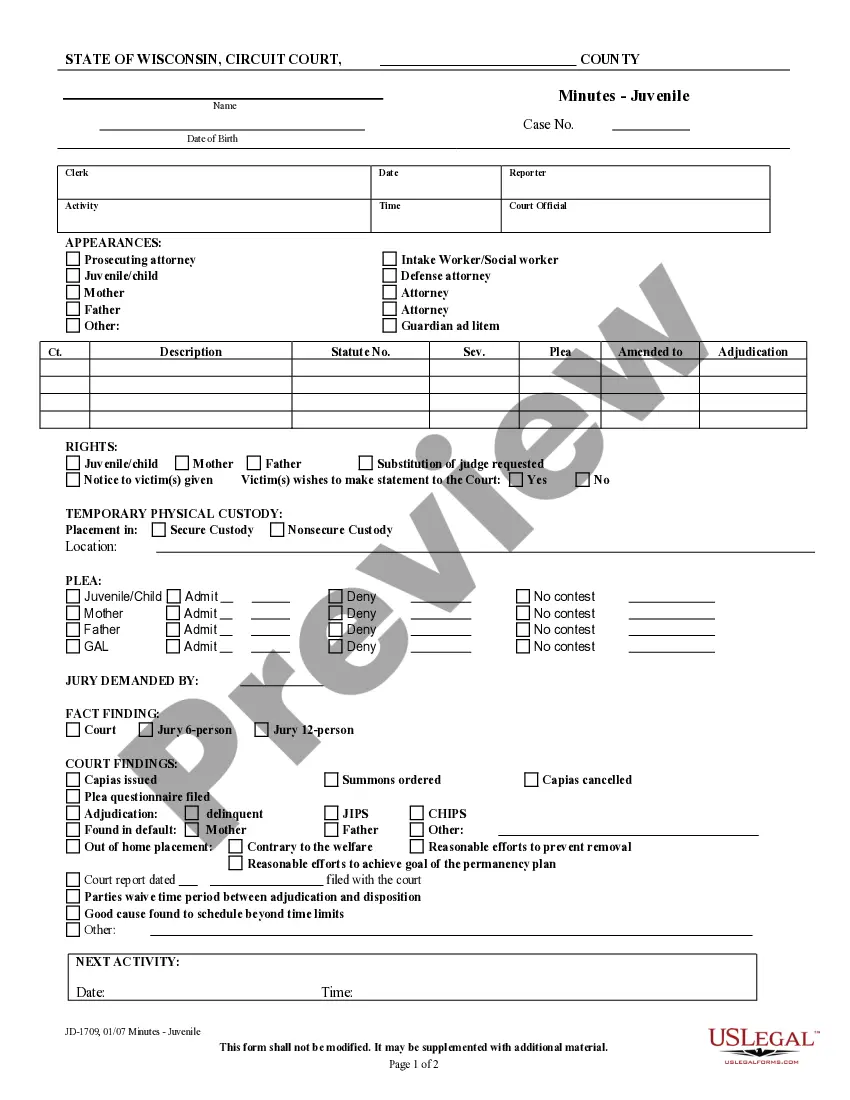

The Heirship Affidavit - Descent is a legal document used to certify the heirs of a deceased individual. This form is designed to establish ownership of both personal and real property when the deceased passed away without a will. In particular, the Heirship Affidavit serves as proof of heirship that may be recorded in land records, making it a crucial document for individuals dealing with inheritance matters.

What’s included in this form

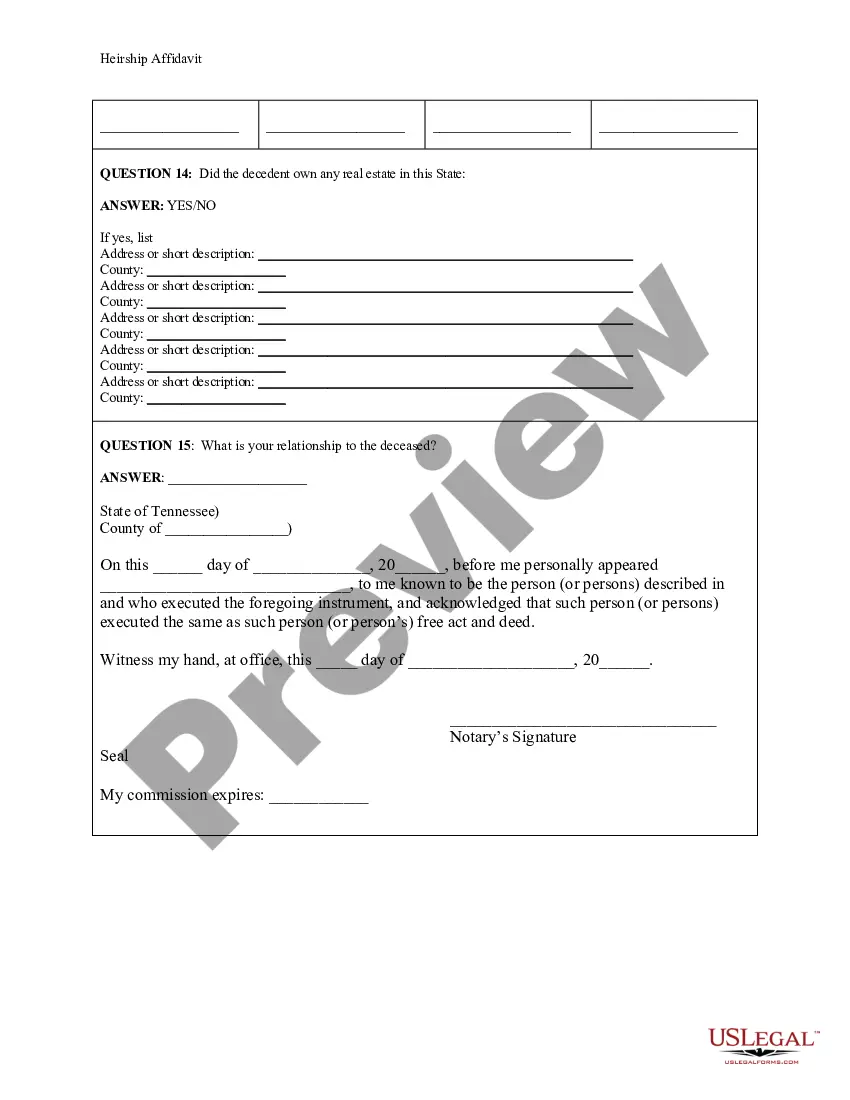

- Identification of the affiant and decedent with their respective contact information.

- Affidavit statements regarding the decedent's family and marital history.

- Questions about the presence of a will and its probate status.

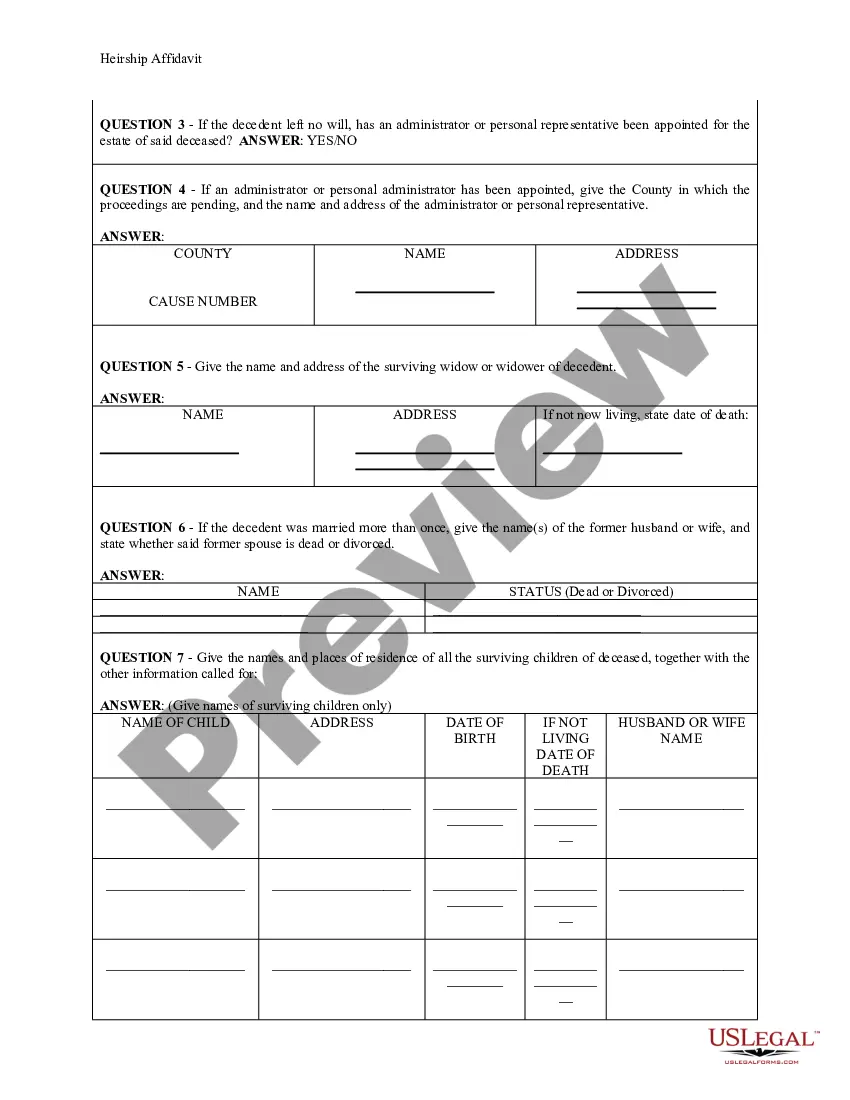

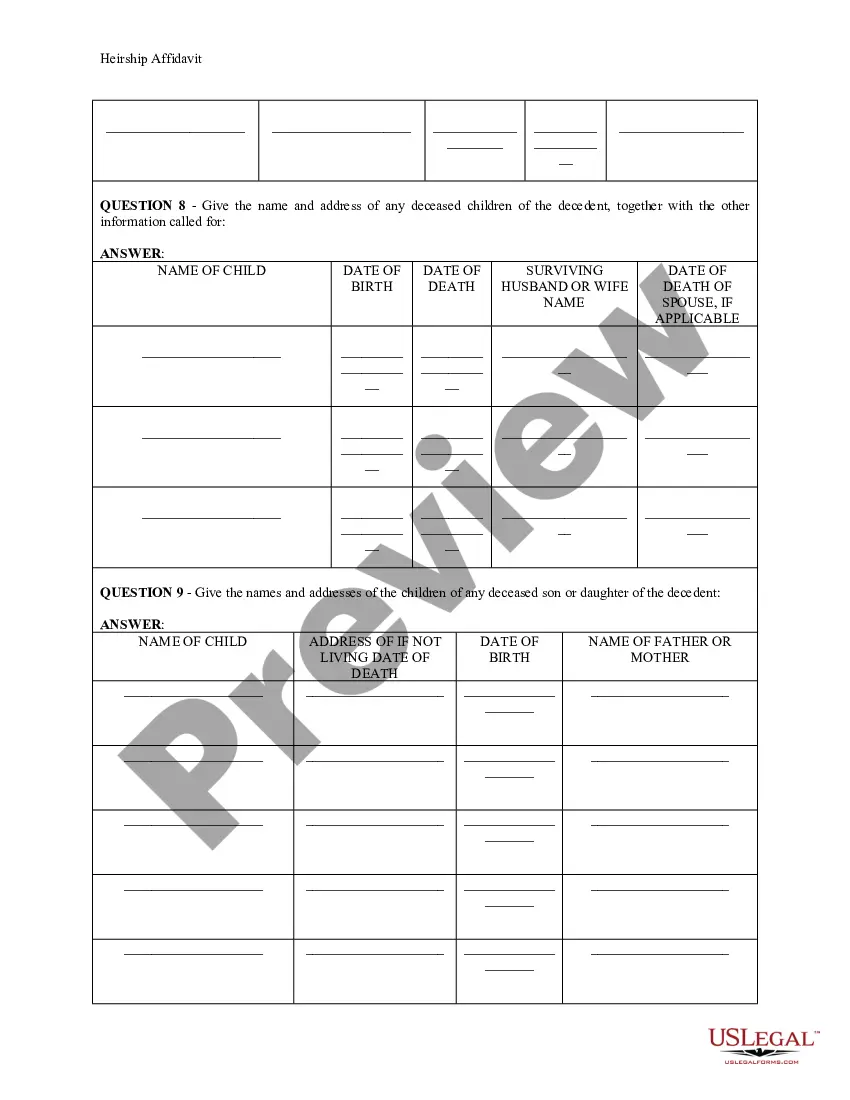

- Details on surviving relatives, including children and spouses.

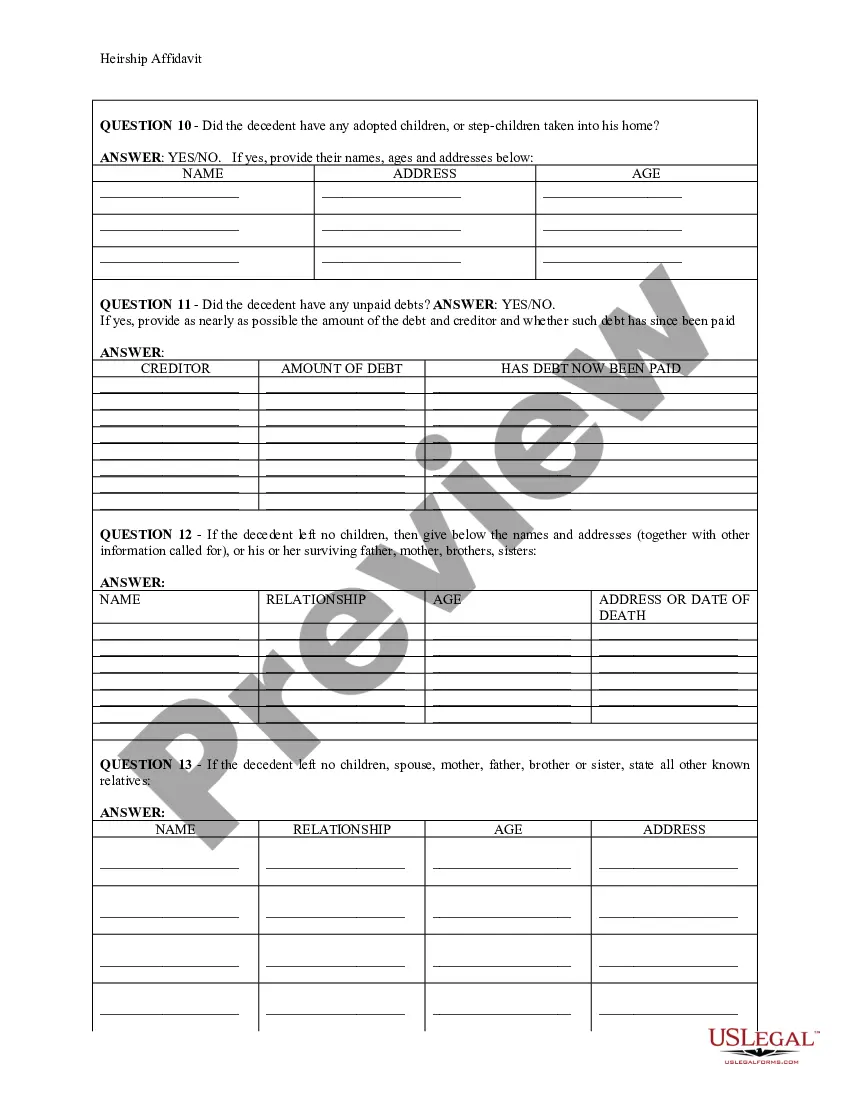

- Information regarding the decedent's assets and outstanding debts.

- Space for signatures and notarization, confirming the affidavit's validity.

When this form is needed

This form is needed in situations where an estate has not been opened for a deceased individual who left behind heirs. For example, if Person A passes away intestate (without a will) and has a surviving son, the son may need to complete this affidavit to sell or transfer ownership of any property formerly held by the decedent. It is also used to clarify the rightful heirs for insurance, bank accounts, or other inheritance claims.

Intended users of this form

- Individuals who are heirs to a deceased person's estate.

- Family members needing to clarify the decedent's heirs for legal purposes.

- Survivors who must assert their rights to property left by someone who died without a will.

- Anyone who needs to provide legal proof of heirship for assets or debts of the deceased.

Steps to complete this form

- Identify yourself as the affiant with your name and address at the top of the form.

- Provide personal knowledge about the decedent, including their residence and date of death.

- Answer the questions regarding the decedent's will and family status truthfully and completely.

- List the surviving heirs, including their relationship to the deceased and relevant contact information.

- Sign the affidavit in front of a notary public to validate the document.

Notarization guidance

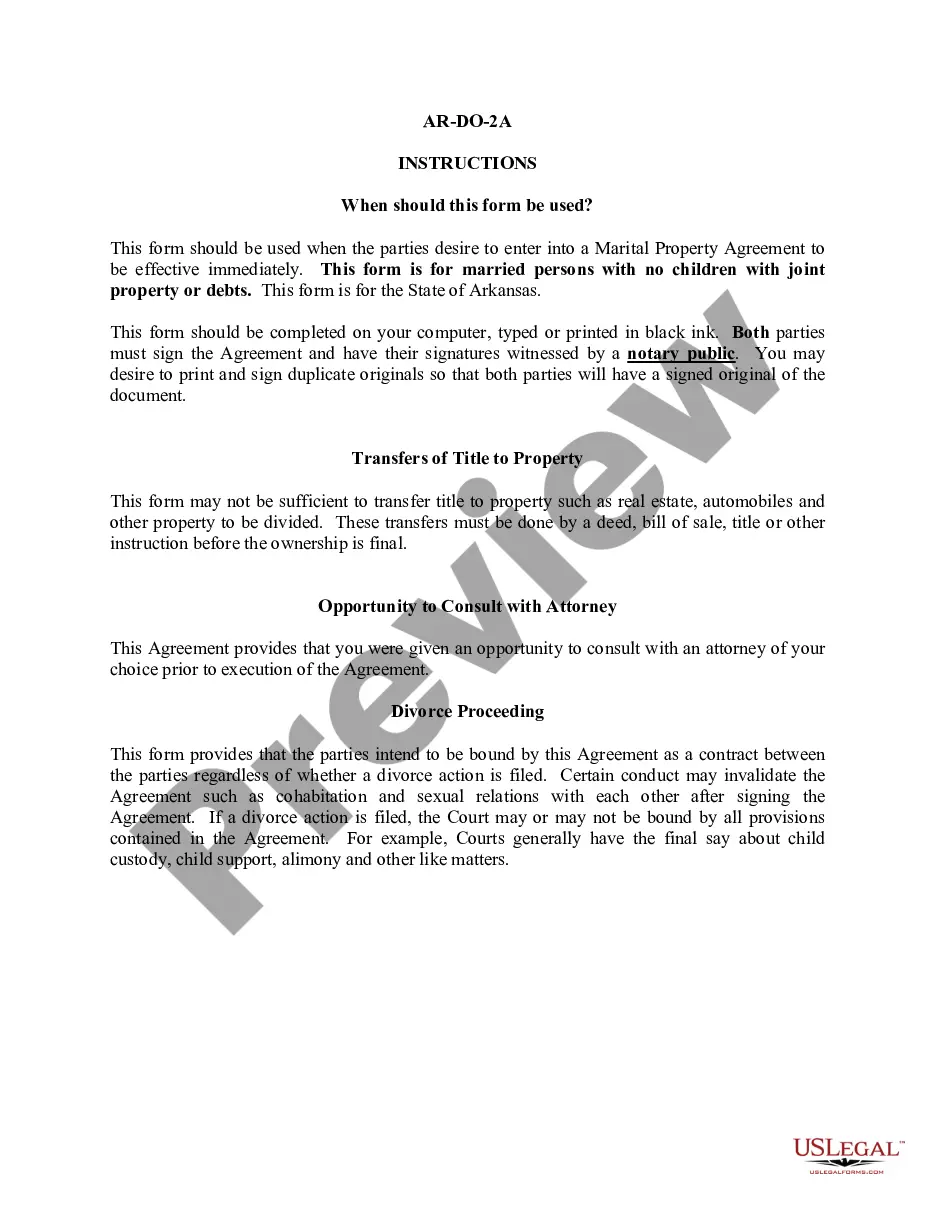

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to provide accurate information about the decedent's family members.

- Overlooking the need for notarization, which can invalidate the form.

- Not answering all questions on the affidavit, leading to incomplete documentation.

Why use this form online

- Convenience: Download the form anytime from any location.

- Editability: Fill out the form directly before printing to ensure accuracy.

- Accessibility: Obtain legally compliant forms without needing to visit a law office.

Looking for another form?

Form popularity

FAQ

The heirship of a deceased person is determined through a document called an Affidavit of Heirship. This is a form that gives a detailed explanation of the heirs at law of the deceased person at the time of his/her death.The deceased, DOROTHY, died at Anytown, Illinois on January 1, 2015.

An affidavit of heirship is needed to transfer a deceased person's interest in real or personal property to his or her heirs when the decedent dies without leaving a last will and testament or without disposing of all of his or her property in a will.

(A judgment in this case is a court order, in writing, reciting that the deceased person is dead, the date of death and a list of who are the heirs.) Proof. Once the judgment is issued, copies of the judgment can be used to show proof as to who is entitled to estate assets.

If a person dies intestate without any children, the spouse recovers the entire estate. If the person left a spouse and children, the surviving spouse will receive either one-third of the entire estate or a child's share of the estate, whichever is greater.

A fee of $15 for the first page and $4 for each additional page is common. Ask if you can file the two affidavits of heirship as one document. Some counties let you file the two affidavits of heirship as one document if the decedent and property descriptions are the same.

Tennessee inheritance laws protect the inheritance rights of any children who were conceived prior to their parent's death, but were born following it. However, that child must have lived for at least 120 hours and been born in the 10-month window that comes after the parent's death.

This law states that no matter what your will says, your spouse has a right to inherit one-third or one-half (depending on the state and sometimes depending on the length of the marriage) of your total estate. To exercise this right, your spouse has to petition the probate court to enforce the law.

When a person who owns real property dies intestate, and there is no survivor mentioned in the deed, the heirs of the decedent, must file an affidavit of descent to establish their chain of title to the property. This affidavit, is known as an affidavit of descent.