Mississippi Small Estate Affidavit for Estates under $75,000

Definition and meaning

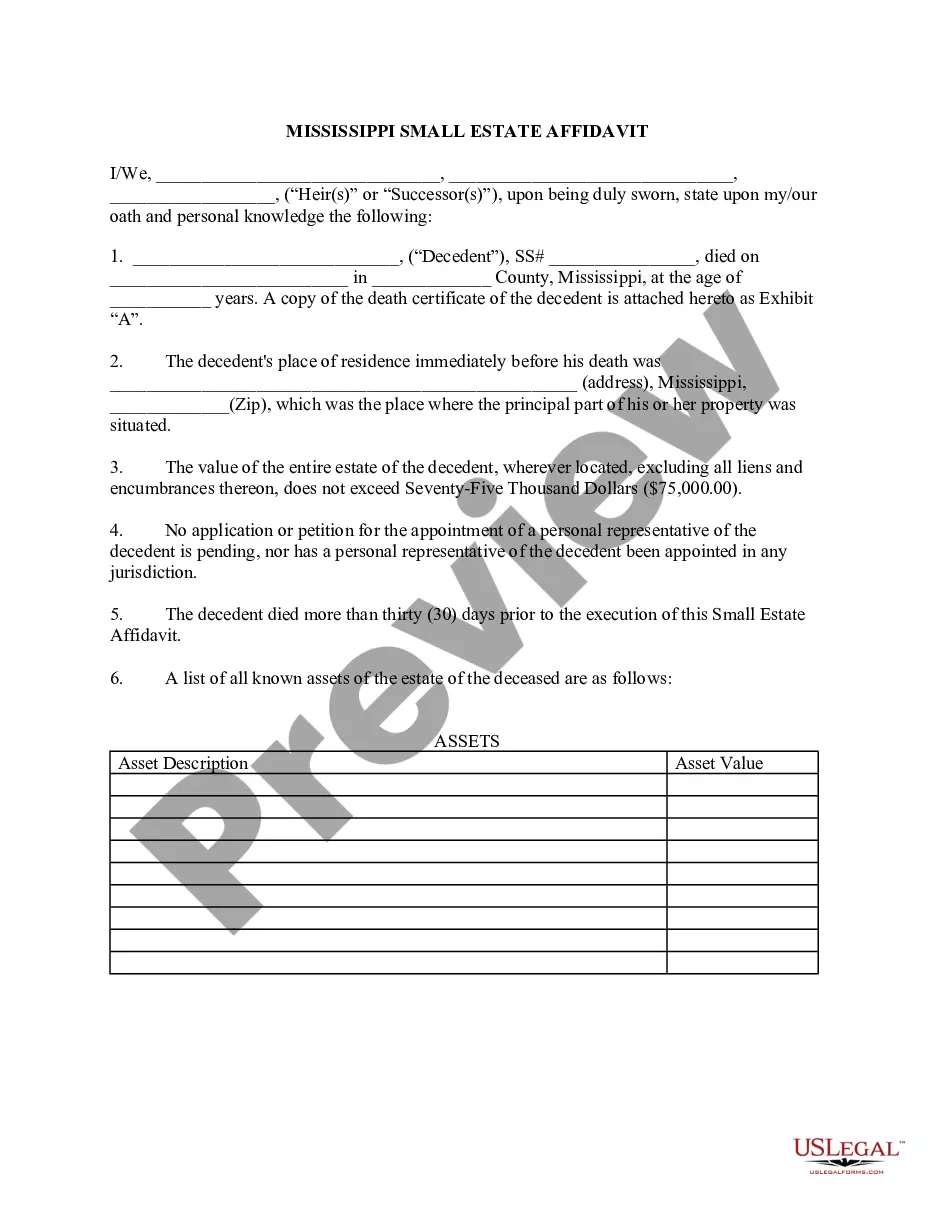

The Mississippi Small Estate Affidavit is a legal document used to handle the estate of a decedent who has passed away with a total estate value of less than $75,000. This affidavit allows heirs or successors to claim the decedent's assets without the need for formal probate, which can be time-consuming and costly. By utilizing this form, heirs can efficiently settle the estate and distribute the decedent's property according to the state's intestacy laws.

How to complete the form

To complete the Mississippi Small Estate Affidavit, follow these steps:

- Gather necessary information about the decedent, including full name, date of death, and social security number.

- Provide the decedent's last known address.

- List all known assets along with their values, ensuring the total does not exceed the threshold of $75,000.

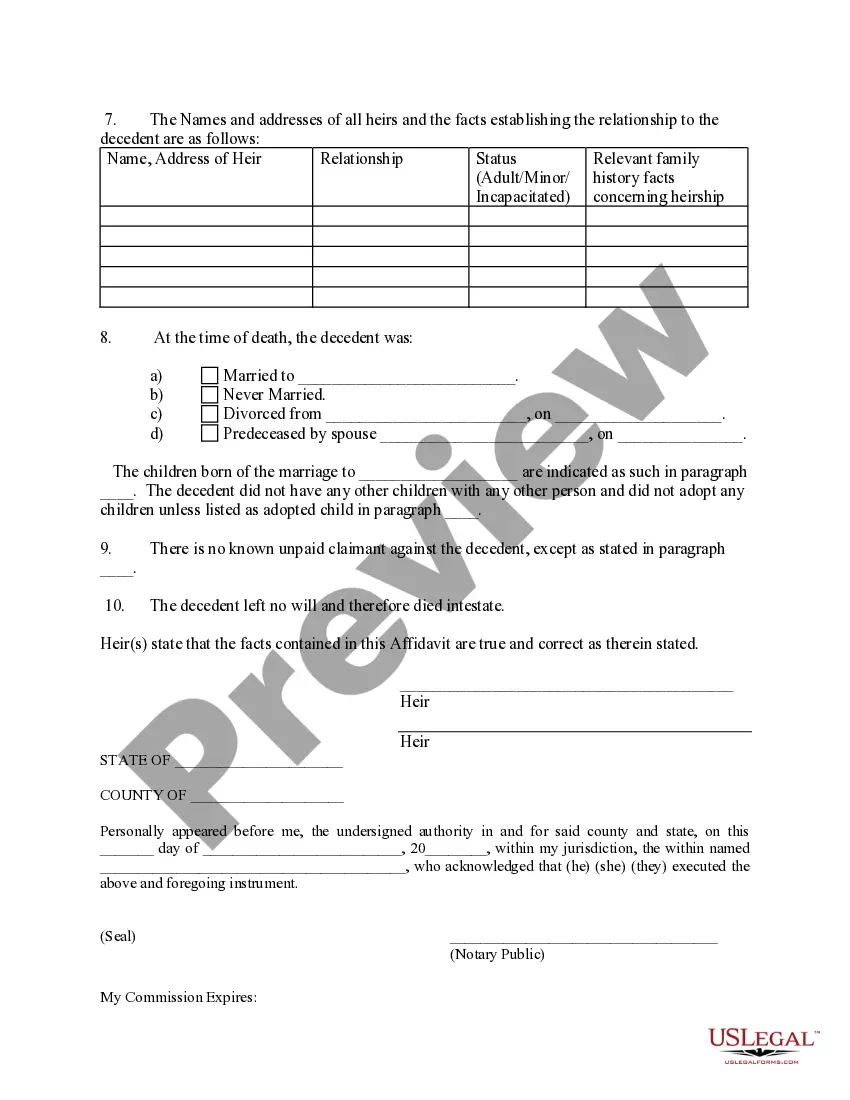

- Detail the names and addresses of all heirs along with their relation to the decedent.

- Include information regarding the marital status of the decedent and any relevant details about children or previous spouses.

- Sign the affidavit in the presence of a notary public.

Who should use this form

This form is designed for heirs or beneficiaries of a decedent in Mississippi whose total estate does not exceed $75,000. Individuals who wish to settle the estate without undergoing the probate process can utilize this affidavit. It is especially useful for those who need to access the decedent’s assets quickly, such as bank accounts or property, for essential purposes like paying debts or settling final expenses.

Key components of the form

The primary components of the Mississippi Small Estate Affidavit include:

- Decedent information: Name, date of death, and social security number.

- Assets: Detailed list of all known assets and values.

- Heir information: Names and relations of all heirs.

- Marital status: Current marital status of the decedent at the time of death.

- Notary certification: Required signatures of heirs and a notary public to validate the affidavit.

Legal use and context

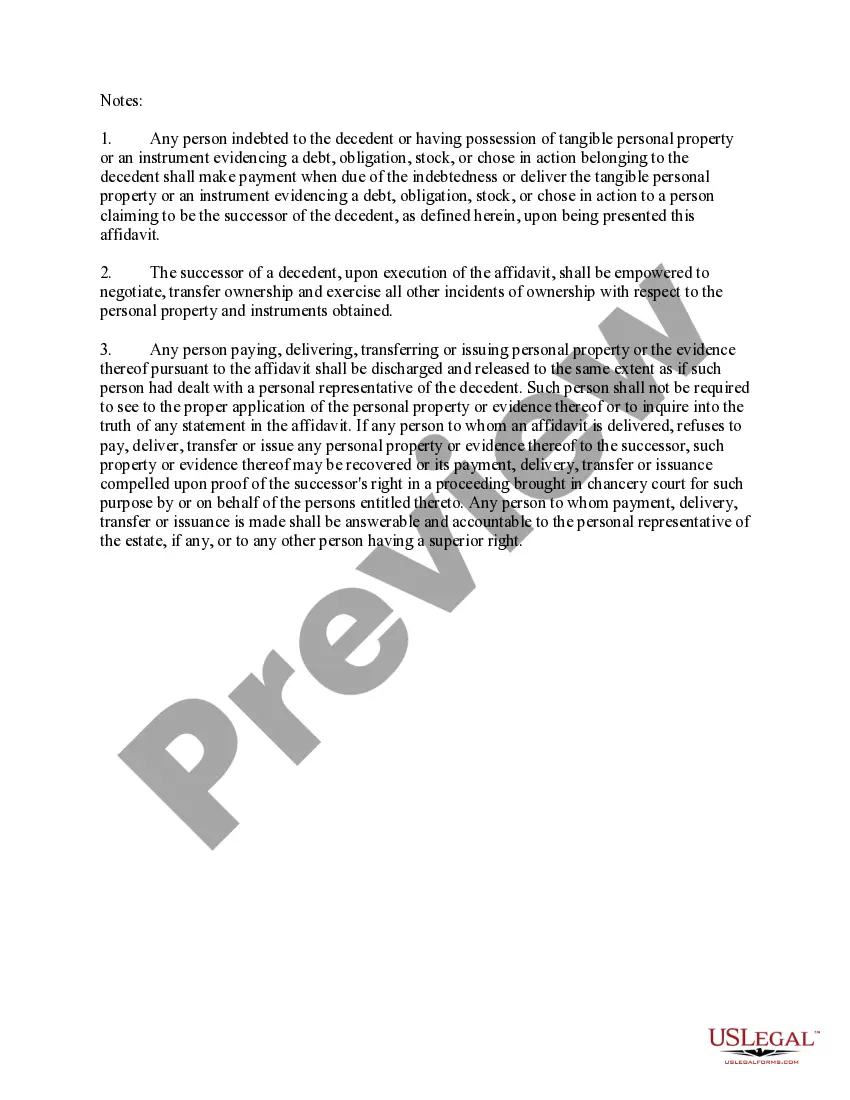

The Mississippi Small Estate Affidavit serves as a legal document that allows heirs to bypass traditional probate procedures. According to Mississippi law, this form can be executed when the estate falls under the monetary limit and no professional personal representative has been appointed. This affidavit helps facilitate the transfer of assets to heirs while maintaining compliance with state laws regarding inheritance and asset distribution.

What to expect during notarization

During the notarization process, you will be required to sign the Mississippi Small Estate Affidavit in the presence of a notary public. The notary will ask for identification to verify your identity and ensure that all parties involved are signing willingly and are of sound mind. The notary will then affix their seal to the document, providing it with legal validity. It’s wise to bring the completed affidavit along with any supplementary documents that may be required.

Form popularity

FAQ

In California for example, an estate valued at $150,000 or less may not need to go to court. In Nebraska, the threshold is $50,000 or less. Figuring out if your estate qualifies as small only takes a few simple steps.

If a person dies without a will, Mississippi's laws of intestacy distribute the person's estate to his or her heirs at law.To establish heirs, the probate attorney files a Petition to Establish Heirs with the chancery court in the county where the decedent died or owned property.

In California, estates valued over $150,000, and that don't qualify for any exemptions, must go to probate.If a person dies and owns real estate, regardless of value, either in his/her name alone or as a "tenant in common" with another, a probate proceeding is typically required to transfer the property.

Most of the time, probate is required in Mississippi. Small estates may have a more informal version of probate, and there are other cases where probate isn't necessary. However, for most instances, probate is necessary to distribute the assets of the estate and transfer ownership to the heirs.

Net value of probate estate is $50,000 or less, or. Probate asset is bank account or accounts totaling no more than $12,500, or. Probate estate is $500 or less.

The executor will need to wait until the 2 month time limit is up, before distributing the estate. Six month limit to bring a claim in other cases, it can be sensible for the executors not to pay any beneficiaries until at least 6 months after receiving the grant of probate.

In the best of circumstances, the Mississippi probate process usually takes 4 to 6 months. This would only be possible if the estate was fairly simple, all interested parties are agreeable, and documents are signed and returned to the probate attorney in a timely manner.

To write a will, Mississippi law states you must be at least 18 years old, of sound and disposing mind, must intend the document to be your will and must have the written will validly executed. Upon your death, your will must go through probate, a court proceeding that declares the will valid or invalid.

In Mississippi, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).